Is the housing market beginning to feel the effects of the end of “team transitory”?

Federal Reserve Chair Jerome Powell abandoned his “transitory” inflation narrative months ago and has since steered the central bank toward its tried-and-true playbook for taming inflation: Raise interest rates until demand recedes and soaring price growth abates.

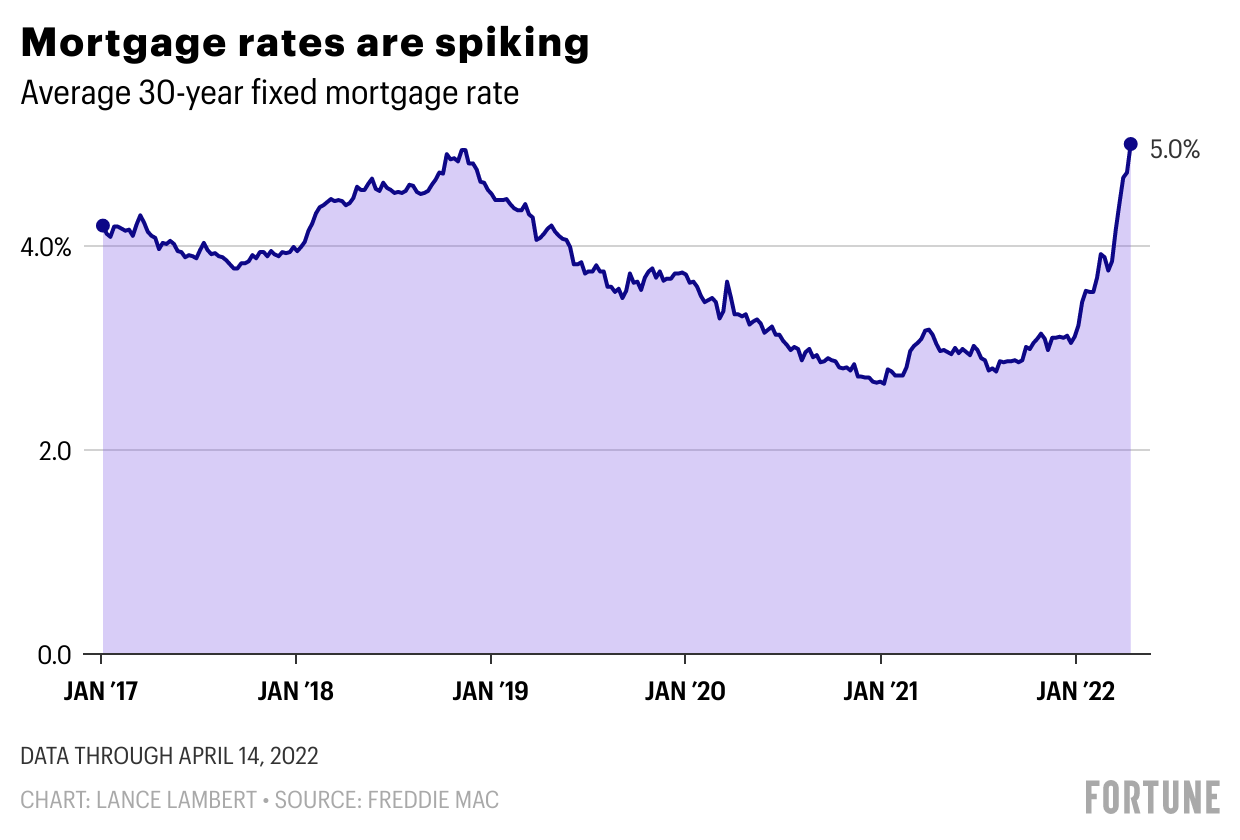

The Fed’s plan might be working. Early data suggest the economic shock caused by spiking mortgage rates is beginning to soften homebuyer demand.

“The sharp increase in mortgage rates is pushing more homebuyers out of the market,” wrote Daryl Fairweather, chief economist at Redfin, in a report published on Thursday.

According to Redfin, 12% of homes on its site saw sellers cut prices in the week ending April 9. That was the biggest one-month spike Redfin saw in price cuts since 2015. Over the past month, there was also a 3% drop in requests for home tours.

Let’s be clear: The jump in sellers cutting prices doesn’t mean home prices are about to plummet. Many of their properties were likely listed above market value, and home shoppers simply didn’t bite. That said, homebuyers being less eager to bid the market upward could indicate, in theory, some softening in the market. It also could signal that home price growth is finally decelerating, i.e., prices could start increasing at more moderate levels.

The fact that homebuyers are pushing back on record prices shouldn’t come as a surprise. Over the past two years, U.S. home prices have soared 32.7%—including 19.2% over the past 12 months. The sting of those soaring prices was lessened, to a degree, by the record low mortgage rates we’ve seen during much of the pandemic. But the end of team transitory means homebuyers are feeling the full brunt of exorbitant home prices.

Over the past four months, the average 30-year fixed mortgage rate has spiked from 3.11% to 5%. A borrower who secured a 3.11% rate on a $500,000 mortgage would owe $2,138 per month over the course of the 30-year loan. At a 5% rate, that principal and interest payment would spike to $2,684.

Factoring in the growth of both mortgage rates and home prices, Redfin says, the typical new mortgage payment has spiked 35% year-over-year to an all-time high of $2,288.

Not only do soaring mortgage rates price out some home shoppers, they mean some borrowers—who must meet lenders’ strict debt-to-income ratios—will lose their mortgage eligibility altogether.

A softening housing market would be welcomed by many housing economists. In their eyes, current levels of home price growth simply can’t be sustained forever. The longer this goes on, the higher the likelihood of an overheated housing market. Or worse: If it doesn’t let up, we could end up in a full-blown housing bubble. Just last month, the Federal Reserve Bank of Dallas published a paper titled “Real-time market monitoring finds signs of brewing U.S. housing bubble.”

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.