The booming housing market is facing its biggest test yet: rising mortgage rates.

Last week, the average 30-year fixed mortgage rate topped 4.67%—up from 3.11% in December. That’s a bigger deal than it might first appear. If a borrower took out a $400,000 mortgage at 3.11%, they would owe $1,710 per month over the 30-year loan. At a 4.67% mortgage rate, that monthly payment spikes to $2,067.

Not only do higher mortgage rates price out some would-be homebuyers, it also means some borrowers—who must meet lenders’ strict debt-to-income ratios—will lose their mortgage eligibility.

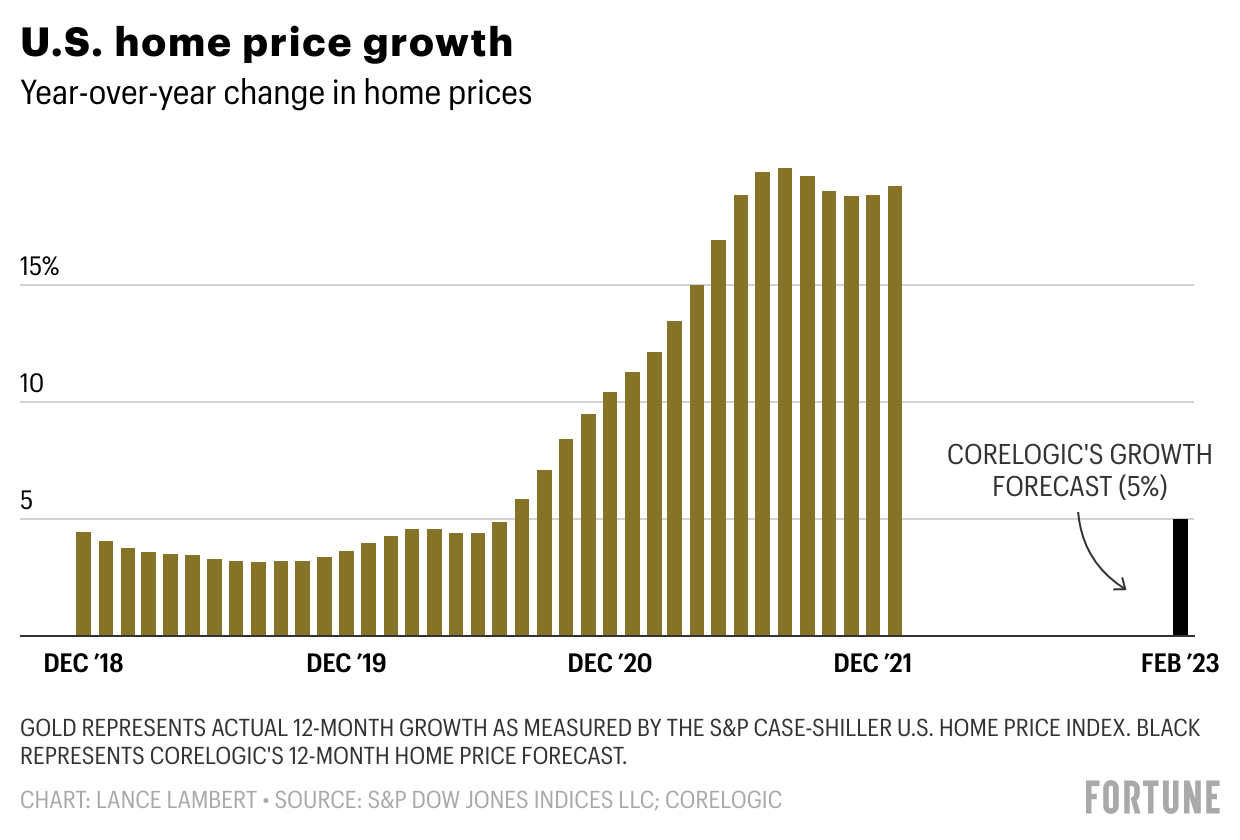

The economic shock presented by mortgage rates has some in the real estate industry predicting that the red-hot housing market will finally lose some steam. Look no further than CoreLogic. On Monday, the real estate research firm, ranked No. 952 in the Fortune 1000, said that home price growth is about to decelerate—by a lot. At its latest reading, U.S. home prices shot up 19.2% between January 2021 and January 2022. But over the coming 12 months, CoreLogic says, home prices will rise just 5%.

There’s another reason CoreLogic sees home price growth decelerating: affordability. Over the past year, U.S. home prices have shot up five times faster than U.S. income growth. That simply can’t go on much longer.

The real estate firm calculated a market risk assessment for around 400 metropolitan statistical areas. CoreLogic aimed to find out whether local income levels could support home prices. The result? CoreLogic deems 65% of U.S. regional housing markets to be “overvalued.” That includes major metropolitan statistical areas like New York, Miami, Seattle, Las Vegas, and Dallas. Every major market in Arizona, Florida, Texas, and Nevada meets CoreLogic’s definition of “overvalued.” Meanwhile, CoreLogic says only 26% of U.S. housing markets are “normal” and just 9% are “undervalued.”

“With robust home price growth since the onset of the pandemic, many markets could now [be] considered overvalued, particularly when comparing the price growth to the rate of local income growth,” Selma Hepp, deputy chief economist at CoreLogic, told Fortune.

But just because U.S. home prices are “overvalued” doesn’t mean home prices are about to plummet.

Indeed, every forecast model reviewed by Fortune still predicts that U.S. home prices will rise over the coming year. That includes models produced by the Mortgage Bankers Association, Bank of America, Fannie Mae, and Zillow.

What’s going on? Industry insiders believe that soaring mortgage rates will help to derail the unsustainable rates of home price growth we’ve seen over the past year. However, many believe the combination of limited supply and the demographic wave of first-time millennial homebuyers will continue to push prices upward, albeit at a lower rate of growth.