Last month India was gearing up for its largest IPO to date. But the world has changed in a few short weeks.

Russia has seized the Zaporizhzhia nuclear power plant—the largest power plant in Europe. Russian troops are laying siege to cities throughout Ukraine, and pushing further into Ukraine’s southern region. Global leaders are condemning Russia’s advances. The threat of World War III is on the table.

Markets have suffered around the globe, and it’s no different in India—making it a rather awful time for Life Insurance Corp., India’s state-owned insurance giant, to try to raise a whopping $8 billion on the public markets.

LIC had filed a draft prospectus in the middle of February, expressing its intentions to privatize a chunk of the business. That public debut, should the Indian government be able to raise what it hopes, would be more than three times the size of India’s largest public offering to date, which was Paytm’s $2.4 billion IPO in November. LIC shares were slated to go on sale to anchor investors next Friday, people familiar with the matter had told Reuters. But it looks as if India’s largest insurance firm is struggling to garner interest.

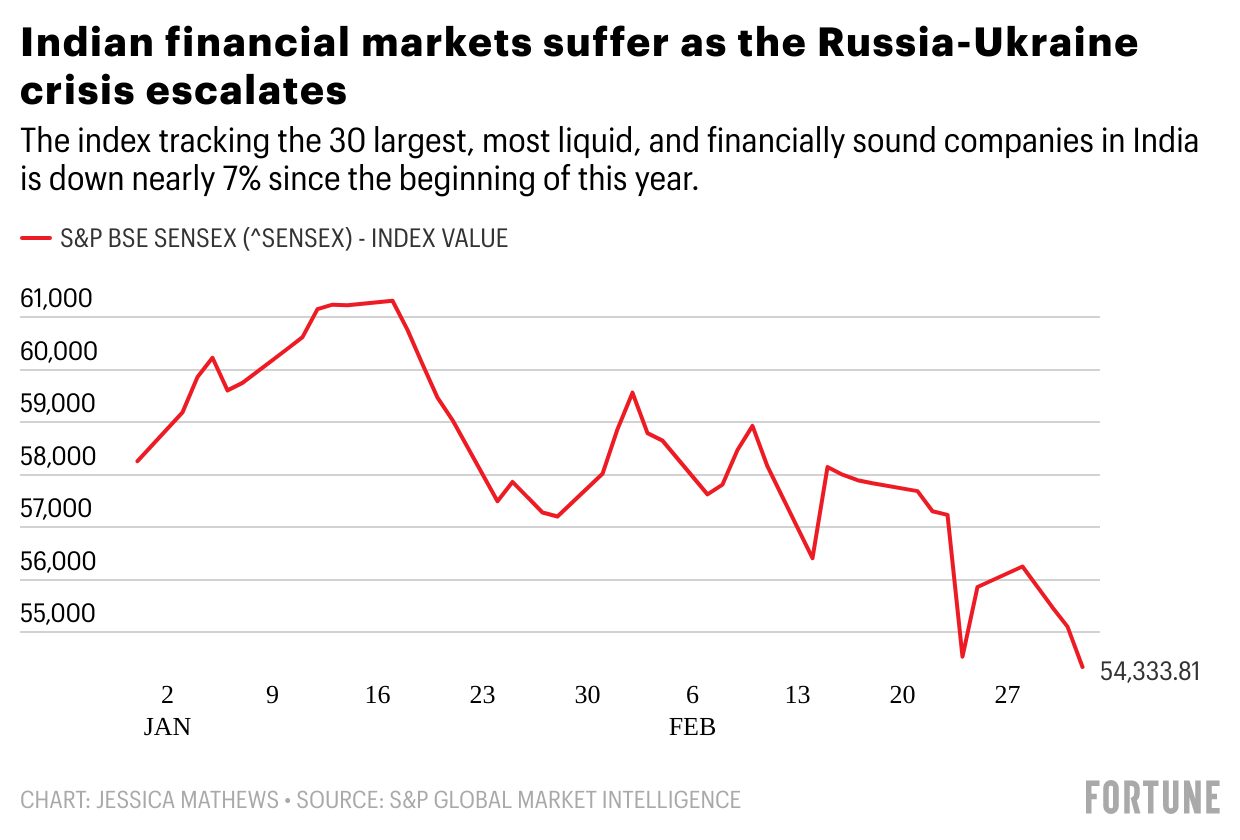

Fund managers have been hesitant to make major commitments amid unpredictable market volatility, according to new reporting from Bloomberg. The S&P BSE Sensex, which tracks India’s 30 largest and most liquid companies, was down 3.67% at market close yesterday. It’s down more than 7.5% since the beginning of February, and nearly 7% since the beginning of this year. Here’s a look:

A lack of immediate interest in LIC shares due to the stock market plunge has bankers and officials readying to move the IPO back into the company’s next fiscal year (which will begin in April), per Bloomberg. If volatility recedes, the share sale process could resume as early as next month, as the government reportedly still wants to close the deal within the next few months. But, given the global crisis, it could end up being pushed back even further.

The LIC offering is part of India’s broader plan to raise more than $10 billion by listing portions of its stakes in state-run companies this fiscal year. The pandemic struck India hard, and its strict lockdown in 2020 contributed to what was the worst recession the country has experienced since attaining independence from Britain.

An IPO could have helped deliver some much-needed cash into the hands of the Indian government. But it might be better for everyone to hold off a little bit longer.

Tiger is still on the hunt… Tiger Global may have renegotiated valuations in recent weeks, but that doesn’t mean it’s slowing down its pace of deals. While there’s still a month left to go in the first quarter, the growth equity fund is on track to surpass the number of equity deals it closed last quarter, according to CB Insights. There have been 65 deals completed through mid-February, and CB Insights is projecting a total of 126 by the end of March. Here’s a look:

SXSW… Around this time next week I will be on my way to Austin to attend South by Southwest. I’m moderating a panel next Saturday on diversity in the blockchain ecosystem, where I’ll be chatting with crypto leaders at BlockFi, BNY Mellon, and Fireblocks (I recommend you attend if that’s up your alley). Let me know if you plan to be at the conference as well. It would be great to meet some of you in person, if time and health allows. Please also send BBQ recommendations for Austin. I’m originally from Memphis and have high standards for this sort of thing, but I’ve learned that Term Sheet readers have good taste.

Until Monday,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

Volocopter, a battery-powered aviation startup based in Bruchsal, Germany, raised $170 million in Series E funding from investors including WP Investment, Honeywell, Atlantia, Whysol and Btov Partners.

Zeller, a Melbourne-based alternative business banking solution, raised $100 million in Series B funding led by Headline and was joined by investors including Hostplus, Square Peg, Addition, and Spark Capital.

99minutos, a Mexico City–based logistics service for e-commerce vendors in Latin America, raised $82 million in funding led by OAK HC/FT and was joined by investors including Kaszek and Prosus Ventures.

Lido Finance, a liquid staking platform for cryptocurrencies, raised $70 million in funding from a16z.

Atomic, a Salt Lake City–based payroll management platform, raised $40 million in Series B funding co-led by Mercato Partners and Greylock and was joined by investors including Core Innovation Capital, Portage, and ATX Venture Partners.

Bright Security, formerly named NeuraLegion, a San Francisco-based application security platform, raised $20 million in Series A funding led by Evolution Equity Partners and was joined by investors including DNX Ventures, J-Ventures, Fusion Fund, and Incubate Fund.

Aether Diamonds, a New York–based creator of diamonds made from atmospheric carbon, raised $18 million in Series A funding led by Helena and co-led by TRIREC, and joined by investors including SOUNDWaves, Khosla Ventures, and Social Impact Capital.

Pristine Surgical, a digital visualization platform focused on improving endoscopic surgeries and based in Manchester, N.H., raised $15 million in Series D funding led by Ceros Capital Markets.

CancerIQ, a Chicago-based early cancer detection and prevention platform, raised $14 million in a Series B funding round co-led by Merck Global Health Innovation Fund and Amgen Ventures and was joined by investors including McKesson Ventures, OSF Ventures, and HealthX Ventures.

VISO Trust, a San Francisco–based cybersecurity and due diligence platform, raised $11 million in Series A funding led by Bain Capital Ventures and was joined by investors including Work-Bench, Sierra Ventures, Lytical Ventures, Mandiant CEO Kevin Mandia, Crowdstrike CEO George Kurtz, and former Splunk CEO Doug Merritt.

Haruko, a London-based crypto company connecting capital to the blockchain, raised $10 million in funding led by Portage Ventures and White Star Capital.

Inworld AI, a platform used to create A.I.-powered characters for virtual worlds and based in Mountain View, Calif., raised $10 million in funding led by BITKRAFT Ventures and was joined by investors including the Venture Reality Fund, Kleiner Perkins, and CRV.

Rarify, a New York–based NFT application programming interface (API) platform, raised $10 million in a Series A round led by Pantera Capital.

Delio, an investment platform for financial institutions based in Cardiff, Wales, raised $8.3 million in funding led by Octopus Ventures.

Plum Life, a platform for selling life insurance, based in Berkeley Heights, N.J., raised $5.3 million in seed funding led by ManchesterStory and was joined by investors including MTech Capital, Sonostar Ventures, and others.

Silico, a London-based A.I.-powered decision-making platform, raised £3.4 million ($4.51 million) in seed funding led by Join Capital with participation from investors including Forward Partners.

Juli, a digital health platform focused on chronic conditions and based in Hull, Mass., raised $3.8 million in seed funding led by Speedinvest and Norrsken VC.

PRIVATE EQUITY

3 Rivers Capital acquired a majority stake in Gaven Industries, a provider of radio-frequency and magnetic shielding products based in Saxonburg, Pa. Financial terms were not disclosed.

Five Star Parks & Attractions, backed by Fruition Partners, acquired Dubby’s Attractions, a family entertainment center based in Pigeon Forge, Tenn., and Celebration Station, a Baton Rouge–based family entertainment center. Financial terms were not disclosed.

Genstar Capital acquired an equal ownership stake with existing investor, Madison Dearborn Partners, in Lightspeed Systems, an education management software company. Financial terms were not disclosed.

Thoma Bravo acquired a majority stake in UserZoom, a San Jose–based UX research platform. Financial terms were not disclosed.

EXITS

Macquarie Asset Management agreed to acquire Roadchef, a motorway service area operator based in Cannock, England, from Antin Infrastructure Partners for £900m ($1.189 billion).

Sonova Holding acquired Alpaca Audiology, an audiology clinic group based in Springfield, Mo., from Thompson Street Capital Partners. Financial terms were not disclosed.

OTHER

Chicken Soup for the Soul Entertainment agreed to acquire 1091 Media, a television and film developer based in Rye, N.Y., for $15.6 million.

Netrisk Group acquired Durchblicker, a Vienna-based online price comparison website. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

Morgan Stanley Capital Partners, the private equity arm of Morgan Stanley, raised $2 billion for a seventh fund focused on business services, as well as consumer, education, health care, and industrial sectors.

PEOPLE

Blue Owl Capital, a New York–based private equity firm, hired Machal Karim as head of environmental, social, and corporate governance. Formerly, he was with the CDC Group.

EQT Partners, a Stockholm-based private equity firm, hired Alex Greenbaum as partner. Formerly, he was with GIC.

Gemspring Capital, a private equity firm based in Westport, Conn., hired Zubin Malkani as managing director. Formerly, he was with CI Capital Partners.

SFW Capital Partners, a private equity firm based in Rye, N.Y., promoted Xiu Li Dong, Gianluigi Sepe, and Andrew Cialino to principal, and Rahul Basu to vice president.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.