Good morning,

When I think about the more than 25 reported publicly traded companies that hold Bitcoin on their balance sheets, the classic song by Journey, “Don’t Stop Believin,’” comes to mind. They believe cryptocurrencies will see brighter days. But, the digital currency is sinking in an epic storm—crypto is down at least $1.4 trillion since November. Meanwhile, there’s also a growing number of high-profile individuals who want to be paid in crypto.

Crypto on the balance sheet

Take for instance electric-car maker Tesla and MicroStrategy, a software developer. The companies together own about 169,000 Bitcoin, nearly 78% of all Bitcoin owned by publicly traded companies, writes Tristan Bove in a new Fortune report. “MicroStrategy alone makes up for more than half of this amount, holding 121,000 Bitcoin, equal to $3.5 billion,” Bove writes. “Even in the wake of the crypto carnage, MicroStrategy has no intentions to back down from its Bitcoin bets.”

For example, MicroStrategy CFO Phong Le recently echoed the company’s founder and CEO Michael Saylor’s notable defense and praise for Bitcoin on his Twitter feed. “Our strategy with Bitcoin has been to buy and hold, so to the extent we have excess cash flows or we find other ways to raise money, we continue to put it into Bitcoin,” Le told the Wall Street Journal last week.

Tesla CEO Elon Musk’s stance on crypto has been crystal clear for some time. In a SEC filing in March 2021, Musk noted his additional title of “Technoking,” and said CFO Zach Kirkhorn would also be known as “Master of Coin.” Tesla is standing firm in retaining its crypto holdings. “In its Q4 earnings report, released on Jan. 26, the company revealed it hadn’t sold off any of its Bitcoin during this year’s ‘crypto winter’ and currently holds $1.26 billion in Bitcoin,” Bove writes.

Crypto compensation

Although the Bitcoin downturn continues, a growing number of individuals, like athletes and politicians, want to be compensated in crypto. For example, New York City Mayor Eric Adams’ first paycheck in office, received this month, was converted into Bitcoin and Ethereum. The New York Post estimates Adams may have lost more than $1,000 of his first check due to the crypto crash.

If crypto is risky on the balance sheet, wouldn’t compensation in crypto be complicated? I asked Alan Levine, partner and co-chair of the executive compensation and employee benefits department at the law firm Morrison Cohen. “There are definitely some things that are problematic,” Levine said. “Until Congress or the IRS weighs in, it’s going remain difficult to pay people in cryptocurrency, even if they want it. You’re not getting cash. You’re getting, basically property, like a share of stock that rises and falls with the course of the market.”

Is it even legal to pay base salaries in crypto? “Under the Fair Labor Standards Act, you have to pay in cash or negotiable instruments,” Levine explained. “It’s unclear yet whether Bitcoin or other cryptocurrencies satisfy that rule. So, it’s risky from an employer’s perspective.” Can you pay people bonuses in cryptocurrencies? “The answer is yes,” Levine said. But it would have to exclude overtime, which is subject to the Fair Labor Standards Act, he said.

Levine noted that in 10 states— California, Delaware, Georgia, Illinois, Maryland, Pennsylvania, Michigan, New Jersey, Texas and Washington—you must pay an employee a base salary in cash. Crypto as compensation isn’t an option in those locations. Another aspect to consider: “how does the employer satisfy the employee’s withholding obligations? The IRS only takes cash,” he said.

It seems companies contemplating putting Bitcoin on the balance sheet or paying employees in crypto have a lot to think about.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

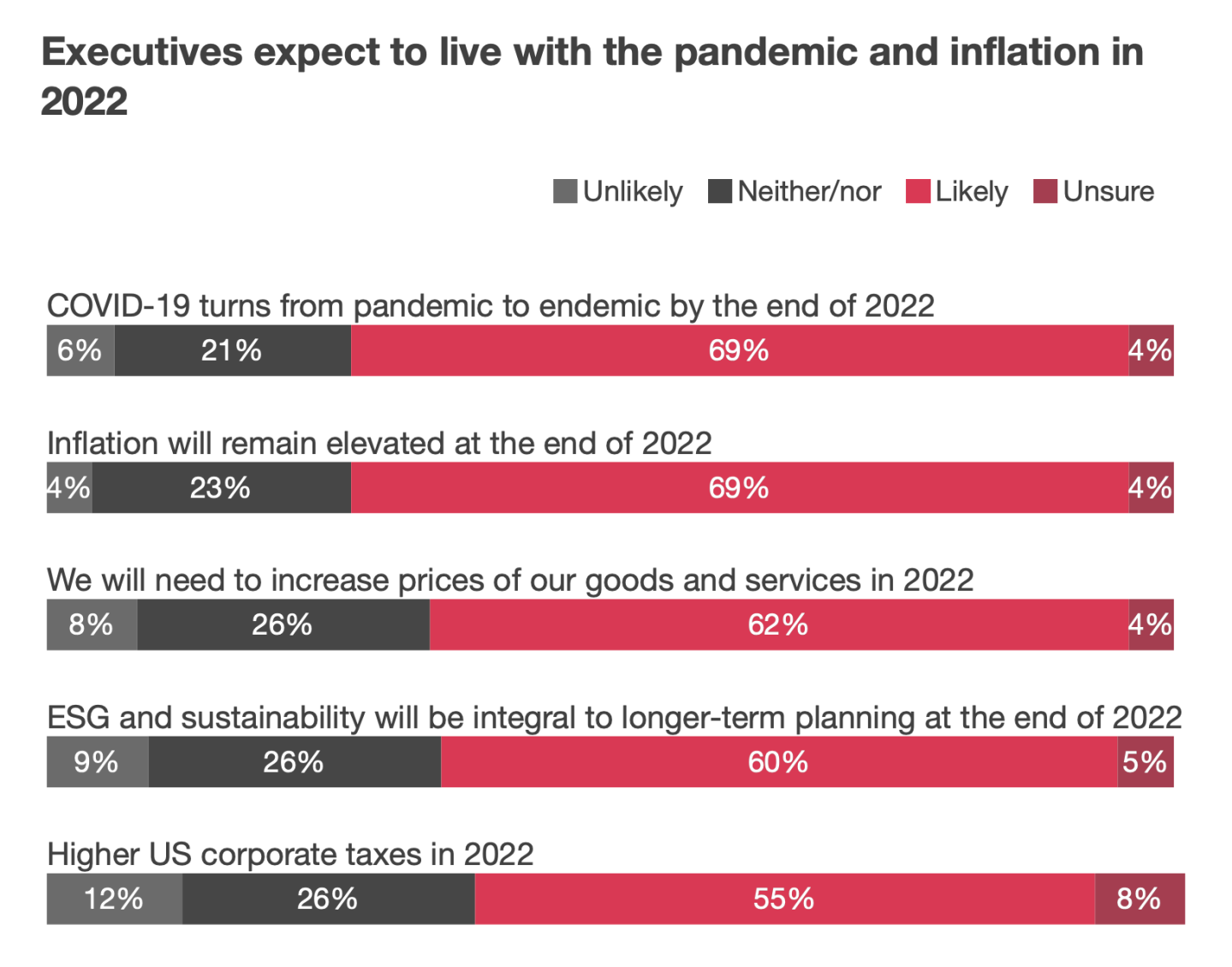

Big deal

As inflation is at a 40-year high, business leaders are striving to meet the challenge, according to PwC's first pulse survey of 2022. The firm's survey of more than 650 C-suite executives found nearly 70% believe COVID-19 will turn from a pandemic to an endemic by the end of the year, and inflation will remain elevated. More than half of respondents also believe ESG will be integral to longer-term planning and higher U.S. taxes are on the horizon. The survey also delves into digital transformation and the war for talent. For example, 77% said the ability to hire and retain talent is most critical to achieving growth. However, just 31% expect talent shortages to ease this year.

Courtesy of PwC

Going deeper

About 79% of U.S. adults surveyed expect inflation will go up, including half who anticipate it will increase "a lot," a Gallup report found. And 78% expect interest rates to rise. Based on surveys over the years, Americans have been more likely to say inflation will increase instead of decrease, according to Gallup. However, the current expectation is higher than usual. "In fact, it is the highest Gallup has measured in its trend," the report stated. "The prior high was 76% in September 2005." The findings are based on telephone interviews with a random sample of 811 adults in the U.S., ages 18 and older.

Leaderboard

Brett Tighe was named CFO at Okta, Inc. (Nasdaq: OKTA), an authentication software provider, effective immediately. Tighe has served as Okta’s interim CFO since June 2021. He previously served as Okta’s SVP of finance and treasurer. Prior to joining Okta in 2015, Tighe spent nearly 11 years with growing responsibilities in the finance organization at Salesforce.

Alan “Al” Villalon was named CFO and EVP at Alerus Financial Corporation (Nasdaq: ALRS). Villalon replaces Katie Lorenson, who transitioned to president and CEO, effective Jan. 1. Mr. Villalon most recently served as deputy director of investor relations and SVP at U.S. Bank. Prior to U.S. Bank, he spent most of his career in equity analyst research roles, including senior research analyst at both Thrivent Asset Management and Nuveen Asset Management/First American Funds Advisors.

Overheard

“Our policy path is not a constriction path. It’s a less accommodative path. If we do the three [interest rate increases] that I have in mind, that’ll still leave our policy in a very accommodative space."

—President and CEO of the Federal Reserve Bank of Atlanta Raphael W. Bostic, as told to the Financial Times.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.