Fed Chair Jerome Powell made it clear while speaking to Congress earlier this month that taming stubbornly high inflation will require the U.S. central bank to both halt its asset purchase programs and raise rates multiple times in 2022.

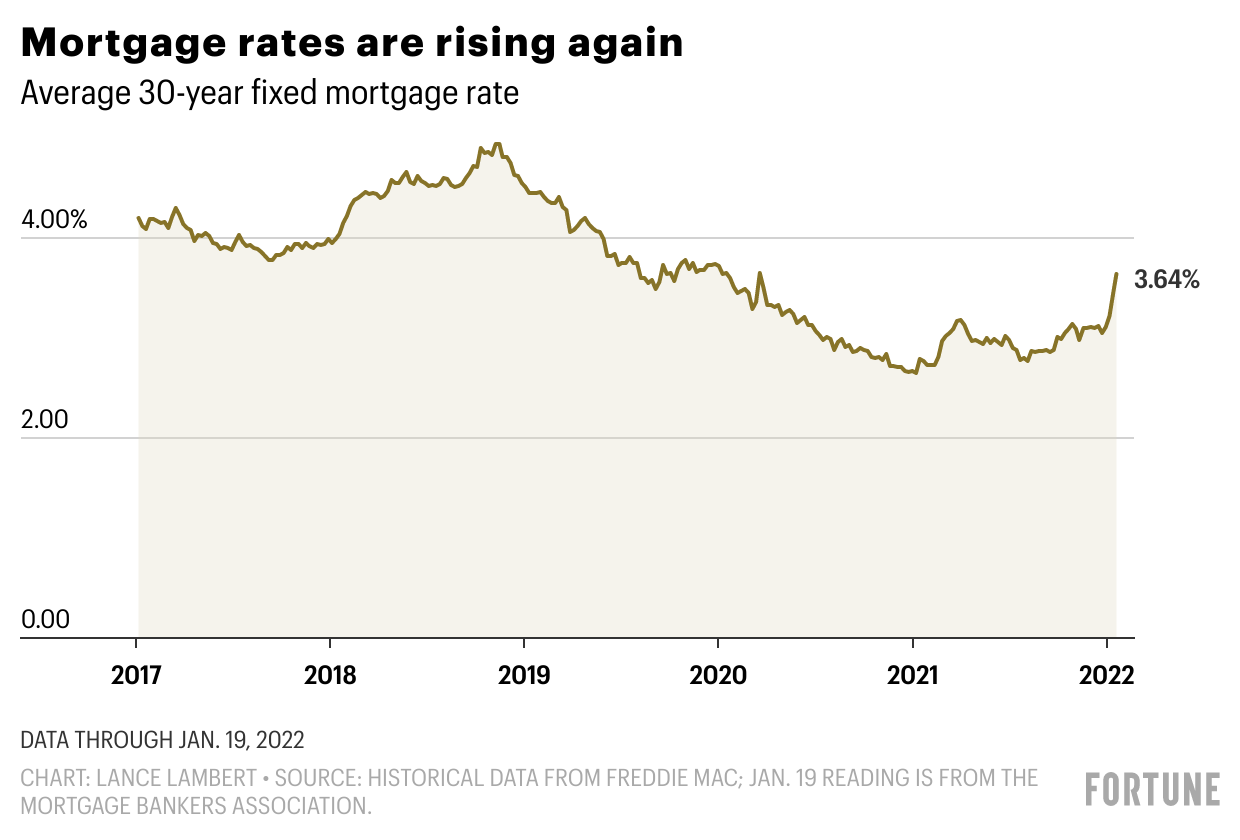

That policy shift is already being felt by home shoppers. On Wednesday, the Mortgage Bankers Association reported the average 30-year fixed mortgage rate has climbed to 3.64%—up from 3.11% in December. That marks the largest one-month jump in mortgage rates since 2013.

“Investors are responding to 40-year highs in inflation and the anticipated response from the Federal Reserve to clamp down on it,” Ali Wolf, chief economist at Zonda, a housing market research firm, told Fortune. “As we look later into the year, we don’t expect many more bouts of big jumps like what we experienced over the past few weeks, but we do expect to see volatility in mortgage rates.”

Even if financial markets have already priced in the biggest mortgage rate jumps, this recent spike is big enough that it alone could shake up the housing market. Just look at the numbers: A borrower who takes out a $400,000 mortgage at a 30-year fixed rate of 3.11% would owe a $1,710 monthly payment; at a 3.64% rate, that payment jumps to $1,827—or an additional $42,244 over three decades.

Not only could that higher monthly payment scare off some would-be buyers, it will also lock some buyers out of the market. That’s because banks issue mortgages based on strict debt-to-income ratios (which includes the mortgage they’re applying for). That means every time rates tick up, some buyers lose their mortgage eligibility.

This mortgage rate spike comes as the housing market is amid one of its hottest stretches in tabulated history—with U.S. home prices notching a 19.1% jump in the most recent 12-month window. While there’s a lot underpinning the strong housing market—including a demographic wave of first-time millennial homebuyers—we shouldn’t overlook the role recession-induced low mortgage rates played in enticing buyers into the market during the pandemic.

That raises a question: Now that mortgage rates are rising again, should we expect home price growth to slow? After all, cutting down on price growth—a.k.a. inflation—is why the Fed is jacking up rates.

Leading real estate companies like Fannie Mae, Redfin, and the Mortgage Bankers Association have all produced forecast models that predict home price growth will decelerate in 2022 as mortgage rates rise. However, they don’t agree on the final numbers. Fannie Mae says U.S. home prices will climb 7.9% this year, while Redfin predicts 3%. Meanwhile, the Mortgage Bankers Association predicts median existing home prices will fall 2.5% in 2022. The big difference between the models is their assumption for where the 30-year fixed mortgage rate finishes the year. Heading into this year, Fannie Mae predicted we’d hit a 3.3% mortgage rate by the end of 2022, while Redfin projected a 3.6% mortgage rate, and the Mortgage Bankers Association predicted a 4% rate by the close of the year. Simply put: The higher mortgage rates go, the more bearish the outlook for home price growth.

“The impact of rising interest rates depends on where they land. If [mortgage] rates approach 4% before the end of the year, there will be a notable downshift in housing demand,” Wolf says. “If mortgage interest rates gradually rise throughout the year, allowing home sellers to price their homes accordingly, then the shock to the system will be less noticeable.”

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.