Try as they might, some of Tesla’s closest rivals are falling further and further behind Elon Musk’s pace car even as they double sales of their electric-vehicle range.

An analysis of the full-year global sales figures for Mercedes-Benz, BMW, Volkswagen, and Audi published this week reveals the underlying problem: Fast growth doesn’t help when you are starting from a small base.

The quartet of German car brands are at the highest risk of seeing customers trade in their Bimmer or Benz for a Tesla. Until Elon Musk came around, they set the benchmark in automotive innovation for the well-heeled car buyer. Now all they can do is play catch-up.

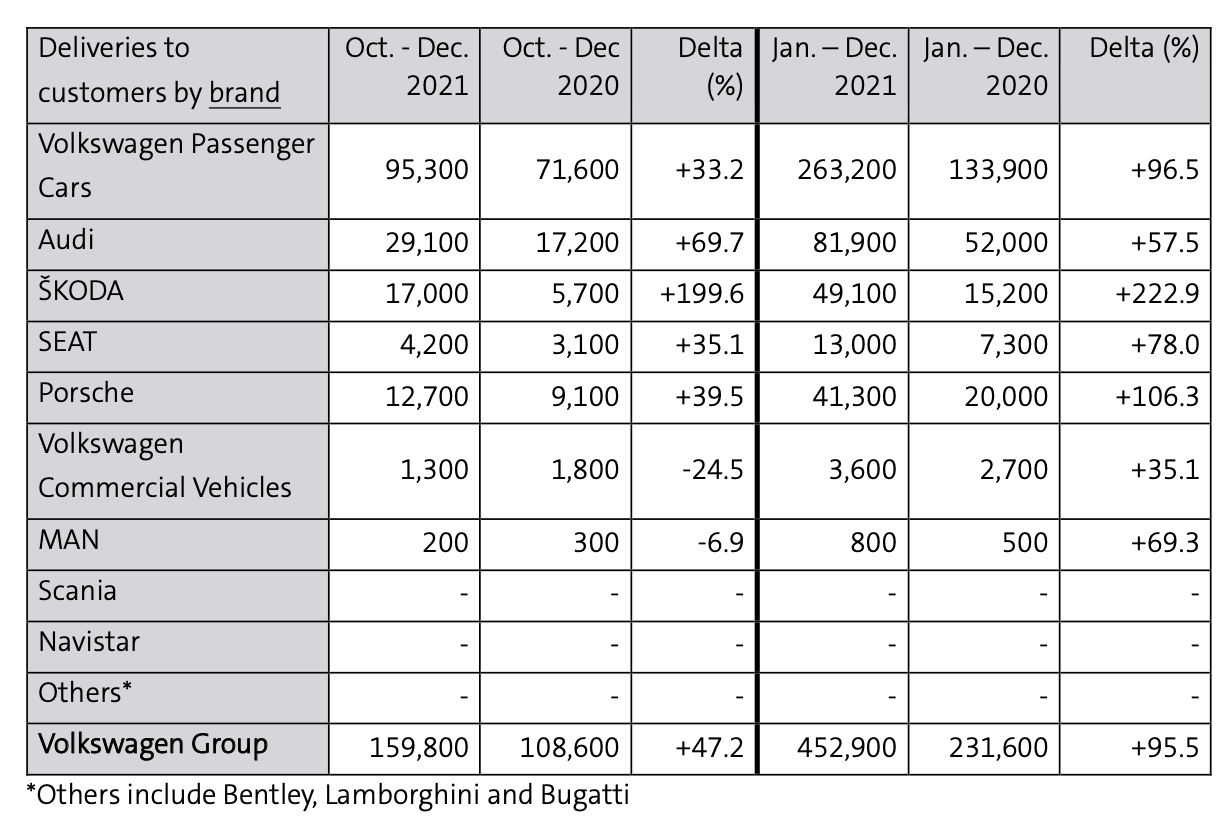

Take semi-premium carmaker VW, for example. It grew electric-vehicle sales faster than Tesla, expanding EV volumes by 96% last year versus 87% for its U.S. rival, yet it delivered only 263,000 cars to customers last year. By comparison, Musk sold 936,000 EVs in 2021—the bulk of which came from just the Model 3 sedan and virtually identical sibling, the Model Y crossover.

That annual gap between Tesla and VW widened as a result to a yawning 673,000 vehicles over the nearly 366,000 from 2020. Tesla still outsells VW at a rate of more than 3.5 cars for each EV that Volkswagen ships.

“It’s puzzling why VW is making such a big deal about their figures, because they’re not great once you compare them to Tesla,” said Matthias Schmidt, a Berlin-based analyst and publisher of a monthly report on Europe’s EV market.

A lack of microchips has certainly proved to be a major constraint to the brand, prompting a near-rebellion among the German workforce. Yet a bigger hint of where the problems lie is in China. Musk’s Shanghai factory has been on a tear, ramping up production at a blistering pace over the course of the year.

As a result, Tesla sold more than 70,000 vehicles in China alone in the month of December, roughly what Volkswagen brand’s vaunted ID family of purpose-built EVs managed for the entire year.

“Bit of a joke”

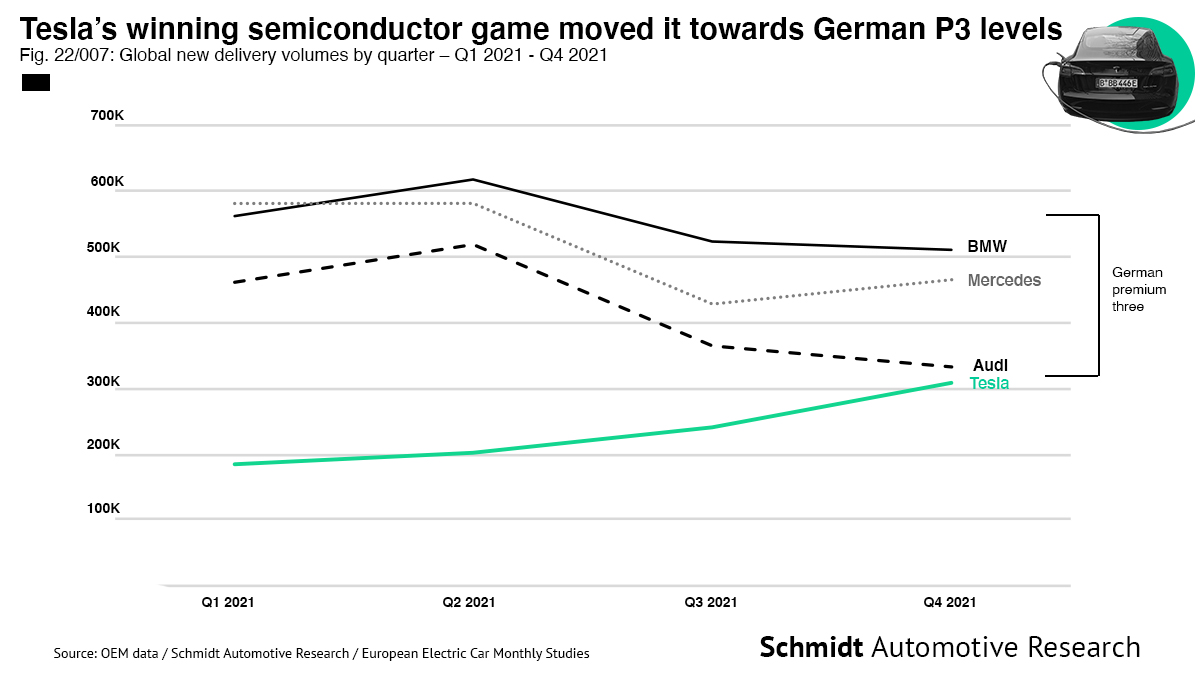

The story isn’t much better for the two largest German premium brands. Sales of fully electric vehicles sporting the Mercedes and BMW logos on the hood both soared by over 150%, yet they failed to impress.

The dedicated EV brand Mercedes-EQ saw global volumes hit only roughly 49,000 cars for the full year. That’s barely any better than Porsche’s 41,000 from its sole EV model, the Taycan. BMW meanwhile achieved some 69,000 vehicles, by comparison.

Perhaps the biggest disappointment came from Audi. Even though it sold more EVs than either of its two domestic rivals with nearly 82,000 vehicles delivered, it failed to keep pace with Tesla since volumes rose only 58%.

Schmidt said the four German carmakers would be better served not trumpeting their growth rates lest they draw too much attention to the figures.

“It’s nothing they should be shouting about really because their gains are coming from low levels, so you would expect to see a huge rise,” Schmidt said. “It’s a bit of a joke to me, really.”

BMW has high hopes for this year with EV sales predicted to more than double as it rolls out the electric iX SUV and i4 sedan models, which launched at the end of last year, to global markets. Later in 2022 it aims to launch the electric version of the 7 Series flagship and popular X1 crossover.

Meanwhile Mercedes is coming with its EQE sedan in the middle of this year in addition to the recently launched EQS, for which it collected over 16,000 orders to date. These are upper-end models, however, priced out of the reach of most people and are best tracked against demand for the Tesla Model S.

Help from Tennessee

Elon Musk isn’t standing still, either. With the number of Tesla assembly plants set to double to four this year, it’s very possible the charismatic CEO may soon sell more cars than Audi does across all its model lines and powertrains, and as many as Mercedes or BMW.

“By the second half of this year it will be a race to see who builds more cars in a quarter: Tesla or the German premium brands,” Schmidt said.

One of those new Tesla factories will be right next door to the erstwhile automotive heavyweights just outside of Berlin.

Volkswagen can at least can hope to significantly expand volumes with 95,000 EV orders on hand in Europe, fresh production capacity coming on stream in its U.S. plant in Tennessee, and a new ID Buzz halo model on its way.

“What really gives me confidence for the coming years is how strong our position is in the U.S. market,” wrote VW Group finance chief Arno Antlitz on LinkedIn on Wednesday. “We are No. 2 with a market share of over 7% in all-electric vehicles, and in 2022 the all-electric ID4 will also start rolling out locally in Chattanooga.”

Now Volkswagen just needs to get its hands on more semiconductor chips.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.