Back in the 1980s, outperforming companies could typically sustain their advantage for eight to 10 years. Now, superior performance regresses to the mean in one to two years on average. In such a fast-moving and unpredictable environment, past success is an increasingly poor predictor of future performance. That’s why BCG and Fortune created the Future 50. Our index, now in its fifth edition, complements traditional performance metrics with an assessment of the long-term growth prospects of the world’s largest publicly traded companies based on indicators and signals of their future potential. We call this measure of growth potential a company’s “vitality.”

The index is based on two pillars: a top-down, market-based assessment of a company’s potential, and a bottom-up analysis of its capacity to deliver growth. For the bottom-up view, we have quantified and tested numerous theories about what drives long-term success across four dimensions (strategy, technology and investment, people, and structure), and we use machine learning to select and weight factors based on their empirical contribution to long-term growth.

Our analysis incorporates a wide range of financial and nonfinancial data sources, such as the growth and quality of each company’s patent portfolio as an indicator of technology advantage. We also leverage natural language processing analyses of each company’s annual reports to unearth indicators of long-term focus and a tendency to serve a broader purpose beyond financial returns.

As in previous editions, we screen out highly vulnerable companies with negative operating cash flow, as well as companies facing inordinately high uncertainties associated with reputational risk or discontinuity in the direction of their business. (Read our methodology here.)

How the Future 50 has performed

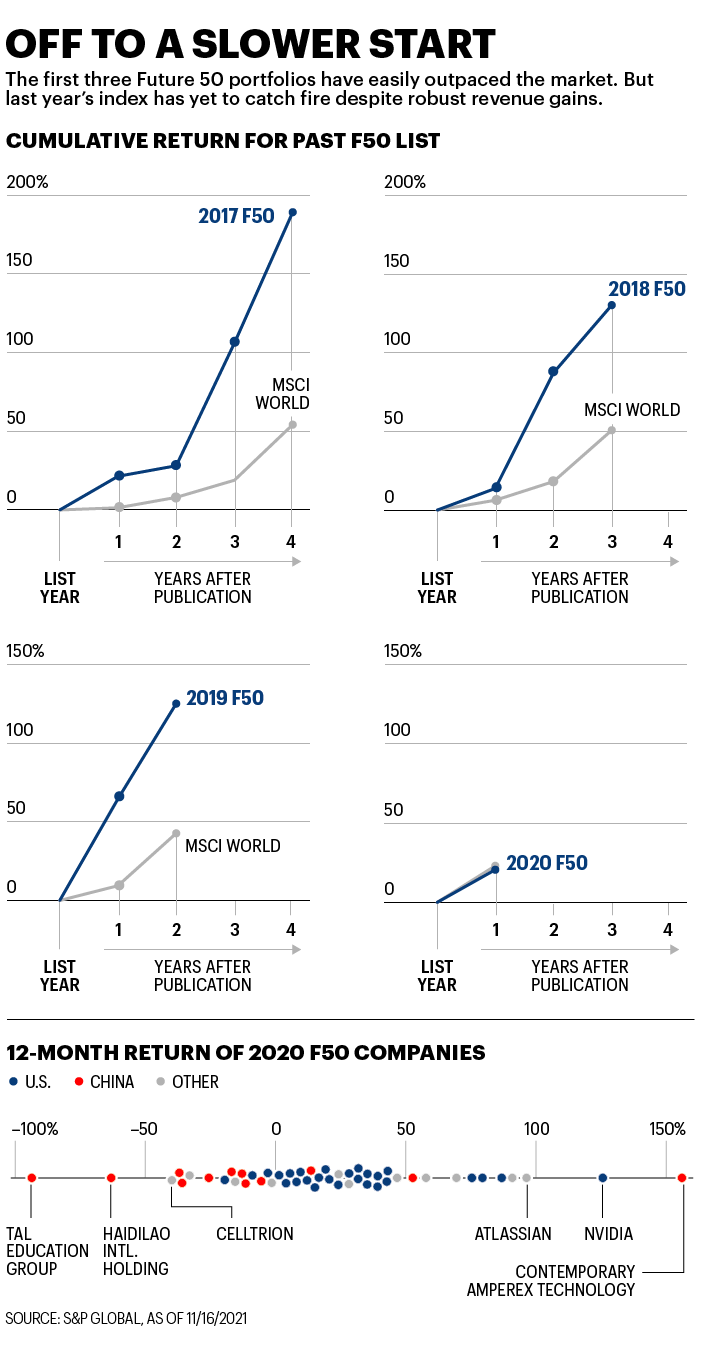

The value of vitality plays out over time and may not always be apparent in the near term. But our 2017, 2018, and 2019 indexes have consistently outperformed the market in both growth and value creation (the latter as measured by total shareholder return).

While last year’s Future 50 has delivered richly on growth, the portfolio’s market performance hasn’t yet measured up. Through the third quarter of 2021, the 50 companies in the index reported a total revenue gain of 28% compared with just 1% for the S&P 500. That’s the good news. The bad news is that the index’s shareholder return of 21%, since publication through Nov. 16, 2021, lags the gains of the S&P 500 (30%) and the MSCI World Index (23%) over the same time frame. Some of our portfolio’s underperformance can be chalked up to headwinds in China. Two Chinese companies in particular faced severe challenges over the past year: Beijing effectively banned the school-age tutoring business of TAL Education Group (down 94%), while hot pot restaurant chain Haidilao (down 63%) has been hit hard by COVID restrictions and a big drop-off in diners.

2021: A turbulent year

The COVID-induced downturn in 2020 was more widespread than any in the previous century: 93% of all economies faced a recession in 2020, compared with 84% during the Great Depression and 61% during the Great Recession. The effects continued to be felt throughout 2021, as businesses adapted to pandemic-induced shifts that are here to stay—notably the accelerated adoption of digital technologies and delivery channels across industries.

An already uncertain environment has been rendered even more unpredictable as regulators turn their attention to some of the fastest-growing technology industries, such as gaming and e-commerce. China in particular has moved decisively to investigate, fine, and even outlaw entire markets, such as for-profit educational tutoring. As a result, some of the largest and most vital businesses in China are facing greater uncertainty and more modest growth prospects coming out of 2021.

The 2021 Future 50

The disruptive effects of COVID and regulatory pressure, especially in China, led to higher turnover in the new Future 50 compared with previous editions. Only 17 companies in this year’s index were included in 2020. The flip side of this is that many businesses have risen to the top of our growth potential assessment by seizing the opportunities created by the COVID crisis. In other words, these companies were resilient: able to buffer the shock and capable of adapting to changing conditions and thriving in new circumstances. Because vitality reflects a company’s ability to reinvent itself, it goes hand in hand with resilience.

The technology sector continues to dominate the Future 50. Companies in the information technology, communication services, and e-commerce industries account for 64% of the index. Enterprise technology companies are still strongly represented with companies like Workday, ServiceNow, Veeva, and Coupa.

As is to be expected with the COVID-driven increase in remote work, digital teaming businesses like Zoom and Atlassian account for 10% of the index. Growing business reliance on digital and A.I. solutions explains strong demand for cloud security and monitoring services, which are also well represented in the index with companies such as CrowdStrike, Okta, and Zscaler.

The rise of sustainability concerns is reflected in the robust representation of renewable energy companies in the 2021 index, including Adani Green Energy, Xinyi Solar, and LONGi Green Energy.

The U.S. (26 companies this year versus 27 last year) and Greater China (16, up from 12) continue to dominate the Future 50. China’s gains came primarily at the expense of Western Europe and developed Asia, both of which declined from four companies to two in this year’s index. If we expand our screening to the top 200 companies, China retains a 32% share—a testament to the growing vitality of China’s overall corporate community.

Gender diversity continues to be an important attribute of the most vital companies. Compared with all large global companies, those on the 2021 Future 50 have a higher share of female senior executives (21% versus 15%) and female managers across the organization (32% versus 28%). However, female CEOs remain rare—both among the Future 50 and in the market overall. Much more progress is needed.

Beyond the top 50, our analysis demonstrates that vitality is possible across geographies and industries. And the inclusion in this year’s Future 50 of 32 companies that made it into the index for the first time proves that crises are also extraordinary opportunities to get ahead and lay the foundations for robust future growth.

Martin Reeves is a senior partner at management consulting firm BCG and chairman of the BCG Henderson Institute. David Zuluaga Martínez is a principal at the BCG Henderson Institute.

A version of this article appears in the December 2021/January 2022 issue of Fortune with the headline, “In an unpredictable world, bet on growth.”