Good morning, Bull Sheeters.

On Friday, risk assets were toxic. Today, they’re being bid up as investors ponder, wait a second, there isn’t yet a wallop of bad news, so why not buy the dip?The early take on the new Omicron variant: yes, it’s spreading, but the early infections are on the mild side… On cue, U.S. futures are on the rise, following Europe higher.

The other big losers on Friday—the dollar, crude and crypto—are also in the green (in some cases, significantly) as I type. Still, the gains are not even close to recouping Friday’s big losses.

In today’s essay, I go by-the-numbers as I dig into Friday’s big sell-off, and pull out some take-aways for what to look for today and in the days ahead.

But first, let’s see what else is moving markets.

Markets update

Asia

- The Asian markets closed mostly lower with the Nikkei, the worst of the bunch, down roughly 1.1% on the day. Asian airline stocks were among the hardest hit.

- Japan will follow Israel in barring all foreign visitors as travel restrictions mount in the face of rising Omicron fears.

- Here’s the good news/bad news on COVID. First, the bad: the global death toll is nearing 5.2 million. Next, the better: the seven-day average for global deaths has been steady over the past week.

Europe

- The European bourses were popping out of the gates, bouncing back from Friday’s mammoth sell-off. After the benchmark Stoxx Europe 600 tumbled 3.7% on Friday, it is up more than 0.7% 90 minutes into the session. Every sector was in the green at the start.

- There are confirmed Omicron cases now in the following countries: United Kingdom, France, Netherlands, Germany, Belgium, Italy and Israel. As Deutsche Bank’s Jim Reid writes this morning, “it’s probably more widespread than people think already.” On cue, the euro is sliding lower against the dollar.

- OPEC+ holds a virtual meeting on Thursday and, with the emergence of Omicron, there’s growing speculation oil producers will call off their plan to boost output.

U.S.

- U.S. futures have been gaining all morning. On Friday, the Dow Industrials got walloped, its worst trading day this year.

- The rout in equities was nothing compared to what we saw with energy prices and with bond yields. Investors piled into bonds on Friday, sending the yield on the 10-year U.S. Treasury hurtling down 16 basis points. A reminder: when demand is brisk for bonds, yields fall.

- What’s on the calendar this week? We have a thin batch of earnings due out from Salesforce (Tuesday), CrowdStrike (Wednesday) and Dollar General (Thursday), plus the November jobs report (Friday).

Elsewhere

- Gold is up (you’d think by more), trading near $1,800/ounce.

- The dollar is flat.

- Crude is bouncing back with Brent above $74/barrel this morning.

- Crypto is bouncing back with Bitcoin above $56,000 after a tumultuous weekend. Ether too is up, nearing $4,300.

***

Omicron: By the numbers

So much happened in the markets on Friday that I feel it’s best to explain the big points in a special Monday edition of the “By the Numbers.”

-2.3%

In a truncated trading session, the S&P 500 fell 2.3% on Friday. That was just the fifth down-day of that magnitude (measured as down more than 2% in a single session) this year, according to Charlie Bilello of Compound Capital Advisors. In case you’re wondering, we haven’t had a single one-day drop of 3% or more in 2021 (compared to 16 times a year ago). It wasn’t an across-the-board wipeout. Work-from-home stocks, including Zoom, Clorox and Peloton, took off, as did the vaccine makers Pfizer and Moderna. The reopening stocks—think energy and banks stocks, plus airlines, cruise ships and meme darlings GameStop and AMC Entertainment—cratered. We’re already seeing Friday’s trade unravel as investors reconsider the Omicron impact. However, the new variant is forcing economists to take a long hard look at their global growth projections, and that could push back investor enthusiasm for the reopening stocks.

+54%

The VIX, the so-called fear index, has been incredibly choppy in recent days. It spiked 54% on Friday, the fourth biggest one-day jump ever, following the Omicron news. During the meme stock frenzy last January, we saw a similar hiccup. That one proved short-lived. It’s too early to tell this time around, but it’s worth keeping an eye on the VIX in the coming days as it’s become a decently reliable gauge for investor risk appetite. A reminder: investors tend to associate a lower VIX number with a period of relative calm—ergo, a good buying opportunity. When it goes up dramatically, as it did on Friday, investors tend to bail out fast. This morning, the VIX sits at 25.66, 10% below Friday’s highs.

$8.9 billion

Omicron may have pushed retail-sales news off the front pages, but we have you covered here. Black Friday sales are in the books, and the numbers were, erm, not great. Online spending topped $8.9 billion on Friday, which amounted to the first-ever decline, as tallied by Adobe Analytics. That shouldn’t come as a huge surprise. Spooked by supply chain snags, shoppers got the jump on Christmas shopping long ago. (Yours truly is nearly done with his list; the dog gets NOTHING this year as she’s failed to dig up a single truffle for the Warner family.) Still, retail stocks sold off heavily on Friday. They’re regaining some ground in pre-market this morning, but not quite recouping all those losses, as we move into another day of Cyber Monday sales.

Postscript

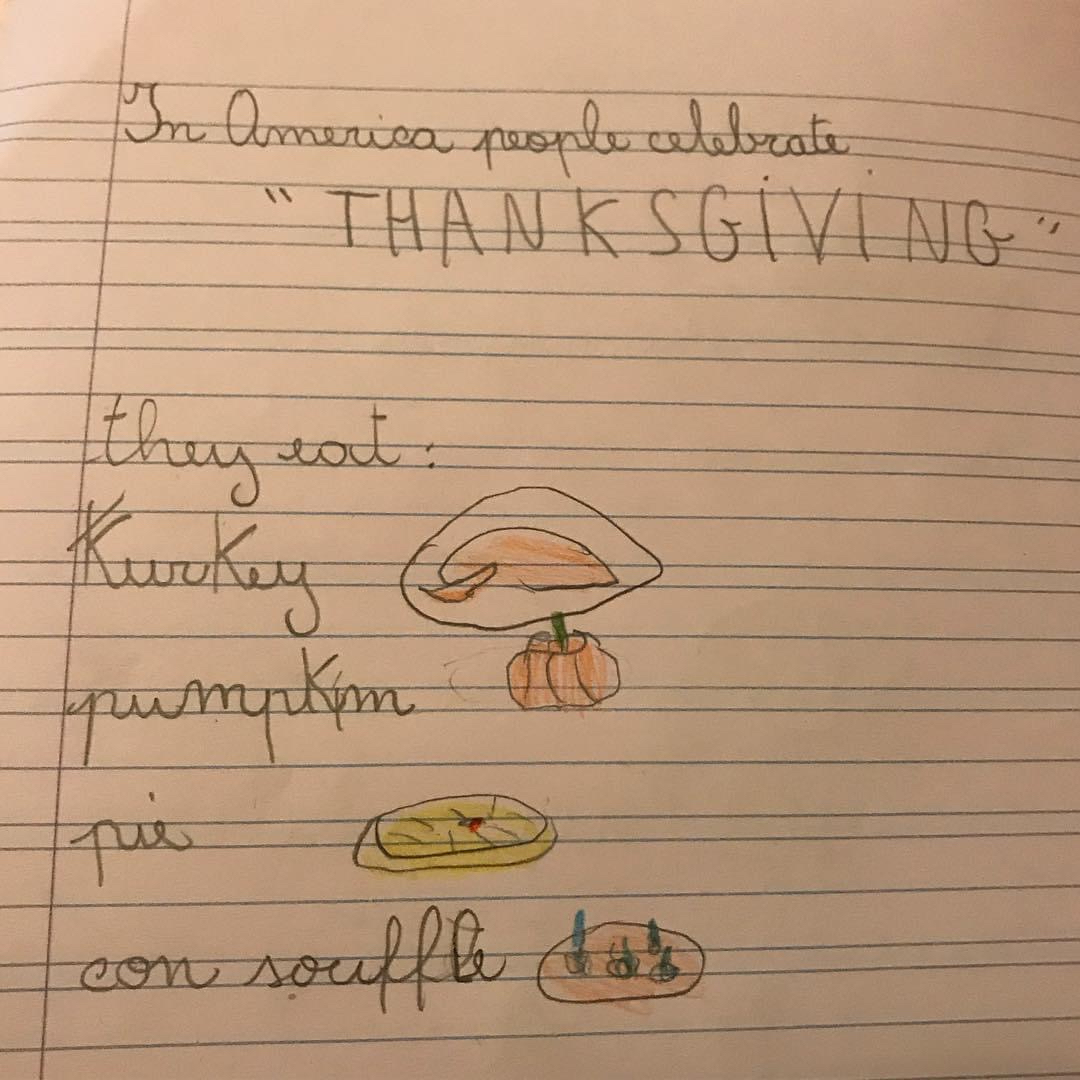

A few years ago, my daughters were asked to prepare a brief report for their classmates on the meaning of Thanksgiving. Being half-American, they were game to lay out for the Romans the basics, starting with the menu.

Here’s what they came up with:

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Bitcoin and other crypto plunge as fear of new South Africa COVID variant routs markets—Fortune

The corporate world’s race to net-zero hinges on tiny villages in the DR Congo—Fortune

Investors Go Back to Their Early-Covid-19 Playbook: Buy Zoom and Peloton, Dump Travel—Wall Street Journal

The Rules of Retirement Spending Are Changing—Wall Street Journal

Market candy

Quote of the day

They were sitting in Paris, for example, and totally underestimated the cost.

That's Laurent Vanat, a consultant on the global ski industry, who grumbled to Fortune's Vivienne Walt about the disastrous 2020-21 ski season in Europe. Widespread closures enacted by public health officials (and not only in Paris) last year wiped out billions in revenues across the industry. This year, the snow is already falling on the Alps, but there are big concerns that it could be another dud of a season. Here's why.

This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.