Happy Monday! Let’s dive in.

As the war for talent continues and the U.S. moves towards recovery from the pandemic, there’s been an increased focus on stakeholder capitalism.

“These days, it would be a rare corporate leader who would say out loud: No, thanks, my company does not have to serve society, and doesn’t want to,” Vivian Hunt, DBE, a senior partner at McKinsey and Company’s London office, wrote in an opinion piece for Fortune. “In this sense, the concept of stakeholder capitalism—considering the needs of consumers, employees, and communities as well as shareholders—needs no introduction. Nor should it be controversial.”

But when it comes to the intent of companies and public perception, there appears to be an increasing disconnect. The nonprofit JUST Capital’s annual Americans’ Views on Business Survey released on Nov. 11 gauges the public’s sentiments toward corporate America. About 49% of Americans surveyed believe companies have a positive impact on society, a decrease from 58% in 2018. JUST Capital’s board members include Arianna Huffington, CEO of Thrive Global, Paul Tudor Jones II, Tudor Investment Corporation founder, co-chairman, and chief investment officer, and John Rogers Jr., co-CEO of Ariel Investments, among others.

The 2021 survey found the optimism levels in various areas reached in 2018 are waning. For example, in 2021, just 22% of respondents said companies are headed in the right direction, compared to 30% in 2018. And over the last four years, trust in business has plateaued as 48% of respondents said they trust companies compared to 47% that distrust them, the report found. The 2021 survey was among a general population sample of 3,000 U.S. adults.

In addition, Americans surveyed think companies prioritize shareholders. About 78% said companies have a positive impact on shareholders (up from 72% in 2018), compared to the work-life balance of their employees (48%) and the financial well-being of its lowest-paid workers (36%).

“It’s clear from labor shortages to the ‘Great Resignation’ that the pandemic has opened Americans’ eyes to what matters most, and they are willing to vote with their feet for better wages and benefits, safe working environments, and more flexibility and opportunity,” JUST Capital CEO Martin Whittaker says.

Finance chiefs can play a key role in changing the current trajectory, Whittaker explains. “To regain trust, CFOs and C-suite leaders should recognize the long-term business case for investing capital in workers and perform a worker financial wellness assessment as a critical first step,” he says.

Along with worker-wellbeing, respondents also pointed to CEOs having the platform to influence society. About 63% said they believe CEOs of large companies have a responsibility to take a stand on important societal issues. And many respondents believe they can apply pressure to make CEOs responsive. About 86% said when people act as a group, they can be effective in trying to change companies’ behaviors, the report found.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

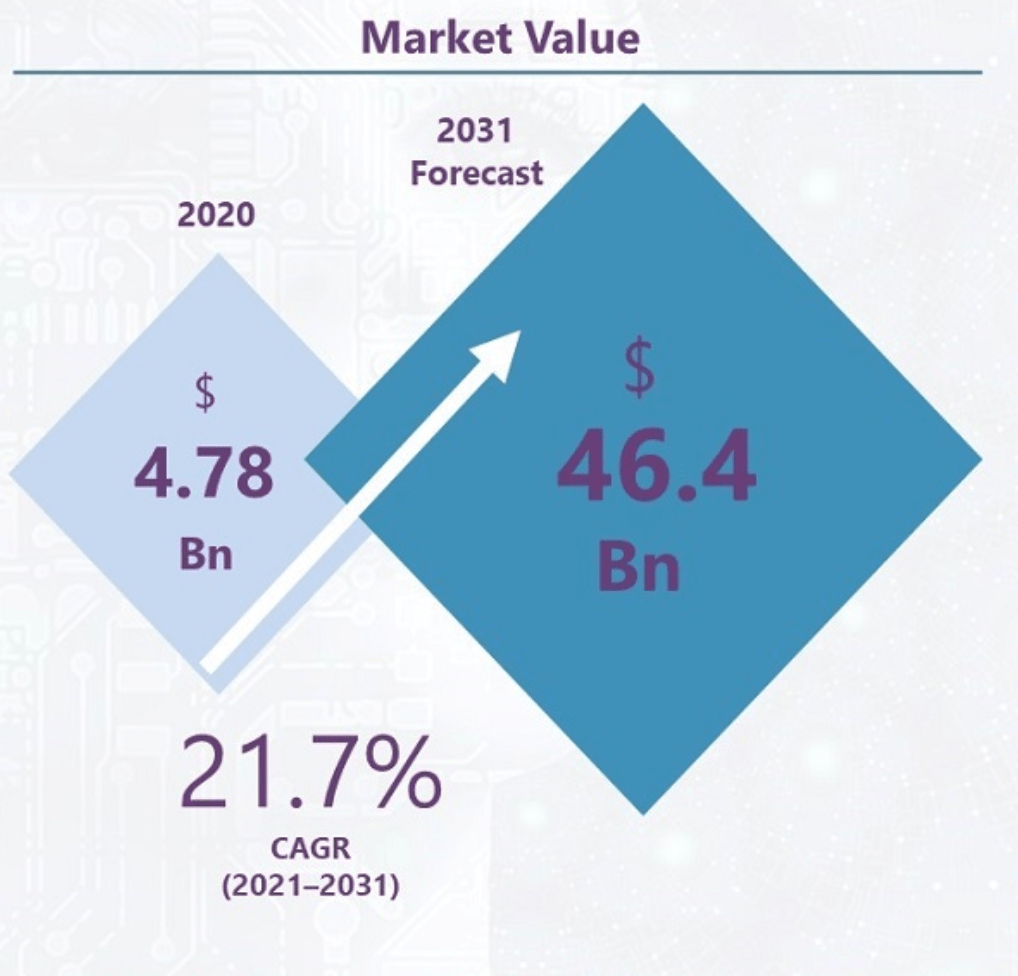

In 2020, "The Global Hyperautomation Market" was valued at $4.78 billion, according to a new market research report released by by Sheer Analytics and Insights Pvt. Ltd. Between 2021 and 2031, growing at a high compound annual growth rate (CAGR) of more than 21.7%, it is estimated to reach $46.4 billion by 2031, the report predicts. Market growth in hyperautomation, a progression of various automation initiatives, is attributed to the increasing demand of artificial intelligence and machine learning with robotic process automation, according to the report.

Courtesy of Sheer Analytics and Insights Pvt. Ltd.

Going deeper

Meet the ‘Trillion Dollar Club’: How 5 companies took over the S&P 500—and likely your portfolio, a new report by Fortune, examines how the market caps of Apple, Microsoft, Alphabet, Amazon, and Tesla have soared. Investors in big-cap index funds are investing a lot more of their money in a small number of extremely expensive stocks.

Leaderboard

Catherine Bonelli was named CFO at Turning Rock Partners, a New York-based private investment firm. Bonelli brings more than 30 years of experience. Prior to joining Turning Rock Partners, she was CFO and chief compliance officer for Circle Road Advisors LLC, a registered investment advisor. Bonelli also spent more than nine years at Fortress Investment Group as managing director and CFO of the Fortress Partners Funds. She also was a director at UBS Alternative Asset Management.

Nick Grindstaff was named CFO at Orbital Energy Group, Inc. (NASDAQ: OEG), effective Nov. 16, 2021. Grindstaff will replace Daniel Ford, who will remain with the company during a transition period. Grindstaff has more than 20 years of experience in the infrastructure services industry. Most recently, he served as VP of finance and treasurer at Quanta Services, a leading international provider of specialty contracting services.

Overheard

"We’re a startup that has the whole horizon in front of us. These stories will continue to evolve as we grow from overviews to deeper and more personal stories, more contextual stories, that move us."

—Actor, director, and producer Kevin Costner on investing in the audio storytelling app HearHere, as told to Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.