This year was an absolute nightmare for would-be homebuyers. Even if they could find a home within their budget—no easy task as inventory hit a 40-year low this year—there’s a good chance they lost it in a frenzied bidding war. That’s not an exaggeration: At one point this spring, a staggering 74% of U.S. home listings were getting multiple offers.

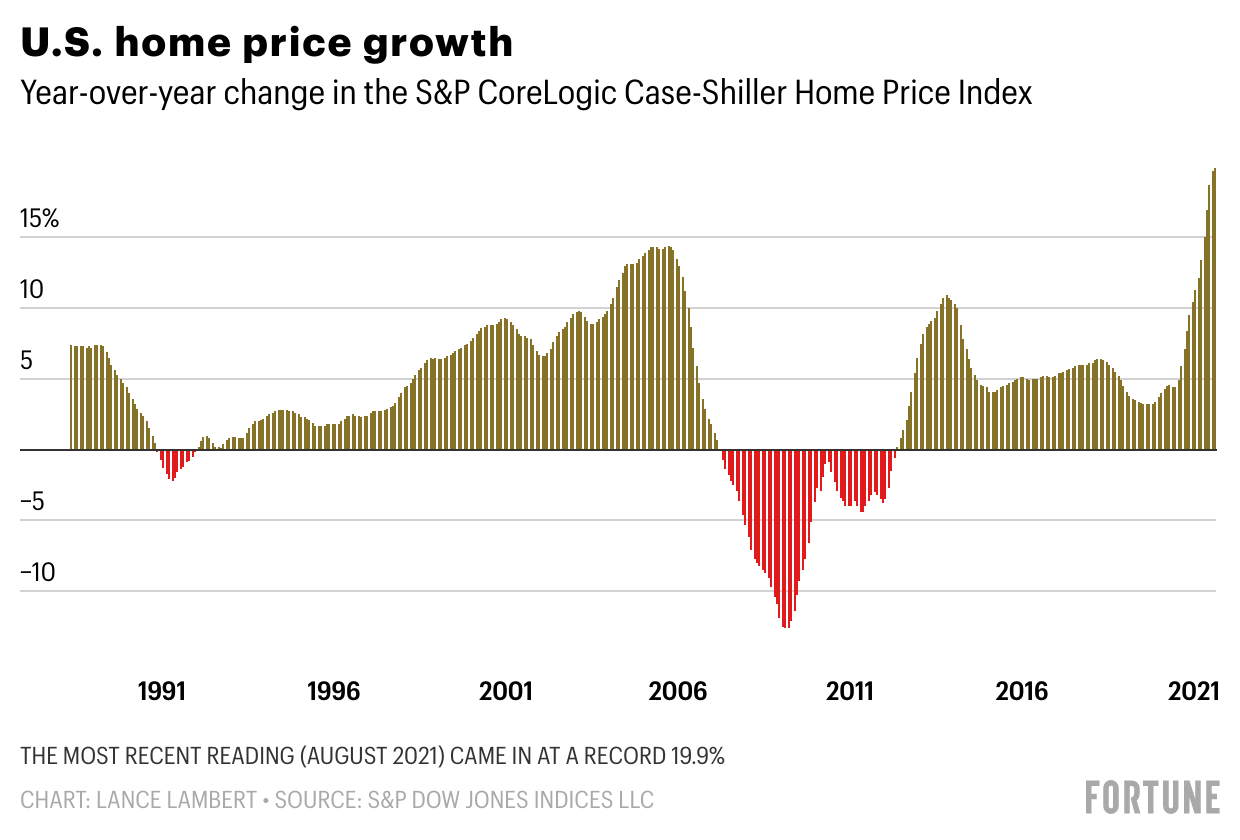

But there might be a tiny bit of good news for house hunters: The industry consensus is that the 2022 housing market will see less crazy price hikes. Every forecast model Fortune has reviewed shows price growth—which soared a record 19.9% between August 2020 and August 2021—decelerating (a.k.a. not going up as fast) next year. Already, we’re starting to see some of that cooling. Look no further than bidding wars. As of September, 59% of homes are getting multiple offers, or a 15 percentage point drop from April.

However, while industry insiders say we’re transitioning into a period where price growth isn’t as astronomical, there’s no consensus on what that new rate of price growth will look like. Indeed, when it comes to the 2022 housing market, the outlooks are all over the place. On the high end, there is Zillow, which is forecasting 13.6% price growth in the coming 12 months, and Goldman Sachs, which predicts a 16% bump by the end of 2022. Fannie Mae is less bullish, saying prices will climb 7.9% in 2022. Meanwhile, CoreLogic is pretty bearish in forecasting just a 1.9% price jump over the coming 12 months. If Zillow or Goldman Sachs are right, that would mean 2022 would still be among the hottest years on record. If CoreLogic’s forecast turns into reality, then we would be headed for the slowest period for price growth since 2012.

These wide-ranging forecasts prompt the question: Why is there so much uncertainty when it comes to the 2022 housing market?

On paper, the fundamentals underpinning the market—demand outpacing supply—remain strong heading into 2022. However, industry insiders tell Fortune two big unknowns make it hard to pinpoint just how big that demand and supply mismatch will be next year.

1. How high will mortgage rates climb in 2022?

Heading into 2021, the Federal Reserve predicted that inflation would remain relatively tame and that it would top out at 1.8% this year. Boy, were they wrong. At its latest reading for the month of October, the consumer price index came in at 6.2%—the highest rate of inflation since 1990. That’s barely below the 7.1% average inflation rate notched during the 1970s, a decade notorious for runaway inflation.

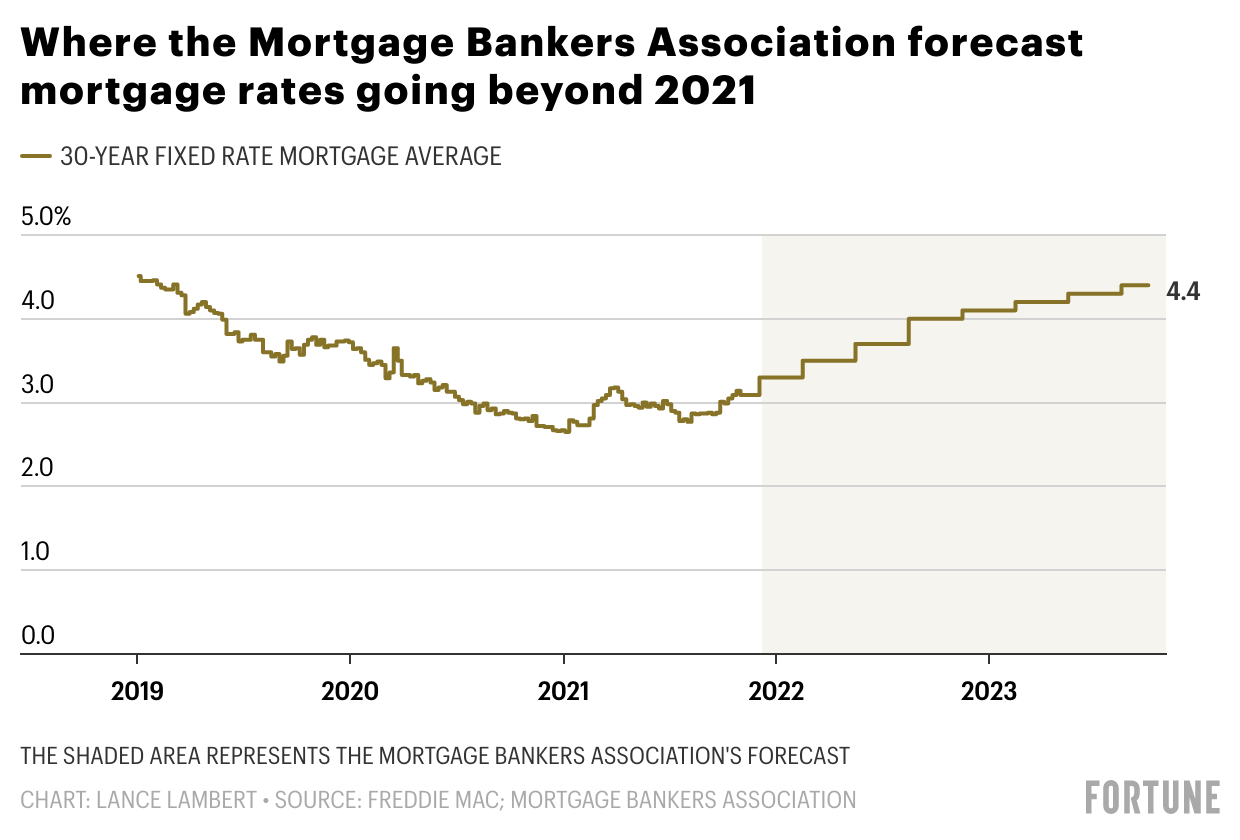

Higher than expected inflation makes it all the more likely that the Federal Reserve would raise the federal funds rate—something it has kept near zero during the pandemic in an effort to encourage more economic activity. But if the Federal Reserve does raise rates, it would also see the average 30-year fixed mortgage rate (currently at 2.98%) rise. Of course, upped mortgage rates directly translate into higher monthly payments—which would lock some buyers out of the market altogether.

“If something changes in the mortgage rate environment, that could throw a massive wrench in everything…Mortgage rates are a bit of an unknown, and they have a direct relation with activity in the housing market,” Devyn Bachman, vice president of research at John Burns Real Estate Consulting, told Fortune.

But the industry isn’t quite sure how high rates will rise.

Fannie Mae foresees the average 30-year rate climbing to 3.4% by the end of next year. Meanwhile, the Mortgage Bankers Association is forecasting that the mortgage rate will climb to 4% by the end of 2022, and to 4.4% by the end of 2023.

Those forecasted rate increases are bigger than they might look. For instance, say a buyer put down 20% on a $500,000 home. If she locked in the current average 30-year rate (2.98%), she would have a monthly payment (excluding taxes and insurance) of $1,682. But if the mortgage rate is 3.4%, it pushes the monthly payment to $1,774. At the 4% rate level forecasted by the Mortgage Bankers Association, that payment spikes all the way to $1,910, or an additional $82,000 over the course of 30 years.

2. Will supply chain shortages hold back homebuilders in 2022?

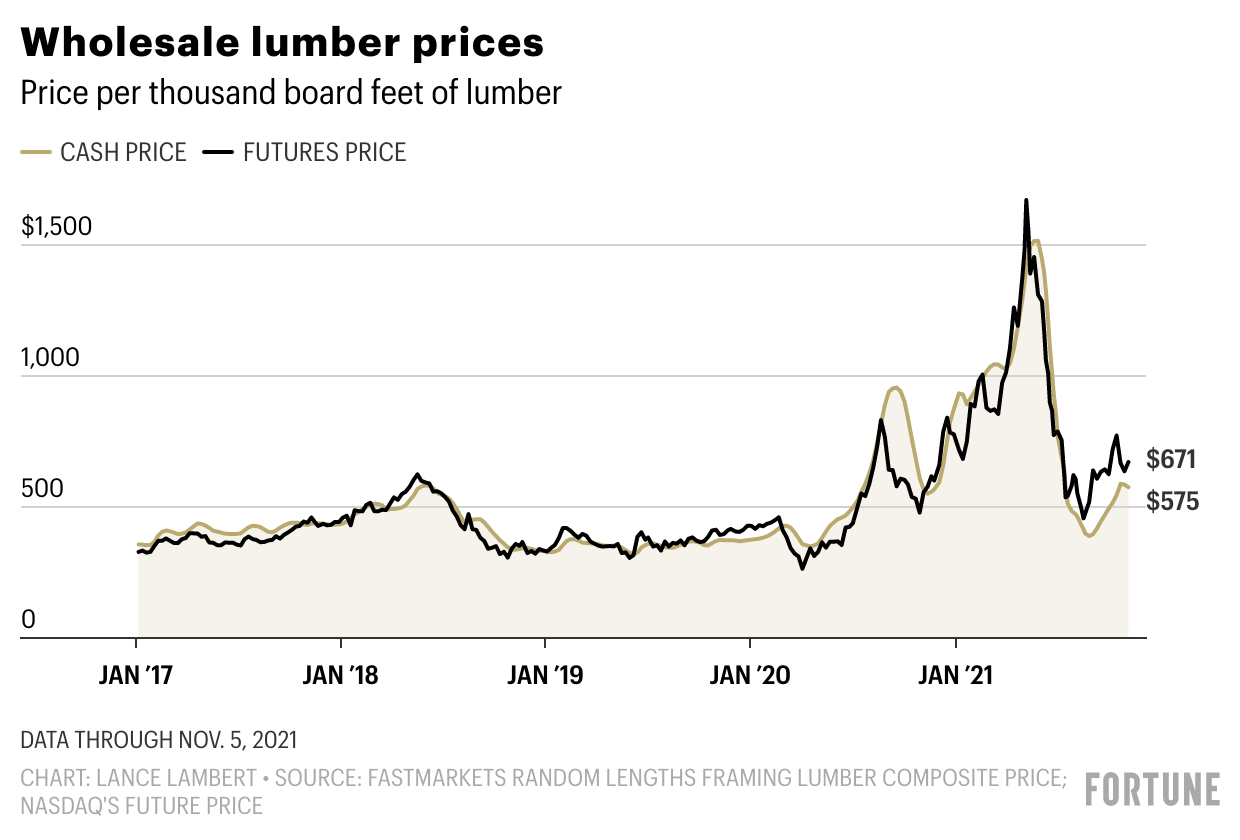

Lumber, which was up 300% this spring above its pre-pandemic price, was arguably the canary in the coal mine for the material shortages and supply chain issues that are plaguing the economy. Ultimately, framing lumber prices started to crash back in May as do-it-yourselfers simply balked at the exorbitant prices. That price correction obviously brought down the price of new homes, right? Not even close. Over the past four months alone new-home prices are up another 5%.

What’s going on? While the wood shortage has eased, the price of almost every other building component has shot up. Concrete. Windows. Paint. You name it, the price is up.

“Lumber has come down; we have more lumber. But that does not mean we have more appliances or cabinets,” Bachman noted. Not to mention, the Great Resignation has hit the construction industry fairly hard. “Labor is starting to rear its ugly head again, and we’re hearing a lot more conversations about ‘I can’t find workers. I can’t get [the work done] on time. There’s not enough labor,’” Bachman said.

Even the correction in the lumber market is hardly a silver lining. After peaking at $1,515 per thousand board feet this spring, lumber prices crashed to $389 by mid-August as DIY buyers sat on the sideline. But now those buyers are rushing back in, helping to send the price back to $575. That might seem cheap compared with the top of the lumber bubble. However, it’s still well above the $375 price builders were paying heading into 2020.

What’s more troubling than the lack of material or supply chain relief is the fact that industry insiders interviewed by this publication don’t have any idea of when—or how—inflationary spikes and labor shortages will get resolved.

Unlike with mortgage rates, which threaten to decelerate prices if they’re upped too fast, homebuilding cutbacks threaten to send prices higher. It boils down to the fact the U.S. is under-built by 4 million homes as the largest chunk of millennials are hitting their peak first-time homebuying years. If builders are forced to scale back further (the 1.55 million housing starts in September are already below the 1.73 million starts in March), it could mean even fewer homes for sale in an already historically tight—and competitive—housing market.

“There is some concern about whether homebuilding can sustain its 2021 pace amid inflationary pressures and various threats to the economy,” Shawn Church, editor at Fastmarkets Random Lengths, told Fortune.

Subscribe to Fortune Daily to get essential business stories delivered straight to your inbox each morning.