Good morning, Bull Sheeters.

According to the markets, all is right with the planet. U.S. futures are gaining, following Europe higher, as we move into another big week of corporate earnings, plus a Fed decision and jobs numbers. Oh, and there’s a global climate summit kicking off in Glasgow in a few hours.

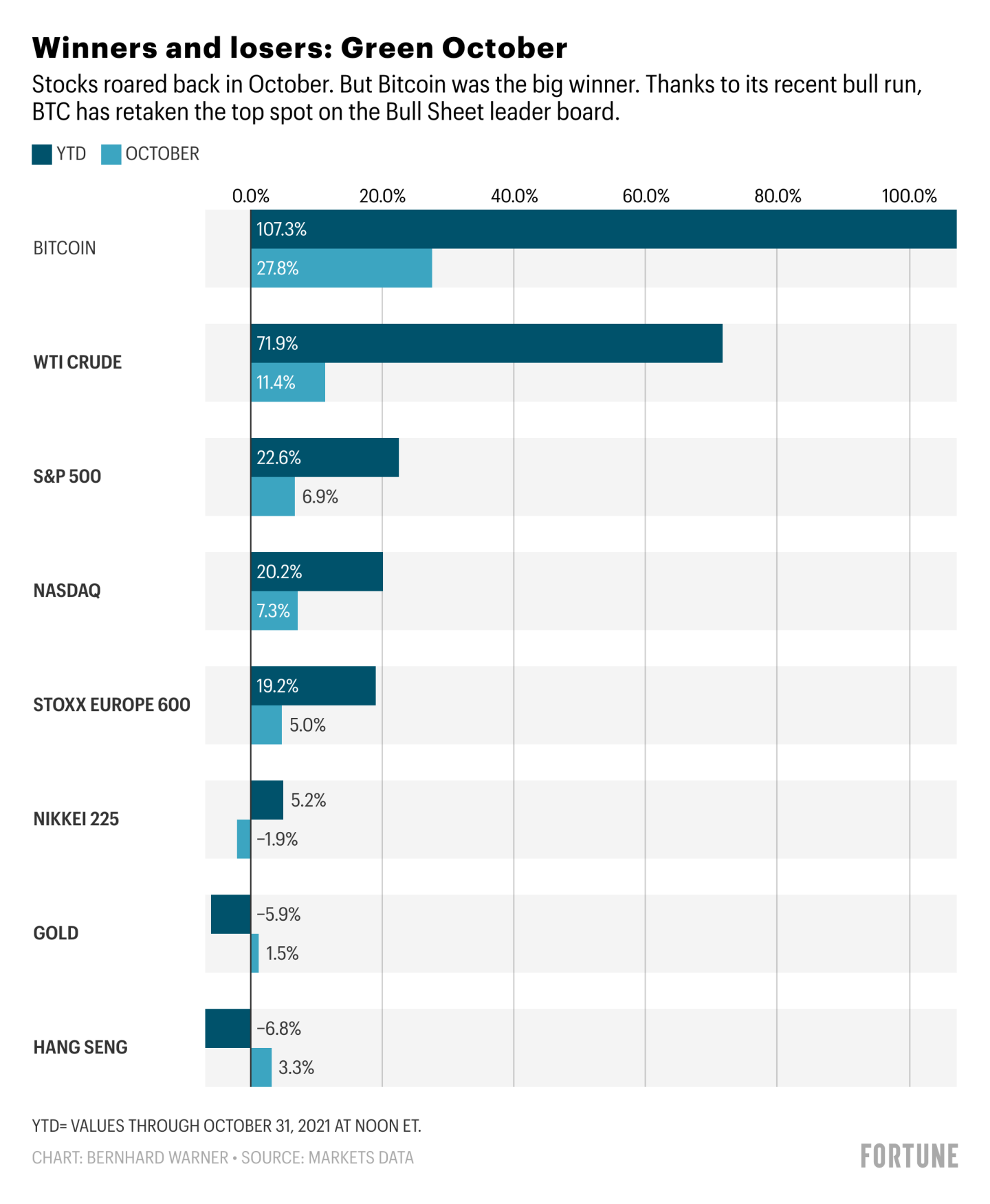

As we do on the first trading day of each month, I’ll be taking us through the big winners and losers in the latest installment of the Bull Sheet leaderboard. What took off last month? Hint: it rhymes with schmeverything.

But first, let’s see what’s moving the markets this morning.

Reader note: In Rome, we moved the clocks back one hour over the weekend so Bull Sheet is on Daylight Destruction Time, which might explain the odd timing of this newsletter hitting your in-box until the global clocks can all harmonize again.

Markets update

Asia

- We start the week with mixed markets in Asia. The Nikkei, an October laggard, is up 2.6%; Chinese stocks are sinking.

- More lousy economic data out of Beijing this morning… China’s factory output slowed more than expected last month, hurt by higher commodity prices and waning domestic demand, Reuters reports.

- Further to the west, Saudi Aramco delivered a gusher of profits last quarter. Soaring petrol prices have been a boon for the the world’s largest oil producer. Alas, shares were down 0.1% on Monday morning.

Europe

- The European bourses were gaining at the open, with the Stoxx Europe 600 up 0.8% in the first hour of the trading session, pushing the benchmark into record territory.

- Shares in Barclays sank more than 3% at the open on news CEO Jes Staley will step down immediately over his ties to the late Jeffrey Eptsein.

- At the G20 summit in Rome this weekend, EU and U.S. officials consigned the Trump-era steel and aluminum tariffs to the scrap heap. A recap: In 2018, Trump slapped tariffs on European steel and aluminum and the EU retaliated, slapping duties on Kentucky bourbon and Harley Davidson motorcycles. And that, dear reader, is how trade wars usually go down.

- World leaders left Rome with a pretty lame climate-protection pledge on Sunday. That doesn’t bode well for the COP26 climate talks that begin Glasgow today.

U.S.

- U.S. futures point to a positive open. That’s after all three major averages pulled off a fourth-straight week of gains.

- EV startup Lucid—which has designed a kind of Tesla range-killer—confirmed its first shipments were to be delivered over the weekend. Shares have been trading at an all-time high since it went public in July.

- What’s on the calendar this week? The Fed meets tomorrow and Wednesday and we get jobs numbers on Friday. As for earnings, we have: Pfizer (tomorrow), Airbnb and Moderna (Thursday) and Berkshire Hathaway (Friday).

Elsewhere

- Gold is up, trading above $1,780/ounce.

- The dollar is up after another solid week of gains.

- Crude is flat on news China will tap its state reserves of oil to keep prices in check. Brent trades around $85/barrel.

- Bitcoin is steady, trading below $61,000.

***

Winners and losers: Rock-tober edition!

Ottobrata romana. Stop me if you’ve heard this: We have this term here in Rome to describe the sublime Indian summer weather—throughout most of September and October, a persistent high-pressure system sits over the city, producing sunny, breezy day after sunny, breezy day.

Investors just experienced a kind of Ottobrata dei mercati: a pleasant breeze that lifted just about everything last month—from tech stocks and bank stocks to European shares and crypto.

The S&P 500 this morning sits at 4,605.38, a record. The Dow sits at 35,819.56, a record. Ditto for the Nasdaq and Stoxx Europe 600.

As we turn the page on the calendar, investors have that risk-on vibe back. That marks a huge change in sentiment. Exactly one month ago, on October 1, I wrote, “As we head into the final quarter of the year, the trend lines don’t look great. Bond yields are rising, as is the dollar, crude, shipping costs and inflation. Stocks are sinking, and crypto is as volatile as ever.”

I was hardly alone in striking a bearish tone. Bull Sheet readers weighed in, telling me they’re taking a break until things cool down.

For those who cashed out, you missed out on the following markets action:

Let’s start at the top. Crypto and crude have been swapping the top spot in the Bull Sheet leaderboard all year. Bitcoin soared nearly 28% last month. Year-to-date, it’s more than doubled. That strong October performance was enough to push oil to the No. 2 spot. The U.S. benchmark West Texas Intermediate (WTI) is up nearly 72% so far in 2021 after gaining a further 11% last month.

Could this mean crypto has become a kind of hedge on soaring crude prices?

I’m not buying it. Everything gained last month. Tech stocks, bank stocks, Chinese stocks, European stocks. Even gold had a decent month. Ok, not everything. The Nikkei had a lousy month, but you get the picture: it was a good month for most portfolios.

And the momentum doesn’t appear to be cooling off.

According to Goldman Sachs, investors sank a further net $28 billion into equity funds in the past week. They weren’t the only buyers. Corporates have authorized a record $1 trillion in stock buyback so far in 2021.

As we move into the winter months there are a lot of tailwinds propelling stocks higher.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

EXCLUSIVE: SEC’s Gensler says crypto ‘unlikely to reach’ potential outside of regulatory oversight—Fortune

Not FAANG but MAMAA: Jim Cramer reveals new acronym for the 5 largest tech giants—Fortune

Amazon’s paltry sales growth shows why it needs more stores—Fortune

Women May Be Better Investors Than Men. Let Me Mansplain Why—New York Times

Narrowing Yield Gap in Treasurys Signals Worries Over Fed, Growth—Wall Street Journal

Market candy

+400%

I could have easily included king coal in the leaderboard above. Coal futures have shot up more than 400% YTD, thanks to the global energy crunch. That's good news for coal traders, not so good for the planet (the burning of coal accounts for 46% of global carbon emissions). Coal's remarkable 2021 performance is one of the marvels of the markets. But there are big doubts this rally will last that long, Fortune's Eamon Barrett explains.

This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.