Good morning,

“I do have a problem with availability and cost of labor today. Can you help me with that?”

That’s a common question from potential customers amid a tight labor market, Michael Keogh, CFO at Bright Machines, a manufacturing software and robotics company, told me. But the company is selective as customers must “believe in the vision of software-defined manufacturing,” Keogh says. Typically, electronic product components are made by machines, but assembled by people. A Bright Machines “micro-factory” is a modular machine for automated product assembly that combines robotics with software powered by artificial intelligence and machine learning. For example, a “vision system is reading what’s happening, it’s feeding that data to the multi-axis robotic arm so the arm is making the corrections accordingly,” Keogh says.

The San Francisco-based company led by CEO and co-founder Amar Hanspal, with more than 550 employees globally, launched in 2018. Clients in the U.S. include United Equipment Accessories, a producer of slip rings and industrial cable reels, based in Waverly, Iowa. In May, Bright Machines merged with SCVX, a special-purpose acquisition company (SPAC) that values the business at $1.6 billion, according to the companies. It’s expected to raise up to $435 million in gross cash proceeds, including $230 million of cash held in trust from SCVX. Since becoming CFO in August, Keogh, a 20-year tech and manufacturing industry veteran previously at Apple and Intel, has been preparing Bright Machines to go public. I asked him why the company chose the SPAC option over a traditional IPO.

“The ability with a SPAC to in one fell swoop shore up your balance sheet with that big capital infusion is very useful for us,” Keogh explains. It’s also a matter of quickly seizing the moment, he says. “The stars are aligned as far as the industry’s readiness for [Bright Machines’] solutions,” Keogh says. He notes the current fragile supply chains, lack of availability of parts, and the challenge of finding qualified talent.

Bright Machines is focused on certain markets where, “we do not see a very heavy penetration on automation,” including the networking industry, medical devices, and consumer products, such as power tools, Keogh says. “Automation makes sense in areas that are highly repeatable,” he explains. “It may be simple automation screw stations, just for screw insertion,” Keogh says. But Bright Machines’ software platform provides analytics in real time to help customers understand where errors exist, which can assist engineers regarding design, Keogh says.

A report by Deloitte and the Manufacturing Institute released in May found a U.S. manufacturing skills gap could leave as many as 2.1 million jobs unfilled by 2030. If automation begins to meet this need, what will happen to the workers that traditionally filled these jobs? They may have the opportunity to upskill, according to Keogh.

“There’s plenty of data that says automation can go hand in hand with job growth,” he says. “This does not take jobs away.” It’s a catalyst for “new types of roles,” Keogh says. The World Economic Forum predicts that the use of automation will result in a net increase of 58 million jobs, according to a report released in February. For jobs transformed by automation, about two-thirds will become higher-skilled, while the other third will be lower-skilled, the report found.

Keogh joined Bright Machines from Stanley Black & Decker, where he was the president of the Stanley X group. “I was at an industrial company that was starting to go through a digital transformation, so I led their innovation business unit,” he says. Keogh has an extensive tech background, but I asked him if, in general, CFOs need to become more tech savvy. Finance chiefs definitely should understand the tasks of their R&D teams or software teams in order to appreciate their challenges, he says. When it comes to the allocation of capital having that knowledge “generates trust internally and people are absolutely going to be willing to follow you,” Keogh says.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

****

Fortune’s CFO Collaborative in partnership with Workday, “The CFO’s Role in Redefining the Future of Work,” takes place on October 27. The program, created just for CFOs, will feature a discussion with Julie Sweet, Chief Executive Officer, Accenture, and KC McClure, Chief Financial Officer, Accenture, and be followed by a panel with CFOs including Tracey Doi of Toyota North America, Scott Herren of Cisco, and Robynne Sisco of Workday. We will explore how leaders are differentiating their organizations when it comes to upskilling, digital capabilities, training, and creating talent pipelines amid the war for talent. CFOs can apply here. For more information, email CFOCollaborative@Fortune.com.

Big deal

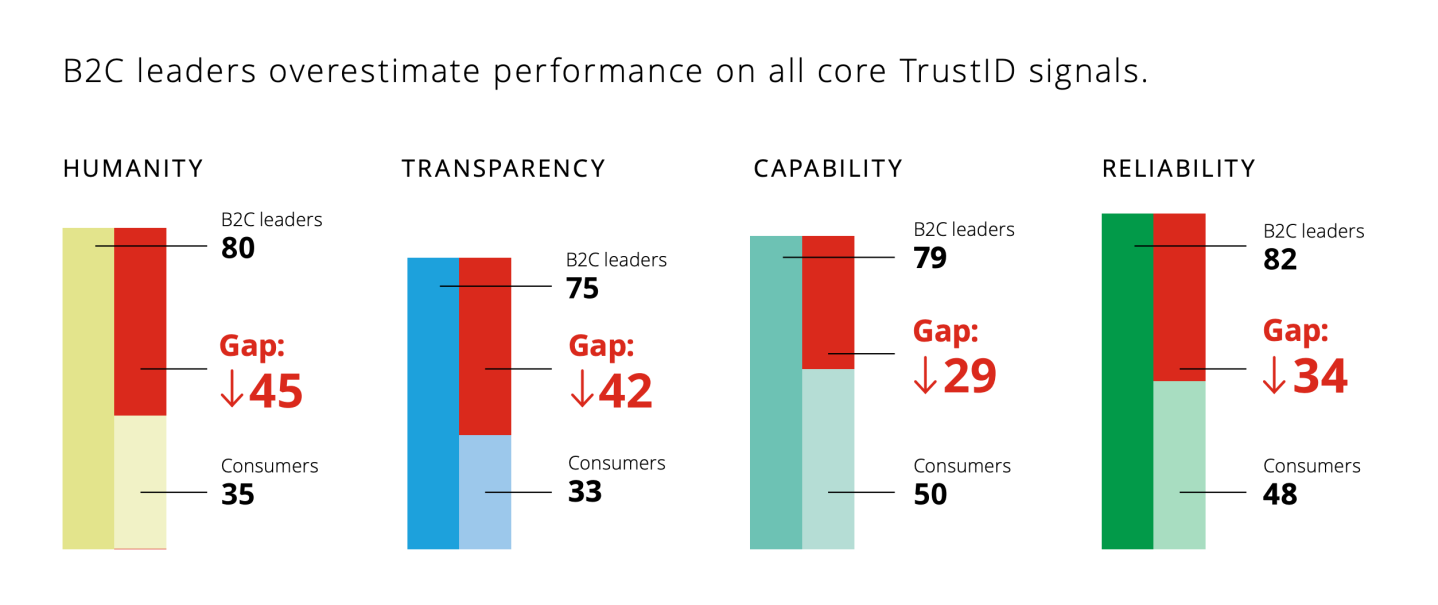

In the U.S., there exists a trust perception gap between consumers and business leaders, according to a new joint study by Deloitte Digital and Twilio Inc., which offers cloud communications platforms. Close the Trust Gap to Unlock Business Value found 79% of business-to-customer (B2C) business leaders surveyed think customers have somewhat or very high trust in their brands. Meanwhile, so far in 2021, just 52% of consumers reported feeling those levels of trust in the brands they've had interaction with. The report identifies "Trust ID signals": humanity, transparency, capability, and reliability. Across the four signals, "disconnects appear between what brand leaders say they value and do, and what consumers say they experience," according to the report. The findings are based on a survey of 1,000 consumers and 500 leaders of large B2C enterprises.

From the report, Close the Trust Gap to Unlock Business Value; courtesy of Deloitte Digital and Twilio Inc.

Going deeper

Artificial intelligence is a component of digital transformation, and a new report in the MIT Technology Review takes a look at its influence. How AI is reinventing what computers are, published on October 22, explores "how computers are made, how they’re programmed, and how they’re used," according to the report.

Leaderboard

George Davis, CFO at Intel (NASDAQ: INTC), has announced plans to retire from the company in May 2022. Davis will continue to serve in his current role while Intel conducts a search for a new CFO, and until his successor is appointed, the company said in its third-quarter earnings report. Davis joined Intel in 2019 from Qualcomm Inc., where he served as EVP and CFO.

Thomas A. George was named SVP of finance and CFO at Genesco Inc. (NYSE: GCO), a specialty retail company, elevating his role from the interim position he has held since December 2020. George previously served nine years as CFO at the global footwear company, Deckers Brands. Earlier in his career, he was the CFO of Oakley, a global eyewear brand, and served in the same capacity at companies in the technology and medical device industries.

Overheard

“Workers right now have a lot of power. They are able to demand whatever they want [in terms of] wages and working conditions, and they are getting it.”

—AlixPartners managing director David Bassuk, on retailers paying big money to find staff in a super-tight labor market heading into the holiday season, as told to Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.