Good morning,

I recently had a conversation with Ankur Agrawal, a partner in McKinsey & Company’s New York office. Agrawal contributed to the development and analysis of Mastering change: The new CFO mandate released on October 7. We talked about the evolving role of the CFO—which, to boil it down, is going to mean increasingly focusing on tech.

“The CFOs I work with, they’re going through their own personal professional development in a different way than they used to five or seven years ago,” Agrawal says. “The skills they need include a lot more technology awareness and literacy.”

The 2021 survey participants include 151 CFOs at companies. The percentage of finance chiefs surveyed who are responsible for their companies’ digital activities has more than tripled between 2016 and 2021, from 9% to 31%, McKinsey found. But Agrawal explains this digital progression began years before the pandemic. “The clock speed of decision making in organizations has rapidly increased, and it was increasing even six or seven years ago,” he says. The “competitive intensity” of disruption in several sectors, along with stakeholders wanting more transparency on what’s happening in the business, created a need to harness information to make better decisions, Agrawal explains.

Concurrently, investor relations has grown significantly. In 2016, 44% of CFOs surveyed said that was a big part of their duties, compared to 64% in 2021, the report found. Technology enabled finance leaders to meet these challenges “in a big way,” he says. Several years ago, CFOs also began to realize there was a need for better and higher efficiency in the finance function, Agrawal explains. Since finance leaders are supposed to be driving change at the company, they want to represent that change in their own function, quickly, he says. In the past 18 months, “COVID has been an accelerant,” he says. Plans for an entire year were made using digital collaboration tools, Agrawal says. “And then insights and reports were generated and shared virtually,” he says.

About six out of 10 respondents reported either a positive or very positive ROI from investments made in technology in the past year, McKinsey found. The share of respondents reporting the use of robotics and artificial-intelligence tools has more than tripled since the 2018 survey.

Finance chiefs who come from tech companies may have a head start. For example, ViacomCBS EVP and CFO Naveen Chopra was previously CFO of devices and services at Amazon and CFO at Pandora and TiVo. Chopra recently told me that he’s prioritizing digital transformation at ViacomCBS. His background gives him “an appreciation for some of the technical complexities involved,” he said. But how are less tech-savvy CFOs getting up to speed?

“I think the best place to learn is on the job,” Agrawal says. “Many CFOs are delegating finance members to participate in big IT projects, and they themselves are spending more time on cross functional projects. They’re not expected to be IT leaders, but getting more well versed with the challenges and opportunities.” Historically, finance was always at the table when technology decisions were being made because “these are large capital expenditures,” he notes.

However, the stakes are increasingly higher now when it comes to tech, and CFOs need to be fully up to speed on every aspect. “There’s not only the safeguarding and compliance role of making sure the money is spent wisely, but also understanding the business drivers and the technology elements of that project,” Agrawal says. “I think that’s a little bit of a shift they have to make it their mindset.”

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

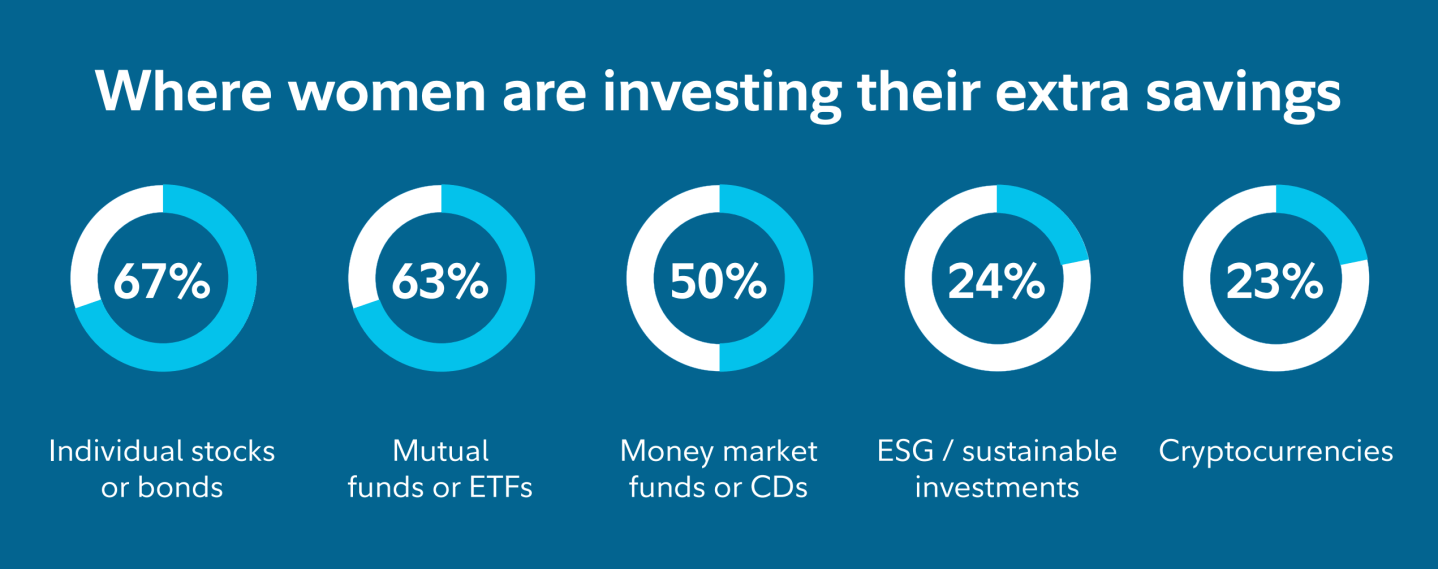

Big deal

Fidelity Investments' 2021 Women and Investing Study released on October 8 found 67% of women report they are now investing savings they have outside of retirement accounts in the stock market. This represents a 44% increase from 2018, according to Fidelity. About 71% of millennials are investing outside of retirement, compared to Gen X (67%), and baby boomers (62%). Women surveyed are investing the most in individual stocks or bonds (67%), and 23% are investing in cryptocurrencies. The findings are based on a nationwide survey of 2,400 American adults (1,200 women and 1,200 men) ages 21 and older. Respondents have a personal income of at least $50,000 and are actively contributing to a workplace retirement savings plan, according to Fidelity.

Courtesy of Fidelity Investments

Going deeper

CompTIA, the nonprofit association for the IT industry and workforce, released an analysis that found U.S. technology companies added new workers for the 10th consecutive month in September. And an estimated 140,000 tech occupations were added throughout the economy. Based on the jobs report released by the U.S. Bureau of Labor Statistics on October 8, CompTIA found tech companies expanded staffing by 18,700 in both technical and non-technical positions, and employment in the sector has increased by 134,600 jobs this year.

Leaderboard

Doug Schenkel was named CFO at Delfi Diagnostics, a biotechnology company, Schenkel was most recently managing director and senior analyst at Cowen and Company, where he led the Life Science & Diagnostic Tools franchise. Cowen published Ahead of The Curve Series research on proteomics and cell and gene therapy tools and has hosted investor conferences, including the Liquid Biopsy Summit, according to Delfi Diagnostics.

Marc Zenner was named CFO at Persefoni, a SaaS-based climate platform company. Zenner previously served as global co-head of corporate finance Advisory at J.P. Morgan. He was professor of finance and chair of the finance area at the University of North Carolina at Chapel Hill prior to his 17-year career in investment banking.

Overheard

“Institutional investors appear to be returning to Bitcoin, perhaps seeing it as a better inflation hedge than gold.”

—As stated in a JPMorgan research note published on October 7, as reported by Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.