This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Happy Friday, everyone, and welcome to Q4.

U.S. stocks just came off their worst month since March, 2020, and October isn’t looking much better. Asia and Europe are trading lower, and U.S. futures point to a weak start to the month.

Over in crypto land, there’s plenty of green on the screen. That said, Bitcoin had a rough September. I detail September’s big winners and losers—spoiler: there were more of the latter this time—in the essay below.

Let’s see what else is moving markets as we close out the trading week.

Markets update

Asia

- The Nikkei is down big (-2.3%) in afternoon trading. Hong Kong and Shanghai are closed today for holiday.

- Move aside Evergrande. A bigger issue for China is the epic power shortages that’s triggering blackouts in parts of the country.

Europe

- The European bourses were 😬 in early trading with the Stoxx Europe 600 down nearly 0.8% in the first hour of trading. Just one sector—utilities—was in the green to start the day.

- BMW shares are down 2.8% in the opening minutes despite the German carmaker raising its bottomline forecast. It hasn’t dodged the semiconductor supply crunch, mind you. It’s profiting from higher car prices.

- The pound sterling is falling again this morning. This doesn’t help: a prominent U.K. business lobby reports business leaders’ confidence in the British economy has “fallen off a cliff” in recent weeks.

U.S.

- U.S. futures are under pressure this morning. That’s after all three major averages closed out September in the red, snapping a seven-month winning streak.

- According to Deutsche Bank, 23 of 24 S&P industry groups closed in the red yesterday. The lone winner: semiconductors.

- The Zoom Video Communications bid to buy Five9 is now off. The culprit: shares in Zoom have tumbled more than 30% since it announced the $14.7 billion deal in July, and Five9 shareholders want none of that under-water stock.

Elsewhere

- Gold is down, trading below $1,760. It had a rough September, too.

- The dollar is up again. The dollar climbed 1.4% in September against the euro, never a good indicator for stocks.

- The crude rally is on pause with Brent trading around $78/barrel.

- Bitcoin is up, trading around $44,000. It’s now recouped all of the week’s losses, but it had a bad month. See below.

***

King crude

As we head into the final quarter of the year, the trend lines don’t look great.

Bond yields are rising, as is the dollar, crude, shipping costs and inflation. Stocks are sinking, and crypto is as volatile as ever. Meanwhile, central banks are running out of options: tapering and tightening are on the cards. Put it all together, and you hear this talk of equities having to contend with a “wall of worry.”

Let’s look backwards at September, the first loser month for 2021. It was the worst one-month sell-off since March, 2020.

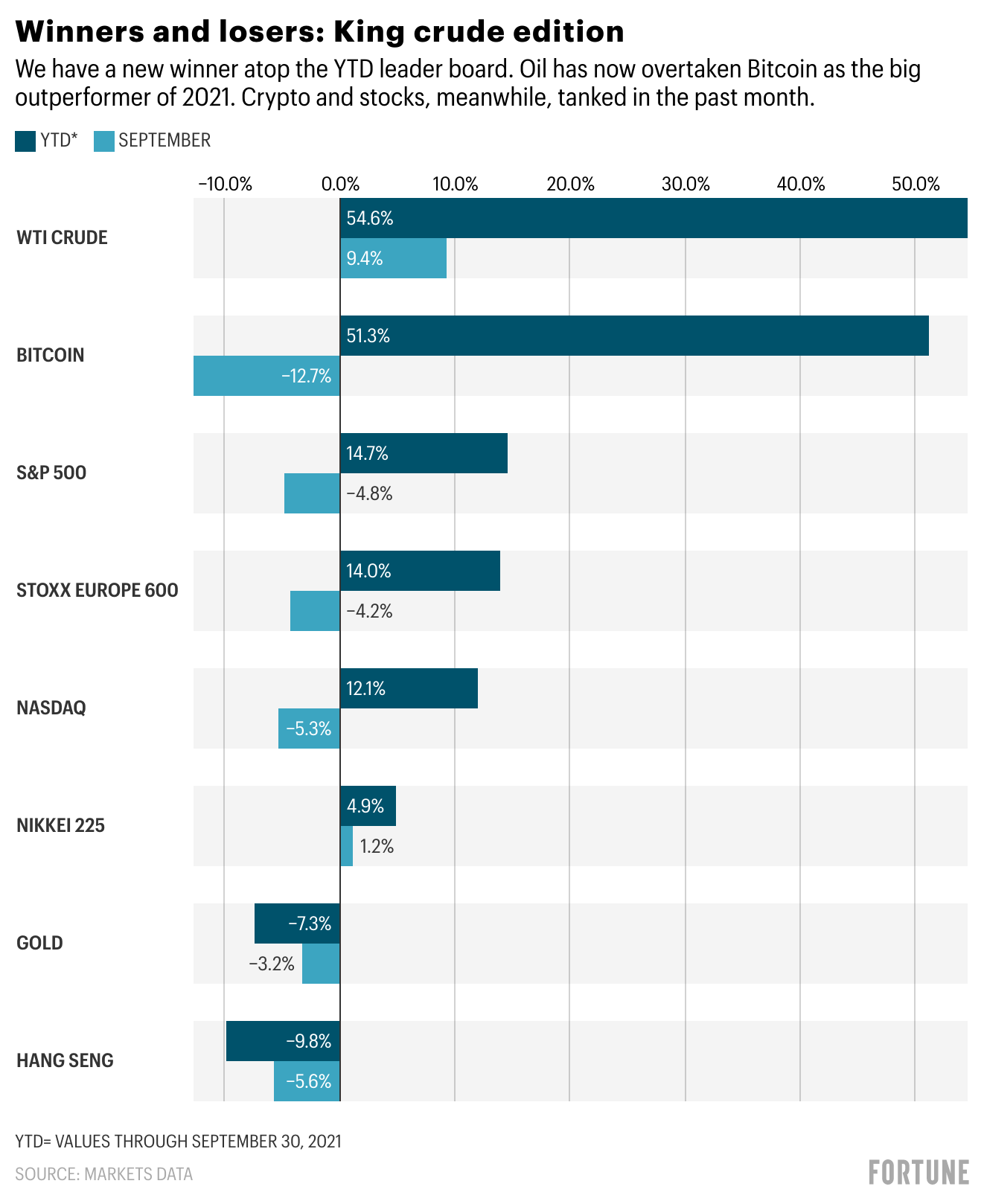

Let’s start with equities. With the exception of Japan’s Nikkei, stocks in all major markets fell last month. Chinese stocks and tech stocks did particularly badly.

As the chart above shows, the Hang Seng (-5.6%) and the Nasdaq (-5.3%) were the worst performers among equities in September. Tech stocks are the most exposed to rapidly rising bond yields. On cue, we saw the yield on 10-year Treasury notes jump 20 basis points last month.

What really catches my eye is the change at the top of the chart.

After a monster August, Bitcoin sank nearly 13% in September. In keeping with its volatile track record, BTC has bounced back overnight to recoup some of those losses. Nevertheless, it was a rough enough month to knock it off the top of the leader board.

Who—or what—is No. 1?

WTI’s comeback in recent weeks—led by an epic energy supply crunch and rising demand—pushes it above Bitcoin as the top performing asset of 2021—on our leader board anyhow. Natural gas (not shown) has seen an even nuttier YTD rise. Rising energy prices are seen as a big headwind for stocks as it will undoubtedly push up inflation and put central banks further into a corner.

The month-ahead view this morning doesn’t look great for equities.

A reminder: on Monday, I will share Bull Sheet readers’ views on where they see the markets heading in the months to come. If you’d like to share your thoughts, there’s still time. Drop me a line.

***

Postscript

Yesterday morning, around this time, I was dashing to finish up the Bull Sheet when I got a WhatsApp message from a radio producer in London. She wanted to know if I could come on air to talk about… Shakira.

I puzzled at the screen. Shakira?

It was the start of a flood of messages I got throughout the day, all of them wondering if I’d seen the Shakira news, and what was my hot 🔥 take. As a journalist friend texted me yesterday evening, “Dude. This is at the center of your Venn diagram. Famous singers and wild boars.”

As you probably now know, Shakira took to Instagram to tell the world she’d been attacked by wild boars in Barcelona. They even snatched her designer purse.

Can you come on our radio show to talk about this?, this producer wanted to know. (Overnight, I got the exact same message from an NPR producer.)

Around then my wife popped by my desk, and I told her there’s breaking news on the boar beat. “Again with the boars?,” she sniffed, wagging her up-pinched hand at me. “Are you the global boar editor?”

She’s kinda tired of boar talk, and I get it. It comes up a lot—at dinners with friends, with total strangers walking the dog. Boars have invaded Rome, and it’s become one of the biggest election-season issues as voters head to the polls on Sunday. And whenever boars are in the headlines, I get flooded with messages, including from Bull Sheet readers.

This might be why: Two years ago, in my freelancer days, I spent a week with a team of vet scientists in Barcelona. I tagged along as they trapped and euthanized packs of wild boars in city parks. (I even put my notebook down a few times to pitch a hand and take blood samples; there were that many of them!) The next morning I would do my best to breathe out of my mouth as they opened the animals up in the morgue.

These were really sick animals. City life was making them sick.

And, the thinking goes, this whole sad collision between humans and nature will make us sick, too. Urban boars, the researchers found, carry all manner of diseases—tuberculosis, hepatitis E and influenza A—that can make the jump to humans. (Before COVID hit, they were even looking into the risk of boars spreading coronaviruses.)

The boars are a sad metaphor for urbanization gone wrong. These highly intelligent animals are drawn into our cities, attracted by tides of trash. Meanwhile, cities, suburbs and exurbs are expanding into their natural habitat. (Ok, to be technical, these animals are native to Eurasia, but now live on every continent on the planet. There are urban boar problems throughout the U.S., Australia, Asia and Europe).

As I wrote then, “the arrival of wild boar in town squares and city parks is forcing us to confront a new reality: we are bumping up against the limits of urbanization. This is a crisis we have largely inflicted on ourselves.”

I spoke to the lead Barcelona scientist, Jorge Ramón López Olvera from the Autonomous University of Barcelona, this morning. He’s been swamped by press calls, too. He told me the city’s boar control measures were continuing to show successes. Last year, he said, was a good year. The incident rate was way down. “Without food and garbage in the streets, why would wild boars go to the city?,” he explained.

Now that tourists are back in force and the city is just about fully open, the boars are coming back too.

I feel bad for Shakira. I’m relieved she didn’t get hurt. But I feel bad for the wild boars, too.

***

Have a good weekend. But first, there’s more news below.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Will your portfolio risk ‘contagion’ from Evergrande? These funds are most exposed—Fortune

Crypto tax rules are a-changin’—Fortune

3 months before Christmas, companies are already bracing for stock shortages and bonkers prices—Fortune

Bull Sheet readers, we have a special offer: 50% off your subscription to Fortune. Just click here, and use the promo code: BULLSHEET . . . Thank you for supporting our journalism.

Market candy

Quiz time

True or false. Every sector in the S&P 500 was down for the month of September?

Answer: Nope. Energy was a rock star last month, surging more than 9%. Alas, the other ten components were duds.