Europe is about to see the emergence of its second EV battery cell champion, alongside Sweden’s Northvolt, that could challenge the dominant suppliers out of Asia.

On Friday, Daimler’s Mercedes-Benz passenger car division inked a deal with Franco-American carmaker Stellantis and France’s TotalEnergies to join their gigafactory joint venture, Automotive Cells Company.

The lifeblood of every electric vehicle, batteries currently represent an estimated third of the car’s total manufacturing costs. While it is common for automakers to assemble the packs themselves, it has been only recently that an increasing number have recognized cells are not a commodity merely to be procured. Lead by brands like Tesla and Volkswagen, they now understand the chemistry is intrinsic to an EV’s competitive performance and have opted to manufacture them as well.

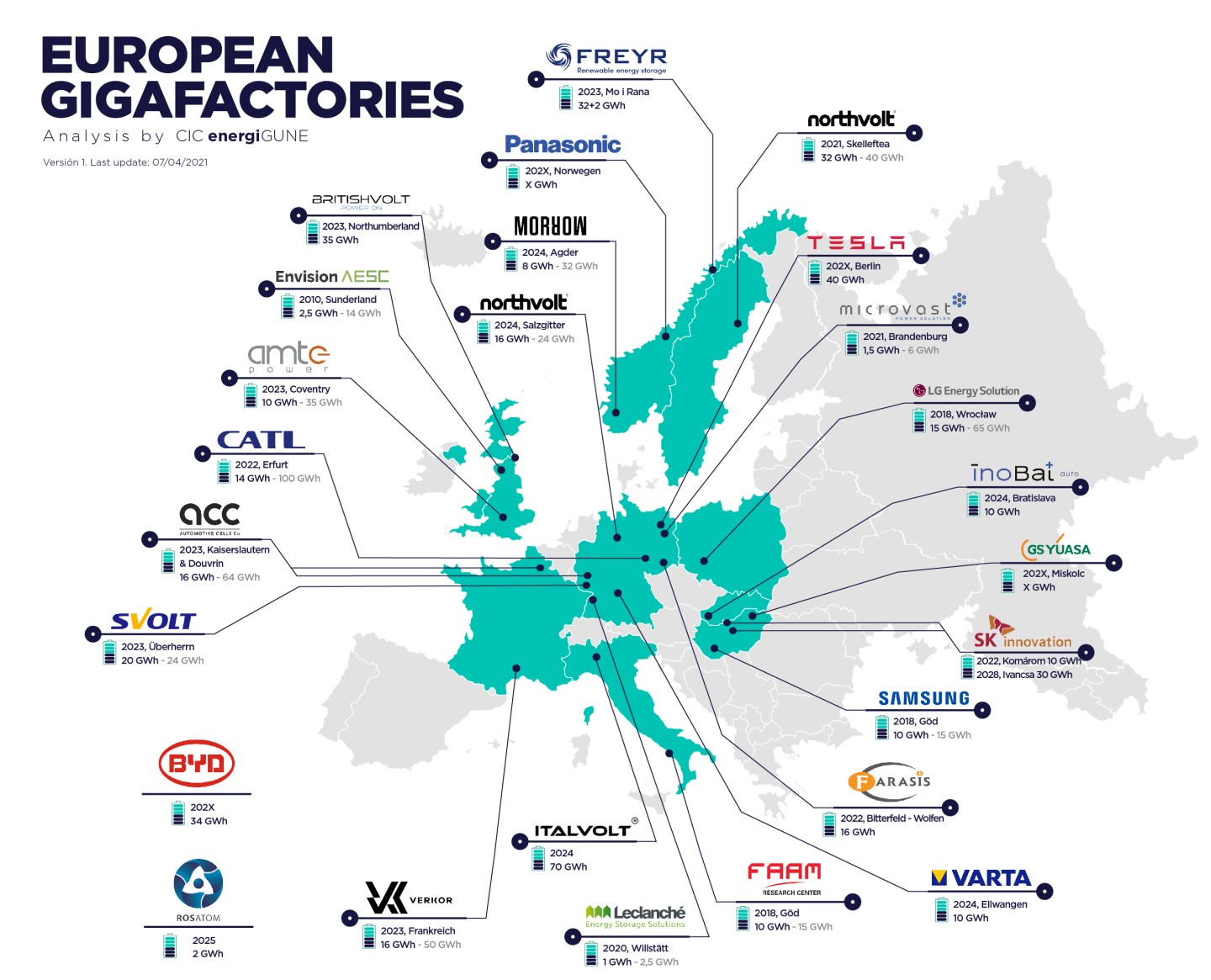

While Europe’s automakers harbor no illusion that they will be able to stop buying cells from companies in the Far East such as CATL, LG Chem, SK Innovation and Samsung SDI, they have long sought to reduce their dependency on these dominant suppliers.

“Mercedes-Benz will bring a vote of confidence in our technology roadmap and product competitiveness that significantly strengthens ACC’s business potential and underpins our ambitious growth plans,” Yann Vincent, chief executive of ACC said in a statement on Friday.

As part of the agreement, ACC will dramatically expand its planned capacity from 48 gigawatt hours by 2030 to a minimum of 120 GWh, or enough to produce 1.6 million cars with an average battery size of 75 kWh each.

Underpinning the deal is a shift in the ownership, with Mercedes taking a direct stake that will lead to each partner owning a third of the joint venture.

Mercedes said the new alliance allows it to secure its supply of cells for its electric vehicle rollout, take advantage of economies of scale and provide its customers with superior battery technology.

“This investment marks a strategic milestone on our path to CO2 neutrality. Together with ACC, we will develop and efficiently produce battery cells and modules in Europe—tailor-made to the specific Mercedes-Benz requirements,” said Daimler CEO Ola Källenius in the statement. “We can help to ensure that Europe remains at the heart of the auto industry—even in an electric era.”

Stranglehold on supply

The deal enshrines ACC as the second major European player, dividing the landscape into two major players backed by differing constellations of customers.

On the one hand there is ACC, which will supply cells to Peugeot, Citroen, Opel and other Stellantis brands alongside Mercedes, which combined account for about 28% of the overall European car market.

This joins the over 150 GWh of production capacity that Northvolt plans to build on the continent by the end of the decade. The Swedish cell supplier counts Volkswagen as its largest shareholder, BMW as another strategic investor and Volvo Cars as a major customer, which together represent another 35% of regional auto sales.

Stellantis and Volkswagen rival Renault Group is the only automaker to choose an entirely separate path, sourcing from Envision AESC, in which alliance partner Nissan Motor Co. holds a 20% stake, as well as from French start-up Verkor.

In order to be closer to their customers’ European electric car factories, three Asian cell suppliers—CATL, LG Chem and Samsung—have broken ground on the continent, building production sites in Germany, Poland and Hungary, respectively.

Friday’s decision indicates it is not purely geography that is the problem, however—Europe’s carmakers want to break Asian cell suppliers’ stranglehold on supply and build up a strategic counterweight that can offset their bargaining power.

This plan has seemed to only become more crucial after the chip shortage illustrated what can go wrong when assembly lines are reliant on parts from the Far East.

“We want a European battery champion from Europe, for Europe,” Mercedes operations chief Markus Schäfer told reporters earlier this month during the Munich motor show.

More must-read business news and analysis from Fortune:

- Chipmakers to carmakers: Time to get out of the semiconductor Stone Age

- Where home prices are going next, according to forecast models

- 3 things to know about Brilliant Earth’s IPO

- Two new quantum computing breakthroughs reveal the technology’s commercial potential

- Two weeks later, how is El Salvador’s Bitcoin strategy going?

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.