Good morning,

As we head towards a post-pandemic world, “I think what we’ve seen from the CFO community, and what our surveys have shown us, is the recovery is going to be very bumpy; it’s going to be uneven,” Steve Gallucci, Deloitte’s U.S. national managing partner and head of its CFO program, told me.

When it comes to optimism, finance chiefs find theirs is faltering a bit, according to Deloitte’s Q3 2021 CFO Signals survey released September 16. A year from now, only 54% of respondents said they expect economic conditions to have improved. That’s a decline from 62% in Q2. The survey gauged the sentiments of 96 CFOs mainly in the U.S., with some also in Mexico and Canada. The dip in optimism may reflect the pullback in planned re-openings due to the spread of COVID-19’s Delta variant in locations where vaccination rates are lower, Gallucci explains.

Compared to the prior quarter, CFOs lowered expectations for year-over-year growth for capital spending, revenue, dividends, and earnings. For example, revenue growth expectations decreased from 9.6% to 8.5%. The internal risk CFOs worry most about is “demand and supply from a talent perspective,” Gallucci says. In the war for talent, particularly in the finance industry, job seekers have more employment options and increased leverage in determining their salary ranges, he says.

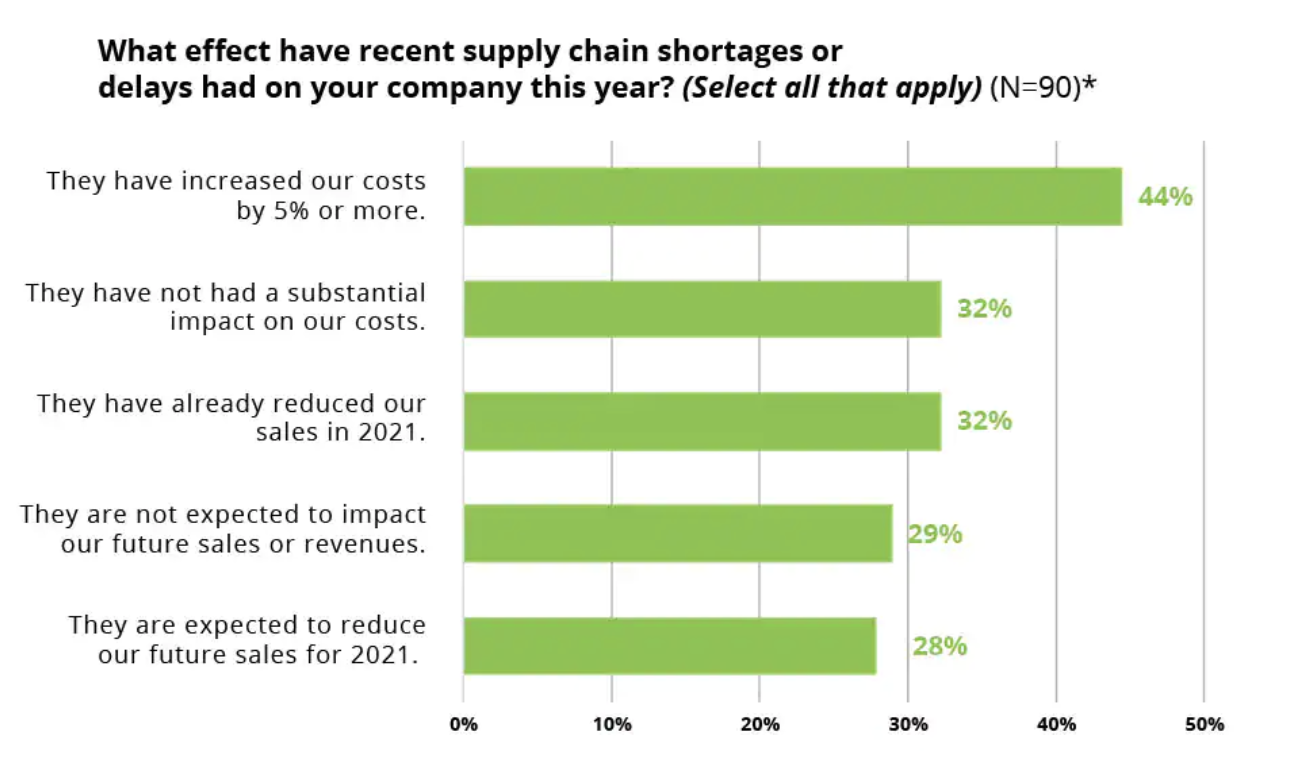

At the same time, external risks, like supply chain issues, are top of mind for CFOs. But there’s a mix of experiences. About 44% of respondents said shortages or delays increased their companies’ costs by 5% or more. And 32% said that has resulted in sales taking a dip in 2021, with 28% expecting future sales this year to suffer. However, 32% of CFOs said supply chain issues haven’t had a profound impact on their costs, and 29% don’t expect future sales or revenue to be affected this year.

“CFOs are spending a lot of time with their executive teams to understand the impact on supply chain and how does that translate to the bottom line?” Gallucci explains. They’re “leaning in from a data perspective [to determine]: how much are we relying on international markets to be able to meet our supply demands? How can we think about that in a different way?”

And speaking of the bottom line, M&A is high on the agenda of finance chiefs. In the next three years, 46% of respondents said they expect up to 10% of their companies’ growth to come from M&A. And 26% said M&A will fuel 11% to 20% of growth.

“We’ve seen a very robust M&A market, and part of that is driven by the attractive capital markets and the ability to finance acquisitions from balance sheets,” Gallucci says. In some cases, CFOs are looking towards inorganic growth to “build capability in terms of human capital,” or the company seeks to get into adjacent markets, he says. The trend will probably continue as “M&A broadly means divestitures as well as acquisitions,” Gallucci says. “There’s a lot of churn going out there,” he notes.

So, CFOs are facing significant internal and external risks simultaneously. “I would say that CFOs are spending more and more of their time understanding and unpacking the external risks because they’re changing rapidly,” Gallucci says. They’ll then “be able to pivot internally in terms of putting in systems, practices, and teams to be able to meet those risks.”

Sheryl Estrada

sheryl.estrada@fortune.com

Quick note: I will be away on Tuesday and Wednesday, so you’ll be hearing from my colleague Rey Mashayekhi. See you on Thursday!

****

Join Fortune on September 28 for its Global Sustainability Forum. The one-day virtual conference will include top-level executives, investors, and decision-makers from across the globe. Best practices in engaging in sustainability transformation and moving “from pledge to practice” will be among the topics. Featured speakers include Michele Buck, chair, president and CEO of The Hershey Company; Jim Fitterling, chairman and CEO of Dow; Jesper Brodin, CEO of Ingka Group; Rich Lesser, CEO of Boston Consulting Group; and Mike Roman, chairman and CEO of 3M. You can apply for the event here.

Big deal

Mobiquity, a digital consultancy, released its Global Benchmark for Sustainable Banking Report on September 15. The report, based on a survey of a total of 400 banking executives in the U.S., U.K., Germany, and the Netherlands, examines how they view sustainability in their practices and the barriers to implementing initiatives. About 37% of U.S. execs agreed cultural legacies that hinder progress are the main challenges to adopting sustainable initiatives. In the U.K., 31% of execs pointed to COVID-19 and industry demands as the main challenge. Meanwhile, 33% of respondents in the Netherlands said a lack of a cohesive ESG strategy is the main issue, and 29% of execs surveyed in Germany said they need more knowledge of the market and how to drive sustainability, according to the report. Less than a third of banking execs surveyed believe sustainability is a top concern at the board level, the report found.

Going deeper

A report released by Indeed on September 16 found 51% of working parents surveyed said they have an individual available to help with childcare or remote learning if a quarantine event occurs. But 40% would have to help their kids with school while they work, and 9% said they'd have to take time off from their job. Women were 57% more likely than men to say they'd need to take time off, the report found. In addressing childcare needs due to illness or quarantine, 85% of parents surveyed said their company offers flexibility. And, 79% of respondents said their employer's policy allows them to take a sick day to care for ill children. About 55% of respondents have employers offering "some level of financial or practical assistance with securing childcare, but not all industries are equally likely to offer it," according to the report. The data is based on a survey of more than 1,000 U.S. working parents.

Leaderboard

Rebecca Shooter-Dodd was promoted from chief financial and operating officer (CFOO) to president and CEO at Revasum Inc., which designs and manufactures semiconductor equipment. Shooter-Dodd joined the firm in January 2019, initially as corporate controller. She was promoted to CFO in November 2020 and took on the additional operating role in May 2021. She was previously an auditor in BDO’s assurance practice in Sydney and London. The company will begin an executive search for a CFO.

Glenn Richter was named EVP and CFO at IFF (International Flavors & Fragrances), effective September 27, 2021. Richter was most recently CFO at TIAA, a provider of financial services. He succeeds Rustom Jilla, who will be leaving the company following a period of transition. Prior to joining TIAA in 2015, Richter worked for Nuveen Investments as COO and chief administrative officer. Before joining Nuveen Investments in 2006, he served as EVP and CFO at RR Donnelley & Sons, and prior to that EVP and CFO at Sears, Roebuck and Co.

Overheard

"This crisis caught a number players off guard."

—Peter Hanbury, a partner at Bain & Co., on the global supply shortage of semiconductor chips and its components, as reported by Fortune.