Back in early 2021, the SPAC frenzy was at its nose-bleed height.

During the first quarter of this year, SPACs, or special purpose acquisition companies, made up 68.5% of all IPOs, per FactSet data. Meanwhile, SPAC issuance topped its record 2020 total in the first three months of 2021.

Amid the glut of SPACs in the market, regulators have grown more wary, and the Securities and Exchange Commission’s new guidelines around accounting practices sent SPAC issuance into a nosedive. Still, although the SPAC surge has markedly cooled, “SPAC issuance has accelerated recently despite continued regulatory uncertainty,” strategists at Goldman Sachs led by David Kostin wrote in a Wednesday report.

But underneath that activity lies a more somber message: The products of the SPAC boom largely haven’t yielded great returns for investors.

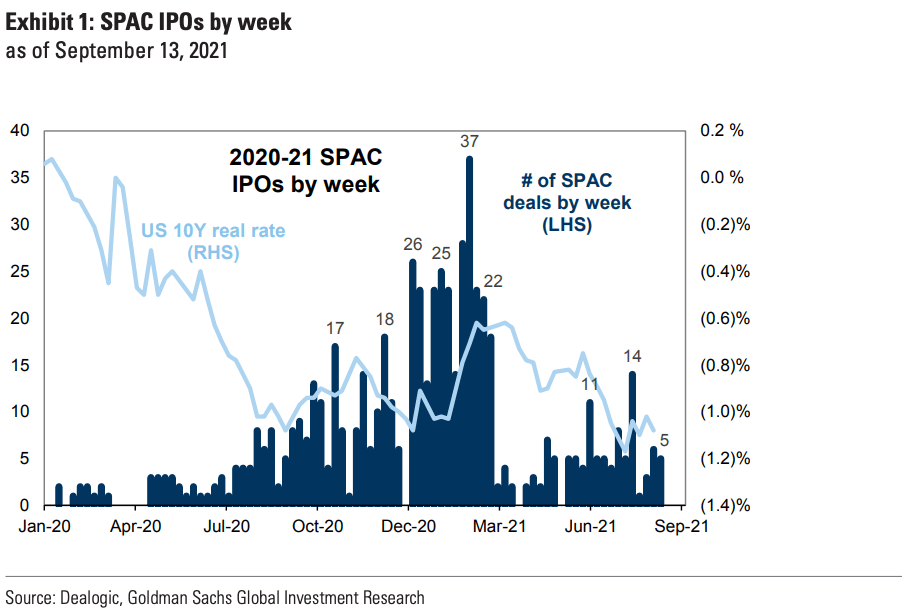

So far in the third quarter, SPACs aren’t down for the count: “An average of 6 SPAC IPOs have raised $1.2 billion in total capital each week,” the Goldman strategists point out. That’s up from the fewer than four SPAC IPOs completed in the average week in the second quarter, though still below the average 21 SPACs raising $6 billion in capital each week during the frenzied first quarter. (See Goldman’s chart below.)

“Lower real rates appear to have provided a renewed tailwind to SPAC issuance,” the Goldman team notes—but those regulatory and legal worries aren’t out of the picture, and “continue to cloud the issuance outlook.”

Matthew Kennedy, senior IPO strategist at Renaissance Capital, tells Fortune that “it’s important to note that even though we’ve come down significantly from the first quarter, we’re still on a record pace from previous years.”

But aside from the sheer number, the headline for investors is that SPAC returns in the market have been disappointing.

Even back in the booming days of early 2021, there were reports suggesting SPAC returns, notably returns post-merger (once the SPAC has acquired a company), have been subpar. The “most important thing to keep your eye on” as an investor is “the performance of these companies once they de-SPAC,” Marc Cooper, the CEO of boutique investment bank PJ Solomon, told Fortune back in April.

Sure enough, according to Goldman’s analysis as of September, “SPAC returns have been weak, especially following deal closure.”

Weak may be understating it a little. “Since its February peak, an ETF of SPACs across stages of the lifecycle (ticker: SPAK) has returned -35%, vs. +14% for the S&P 500,” they note. Meanwhile other “high growth and interest rate-sensitive pockets of the market,” like long duration stocks and non-profitable tech stocks, “have fared better but also declined.”

Of the 172 SPACs that have closed a deal since the start of 2020, “the median has outperformed the Russell 3000 from its IPO to deal announcement,” the Goldman strategists note. But “in the six months after deal closure, the median SPAC underperformed the Russell 3000 by 42 [percentage points].”

Looking at it another way, Renaissance Capital’s Kennedy notes that based on his data, 70% of SPAC IPOs so far this year are trading below their $10 offer price (that’s through September 15, and includes those that have announced and a few that have completed mergers). And of the SPACs that have completed mergers in 2021, 58% trade below their original offer price, according to Renaissance data.

Moving forward, “the SPACs in the pipeline will have a harder time raising IPO capital compared to early 2021, due to a broad-based decline in SPAC returns and greater regulatory scrutiny from the SEC,” per a September report from Renaissance Capital.

That’s not to say all SPACs are bad investments, of course. Kennedy notes that, “on an individual basis…we’ve definitely seen very competent, experienced SPAC sponsors find the good companies.”

But it seems investors may need to be choosier than ever.

More finance coverage from Fortune:

- This chart shows why the housing market may see an end-of-September shock

- Can young people still count on Social Security?

- Circle, Brex, Stripe: Payments companies are attracting supersize funding deals

- Unicorn startup Papaya Global nearly quadruples its valuation, eyes an IPO

- Why Alexis Ohanian gave a second chance and funding to plant-based meat startup Simulate

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.