This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning.

U.S. futures have been yo-yo-ing all morning ahead of today’s big release of Fed minutes. A warning: you’ll hear that T-word—tapering—a lot as we get closer to next week’s annual confab of central bankers in Jackson Hole.

Overseas, Asian stocks are bouncing back, but European shares are once again in the red. There’s light volume just about everywhere so any downbeat news is likely to turn markets negative. And there’s plenty of awful headlines—whether it’s the global implications of a Taliban flag flying over Afghanistan or spiking Delta deaths—to fuel the risk-off sentiment weighing on markets.

In today’s essay, I look at the most crowded trade out there. Hint: it rhymes with “heck.”

But first, let’s see what else is moving the markets.

Markets update

Asia

- What’s this? The major Asia indexes are climbing with the Hang Seng up nearly 0.5% in late afternoon trading.

- Are Chinese ADRs really “uninvestable”? That’s what longtime China bull Marshall Wace says as the consequences of Beijing’s regulatory crackdown on high-growth tech companies continues to ripple across the globe.

- Look no further than KraneShares CSI China Internet ETF (ticker: KWEB) for clues on investors souring en masse on the once high-flying China tech stocks. KWEB is down 41% year-to-date after bombing lower yet again yesterday.

Europe

- The European bourses were mixed with the Stoxx Europe 600 up nearly 0.1% at the open, before slipping.

- Healthcare and travel and leisure are the leading sectors; energy is the big laggard.

- Shares in Carlsberg popped at the open, up 3.3%, after the brewer raised its outlook on strong sales in China and Russia.

U.S.

- U.S. futures are flat, but that’s better than what we saw 24 hours ago. Yesterday, the Dow fell, snapping a five-day winning streak, and the S&P 500, off 0.7%, suffered its worst day in a month.

- One of the big culprits: disappointing retail sales data yesterday sent investors to the exits.

- Speaking of selling…Walmart is down 0.2% in pre-market trading after the retailing giant told investors yesterday it sees its e-commerce division growing into a $75 billion business this year. It also revealed that same online growth engine is starting to slow.

- Looking ahead, Robinhood delivers its first quarterly report as a public company after the bell today.

Elsewhere

- Gold is up, creeping closer to $1,800/ounce.

- The dollar is lower.

- Crude is rebounding, but Brent continues to trade below $70/barrel.

- It’s August, and yet there’s plenty of volatility in crypto. Bitcoin dipped 1.5% to trade just above $45,000.

***

Overcrowding

There’s not much fuel in the tech trade these days. The Nasdaq is flat in August, off a measly 0.1 percent. The big-cap Nasdaq 100 is not faring much better. The lackluster performance comes as Treasury yields trade without much direction. Just about every time they spike, tech stocks tend to dip. And when they fall, the Nasdaq regains that lost ground.

This cycle will probably be with us until we get a bit more direction on Fed policy. The good news: a new puzzle piece could arrive later today.

As Paul Donovan, chief economist at UBS writes in an investor note this morning, “The US Federal Reserve minutes are due, driving economists to a fevered level of excitement. The Fed is clearly moving to join other Anglo-Saxon central banks in scaling back its bond purchases. The question is how quickly, and by how much. The likely timetable is a theoretical discussion at next week’s Jackson Hole summer camp, a decision in the fourth quarter, and action after that.”

All this anticipation is likely to weigh on bond yields and tech stocks in the near term.

Meanwhile, there’s an argument to be made that tech stocks are getting too pricey, anyhow, and that it’s time to reposition—ahead of any pronouncement by Jerome Powell & co.

“A rotation within the technology sector has been taking place for months now—that is, a rotation away from the old-school FANG stocks in favor of newer and somewhat smaller tech stocks,” writes George Ball, chairman of Sanders Morris Harris, a Houston-based investment firm, in an investor note.

A good indication of this is the FANG+ Index. It’s down 2.2 percent in the past 30 days, underperforming the wider Nasdaq. Over the past six months, it’s fallen further, down 3.5 percent.

Despite this performance, investor portfolios remain overweight tech. According to BofA Securities’s most recent global fund manager survey, the “long U.S. tech trade” is once again the most crowded trade out there—by a wide margin.

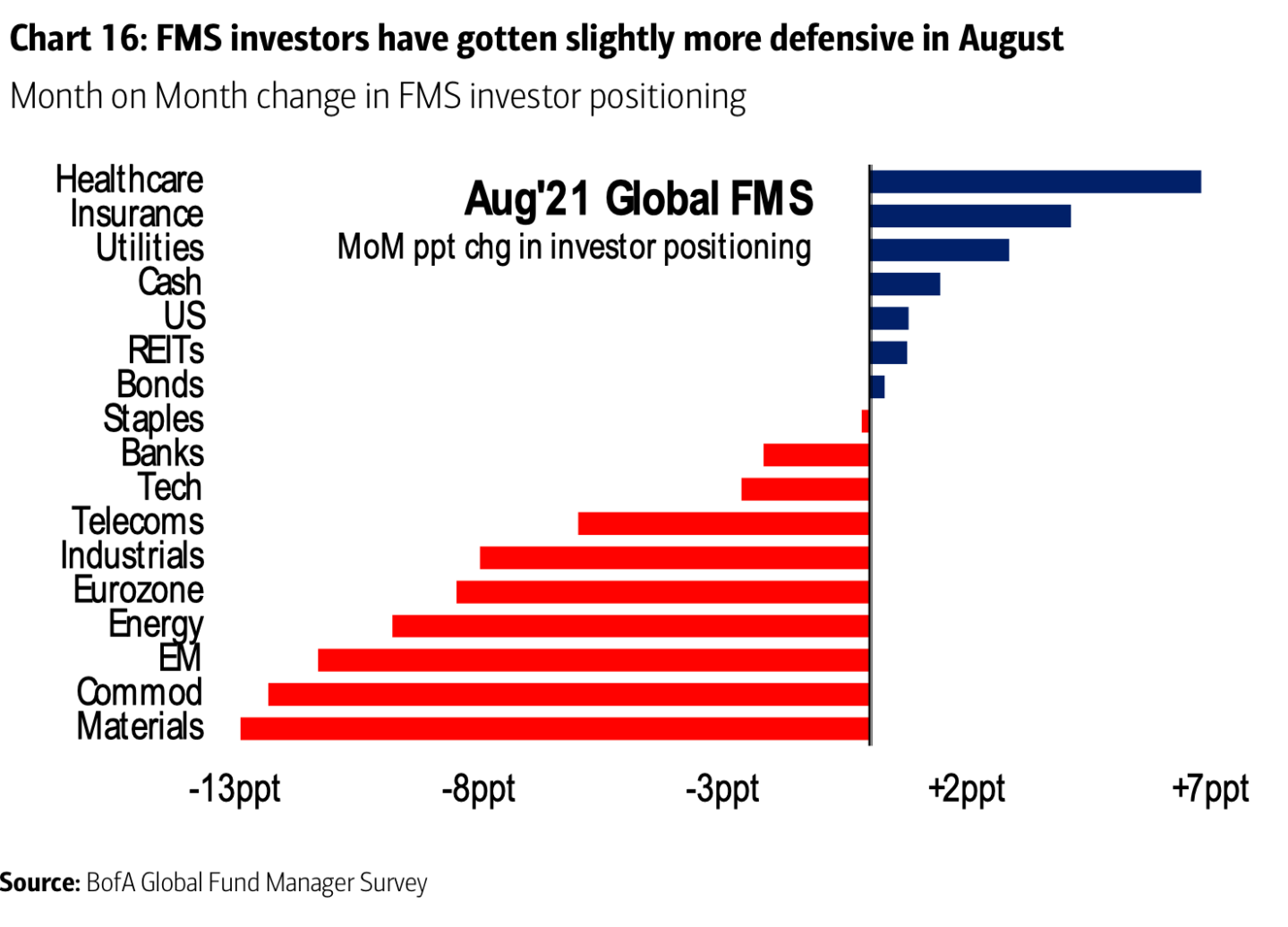

At the same time, investors are in fact beginning to rethink the tech trade. As BofA Securities notes, with a tapering decision looming, “investors have gotten slightly more defensive with an increase in healthcare, insurance, utilities and cash.”

These are just a few data points, but it adds to the growing chorus of chatter about whether tech stocks are a good place to put your money these days.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.co

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

It’s been a while since the S&P 500 had a big pullback—and that could mean rocky times ahead—Fortune

Here’s how much the war in Afghanistan cost—in lives and money—Fortune

Pandora’s sparkling comeback powered by stimmy checks and lab-grown gems—Fortune

Market candy

Quote of the day

The types of stocks that are listed in the U.K. are unloved.

Looking to get in on the red-hot Europe trade? Then you might want to give London a miss. The biggest names on the FTSE have rebounded from a year ago, but are far underperforming their peers in Europe and the S&P 500, belying just about every prediction we saw at the beginning of the year. There are a host of reasons why investors aren't feeling the love for U.K. shares, as Nick Hyett at Hargreaves Lansdown puts it. Adrian Croft explores what's dragging down the FTSE.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.