This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning.

European stocks continue their impressive run with the benchmark Euro Stoxx 600 adding to Wednesday’s record close. Tech, finance and utilities lead the way, helped by another batch of strong corporate results. Speaking of record closes, Robinhood is coming back to Earth this morning. But $HOOD bulls can hardly complain after yesterday’s huge gains.

Crypto, too, is having a good day. Bitcoin nearly crossed above $40,000 overnight, before slipping.

Let’s see what else is moving the markets.

Markets update

Asia

- The major Asia indexes are mixed with the Nikkei, the best of the bunch, up 0.5% in afternoon trading.

- Chinese tech stocks are having another rough session. Tencent, off 4.8%, is headed for its worst day of the year after further rumbles Beijing will crack down on the gaming industry, this time by closing a beneficial tax loophole.

- The other concern is Delta. COVID cases are spiking across China, forcing the government to adopt an aggressive containment strategy that includes curbs on public transport and new quarantine measures. This wave will test China’s vaccine strategy.

Europe

- The European bourses had a groggy open before rebounding. Two hours into the trading session, the Stoxx Europe 600 was up 0.3%, boosted by strong corporate results across the board.

- Speaking of strong results… shares in Rolls-Royce were up 2.4% in early trading after the jet-engine maker surprised the markets with a return to profit as air travel picks up again.

- Adidas is one of the day’s big losers, off 4.1% despite the company posting a big top-line beat on strong global demand for comfy leisure, and upping its full-year forecast.

U.S.

- U.S. futures have been trading sideways all morning. The Nasdaq eked out a meager gain on Wednesday while the S&P 500 and Dow fell.

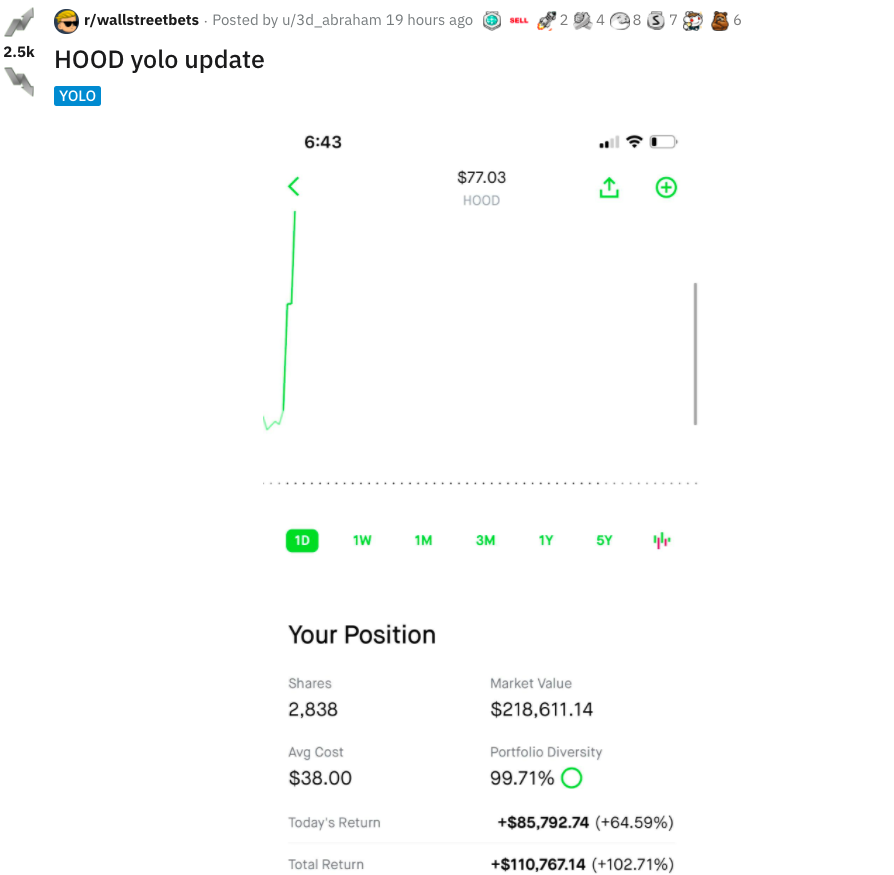

- What goes up, must come… Shares in Robinhood are down 6.1% in pre-market trading today after a monster two-day rally saw it gain 50%. What’s behind the big jump? Fortune‘s Declan Harty explains.

- Uber posted a worse-than-expected loss, hit hard by driver-recruitment costs. Shares are off nearly 4%, pre-market.

Elsewhere

- Gold is down a touch, trading around $1,810/ounce.

- The dollar is in the red.

- It’s been a rough week for oil bulls. Crude is flat with Brent around $70/barrel.

- Bitcoin is up 2.5%, trading near $39,000.

***

Buzzworthy

All-time high: U.S. stock market edition

🚀🚀🚀

All-time high: Robinhood edition

💵💵💵

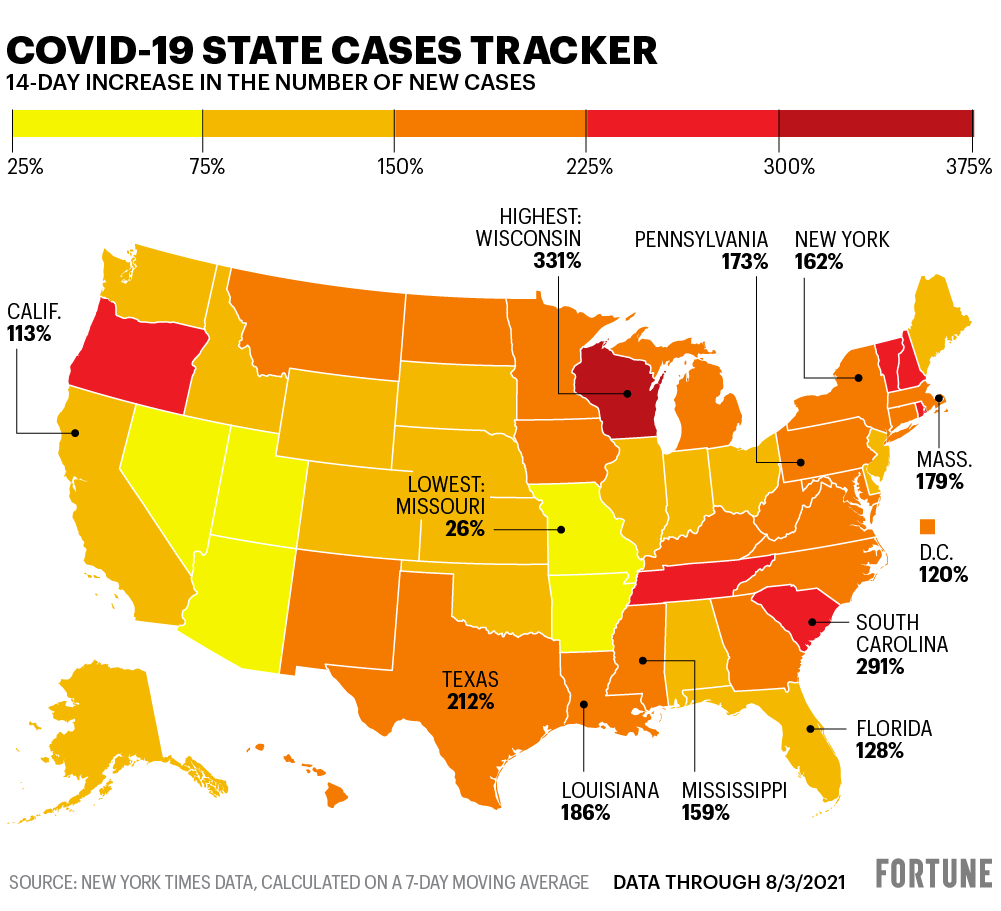

All-time high, Delta edition

COVID cases in U.S. have soared 139% in the past week, levels not seen since February, Fortune’s Maria Aspan reports. Wisconsin leads the nation in this glum category, with South Carolina, Oregon, Rhode Island and Texas also seeing worrying spikes.

😬😷😬

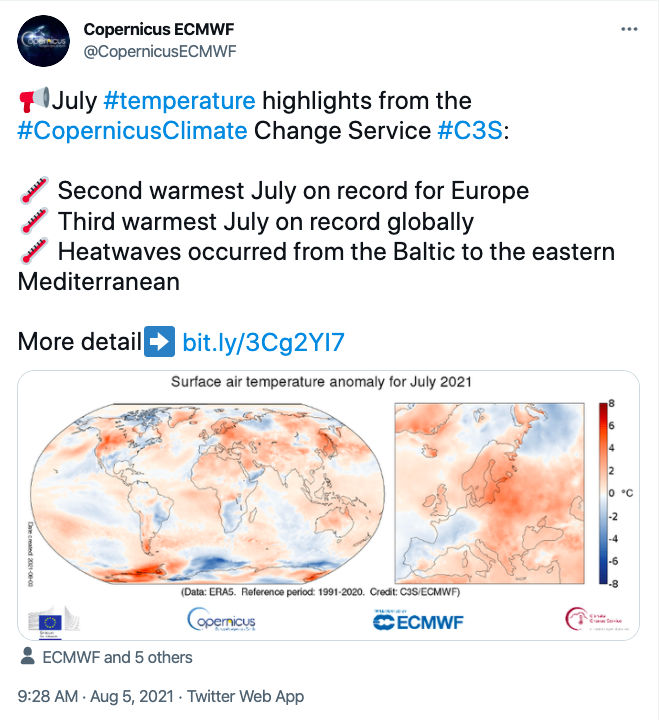

All-time high, climate edition

🌎🔥🚒

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

China’s Delta outbreak tests Beijing’s faith in its homegrown COVID vaccines—Fortune

Move over EVs—used cars, dents and all, have become the unlikely cash cow for Big Auto—Fortune

Bond rally pushes global stock of negative-yielding debt above $16tn—Financial Times

Weber Prices Below Expectations as Grill Maker Downsizes Its IPO—Wall Street Journal

‘Businesses are sleepwalking into a mental health crisis’: COVID is pushing workers to the brink—Fortune

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

Robinhood has become the latest meme stock.

That's Interactive Brokers Chief Strategist Steve Sosnick commenting on the incredible retail-trader-led rally in HOOD. The "fervor," he says, is so high, he's calling Robinhood the next GameStop or AMC Entertainment.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.