Good morning,

Mind the gap? CFOs certainly do—at least when it comes to data gaps.

During the COVID-19 pandemic, 49% of Workday’s CFO Indicator Survey respondents said their organization’s biggest gap was the ability to execute with accurate and timely data for quick, informed decisions. The report released on July 28 by Workday, a provider of enterprise cloud applications for finance and human resources and Fortune’s CFO Daily partner, is based on a global survey of more than 260 finance chiefs.

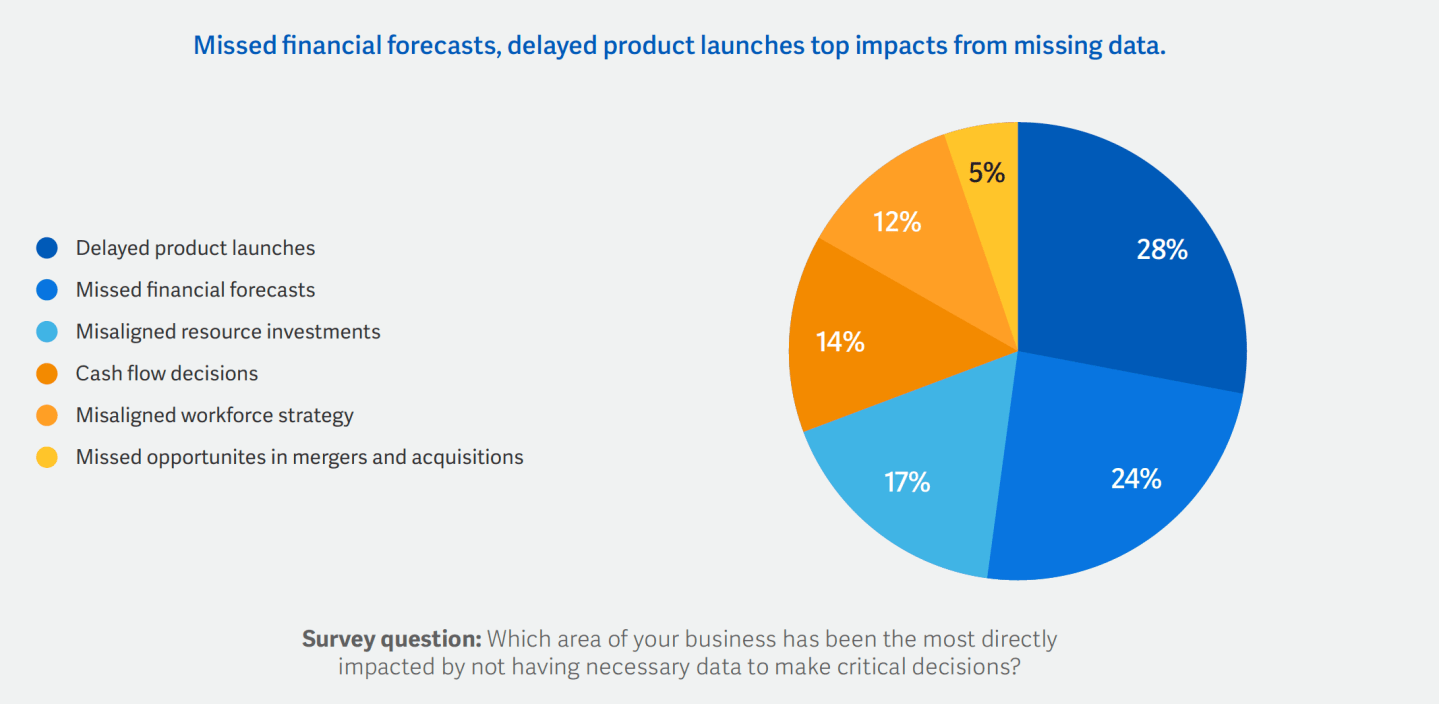

Gaps in data ultimately affected performance. About 28% said the lack of data impacted critical business decisions in product launches. Meanwhile, 24% cited missed financial forecasts, and 17% pointed to misaligned resource investments.

“A lot of companies today have siloed data,” Barbara Larson, senior vice president of accounting, tax, and treasury at Workday, told me. “In many cases, it’s still very much an on-premise legacy system.” It’s hard to access, synthesize, and analyze the data, “particularly when you’re trying to move as fast as the companies needed to move during COVID,” she says.

“If I look at Workday, specifically, we saw all of our planning customers experience an increase in forecasting, 30 times the average, just in March of 2020,” Larson says. “So, just imagine if customers are trying to do that in spreadsheets or by pulling data from multiple or separate systems.”

As a result, a cloud-focused digital transformation has ramped up. “We’re starting to see that acceleration to the cloud for finance across all industries as companies start to embrace cloud technologies to automate and streamline not only their financial management but their planning,” Larson says.

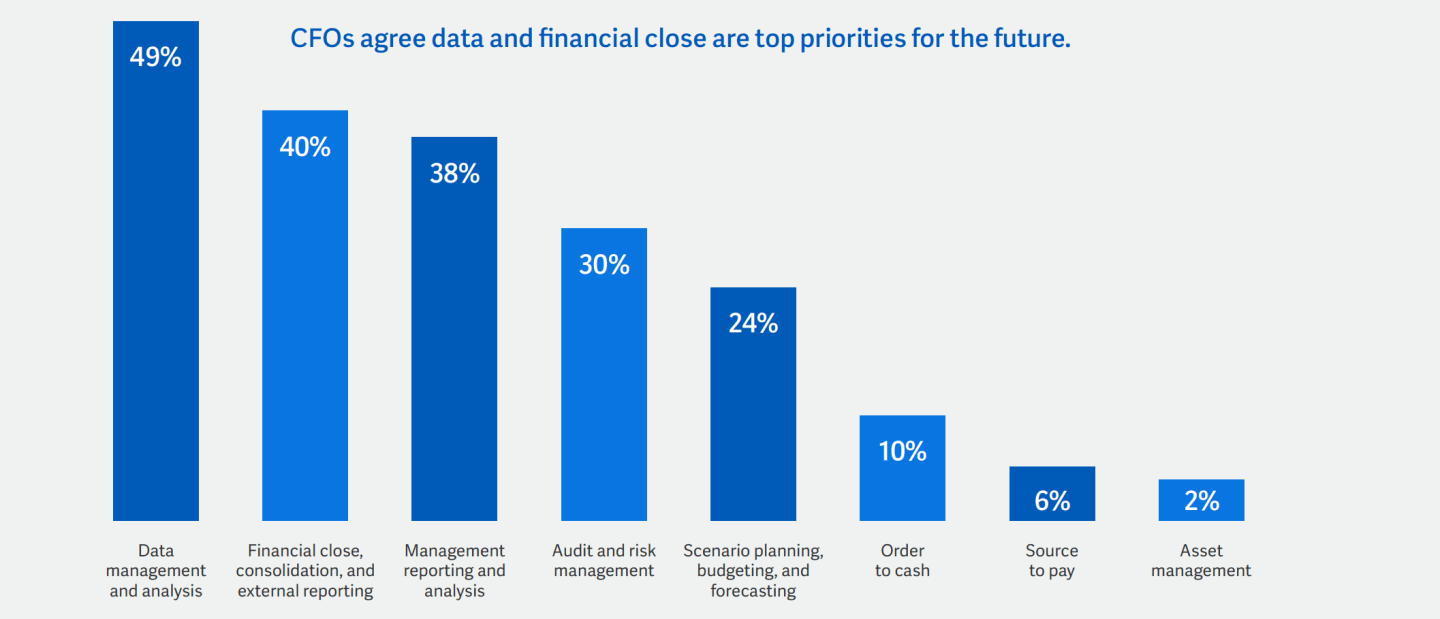

Along with data management and analysis, the second-biggest priority reported by CFOs was financial close, consolidation, and external reporting. The next step will be embracing new technologies, according to the report. The intelligent automation features of cloud financial technology CFOs intend to invest in include predictive analysis (49%), machine learning (45%), and artificial intelligence (43%).

In addition, environmental, social, and corporate governance (29%) and diversity, equity, and inclusion (26%) emerged as top business priorities more than cybersecurity (12%) and cryptocurrencies (11%), the survey found.

“I think because of the pandemic, ESG is top of mind for CFOs at corporations and investors have witnessed firsthand how non-financial risks can significantly affect corporate valuations as well,” Larson says. “CFOs are recognizing that these are strategic opportunities, and there’s a lot of work for companies to comply.”

Finance chiefs ultimately own the responsibility of compliance reporting, which includes procurement authority, she says; and that’s where a cloud-based data management system may help. It’s key to have a flexible, agile system that can track not only the financial data but also ESG components such as employee population and spend management—who you’re doing business with and their ethical or social compliance practices, Larson says. “And then serve it up in a report or a dashboard, which has all of that information in one place,” she says.

Any advice for organizations just starting out in digital transformation? “When you think about moving to the cloud, it’s not just a lift and shift,” Larson says. “It’s really looking at your processes and where you want to be as a finance organization. You should design your processes around what you want to get out of the system.”

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

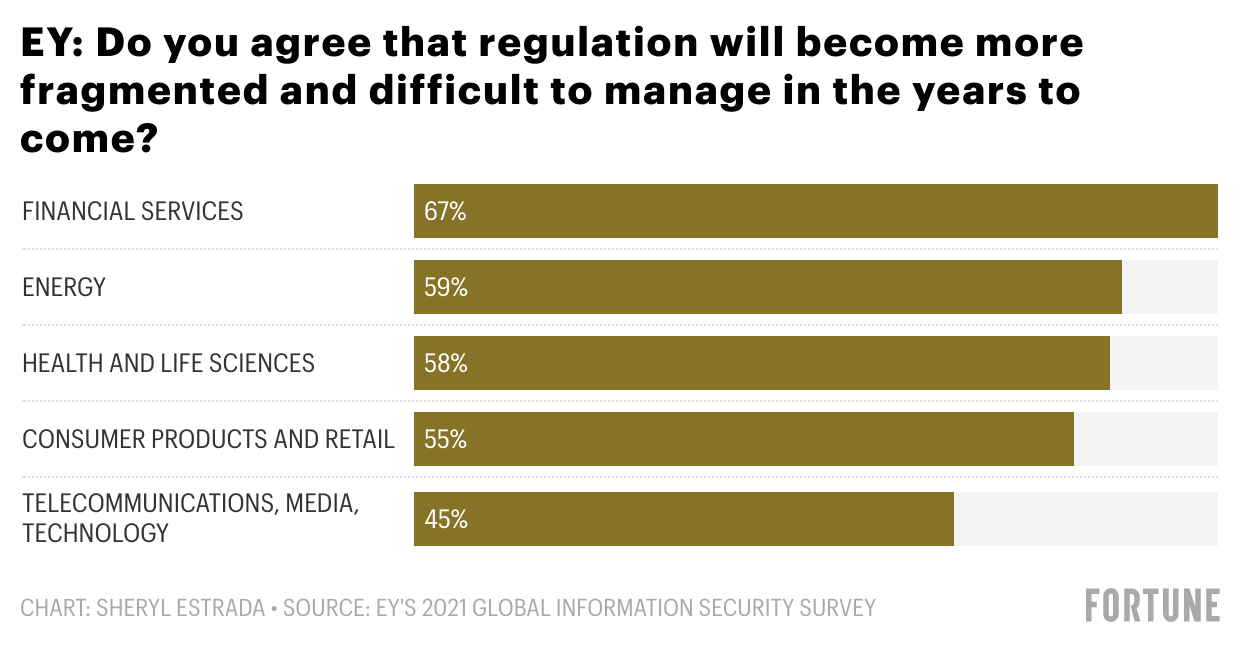

The global compliance environment for cybersecurity is becoming increasingly complex, according to EY's 2021 Global Information Security Survey (GISS). Organizations in certain sectors, especially financial services, have to manage industry-specific regulations as well. The GISS also found that 56% of respondents said businesses have "sidestepped cyber processes" to meet requirements around remote work, and 77% warn of an increase in the number of disruptive attacks. EY surveyed more than 1,000 cybersecurity leaders at organizations worldwide.

Going deeper

Bitcoin is moving toward general acceptance among U.S. investors, especially for those under age 50, according to a recent report by Gallup. In 2021, 6% of investors surveyed said they own Bitcoin, up from 2% in 2018. But among investors ages 18 to 49, ownership increased to 13%, up from 3% in 2018. About 3% of investors ages 50 and older said they own it, compared to 1% three years ago. Gallup defined the investors as adults with $10,000 or more invested in stocks, bonds, or mutual funds.

Leaderboard

Peter Buhler was named management board member and CFO at Valneva SE, a specialty vaccine company. He currently serves as CFO at Quotient, a Swiss diagnostics company. Buhler also held senior finance roles at Eli Lilly, Merck Serono, and Logitech.

David Wyshner was named the CFO at Kyndryl, a technology infrastructure management company. Kyndryl is a new independent public company that will be formed following the separation of IBM's Managed Infrastructure Services business, according to the announcement. Wyshner most recently served as CFO at XPO Logistics. He was also previously CFO at Wyndham Worldwide.

Overheard

"It's certainly not going to be easy, which is one of the reasons why Uber is attracted to the problem."

—Uber CEO Dara Khosrowshahi on the company integrating its ride-hailing services with flying taxis, through a partnership with Joby, on a single platform, as reported by Fortune.