This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning.

From Tokyo to Frankfurt, it’s a risk-off day. Asian stocks started Thursday under pressure. And that spread to Europe, and now to U.S. futures. Oil, too, is lower. Crypto is plunging. The dollar and bond yields are in retreat.

We haven’t seen across-the-board drops like these in weeks. What’s so unsettling? The latest COVID data is spooking investors, as are inflationary concerns.

The biggest turbulence can be found—again—in the crypto markets. Bitcoin, Ethereum, Dogecoin (and just about every other alt-coin) are down, with some off more than 10%, as China voices its latest concern about the rise of digital currencies.

Let’s see what else is moving the markets.

Markets update

Asia

- The major Asia indexes are solidly lower in afternoon trading with the Hang Seng down 2.4%.

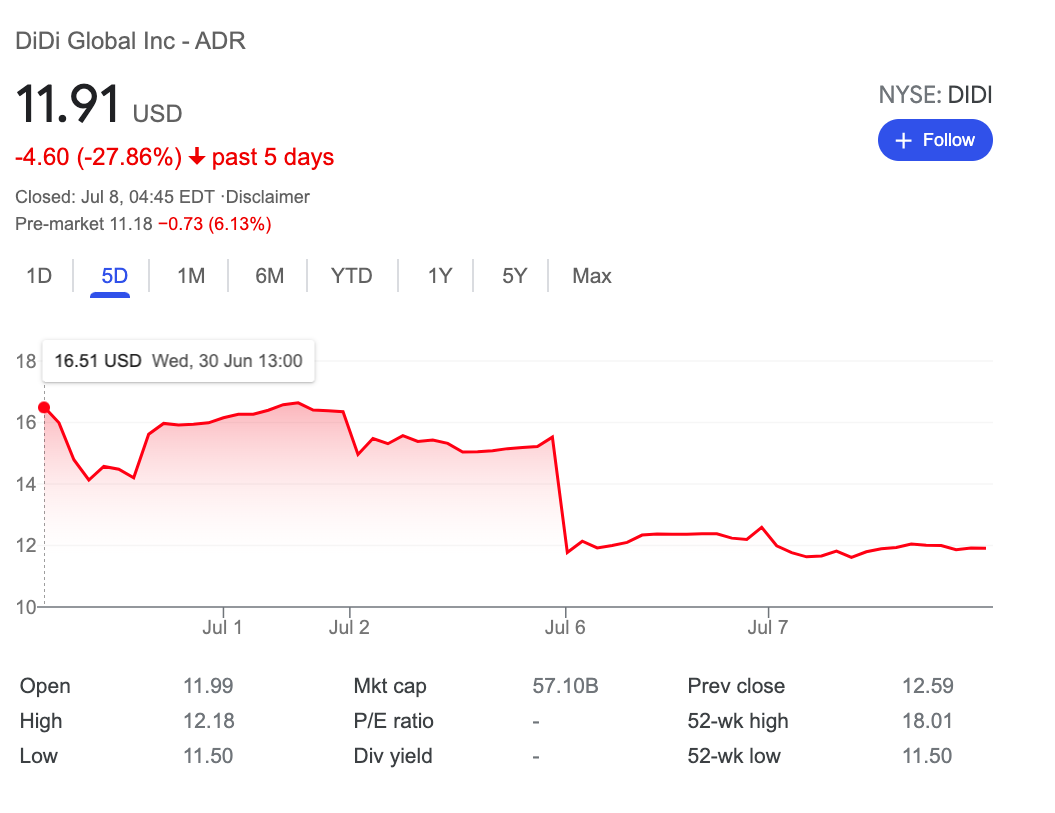

- The fallout from China’s crackdown on Didi Global continues with a batch of new lawsuits from U.S. shareholders. Shares have plunged more than 27% in the past week, and are under pressure again in U.S. pre-market trading today.

- Global COVID deaths surpassed another grim milestone, topping 4 million. The world is on pace to notch 1 million new deaths every two-and-a-half months. And with the Delta variant on the march, third (or fourth?) wave fears are growing, and that’s weighing on investors.

Europe

- The European bourses out of the gates were a blur of red with the Stoxx Europe 600 down 1.4% in early trading.

- The European Central Bank will allow inflation to run a bit hot—above 2%, that is—signaling to the markets it intends to remain dovish on rates to boost the economic recovery underway. The euro jumped on the news.

- Wise (formerly Transferwise) soared 9.3% in its first day of trading on Wednesday in London, as investor interest soared for the profitable fintech. The listing was a first of its kind for the London Stock Exchange. It’s up a further 2.1% this morning.

U.S.

- U.S. futures are under pressure this morning. The Big Three indexes all finished higher yesterday, with the S&P 500 and Nasdaq hitting, yep, fresh all-time highs on Wednesday.

- Shares in Alphabet’s Google are down 0.4% in pre-market trading after news broke yesterday that 36 states and the District of Columbia have filed a lawsuit against tech giant for abusing its “dominant position” in the app economy.

- Speaking of lawyers’ fees… Former president Donald Trump announced yesterday’s he’s filed suit against Google, Facebook, Twitter and their CEOs for kicking him off their social media platforms. The news didn’t do much to their collective share price.

Elsewhere

- Gold is up, trading above $1,810/ounce.

- The dollar is flat after hitting a three-month high yesterday.

- Crude is down with Brent below $74/barrel.

- Bitcoin, too, is sinking, trading below $33,000. Ethereum and Dogecoin were faring even worse.

***

Buzzworthy

Seventh heaven

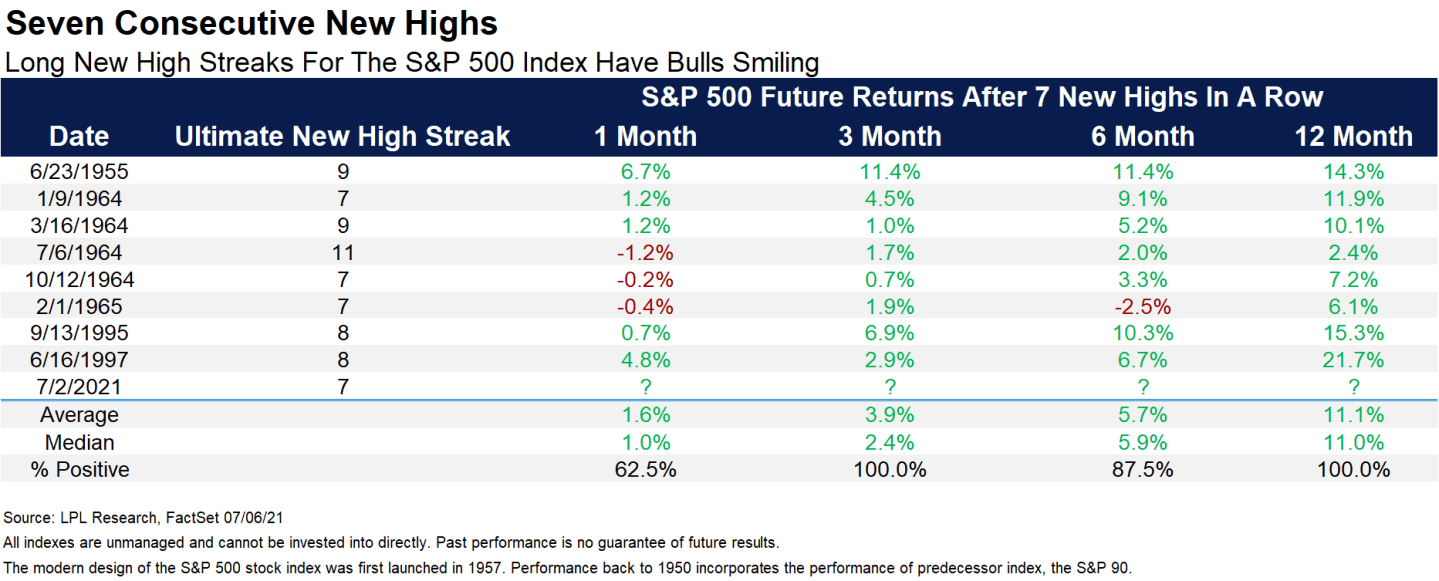

Earlier this week, investors saw a seven-day winning streak in the S&P 500 come to an end. According to LPL Research, such rallies tend to be a harbinger for further gains in the short (one month out), medium (six months out) and longer term (12 months out). One to watch.

💵💵💵

Or, maybe we should just watch this indicator

🚀🚀🚀

A reminder: don’t mess with China

😬😬😬

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

A big concern. The last read we got on inflation was a bit concerning. Prices are rising at their fastest clip since 2008. The Fed is unconcerned, but Americans are downright worried. In our latest Fortune-Momentive poll, roughly seven out of eight respondents told us they're concerned about inflation. That could be a headwind for stocks in the months to come.

"Fraud Market." The popular encrypted messaging app Telegram has become a hotbed for all manner of crypto fraud tips and discussions. The tips are pretty blatantly dodgy, as Fortune's Jessica Mathews found out.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Cashing in on IPOs

Our latest Quarterly Investment Guide just went live, and this time our writers took on the hottest of topics: IPOs. Whether via the SPAC or the more traditional route to market, new listings are booming in 2021. That doesn't just bode well for the startup community. Such gains tend to spill over into the wider stock market. You can check out the full package here.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.