There are few situations where you’re more vulnerable than when you’re being transported to an emergency room in an ambulance. The choice of having a sudden collapse or unexpected accident isn’t a choice at all; it’s a quirk of circumstance that requires immediate attention, and ambulatory services have an obligation to get a patient to a medical facility as fast as possible.

But what happens next can be an ugly game of financial hot potato. The labyrinthian nature of the U.S. health system can leave patients on the hook for tens of thousands of dollars in out-of-pocket medical costs after being trekked to an ER in an ambulance, with little to no say in the matter, according to new research from the Kaiser Family Foundation (KFF), a health care think tank. It’s pretty difficult to insist on going to a hospital that has an emergency room covered by your insurance when you may be on the cusp of death.

This is what’s known in the industry as “surprise billing,” a glaring loophole in American medicine wherein patients may receive care from an out-of-network provider or physician. The Biden administration on Thursday proposed a series of regulations that would ban surprise billing for emergency medical services regardless of where such services are provided, in-network or not. But as of now, this remains an “interim final rule” that doesn’t carry the full force of the law.

Currently, if a health insurer refuses to cover the costs of such services, that could mean massive bills for as many as half of patients who have to take an emergency ambulance ride, per KFF’s report. And while Congress is working to crack down on the practice via the No Surprises Act, set to go into effect in 2022, large swaths of the American populace could still face an unexpected and unwelcome hospital tab.

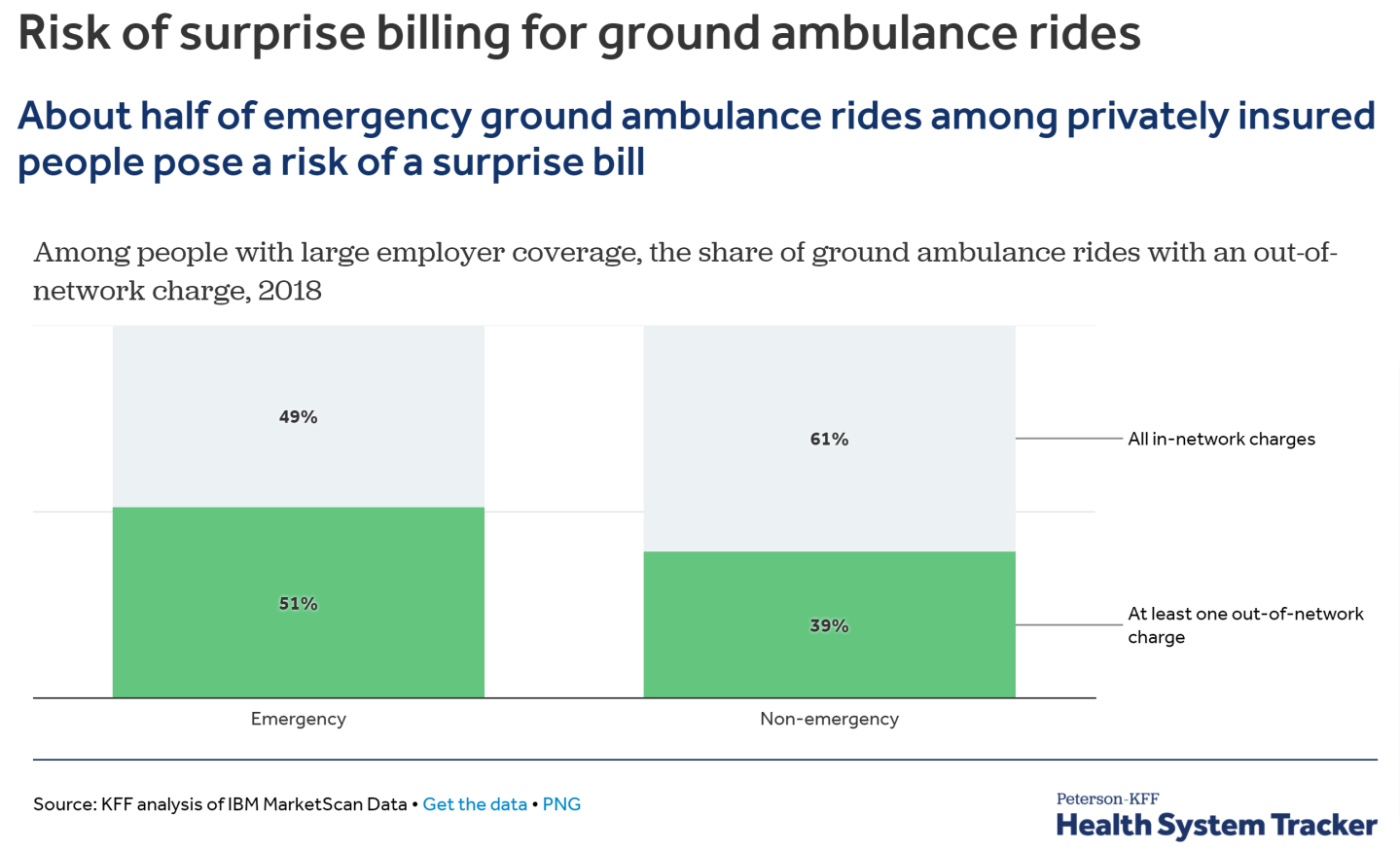

KFF’s report is especially damning when it comes to private health coverage for emergency ambulance rides. “We find that 51% of emergency ground ambulance rides and 39% of nonemergency ground ambulance rides included an out-of-network charge for ambulance-related services, putting the patient at risk of a surprise medical bill,” wrote the study’s authors. All told, that adds up to about 1.5 million privately insured Americans who may wind up in an ER via ambulance just to pay a hefty and unexpected tab.

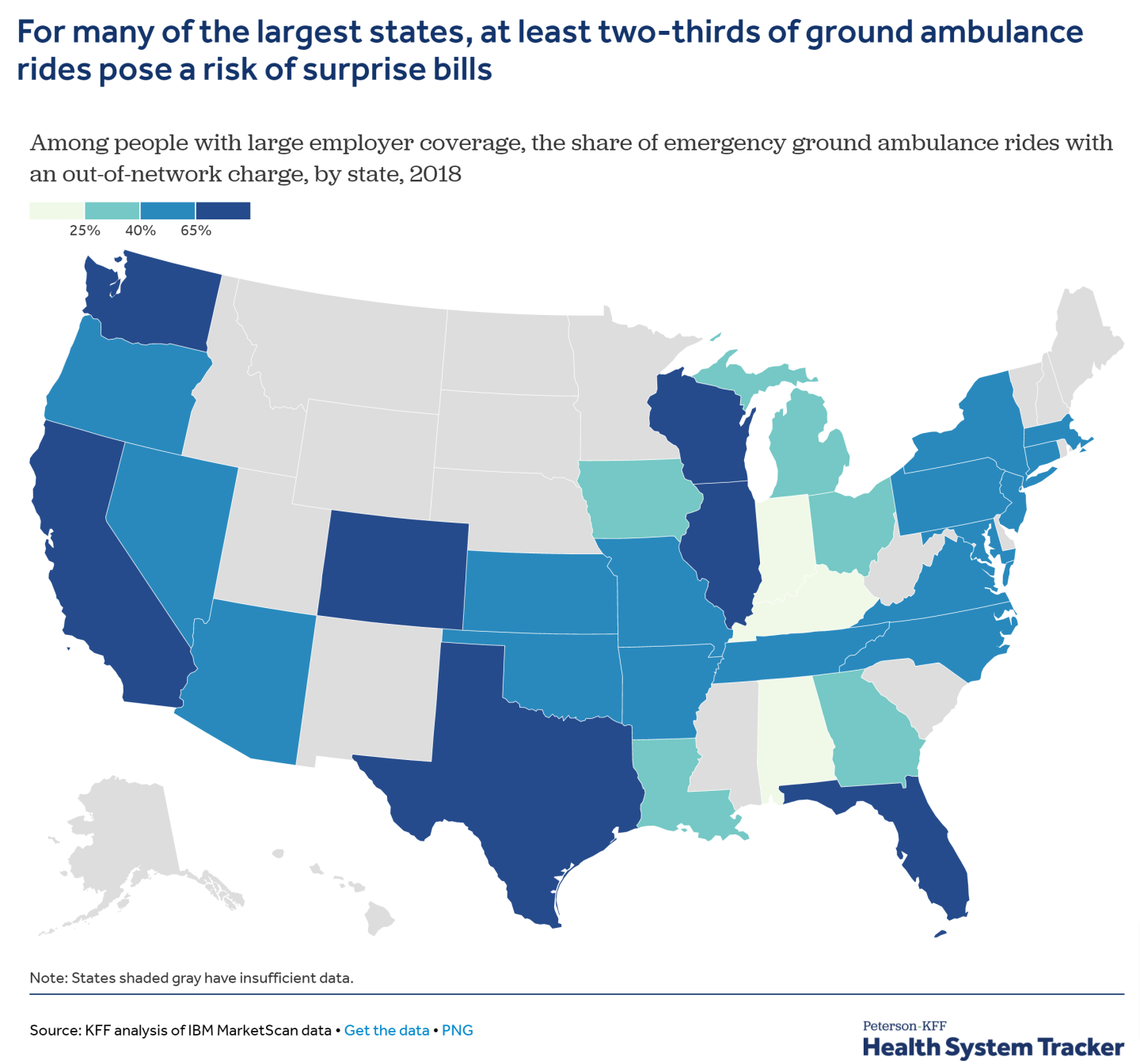

As with most aspects of American health care, regional differences abound. For instance, individuals with private insurance provided by their employer in large states like California, Texas, and Florida have a far higher risk of getting a surprise medical bill for being taken to the ER in an ambulance. And surprise bills aren’t chump change. A separate KFF analysis found that nearly 40% of insured, non-elderly adults received an unexpected medical bill in the past 12 months, and 10% were charged because of receiving care from an out-of-network provider. About 13% who received surprise bills said their unexpected out-of-pocket costs would exceed $2,000. For context, depending on age, family status, and other demographics, American households have anywhere between $2,700 and $8,900 in liquid savings on average.

Addressing this issue will likely require further federal action than what will be enacted under the No Surprises Act, according to watchdog groups.

“The law will protect patients from most surprise medical bills for unexpected out-of-network care at in-network medical facilities, or in emergencies,” writes the public interest organization U.S. PIRG.

“However, the law includes provisions which allow patients to waive those hard-won consumer protections. If the regulations are poorly written, the consent provisions could be abused and these protections will end up on the surgical suite floor.”

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.