This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters, and happy Friday.

All eyes are on today’s non-farm payrolls number. And the markets are on edge until we get that reading at 8:30 a.m. ET.

As Deutsche Bank’s veteran research strategist Jim Reid writes in this morning’s note, “in a career where I’ve seen around 310 U.S. payroll Fridays and the same number of U.S. CPI releases I suspect that today’s employment is in the top 5% for anticipation levels… [combine that] with next week’s CPI [and it’s] close to being the most potentially interesting I’ve ever seen. Obviously either or both could end up being a damp squib, but it feels like something exciting is going to come out of these reports.”

“Damp squib” more or less sums up the equities markets at the moment. U.S. futures are flat, and Europe and Asia are pretty lackluster.

There is action in the crypto market, however. It’s Friday, and, on cue, Bitcoin, Ethereum and Dogecoin are all tanking.

Let’s see what else is moving markets.

Markets update

Asia

- The major Asia indexes are mixed as they close out the week. The Hang Seng Composite, the best of the bunch, is up 0.2%.

- Global COVID vaccinations surpassed the 2 billion mark this week, six months after the first jabs were administered. That’s good. At this pace, Bloomberg calculates, it would take a further nine months to inoculate, crucially, 75% of the planet. That’s less good.

- Coal, the dirtiest of fossil fuels, is making a big comeback thanks to huge Chinese demand.

Europe

- The European bourses are a touch higher with the Stoxx Europe 600 up 0.2% mid-morning. Retail and utilities lead the way.

- G7 finance ministers are in London, and corporate taxes are on the agenda. There was a bit of gamesmanship ahead of the confab with the U.S. announcing hefty tariffs against a host of G7 countries, before suspending them.

- The EU yesterday updated its COVID-governed travel guidelines in time for the busy summer season. It added Japan to its open-borders list, but Americans did not make the cut.

U.S.

- U.S. futures are a touch lower this morning. The Nasdaq and S&P 500 are down for the week.

- Before the bell today, we get the non-farm payrolls report. After the April dud, economists’ estimates are all over the place for this one. The median estimate is for a net 674,000 new jobs.

- Reddit’s 💎 hands crowd had a nerve-racking day yesterday. AMC Entertainment, the king of the meme stocks, plunged 17.9%—shares were off more that 40% at one point—after the indebted and loss-making movie chain said it would issue more shares. It’s down a further 7.5% pre-market.

Elsewhere

- The gold rally is taking a breather, trading around $1,870.

- The dollar is up.

- Crude is flat with Brent trading above $71/barrel.

- Bitcoin is off nearly 6%, trading around $36,000 at 4 a.m. ET. Elon Musk is being blamed for the slump. Something about a tweet involving a broken heart emoji and Linkin Park. (That isn’t even the nuttiest sentence I’ve written this week.)… Ethereum and Dogecoin are down even more on the day.

***

By the numbers

As high as 1 million

Economists could be forgiven for flubbing today’s jobs numbers. April saw the the biggest miss ever. The difference between the consensus estimate and the actual number was 734,000 jobs last month. They missed by that much. And this time? “Economists believe that U.S. payrolls grew by about a million people. Or maybe around 335 thousand. Or something in between,” writes UBS chief economist Paul Donovan. “These might seem like wild guesses, but they are not—these are educated guesses, and economists have the degree certificates to prove it. Forecasting is hard because this is not a normal economic cycle (so normal models do not work). Past data will be revised significantly. Seasonal adjustment probably is not working—in April, people were behaving like it was the summer. The explosion of business start-ups is unlikely to be properly captured in the numbers. But the basic story is of an economy that is recovering well, and which can generally find the workers that it needs.”

So why then is so much riding on this one report? Because, as Citigroup explains (HT to CNBC), the “May jobs data will be a key factor in determining the path of Fed policy in coming months.” A rosy print will tell us a lot about the strength of the jobs markets, and the strength of wages. That all factors into the inflation calculation, and whether the Federal Reserve will need to signal to the markets, the economy is doing just fine. You’ve got this. We’re out of here. The Fed won’t make a decision on monetary policy on just one jobs report, but a particularly strong number today could signal a change in thinking in where they stand on tapering.

Five-year winning streak

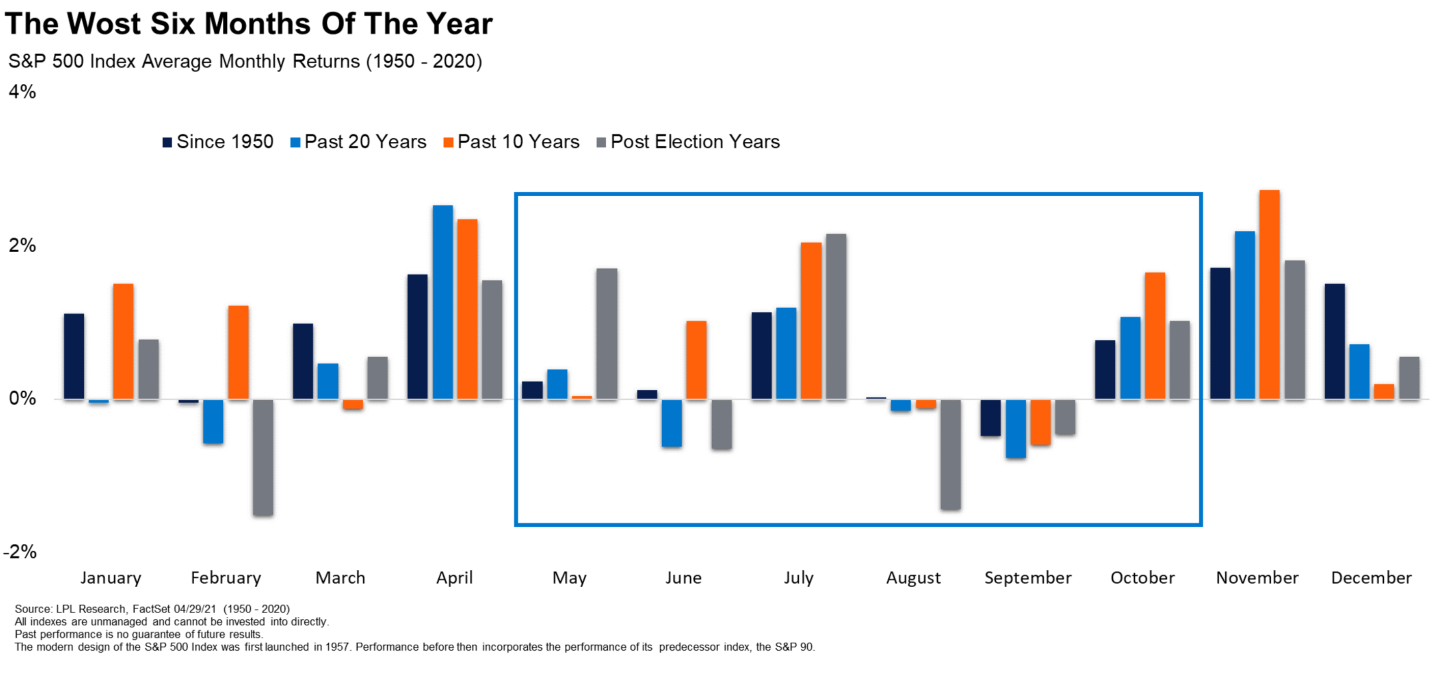

The markets are down for the week, which is hardly a surprise to Wall Street data-crunchers. If there are seasons to the markets, then we’re about to enter a slow one. Going back to 1950, the S&P 500 in the May-through-October period has historically underperformed, as LPL Research breaks out in the below chart. And June has been a particular dud, on average, over the past 20 years.

But the data tells a conflicting story. June may be the fourth-worst month for returns, dating back to 1950, but the S&P has ended in the green each of the past five Junes. As Ryan Detrick, Chief Market Strategist for LPL Financial, writes, “we wouldn’t be surprised at all if stocks took a well-deserved break in June, but this month is rather misunderstood, as a massive sell-off or the start of significant weakness isn’t likely, as that isn’t what June typically brings.”

2,321%

That’s the year-to-date return for AMC Entertainment, which sounds pretty spectacular. But if you bought AMC shares on Wednesday, during its crazy rally, you’re probably out-of-pocket right now. Shares are down 25% from the June 2 all-time high; they are off again this morning. That’s pretty expensive free popcorn.

***

Have a nice weekend, everyone. But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Quiz time. It's Friday. Let's have fun with this one. Ready? House prices are through-the-roof in just about every market on the planet. Home buyers in the U.S. have seen median house prices climb by a staggering 13.2% in the past year alone. That's not even close to the fastest-growing markets. Can you guess which country tops the list? You can find the answer here.

The Big Five. Twenty years ago, I covered the excruciating near-collapse of "the Big 5" music labels. The biggest of the majors, Universal Music, is now in the sights of hedge fund billionaire Bill Ackman. According to the Wall Street Journal, Ackman's got a SPAC—Bull Sheet needs a SPAC—that plans to buy the label, and take it public. If only we had SPACs 20 years ago. Imagine the sweet music we'd have had.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Why does crypto tend to drop every weekend?

This crazy cycle in which Bitcoin and its peers seem to drop at the end of each week has been a maddening occurrence for crypto bulls. What gives? Fortune's Jessica Mathews digs into this puzzler and finds that, no, it's not all Elon Musk's fault. But it may have something to do with the dreaded "Sunday effect."

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.