Dealmakers are having a record-breaking year.

So far in 2021, global mergers and acquisitions have totaled a record $2.4 trillion, up 158% from the same period last year, according to a Refinitiv Deals Intelligence report out Wednesday. That marks the highest year-to-date total going back to 1980 when Refinitiv’s records began (the first quarter was also a banner few months for M&A).

“As the surging stock market continues to drive confidence, and interest rates remain at record lows making borrowing for acquisitions cheap, dealmaking continues at pace,” Lucille Jones, a Deals Intelligence analyst at Refinitiv, wrote alongside the report.

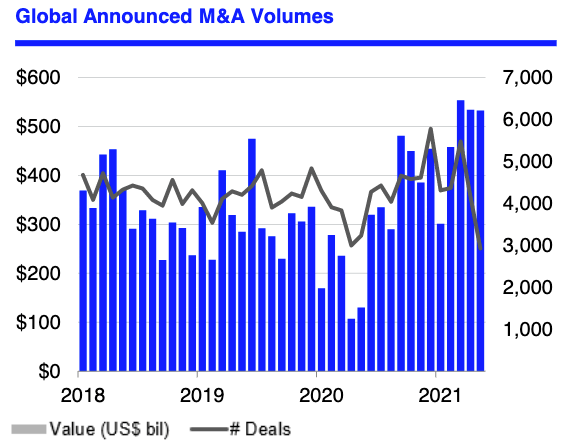

Though deals in May totaled slightly less than those in April, they still topped $500 billion globally (at nearly $533 billion) for the third consecutive month (see Refinitiv’s chart below), and notched the highest-ever May total. Deals involving at least one U.S. company (worth together some $274.2 billion for May) slumped 3% from the month prior.

Notably, the much-beloved tech sector wasn’t the hottest area to find deals last month. According to Refinitiv, media and entertainment deals accounted for 29% of “M&A announcements by value during May 2021,” knocking tech off the top spot for the first time in 10 months. That media and entertainment deal spurt was boosted by megadeals like the $43 billion WarnerMedia and Discovery merger and Amazon’s $8.5 billion purchase of famed studio MGM.

At some firms, there has been “anecdotal evidence to suggest this forward calendar [year] is out of control” for M&A, Marc Cooper, CEO of boutique investment bank PJ Solomon, told Fortune back in April. Indeed, Cooper added, if the backlog of deals the firm was working on “means anything, it’s going to be a big back half.”

SPACs sticking around

One notable area that has been a big deal driver has spurred plenty of debate in recent months: SPACs, or special purpose acquisition companies. SPACs exploded early in 2021, but saw a slump in April as concerns boiled up about regulation and post-deal stock performance.

Still, “the recent SPAC boom continues to fuel dealmaking, with SPAC combinations accounting for 11% of global M&A activity in May,” Refinitiv’s Jones noted, with 28 SPAC deals announced globally last month.

Indeed, well-known firms including investment app Acorns, which announced last week it will go public via a SPAC deal, and fintech SoFi, which just debuted in the public markets, have opted for the blank-check route.

More must-read finance coverage from Fortune:

- Will stocks keep going up this year?

- A 21% global tax floor would mean $140 billion more for Europe and U.K., think tanks claim

- “Intentionally boring” virtual shareholder meetings are here to stay—and that could be bad news for small investors

- When will India’s economy recover from its second COVID wave? Economists are split

- Yes, you can spend cryptocurrencies using Apple Pay