This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

U.S. futures are gaining as June gets off to a promising start. European stocks are in the green, too, as the great reopening trade continues to build momentum. At last check, the handle on the 10-year Treasury note was flatlining at 1.61%—that’s good news for stocks.

In today’s essay, I dig deep into the winners and losers from last month. A hint on the big winner: we haven’t called its name much since last summer. It rhymes with “old.”

But first, let’s check in on the rest of the markets action.

Markets update

Asia

- Asia is mixed with the Hang Seng up 1.1% in afternoon trade.

- China is loosening its controversial births policy, but only slightly. A family can now have three children (up from two) as the birth rate slips. On cue, China’s infant-care stocks are rallying.

- Asian food giant Monde Nissin—maker of ‘Lucky Me!’ instant noodles, ‘SkyFlakes’ biscuits and Dutch Mill yogurt—began trading today on the Philippines Stock Exchange . . . and it didn’t go so well.

Europe

- It’s a risk-off day in Europe with the European bourses higher out of the gates. The Stoxx Europe 600 gained 0.5% in the opening minutes with basic resources, autos and travel and leisure leading the way higher.

- As of today, you can dine indoors in much of Italy, one of the last big COVID-19 restrictions to be waived by the Draghi government. I circled this date on my calendar ages ago. There’s this amazing family-run restaurant in a little hilltop town in Marche where they serve the most incredible dish of pasta ortica, but only if you can get a table inside. As such, I’m not ready to tell you where this place is. Forget I even mentioned it.

- The pound sterling hit a 3-year high this morning as the economy continues to improve, and the housing market takes off.

U.S.

- U.S. futures are clinging to the slightest of gains. That’s after the Dow[hotlink] and S&P finished out May in the green, a fourth consecutive month of gains.</li><li>Shares in [hotlink]Tesla were down 0.9% in pre-market trading after CEO Elon Musk acknowledged in a tweet—where else?—that the company is hiking prices on its new cars thanks to supply chain complications.

- On the calendar this week we have manufacturing data today and the big jobs report on Friday. The estimate is for a big upward revision for April (you’ll recall the April print was a surprising dud), and roughly 678,000 new jobs in May.

Elsewhere

- Gold is up, trading around $1,915/ounce.

- The dollar is lower this morning.

- Crude ended May with a bang. Brent is trading above $70/barrel.

- Crypto had another rollercoaster weekend before recovering somewhat. Bitcoin trades around $36,000. It had a brutal month, however.

***

The big winners and losers

My New York Mets are in first place. But you know who had an even better month? Gold bugs and meme “stonk” bulls.

Let’s first look at the former.

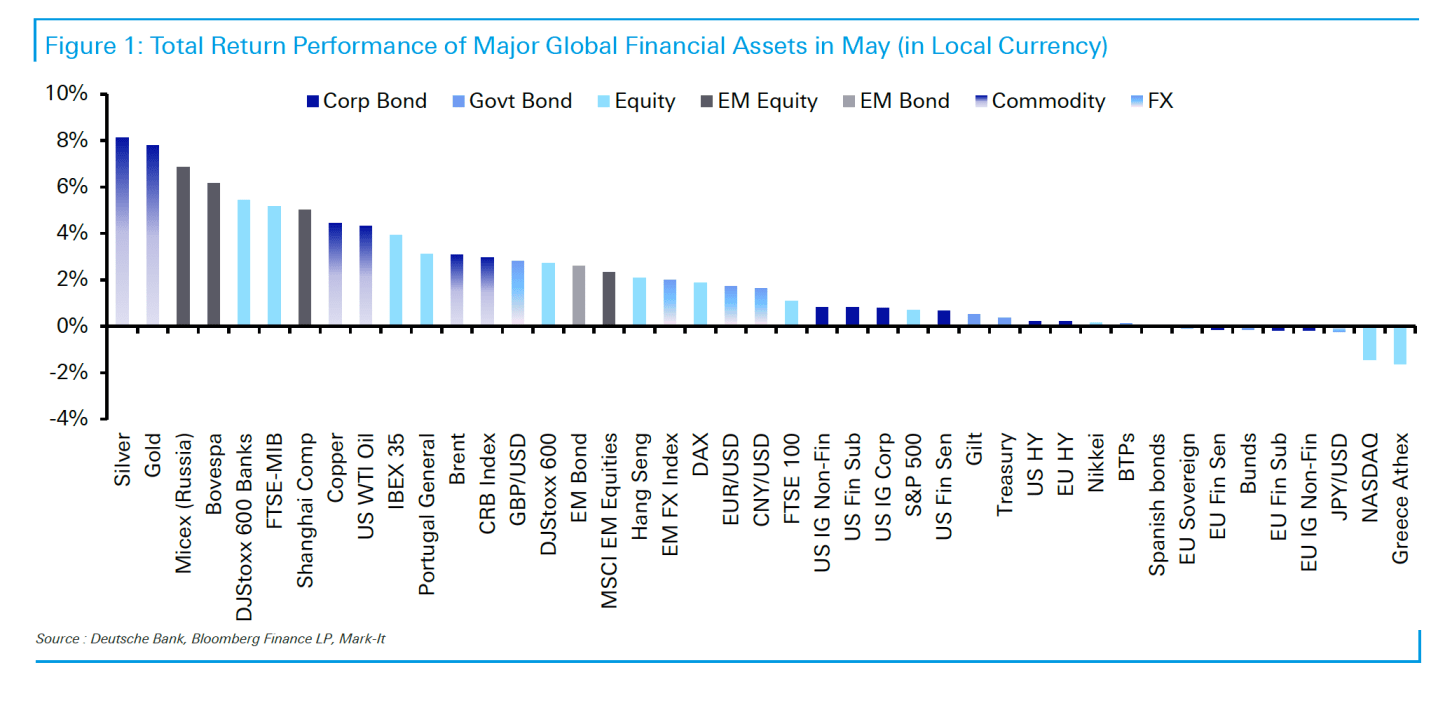

According to Deutsche Bank, the shiny yellow stuff gained 7.8% in May. Silver did even better as we witness a commodities boom for the ages.

That gold tends to rally as equities slump is no longer axiomatic in these markets. For example, we saw gold go on a tear in July and August last year, in line with a bull run in tech stocks—and a collapse in value stocks.

This time around, we’re seeing the opposite: a rush to gold as tech and crypto underperform, and value stocks (the DJ Stoxx 600 Banks index was up 5.4% last month, and the S&P 500 Financials was up 4.8%) outperform. This all means the hedge out of equities and into gold is happening, but it’s more selective.

Now, let’s look at meme stocks. It’s easy to dismiss this group for its iffy fundamentals, but they do, by and large, come from the batch of so-called recovery stocks. And, newsflash: the recovery is alive and well.

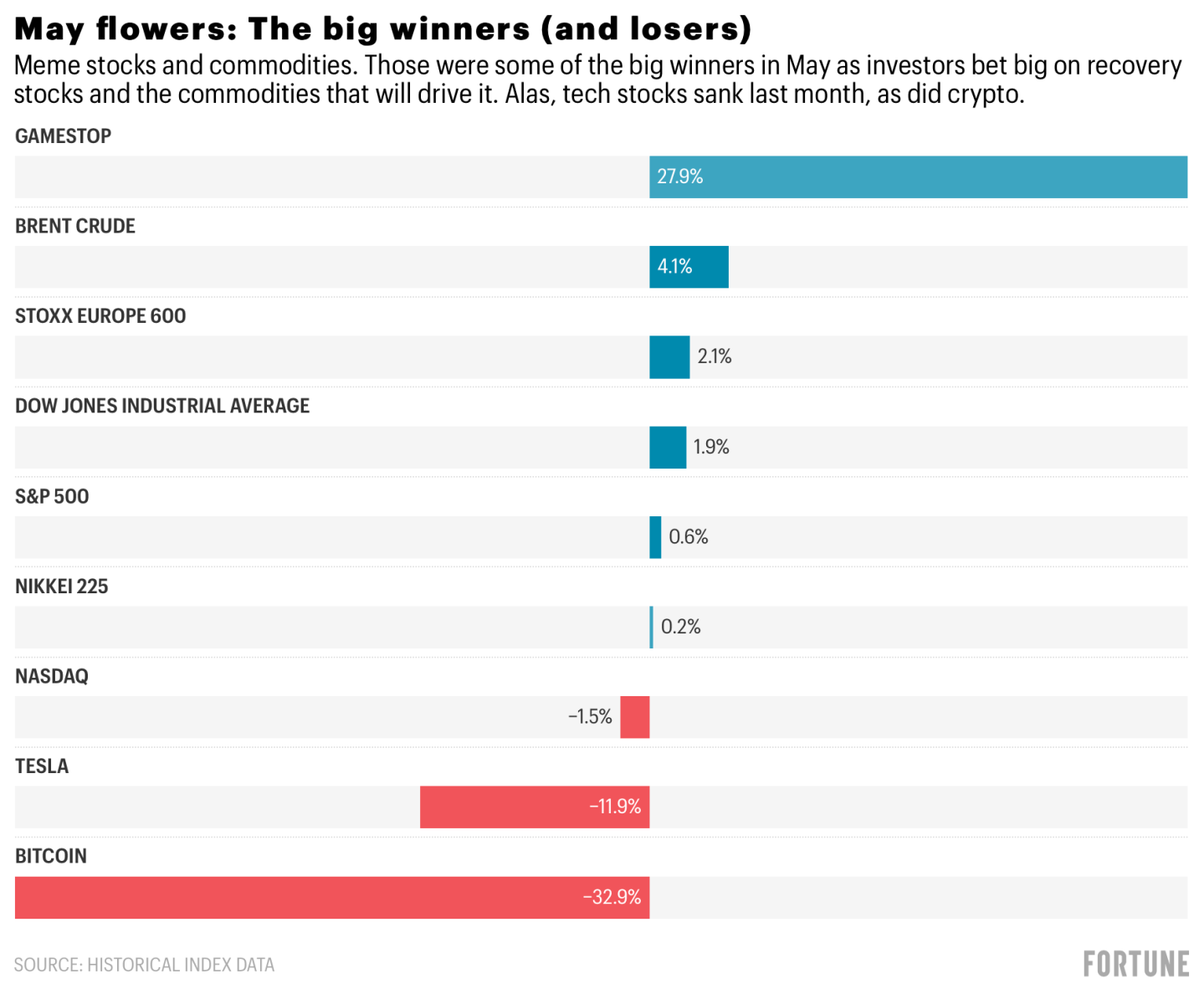

The prince of the meme stocks is GameStop, which climbed a further 27.9% in May. That’s even as my nephew cashed out last week. (He wasn’t alone; GME slumped 12.7% on Friday.)

If GME was the prince of May, then the frogs were Tesla and crypto.

Bitcoin lost one-third of its value during what was an incredibly volatile month. From peak to nadir last month, BTC fell as much as 47.3%. It was hardly the most volatile. Dogecoin lost nearly two-thirds of its value at one point last month, and Ethereum was off 60% from peak to trough.

Now, let’s look at tech. Despite a decent end-of-month rally, the Nasdaq finished May in the red, off by 1.5%, as the cyclical rally continues. What should be somewhat worrying to tech bulls is the fact that tech slumped even as bond yields barely budged last month.

The inflationary fears were a real headwind to tech stocks. But that was last month. Now, it’s a case of the cyclical rotation getting the worst of the sector.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

Pandemic paradox. Sticking with the best and worst theme...COVID-19 ravaged India and Vietnam just saw a stellar month for stocks. India's Nifty 50 climbed 6.5% in May and Vietnam's VN Index soared 7.2%. Alas, Taiwan proved the outlier. The Taiex was Asia-Pac's worst performer, down 2.8%

Lumbering ahead. Shares in Trex, America's biggest maker of composite decking (from recycled plastic), have been on a tear this year, up roughly 18%. One reason? The price of wooden decks has soared during the great lumber rally of 2021, making Trex decks increasingly price-competitive.

Sanctions, schm-anctions. This year's crypto rally has been a boom for a different kind of speculator: rogue actors looking to avoid economic sanctions. Adrian Croft explains how a tried and true tool for punishing rogue states and groups is fast losing effectiveness in the Bitcoin age.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

This day in history

It's been a while since I last did this particular Market Candy feature, a favorite for some of you. Last year at this time, the big winners and losers for May were...just about every imaginable equities sector. In May 2020, the Nasdaq climbed 6.8%. It was hardly the biggest winner. That crown went to the Russell 2000 (+10.6%) and the Nikkei (+11.5%).Good times, indeed.