This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning.

U.S. futures are trading lower, with Big Tech leading the way down. That’s even as bond yields remain totally stuck in neutral. The 10-year Treasury note is now at 1.588%, continuing its sideways trajectory.

Investors are taking a breather ahead of a big batch of data coming out in the coming hours on jobless claims, durable goods orders, GDP, and pending home sales.

In crypto land, it’s a blur of red with Bitcoin, Ethereum and Dogecoin all under pressure.

Let’s see what else is moving the markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading with the Nikkei down 0.3%.

- The era of engagement with China “has come to an end.” So says President Biden’s Asia czar, Kurt Campbell, citing China’s “assertive” push in the region that includes military clashes with India and a bruising “economic campaign” against Australia as two recent examples.

- The comments come as the U.S. and China trade representatives meet in Beijing today for the first round of what’s being described as “candid” talks.

Europe

- The European bourses are mostly higher out of the gates this morning with the Stoxx Europe 600 up 0.1% in early trading.

- Shares in Royal Dutch Shell were down 1% after a Dutch court ruled on Wednesday the oil and gas giant has to slash emissions further and faster than planned, saying it’s a big contributor to climate change. Now that they have powerful friends in the ESG investment community, climate hawks are feeling emboldened.

- Bayer really wants its Roundup weed killer legal troubles to go away…but they won’t. A U.S. judge on Wednesday rejected Bayer’s offer to pay up to $2 billion to settle future claims. Shares were 5.2% lower on Thursday, one of the biggest losers on Germany’s DAX.

U.S.

- U.S. futures point to a weak open. That’s after the major averages barely eked out gains on Wednesday.

- The big out-performers yesterday were the meme stocks—erm, stonks. GameStop, AMC Entertainment and Express Ltd. all saw double-digit gains yesterday. Alas, my nephew sold his GME shares yesterday, he told me, which may explain why the video game retailer is 4% lower in pre-market trading at the moment.

- What’s on the calendar today, data-wise: pending home sales, a second reading on GDP and jobless claims.

Elsewhere

- Gold is flat, trading around $1,900/ounce.

- The dollar is down. Again.

- Crude is down with Brent around $68/barrel.

- As we near the weekend, Bitcoin is under pressure again. (Probably a coincidence.) As of 4 am ET, it was trading around $38,200. Ethereum, Dogecoin were off 4.3% and 5.7%, respectively.

***

Buzzworthy

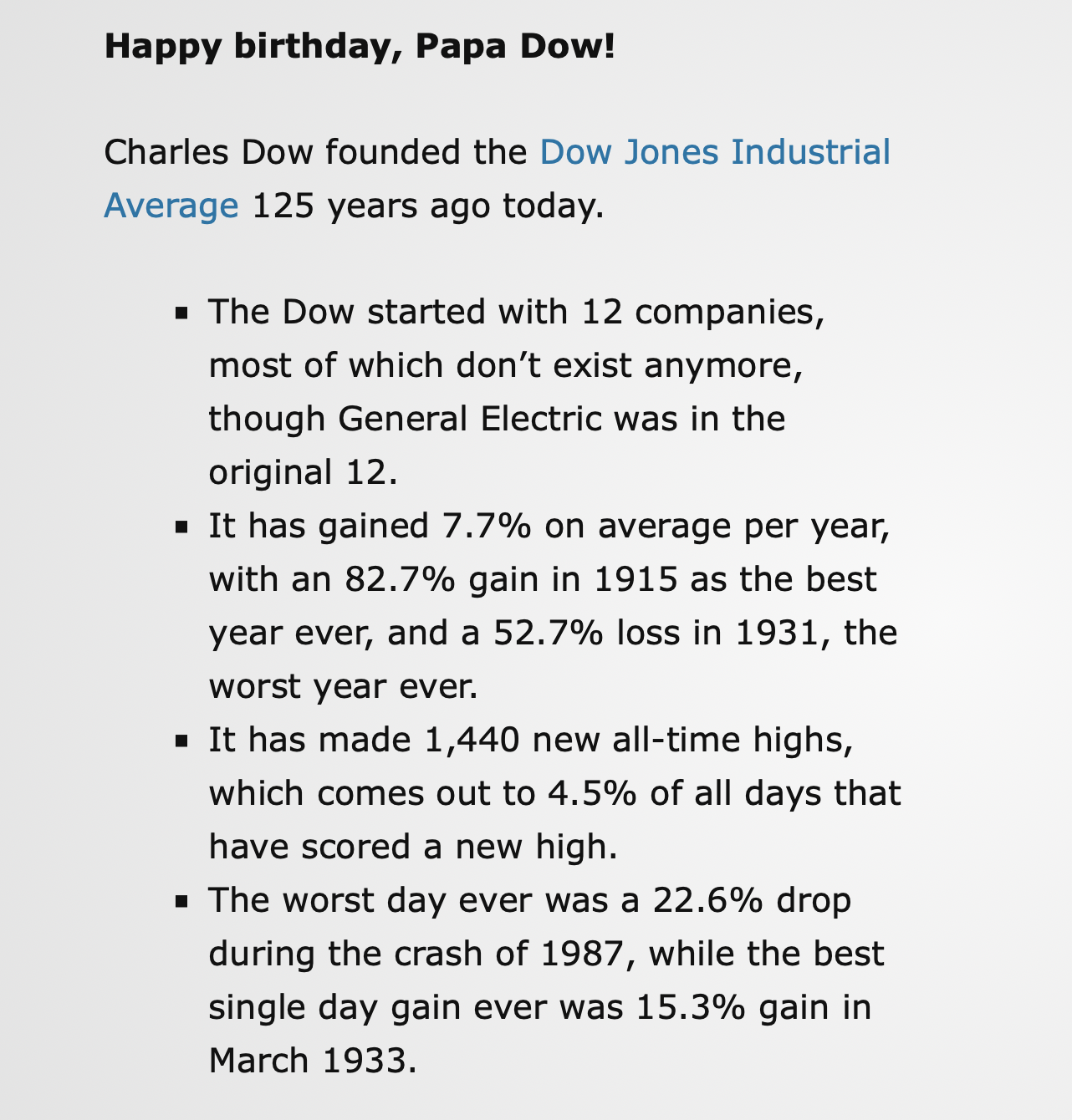

Happy (belated) Birthday!

I was remiss in not mentioning this yesterday, but better late than never. Data and stats courtesy of LPL Research.

🎂🎉🎂

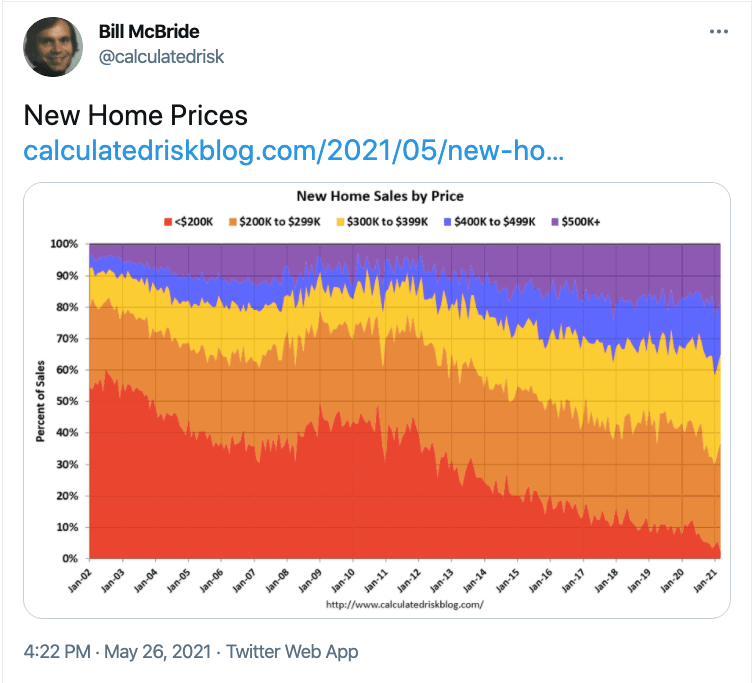

House prices 🚀

I’ll help you out with the fine print here: homes costing $300,000 or more now make up about 60% of the market. A decade ago, they made up less than 30%, according to Calculated Risk.

🏡 🚀

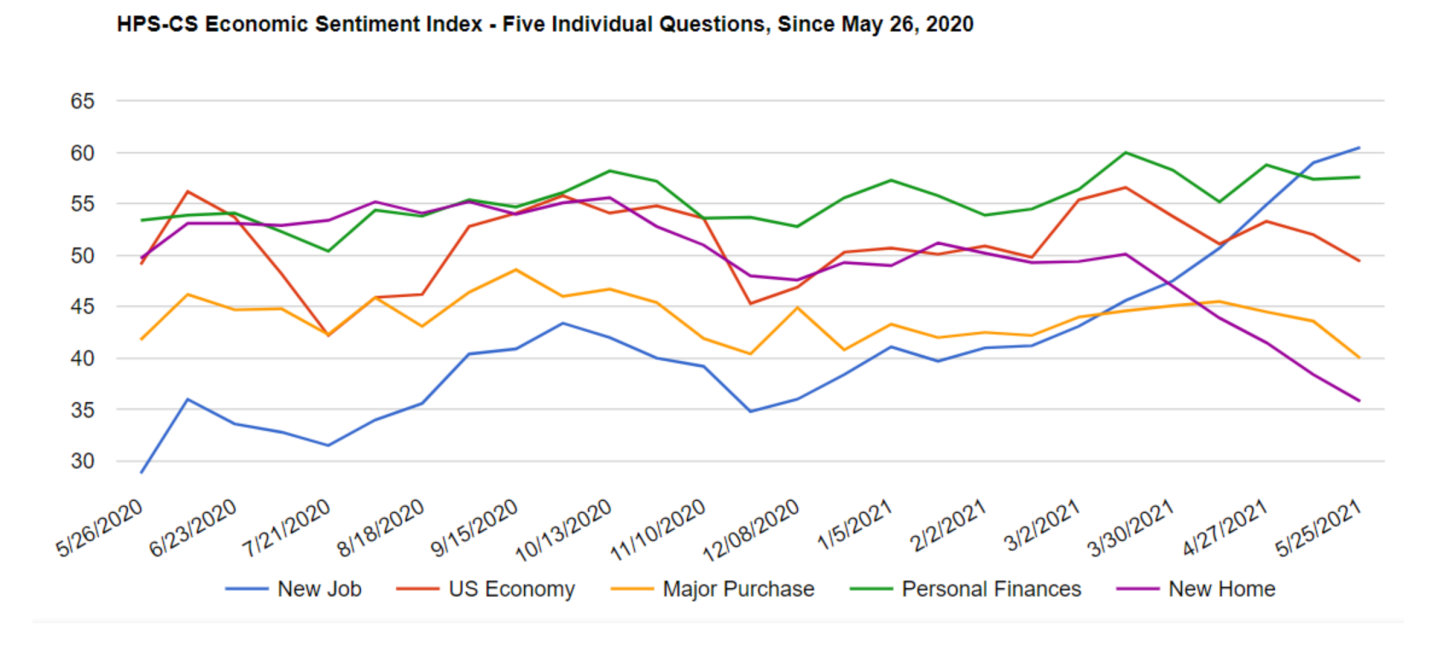

The great decoupling

According to the latest HPS-CivicScience Economic Sentiment Index survey, Americans are feeling far more bullish about the jobs market than they are about the housing market. Their confidence in landing a new job (blue line) is soaring; finding a new house (magenta line) is tanking.

😬

“Crushing day” for Big 🛢️

🌎🌲🌻

***

Postscript

I have an update on yesterday’s Bull Sheet.

A number of readers—quite a few of you, actually—responded to my pachyderm puzzler.

All but one of you ultimately sided with my wife and the girls on account that you interpret pachyderm to be a non-specific grouping of four-legged, thick-skinned mammals, and therefore, my entry should earn nil points.

This thin-skinned mammal doesn’t agree. I will look for a higher authority to appeal the matter to.

One other thing…Just about all of you admitted to me that you have no credentials in zoology, but that you feel qualified to comment on matters of marital/domestic harmony.

Gee, thanks.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Icahn eyes crypto. Billionaire investor Carl Icahn says he's studying Bitcoin, Ethereum and the whole cryptocurrency sector, and he may be ready to pounce with a $1 billion bet.

Missed out on meme stocks? Now there's an ETF for that. As Fortune's Chris Morris reports, "Tuttle Capital Management has launched the FOMO—'fear of missing out'—ETF, which lets investors take part in the retail trading boom for select stocks that might not be on their radar."

Archegos meltdown. As we've long suspected, federal investigators have opened an investigation into the collapse of Archegos Capital Management. Archegos's toxic trades ended up costing these global banking giants billions.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

If Tesla bought a bunch of Bitcoin in early February at $35,000 and after a big jump, the price falls to $31,000 on May 19 (as actually occurred) it's obliged to take a $4,000 impairment on every one of those coins. But if Bitcoin vaults back above $31,000, Tesla doesn't get to mark the coins back up and eliminate the write-down. Those impairments are forever.

That's Fortune's Shawn Tully who gives TSLA investors a preview of what could be sitting on the EV maker's books after the rollercoaster ride in Bitcoin prices in recent weeks.