Good morning,

Fortune, in partnership with Workday, launched the first installment of our virtual CFO Collaborative event series on Tuesday. Financial leaders from a variety of industries came together to talk about the critical role of the CFO in a post-pandemic world.

Panelists and attendees discussed so many important topics. I’ll be sharing the highlights in the next few newsletters. Today, I’m sharing the takeaways from discussions on the evolution of the CFO role and what can be a pain point — the explosion of data.

Traditionally, finance was a back-office function, Aneel Bhusri, co-founder and co-CEO at Workday, said. Today, the role of the CFO is “really to be the partner to the CEO and the business,” Bhusri said. Looking toward the future, being comfortable with technology like machine learning and also big data is essential to the role, he said.

“I think we’re in a world of constant learning,” Bhusri said. “There’s a lot of technologies out there that can add quite a bit of leverage to your business.” He advised experimenting in one division with a particular technology, then seeing if it makes sense to implement on a wider scope.

Having access to large amounts of data is beneficial, but it can be overwhelming, if it’s not harnessed in an effective way, Nasdaq CEO Adena Friedman told Fortune CEO Alan Murray. Prior to joining Nasdaq, Friedman was CFO at Carlyle Group.

As the CFO at Carlyle, “the CIO reported into me, and it allowed us both to sit together and say, ‘Okay, how are we going to modernize the technology to support an evolving CFO role?’” Friedman said. She spent a lot of time thinking through the corporate system, she said.

“I think a lot of the skill sets that CFOs have are quite relevant to being the person who harnesses the data within an organization,” Friedman said. A CFO doesn’t necessarily need to be an expert in Java or Sequel software, yet might have people on their team who are experts, she said. But a CFO needs to know “how to kind of unpack a process and repack it up in a way that gets you a different conclusion,” she said.

Allen Parker, CFO at Zillow, and Christina Spade, executive vice president and CFO at AMC Networks, talked with Fortune Senior Editor Lee Clifford about how they approach technology and data.

As AMC is an entertainment media company, “we’d love for data to be able to predict all the hit programming out there before we invest in it,” Spade quipped. “But unfortunately, we have not cracked the code for that yet. But I keep trying.”

AMC is relying more and more heavily on data to help predict what we want to watch. “In the world of streaming, we actually learned quite a bit more about our viewership,” she said. “And so it’s opened up a whole new important world to us that we really are benefiting from.”

Technology continues to power customer experience at Zillow, Parker said.

“With the advent of machine learning and technology … there’s all this information that we’re now able to use that enhances that ability to value that house or value that location, or to improve the customer experience when they’re on our site,” Parker said.

Machine learning has the ability to “scale and iterate very quickly,” he said. “I think the next stage is going to be computer vision as more and more 3D home tours populate our site. We’re actually able to use computer vision to even be more accurate about the value of these various houses,” Parker said.

By the way, we polled attendees the following question: What is the top barrier you face as you look to democratize data access and accelerate decision readiness at your organization?

The top answer? Inflexible legacy technologies, which won by a landslide (61%).

Do you agree?

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

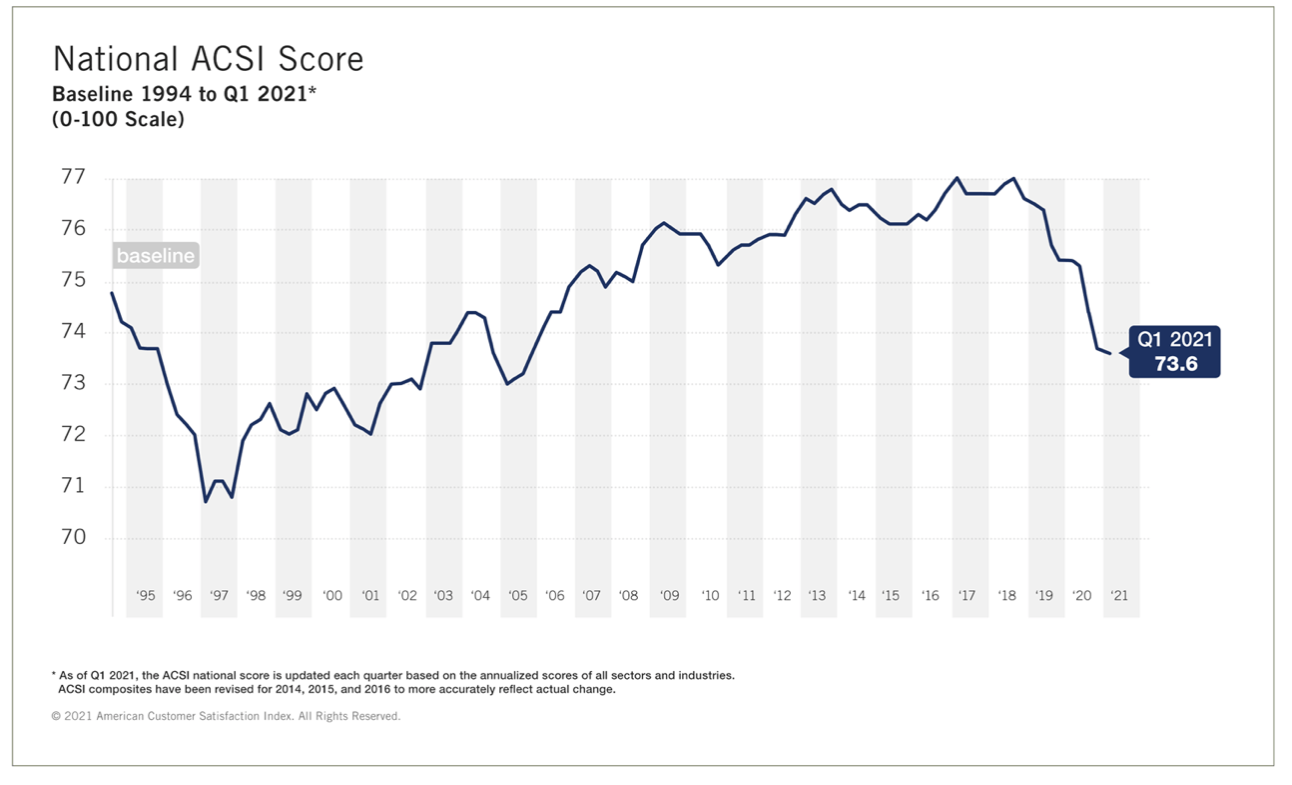

Overall customer satisfaction fell in the first quarter of 2021, according to American Customer Satisfaction Index (ACSI) data. It has now decreased in nine of the past 10 quarters and “puts ACSI at its lowest level in 15 years (73.6 out of 100),” a report released May 11 found. Prior to the coronavirus pandemic, the downturn in customer satisfaction began in late 2018. The report suggested businesses upgrade their analytics tools in order to create useful data to better understand customer demand.

Going deeper

The driving factors of finance leaders' budgets and technology adoption plans were analyzed in OneStream Software's “Enterprise Financial Decision-Making 2021North America” survey. The software company's study, conducted by Hanover Research, found that along with the effects of the coronavirus pandemic, the "political and social landscape have also heavily impacted investment decisions." Many executives were led to prioritize sustainability and diversity initiatives as well.

Leaderboard

Kevin Haggard was named SVP and CFO at Callon Petroleum Company, effective May 17. Most recently, Haggard served as VP and treasurer at Noble Energy, where he directed the company's global corporate finance and treasury operations.

Vineet Agarwal was named CFO at Korro Bio, Inc., an RNA editing company. Agarwal joins Korro from J.P. Morgan Chase & Co., where he most recently served as senior executive director in the Healthcare Investment banking group based out of New York.

Overheard

"I am amazed how bad these analysts have become. Some of them can't even do basic maths. All of them mix up definitions. It's unbelievable."

— Just Eat Takeaway CEO Jitse Groen on Twitter, criticizing analysts. He later apologized, but also took another jab. "Groen ended his rant, without providing further insight, by pointing out a trend lines comparison of Just Eat Takeaway’s Just Eat, Deliveroo, and Uber Eats," Bloomberg reported.