This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Live from your inbox, it’s Monday morning.

Well, Elon Musk didn’t disappoint. His debut co-hosting Saturday Night Live sent Dogecoin on a wild ride this weekend. After an impressive rally on Friday and Saturday, the joke coin crashed by roughly 30% shortly after the so-called “Dogefather” agreed in a skit that, yeah, Dogecoin is little more than a hustle.

Ah, but like all good hustles, this one’s got legs. $DOGE has regained most of its losses, and its market cap has soared above $70 billion. In today’s essay, I put into perspective a rally that’s pushed the valuation of the crypto coin above some of the biggest companies on the planet.

Elsewhere, commodities and crude are gaining, as are U.S. futures. Tech stocks, alas, are slumping again.

Let’s see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading with the Shanghai Composite up 0.3%.

- Economists have long been saying China’s imminent rollout of the digital yuan could be a huge threat to the dollar‘s standing as the world’s reserve currency. But on the ground, the early users find the digital currency kinda meh.

Europe

- The European bourses were as flat as a piadina romagnola out of the gates, with the Stoxx Europe 600 up 0.05%. Energy and raw materials lead the way this morning; tech and travel and leisure are the laggards.

- The British pound is rallying after the Scottish Independence Party underperformed at the polls, pushing off, for now, talk of a referendum on whether Scotland should make a clean break from London. A reminder: give voters the option to leave somewhere, anywhere, and they’ll probably vote to go.

U.S.

- U.S. futures are higher, but have been losing ground throughout the morning. That’s after the Dow[hotlink] and S&P 500 finished last week in the green; the [hotlink]Nasdaq sank 1.5% last week.

- Fuel prices took off on Sunday after a cyber attack crippled one of America’s biggest pipeline operators. West Texas Intermediate, the U.S. benchmark, climbed above 65 bucks, and natural gas futures spiked as well.

- Corporate results continue this week with earnings calls from Marriott (today), SoftBank (tomorrow), and Alibaba and Walt Disney on Thursday.

Elsewhere

- Gold extends its recent rally, trading above $1,830/ounce.

- Friday’s disappointing jobs numbers have hit the dollar hard. It’s given up nearly all its gains for the year.

- Crude is rallying again with Brent trading above $68/barrel.

- Bitcoin is climbing, trading near $59,000.

- A reader, rightly, asked me to add lumber prices to this roundup as he’s sitting on a nice plot of land, and he’s watching in dismay as lumber prices take off. I am sorry to report that the July futures contract just topped $1,670, a jump of more than 12% in the past week. Don’t bring this lumber inflation issue up to Italians. They don’t get it. When it comes to building homes, they’re stuck in the stone age.

***

The big Doge

If you bought Dogecoin in the run-up to Musk’s big appearance on SNL this weekend, please drop me a line.

Clearly, crypto bulls did just that, sending $DOGE up to 74 cents a few hours before Musk took the stage. Once he started talking though, it bombed.

Talk about a tough crowd.

As my colleague Robert Hackett reports, “early in the episode, Musk’s mom, Mae Musk, dissed the buzzy cryptocurrency during the opening monologue. ‘I’m excited for my Mother’s Day gift,’ she said on the eve of that holiday. ‘I just hope it’s not Dogecoin,’ she joked.

“Musk, wearing an impish grin, returned: ‘It sure is!'”

That might go down as one of the most expensive joke ever told. Right after that opening monologue, Doge bombed down to $0.49, wiping a good $20 billion off its market cap.

Ah, but the joke is hardly over. The Dogecoin price recovered on Sunday after Musk’s SpaceX announced—get this—a moon shot funded by Dogecoin.

I can almost hear you muttering about now, “yeah, somebody is getting taken for a ride here.”

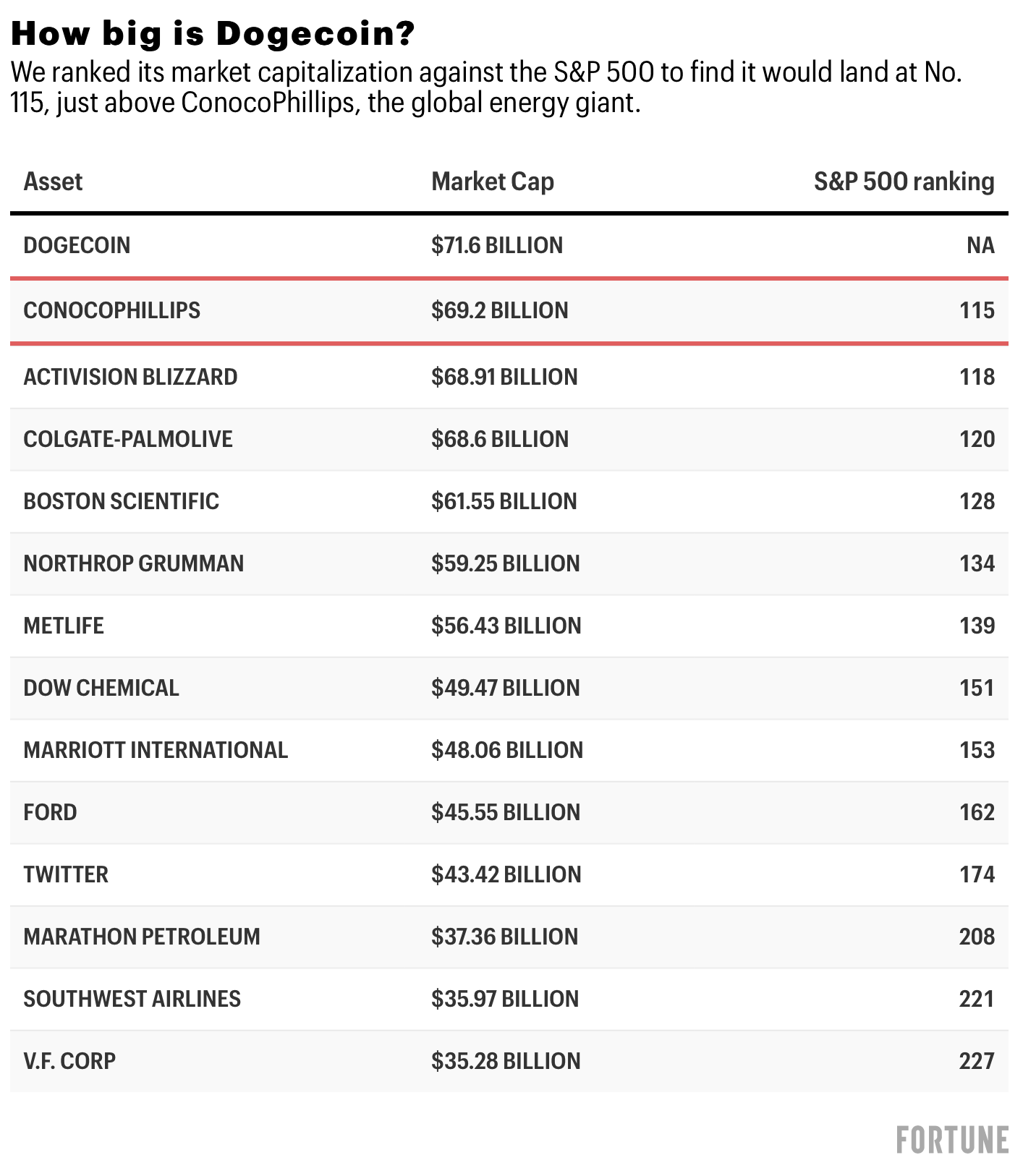

Dogecoin is a financial asset that somebody coined as a joke. And yet investors are paying a premium for it. As of 9 a.m. Rome time this morning, Dogecoin’s market valuation was $71.6 billion, higher than 385 companies listed on the S&P 500.

As the chart above shows, Dogecoin is more valuable than oil giants, airlines, carmakers, software companies, and insurance companies. It’s bigger than profitable companies. It’s bigger than companies that make things, and innovate. It’s bigger than companies that have built and grown cherished global brands. It’s bigger than companies that employ a lot of people, and create real economic value.

This is amounting to one expensive hustle.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

"Goldilocks scenario." From the rally of the commodities boom, a new upstart has emerged: iron ore. Futures have risen 10% on soaring demand, leading Goldman Sachs analysts to declare we're at the start of a "Goldilocks" moment for bulls speculating on these commodities.

Quadruple-digit gains. Lost in much of the Dogecoin craziness, is the impressive rally in Ethereum. The world's second largest cryptocurrency is up 2,200% since March, 2020. My colleagues Lee Clifford and Robert Hackett explain what's behind the surge.

Save the date. On June 8-9, Fortune will host its annual Fortune Global Forum, which yours truly will co-chair. There's a blockbuster lineup of CEOs and business leaders who will join us to discuss what to expect from the economic bounce back, plus tackle the big issues around innovation, growth, sustainability and leading in an age of true disruption. Come and join in the discussion. Registration is now open.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

30%

If you have kids of a certain age, you no doubt have witnessed the mania around Doc Martens, the distinctive thick-rubber soled shoes and boots that were cult favorites of punk rockers a few generations ago. Today, they're beloved by fashionistas, influencers and a lot of teens—and you see that demand in the crazy prices. I bought my only pair about 20 years ago, paying maybe 50 quid for an indestructible pair (I wear them when doing heavy duty gardening or DIY work). They're way pricier than that today. Riding this newfound popularity, Dr. Martens PLC went public in January, and the stock is absolutely kicking it. Eric J. Lyman explains why.