Good morning,

Data overload is real for finance and accounting professionals. For more insight on this topic, earlier this week I chatted with Shari Littan, director of corporate reporting research and policy at the Institute of Management Accountants. Littan said her role includes conducting research to help the 140,000 members of the organization deal with the proliferation of tech-based solutions. Lack of access to collaborative cloud-based technology is a “pain point” Littan explored in a report she coauthored. “There still seems to be significant internal competition for resources within organizations that often puts a lower priority on moving corporate reporting to cloud-based collaborative systems,” Littan told me. For some financial reporting teams, that means continuing a “spreadsheet, cut-and-paste exercise,” she said.

Cecilia Owens is the new CFO and chief operating officer at Grandview, a privately held Los Angeles entertainment management and production firm. Owens shared her journey from growing up in Compton to a career in several financial leadership roles. Though most film productions shut down last spring due to the coronavirus pandemic, the writers kept writing, Owens said. “And now we’re at a place where we see the growth about to occur,” she said. “I do anticipate a significant increase in demand resulting in what many have described as a big blockbuster year particularly with movie theaters returning to pre-pandemic capacity,” she added.

Ineffective preparation, delaying the decision to divest, and emotional attachments are some of the reasons many corporations around the globe are having a tough time trying to sell off parts of their businesses, according to EY’s 2021 Global Corporate Divestment Study, which was published May 5. The data, based on a survey of 1,040 global C-level executives, was conducted between January and March 2021. “Our study found that 79% of respondents failed to meet price expectations for their most recent divestment,” Rich Mills, EY global and Americas sell and separate leader said. About 78% of companies said they held onto assets too long when they should have sold them, according to the study. “We believe the best way to remove such obstacles is to better link divestment decisions to the company’s strategy of long-term value creation,” Mills said.

I talked with Jessica Alba, founder and chief creative officer of The Honest Company, about the road to an IPO. On May 5, Honest debuted on the Nasdaq reaching $23 per share, up almost 44% from the initial trading price of $16. Alba said: My vision, always, from the beginning was to really create this clean lifestyle brand and make it available to people and build community. Over time, I was building out this strategy with our CEO Nick Vlahos, who joined me four years ago. As we looked at all of our options and opportunities in this next phase of growth for the company, what made the most sense was for us to do a public offering. Also a key part of our talk (and her IPO)? Honest CFO Kelly Kennedy. You can read the full story here if you missed it.

Finally, Elon Musk is hosting SNL this Saturday. Will you be watching? We’re betting he’ll get a big reaction—he usually does.

See you Monday.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

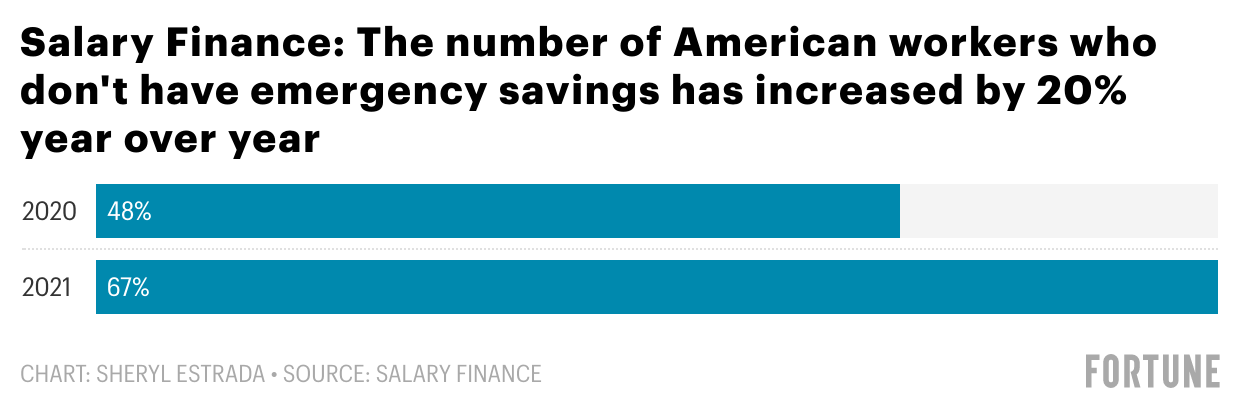

"Inside the Wallets of Working Americans," a new report by Salary Finance, a global provider of financial education and salary-linked benefits, found that financial stress continues to affect employee productivity. Workers increasingly lack emergency savings, and a disparity exists in financial well-being when factoring in gender, race, sexual orientation, and disability status, according to the report. The data is based on a survey of more than 3,000 American workers.

Going deeper

Here are a few good Fortune weekend reads:

There are two very real reasons Ethereum is taking off by Ben Carlson

'Pure panic': Lumber prices up a staggering 280% as builders scramble for supply by Lance Lambert

11 states have vaccinated at least 50% of their population by Erika Fry and Nicolas Rapp

Tesla stands to lose lucrative business selling CO2 credits to Fiat Chrysler successor Stellantis by Christiaan Hetzner

Leaderboard

Some notable moves from this past week:

Kristina Campbell was named CFO at Ripple, a provider of enterprise blockchain and cryptocurrency solutions for global payments. Previously, Campbell was CFO at PayNearMe.

Michael Dastugue was named CFO at HanesBrands, a global marketer of branded everyday apparel. Most recently, Dastugue was EVP and CFO at Walmart U.S.

Elena Gomez was named CFO at Toast, a cloud-based, end-to-end technology platform for the restaurant community. Since May 2016, Gomez served as CFO at Zendesk.

Sherry House was named CFO at Lucid Motors, a producer of electric vehicles. House joins Lucid from Waymo.

Bob Mack was named EVP and CFO at Polaris Inc. Mack has been serving as interim CFO since January 2021.

Overheard

"The era of the one-size-fits-all perks is gone. And it's gone for two reasons. One, people now want a good quality working life — which is critical. But employers also realize that these don't work."

— Cary Cooper, professor of organizational psychology at the Alliance Manchester Business School, University of Manchester, as told to the Financial Times.