This article is part of Fortune‘s quarterly investment guide for Q2 2021.

Call it “The Once and Future King.” Not T.H. White’s book about Arthur, but cash.

For some savvy investors, the phrase “cash is king” has made a comeback. They’re ramping up a bet on the staidest investment of all, getting ready to pounce on opportunities at a time when they see overheated markets, and uncertainty ahead. The move is bold and can offer strong advantages if done right.

How much cash should you carry?

Financial advisers traditionally have a rule of thumb: Keep three to six months of expenses in cash as an emergency fund as well as enough “near-term liquidity” to cover foreseeable expenses over the same period, says Brian Price, head of investment management at Commonwealth Financial Network.

“For me, basically cash in a normal market is transactions, emergency fund, and that’s about it,” says Tom Smythe, professor of finance at Florida Gulf Coast University. “Probably, 98% of your portfolio is in stocks and bonds,” leaving 2% in cash.

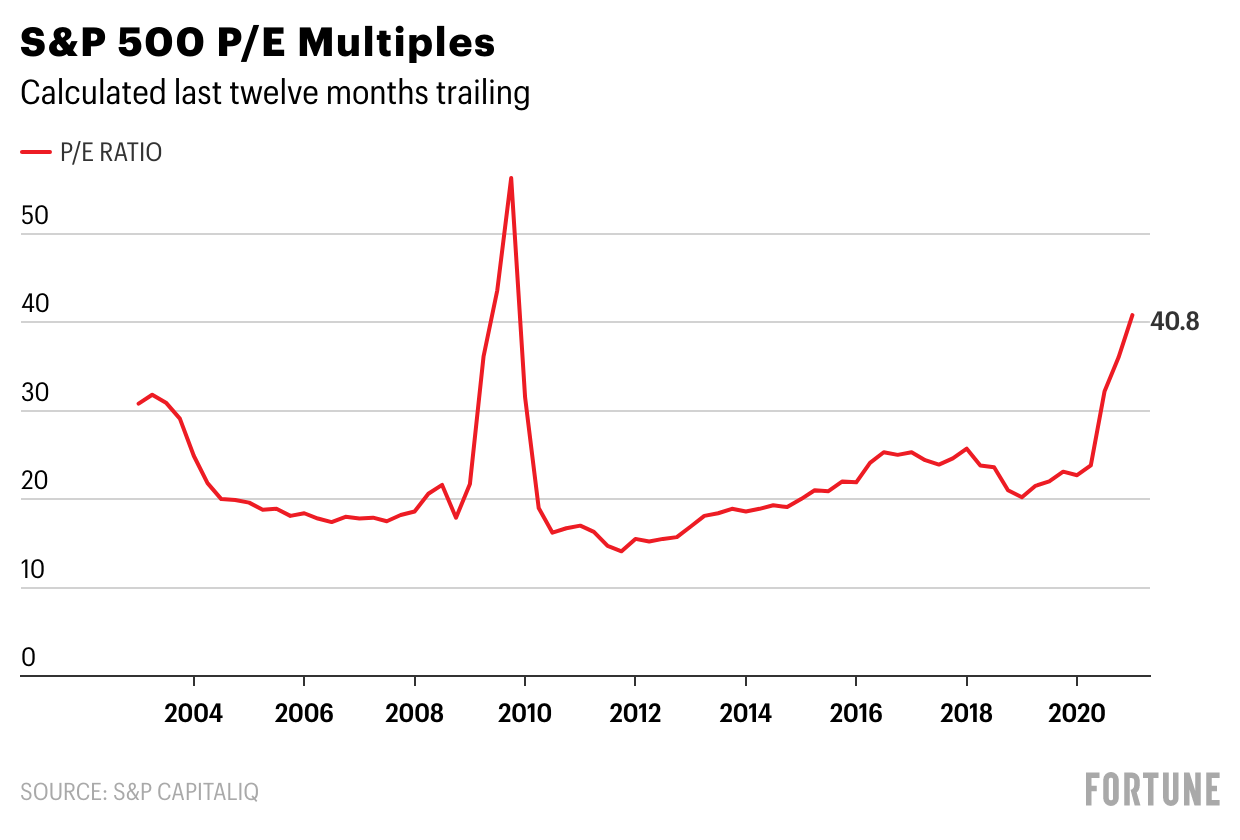

But current markets aren’t normal. The S&P 500’s P/E multiple is the second highest it has been in many years, according to data from S&P Capital IQ.

That’s leading some to alter their recommendations. “I would say you’d probably want 5% to 10% in cash now,” Smythe says. “Typically, investors want to build their cash positions in times of anticipated market drawdowns,” adds Lauren Goodwin, a multi-asset portfolio strategist at New York Life Investments. There’s also a lot of uncertainty, she notes.

“The potential range of outcomes today we believe is wider than usual,” echoes Karen Harding, a partner and private wealth team leader at NEPC. “I am afraid equities are expensive and going to sell off.” Cash offers the “dry powder” to bargain hunt, Harding says. If the S&P 500 dropped more than 30% as, for example, it did between Feb. 19 and March 23 in 2020, an investor could load up on stocks that will likely eventually head up again.

“We have incredible amounts of leverage in the markets right now,” said Robert S. Phipps III, director at wealth and portfolio management firm Per Stirling Capital Management. “I do think [bond] rates are headed higher. I do think inflation is headed higher. If the FAANG [major tech] stocks are hurt in higher rates, it will be harder for index investors to get a good return.”

Phipps upped his firm’s portfolio cash allotment to an unusual 30% for quick allocation in turbulent conditions. “I want to have a lot of risk exposure when there is a strong availability of high risk-adjusted returns.” He’s eyeing cyclicals as well as value stocks, which “look better now for comparative growth than any time in my investing history.”

Avoid getting nicked

For most investors, selling off existing equities to take a profit and put the money into cash is probably unwise. Not only is there tax on capital gains, but for long-term investors even if there is a selloff shares are likely to eventually return to current levels. Meanwhile even if you foresee a selloff, timing the market perfectly is nearly impossible. “It could be like catching a falling knife,” said Aviva Pinto, managing director of Wealthspire Advisors. “You may be buying in while the market is falling” or selling shares while there’s still an upside.

Under a cash-is-king strategy, however, new money like dividends, distributions, and additional savings could go into your brokerage settlement account for the times you rebalance your portfolio—selling losers, buying assets with more potential—to ensure optimum performance.

Plus, having new money stay in cash “allows us to rebalance without having to sell positions in taxable accounts, thus avoiding unfavorable tax liabilities,” said Sam Brownell of Stratus Wealth Advisors.

There is a downside of cash: inflation. As prices generally go up, the value of money falls. Unless cash is parked in an account that offered an interest rate higher than inflation—high savings interest rates are well below 1%—inflation will eat away at your asset.

In more normal times, much of the cash would go into fixed-income assets to balance equities holdings. But yields on what is supposed to be the “safe” part of a portfolio, generating income no matter what the current value might be, are hardly impressive. The difference in performance between fixed income and cash is so low that “it’s basically a wash,” Harding said.

But with prices at or near historic highs, and many predicting they’ll come back to earth, cash does offer the ultimate contrarian bet: If stocks swoon, you’ll be poised to buy when everyone else is panic selling.

Explore Fortune’s Q2 investment guide:

- 10 stocks fund manager Cathie Wood is buying—and 3 she’s avoiding

- Bitcoin investors: Learn about the Hunt brothers and the silver market

- Why some investors are betting on cash

- How to invest for the 22nd century

- Everything you need to know about buying NFTs

- What the savviest short-seller has in his sights next

- The investment billionaires like Bill Gates are doubling down on

- Coinbase? Bitcoin? The case for making a few wild bets