This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

Coinbase, the IPO of the year (that wasn’t a traditional IPO, of course), was as volatile as you’d expect from a direct-listing. It soared above a $110 billion valuation in early trading, only to bomb below the 12-figure club at the close.

I mostly followed the action on Twitter, where COIN investor after COIN investor revealed they came away with burned fingers. As far as fundamentals go, COIN is producing some excellent memes. (I suspect there are some 💎-hand Bull Sheeters who got in early on $COIN. If that’s you, please drop me a line.)

As I type, U.S. futures contracts are gaining, following Europe higher. We have another busy day of earnings, plus some retail and jobs data.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are mostly lower in afternoon trading with the Hang Seng down 0.4%.

- India is seeing a brutal second wave of COVID cases, with a record 200,000 new infections reported today. But help is on the way—or is it? The country just signed a big vaccine deal to distribute the Sputnik V vaccine—and, still, doubts swirl around whether Russia’s COVID-killer can effectively do the job.

Europe

- The European bourses were higher out of the gates this morning with the Stoxx Europe 600 up a quarter of a percent at the open.

- Deliveroo is down 2% in early trading after it gave investors a conservative outlook about the months ahead.

- The Russian ruble tanked overnight on news the Biden Administration is preparing a fresh wave of sanctions to punish Russia for its suspected role in various hack attacks and election meddling. Russian stocks were down 1% as well.

- Heathrow Airport, Europe’s largest (and one of the most confusingly laid-out airports on the planet—still, nothing is worse than JFK in New York) is still losing 5 million quid ($7 million) per day. Airport management is banking on vaccine passports this summer to revive its business, and lift the sector.

U.S.

- U.S. futures point to a positive open, with a bit of a bounce-back from tech stocks. More big earnings are on tap from Bank of America, PepsiCo, BlackRock and Citigroup.

- Also on deck: U.S. retail sales and the latest jobless claims figures.

- Coinbase is up more than 10% in pre-market trading after a topsy-turvy trading debut yesterday. My nephew tells me he has a limit-order in to buy one share (at the right price). Über bull Cathie Wood is all-in too, snatching up $246 million worth.

- You know who else had a decent day yesterday? Goldman Sachs. The Wall Street giant raked in trading fees at a near-record clip last quarter, pushing shares up more than 2%.

Elsewhere

- Gold is up, trading above $1,740/ounce.

- The dollar pushes lower as equity futures tick upwards.

- Crude is down with Brent trading above $66/barrel.

- Bitcoin is down, but still trading above $63,000.

***

Buzzworthy

Making $COIN

Losing $COIN

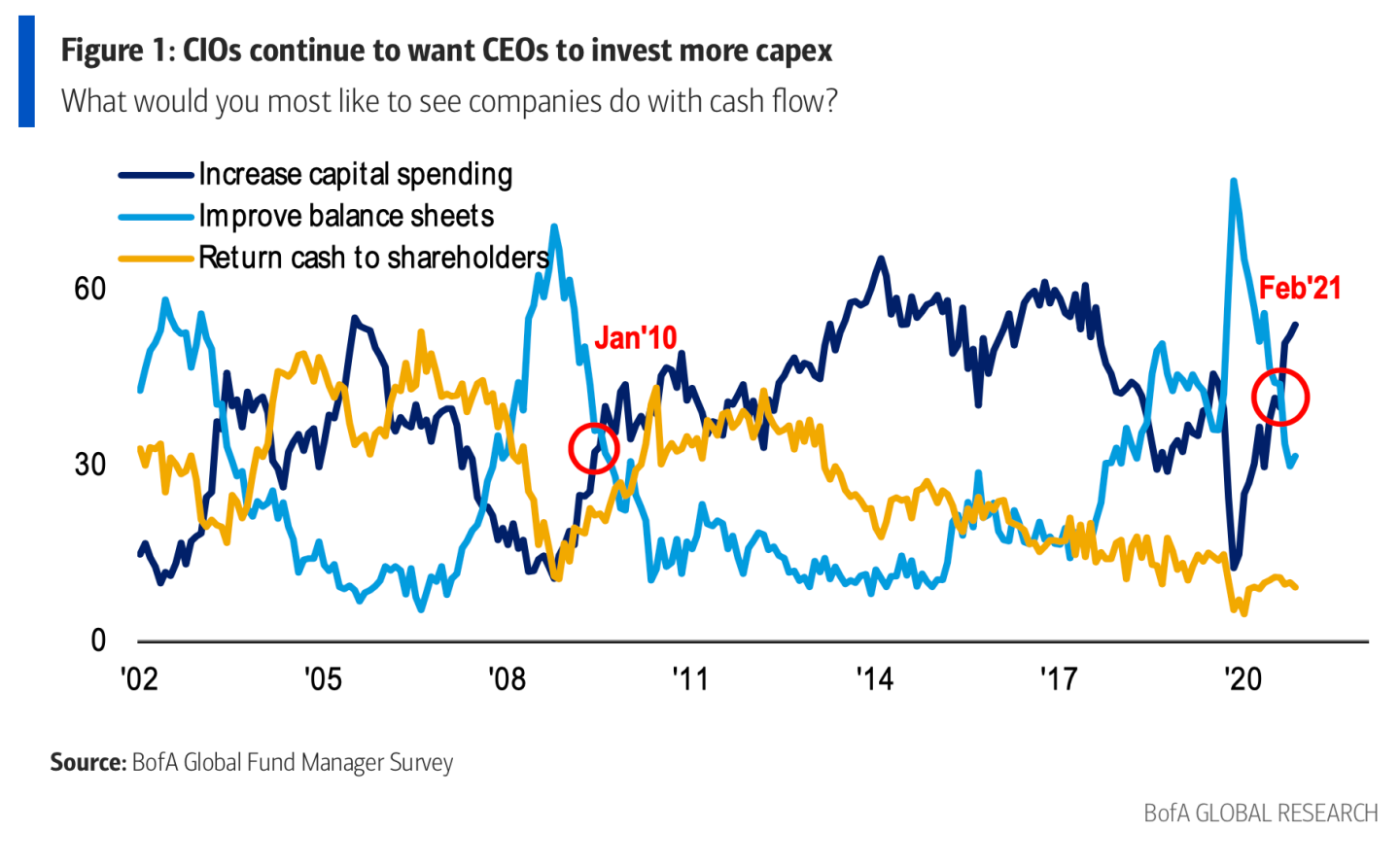

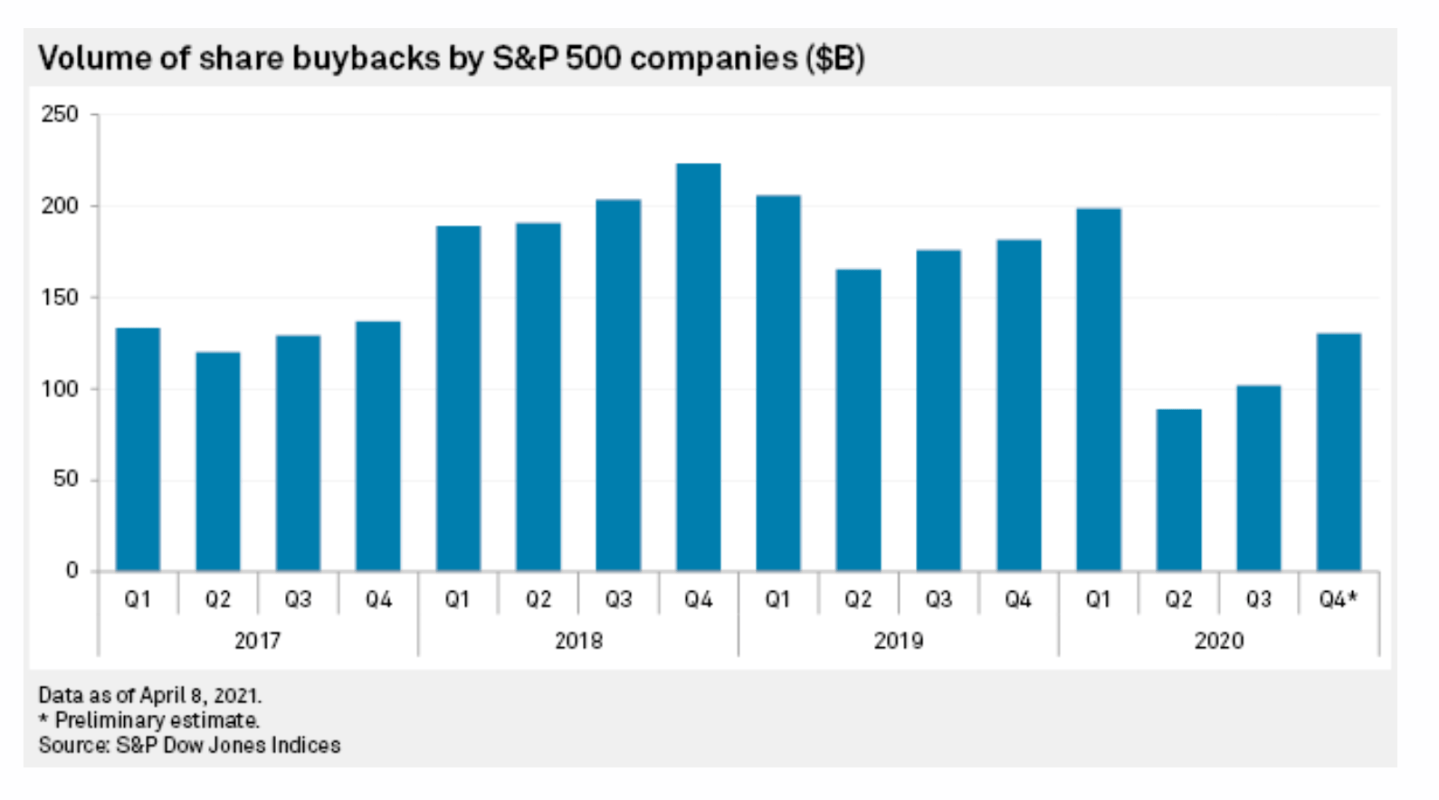

Investors to CEOs: More CapEx. Ditch buy-backs

CEOs to investors: buy-backs are back!

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

London blitz. London's stock exchange is weighed down with old economy stocks, and that meant U.K. shares, as a whole, underperformed its global peers in a big way last year. 2021 looks to be a very different story, Adrian Croft reports in Fortune. A bundle of new tech shares have listed so far this year in London, and there are a bunch more in the pipeline. As is the case with tech, a disruption is afoot, and again investors are looking to cash in.

A Wall Street villain. The news broke right around the start of the trading day yesterday: Wall Street fraudster Bernie Madoff had died in prison at age 82. There's so much to the Madoff story, and Fortune's Geoff Colvin breaks down his complicated relationship with clients, and his ultimate downfall.

More on Bernie... Here's one from our archive—"How Bernie did it," a brilliant 2009 profile by James Bandler and Nicholas Varchaver.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Thinking of buying COIN?

The first time I checked in on the Coinbase share price yesterday it had just crested $420. Way too pricy for this hack, I figured. Sure enough, had I pulled the trigger at that moment I'd be waaaay underwater right now. But the bulls are still convinced this stock is a 🚀. Fortune's Anne Sraders talked to the trading pros, and breaks down the pros and cons of getting in on COIN at these prices.