Where do future growth opportunities lie in business? That’s one of the core questions behind the Future 50, a forward-looking index created by BCG and Fortune to identify the companies with the best long-term growth prospects. Our most recent ranking shows a clear tilt toward technology: 29 of the top 50 companies are found in the information technology, communications, or e-commerce industries.

This is not altogether surprising, given recent market developments that have seen the tech sector gain an even larger share of the overall economy in the wake of COVID-19. Consider that just four companies—Apple, Microsoft, Amazon, and Alphabet—now have a combined market cap equal to one-fifth of the S&P 500 overall.

On the surface, this might seem to point toward a future in which opportunity is mainly determined by industry, with only tech or tech-adjacent companies disproportionately succeeding in the long run.

A deeper look, however, reveals that industry is not destiny. Our analysis reveals a wide range in corporate vitality (our term for a company’s capacity to innovate, reinvent, and sustain long-run growth) within all sectors—and therefore opportunity to gain future advantage everywhere. Many of our winners were non-tech-sector companies deploying new business models, often employing technology to enable those changes.

“How to play” matters more than “where to play”

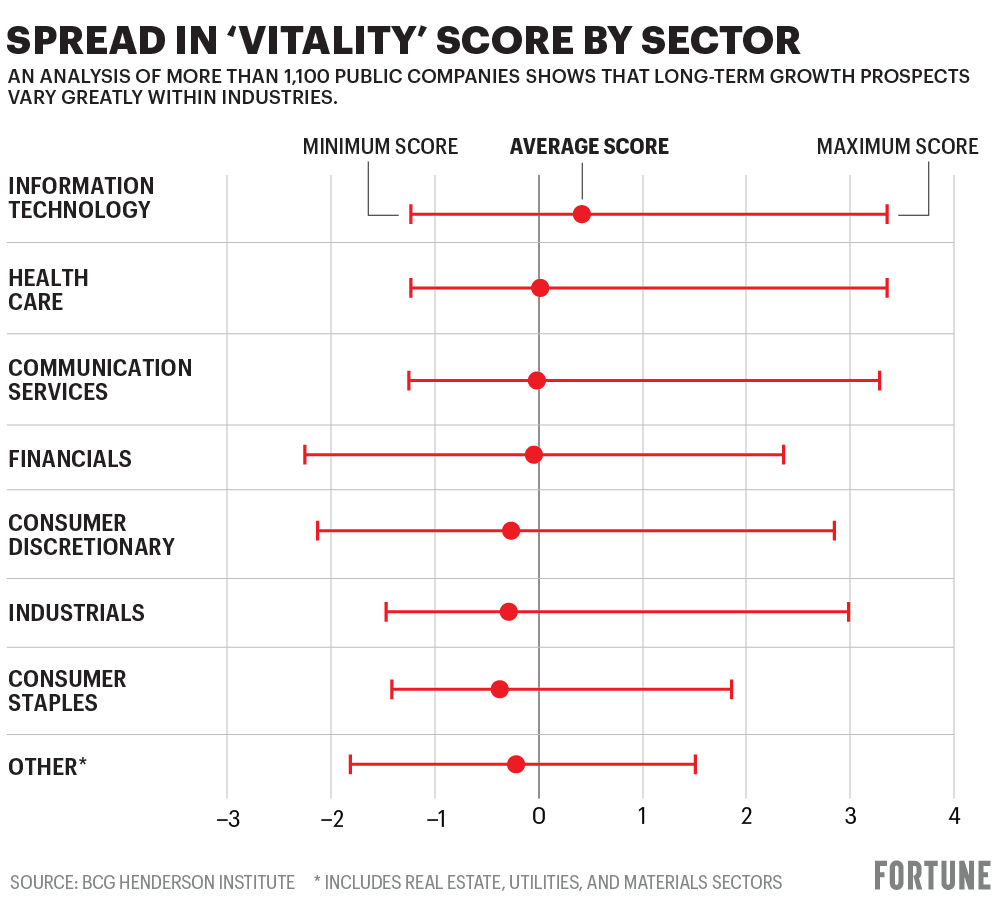

While it’s true that some industries stand out at the very top of the Future 50 index—for example, the top six companies in our 2020 ranking all provide enterprise technology—zooming out to the larger landscape of companies reveals a much wider distribution in vitality. Across more than 1,100 large global public companies (those with at least $10 billion in sales or $20 billion in market capitalization), we find that there is a gap between the most vital sector (information technology) and the least (consumer staples) on average. But the gap between the top and bottom performers within each industry is much greater. Only 10% of the variance in corporate vitality is driven by differences between sectors; the remaining 90% is explained by a company’s outperformance within its sector.

Our analysis shows that it is possible to be highly vital no matter what aspect of business you’re in. Every major sector (by S&P classifications) has at least one company in the top 10%, and the Future 50 includes companies in industries as diverse as restaurants, building materials, and education.

A look back at past performance similarly supports the idea that industry is not destiny. For instance, it is commonly believed that a company’s sector is the main driver of how badly it will be hurt by an economic downturn—countercyclical industries will still have opportunities, while cyclical ones will be in for uniform pain. However, that could not be further from the truth. When analyzing companies across the last four U.S. economic downturns, we found that at least 10% of companies increased revenue growth and profit margins in every sector. Even amid the massive market shock of COVID-19, the spread of performance within sectors was much greater than the differences among them.

It’s true that some industries are more attractive than others on average, but business strategy has always been about exceeding the average by being exceptional on some dimensions. For businesses that can do so, there is no such thing as a bad industry.

The art of defying the average

Companies that thrive sustainably don’t allow the industry in which they operate to constrain their capacity for innovation and reinvention. What can we learn from some Future 50 companies about what it takes to build a business that can defy the average?

Lesson No. 1: Adopt a uniqueness mindset. To rise above the pack, forward-looking leaders must articulate a perspective on what makes their business unique and different from competitors. A sharp articulation of corporate purpose and unique strategic imperatives signal to investors a path toward standing apart from peers and being exceptional.

For example, Lululemon Athletica (No. 20 on the Future 50) has excelled at communicating the uniqueness of its products in filling a gap in the retail apparel market. By combining performance and style in its athletic apparel, Lululemon has defined and shaped a new market for athleisure wear that now exceeds $100 billion in annual sales.

Lesson No. 2: Set extraordinary ambitions. A strategic focus on incremental goal setting will likely yield the same steady improvements attained by competitors—hardly a formula for defying the average. By setting extraordinarily ambitious goals, leaders encourage their teams to break existing mental models and reimagine their business—thereby increasing the odds of identifying the growth opportunities required to outperform in the future.

Few leaders exemplify this notion as much as Elon Musk of Tesla (No. 18 on the Future 50). The extraordinary nature of Musk’s ambitions have stretched existing mental models for automakers past the breaking point and forced employees, suppliers, investors, and customers to reimagine the future of the auto industry.

Lesson No. 3: Compete on the rate of learning. An acceleration in the use of big data, machine learning, and automated decision making has dramatically steepened the learning curve for corporations. Those best-positioned to outperform in the long run will have the capacity to innovate and reinvent around new business models that combine both human and technological capabilities.

Alibaba (No. 40 on the Future 50) is one such example. The company’s flexible, decentralized organizational structure grants smaller units the autonomy to act, experiment, and learn independently. The resulting “self-tuning enterprise” continues to be well-positioned to learn faster than competitors and shape new growth opportunities in a dynamic market.

The fate of an organization is not predetermined by the industry in which it operates. By fostering the organizational capacity for innovation and reinvention, companies in all sectors can achieve vitality and thrive sustainably.

Martin Reeves is the chairman of the BCG Henderson Institute. Tom Deegan is a data scientist at the BCG Henderson Institute.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.