This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, Bull Sheeters. Global stocks and U.S. futures look weak this morning, but there’s no sign of a slowdown in the crypto corner. Bitcoin hit another all-time high yesterday after Mastercard and Bank of New York Mellon announced plans to allow customers to use cryptocurrencies.

Meanwhile, Walt Disney is popping in pre-market after impressive results yesterday. And, the markets have minted a new billionaire. Congrats to Bumble founder, Whitney Wolfe Herd, on a smashing stock market debut yesterday.

Let’s see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are mostly lower, with Japan’s Nikkei off 0.1%.

- Today marks the beginning of the Chinese lunar new year holiday—it’s the year of the ox. The markets in Shanghai and Hong Kong are closed today… To all our friends who are celebrating, I want to wish you a warm happy new year!

Europe

- The European bourses were down out of the gates. The Stoxx Europe 600 was 0.3% lower at the open, before sinking lower.

- You’d have to travel back to 1709, to the reign of Queen Anne (I had to look that up), to find such economic weakness out of the British Isles. The U.K. economy shrank by 9.9% last year, but it avoided a double-dip recession thanks to Q4 gains.

- It’s only February, but the European Commission sees storm clouds ahead for 2021. The official eurozone GDP forecast was slashed yesterday as vaccine rollout hiccups stymie growth.

U.S.

- The U.S. futures point to a weak open. But all three major exchanges are on pace to finish the week in the green after the Nasdaq and S&P 500 eked out record closings on Thursday.

- A stock to watch today is Disney. Shares in the entertainment giant are up 1.6% in pre-market trading after the company posted surprisingly strong subscriber gains at its Disney+ streaming service.

- Trading volumes are sky-high, meanwhile, and that’s making hearts race on Wall Street. We saw something like this last March just before the markets crash, but this time it appears investor exuberance rules the day.

Elsewhere

- Gold has had another volatile week. It’s trading down, around $1,820.

- The dollar is up as equities wobble.

- Crude is lower, with Brent trading just above $60/barrel.

- At 10 a.m. Rome time, Bitcoin was trading above $47,000, capping a stunning week of gains.

***

By the numbers

15.8 billion

Over the past three weeks, the average daily trading volume has topped 15.8 billion shares across the U.S. exchanges. Why is that a big deal? Such a trading frenzy hasn’t been seen since last March, just as equities crashed in historic fashion. Typically, surging volumes and surging volatility go hand in hand. “This time, volatility is much more subdued suggesting the jump in trading activity is one more sign of exuberance in the stock market,” notes Bloomberg’s Cormac Mullen. One thing that’s different this time around is the surge in retail trading. And that cohort is to-the-moon bullish. Their trade of choice is call options, a bullish bet that stocks only go in one direction: up. As Chris Weston of Pepperstone Group tells Bloomberg, “We’re seeing so many signs of frenzied speculation… This is part of the retail trader explosion.”

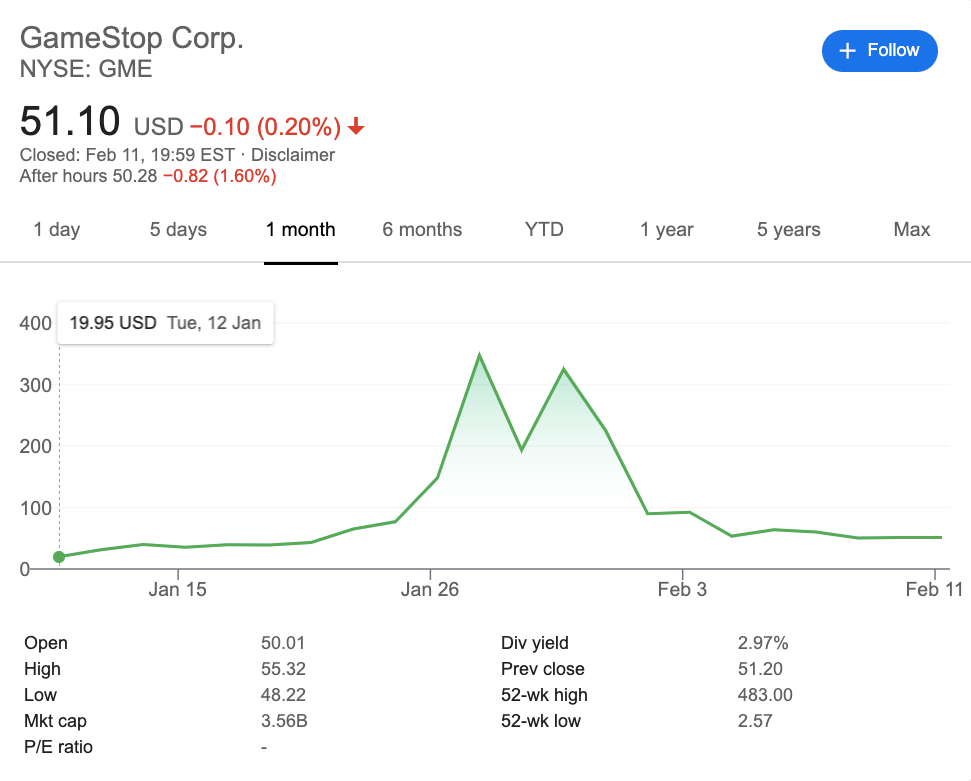

-85.3%

I continue to marvel at the GameStop YTD share price, now down 85.3% from its Jan. 27 closing high.

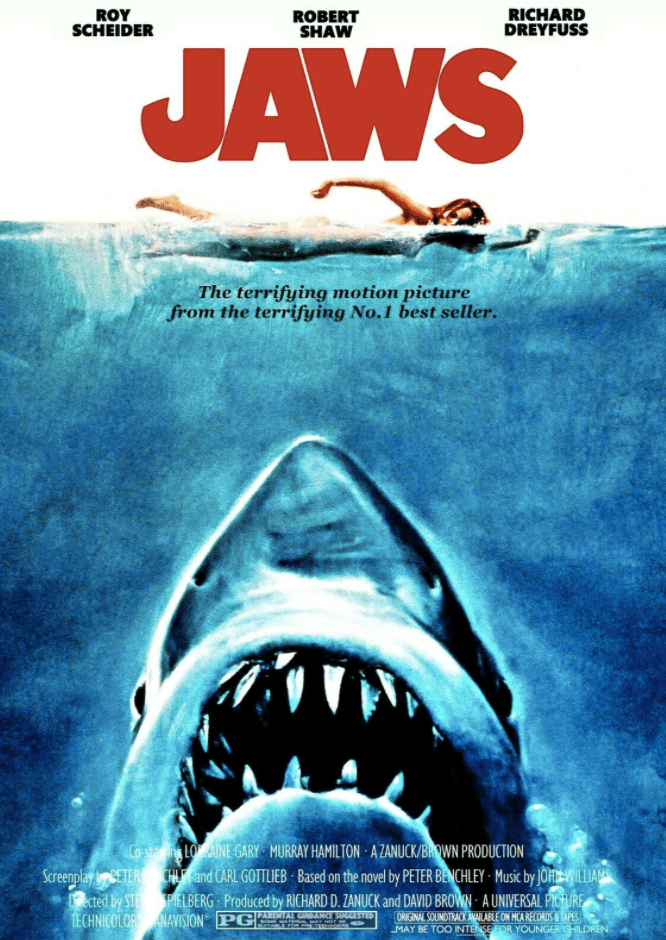

Where have I seen that image before? Oh, yeah…

27%

The hands-down best-performing asset of the week is Bitcoin, up 27% since this time last week. We’re seeing one of the great bull rallies for crypto, and this time it’s built on, dare I say it, fundamentals. Tesla’s $1.5 billion bet on Bitcoin shows, if nothing else, that demand is as strong as ever. Then we had yesterday’s news that Mastercard and BNY Mellon want to facilitate cryptocurrency use among customers, the latest pronouncement among Big Finance and the fintechs that they’re all-in on crypto. Such acceptance by corporate giants make these Bitcoin 50K forecasts look more inevitable by the day. There, I said it… The Dogecoin rally to $9 billion, however, still baffles me. Its creator thinks it’s nuts, too.

***

Have a nice weekend, everyone. And, it will be a long one. Bull Sheet will be back on Tuesday, Feb. 16, on the other side of the Presidents’ Day holiday… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Billionaire at 31. Bumble CEO Whitney Wolfe Herd made history yesterday with the smashing IPO success of her women-first dating app. The stock finished the day up 63% in its Nasdaq trading debut, making Wolfe Herd a rare self-made female billionaire, writes Fortune's Emma Hinchcliffe.

Up in smoke. Bored with the likes of Tootsie Roll and GameStop, the Reddit brigade had been pushing up cannabis stocks in recent days. That trade unraveled in a big way on Thursday, however, with huge drops in stocks like Tilray, Aurora Cannabis and Canopy Growth. A total buzz kill, dude.

Calling all finance whizzes. Fortune is seeking a writer to grow a brand-new newsletter and community for us—one for CFOs and other financial leaders. If this applies to you (or to someone you know), please check out the job description here.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

-3.38%

The machines can't save us either, apparently. We all know the Reddit-fueled rally in GameStop and other stonks led to brutal losses for all manner of traditional hedge funds last month. Turns out the Reddit brigade also bested the quants. "Hedge funds that depend on artificial intelligence to make their trading decisions were also seemingly unable to figure out how to play the stonk market, contributing to a dismal start of the year for these investors," Fortune's Jeremy Kahn writes. To wit, the Eurekahedge AI Hedge Fund Index in January had its worst one-month performance in over a decade, falling 3.38%.