This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, Bull Sheeters. It’s a risk-on day as investors seek to extend the weeklong rally. Broad-based gains in tech, autos and pharma are pushing global equities ever closer to an all-time high. U.S. stocks hit that milestone yesterday.

On the calendar today is a big payrolls report. Elsewhere, investors are paying close attention to the pace of vaccinations, rewarding those countries that emerge as the early leaders.

Let’s see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are mostly higher, with Japan’s Nikkei up 1.5%.

- It’s IPO day for TikTok rival Kuaishou, and investors have plenty of reason to post to the platform celebratory video snippets. The stock surged 200% at the open in Hong Kong.

- Nickel-rich Indonesia has been courting Tesla for some time to invest in the country. According to CNBC, the EV maker is finally listening, a development of particular interest to those following the race to find a cheaper, more plentiful raw material to go into electric batteries.

Europe

- The European bourses were up modestly out of the gates. The Stoxx Europe 600 was 0.3% higher at the open.

- Daimler shares closed up 2% on Thursday after the German automaker said it will split the company into two parts: the flagship Mercedes-Benz car division and Freightliner, the maker of big rigs.

- Regulators from Brussels to Beijing still need to sign off on Nvidia’s $40 billion takeover of chip giant Arm. It all adds up to one of the most scrutinized deals in recent memory.

U.S.

- The U.S. futures point to another strong open. Yesterday, the S&P 500 closed at an all-time high as stimulus talks and slightly improved jobless claims data lifted investors’ spirits.

- Shares in Ford are up 1% in pre-market trading after the carmaker said it will invest a combined $29 billion on EV and autonomous vehicles through 2025. Alas, a chips shortage is denting its 2021 outlook.

- In “closing the barn door” news: Now that GameStop has bombed more than 80% this week, and AMC Entertainment is off more than 50%, Robinhood has lifted all restrictions and limitations on trading in the stocks. Go get ’em, day traders!

Elsewhere

- Gold has had an awful week. It’s trading below $1,800, down 2.7% in the past seven days.

- The dollar is flat, but it’s had a heckuva week.

- Crude is higher, with Brent trading just below $60/barrel.

- Bitcoin is down 1.2% at 10 a.m. Rome time, trading around $37,750.

***

By the numbers

100,000

All eyes will be on today’s jobs report before the bell. Economists estimate the U.S. economy added 100,000 jobs in January. A reminder: December’s report was brutal with 140,000 jobs lost in the month. Why is this report such an important bellwether? Because, as USB chief economist Paul Donovan points out, the U.S. labor market appears to be stalling out. That’s puzzling and frustrating considering the amount of helicopter money Washington has dumped on the economy in recent quarters. So here’s what to look for in today’s report: “Structural issues will affect unemployment,” Donovan begins. “The negative is long-term unemployment is increasing in dying industries. The positive is employment data may underestimate the boom in business start-ups… Quarantining may be preventing workers from working. Some sectors have reported labor shortages. This is likely to show up in overtime and earnings data.” In other words, don’t get distracted by the headline unemployment rate. The bigger story can be found in poring over the data to see which industries are growing, and which aren’t.

$24 billion

Is the GameStop rally well and truly over? The diehards on WallStreetBets would tell you, No way! They continue to counsel their peers to hold the line. But enthusiasm is fading. The stock crashed by 42% yesterday, bringing its market cap to below $4 billion. A week ago, when the stock was trading above 400 bucks, it was the most valuable stock on the Russell 3000. That trade unwinded fast, and in spectacularly damaging fashion. Investors have wiped $24 billion from its market cap in just five trading sessions. I dearly hope the YOLO traders will have learned a lesson from this adventure in day trading.

10 million+

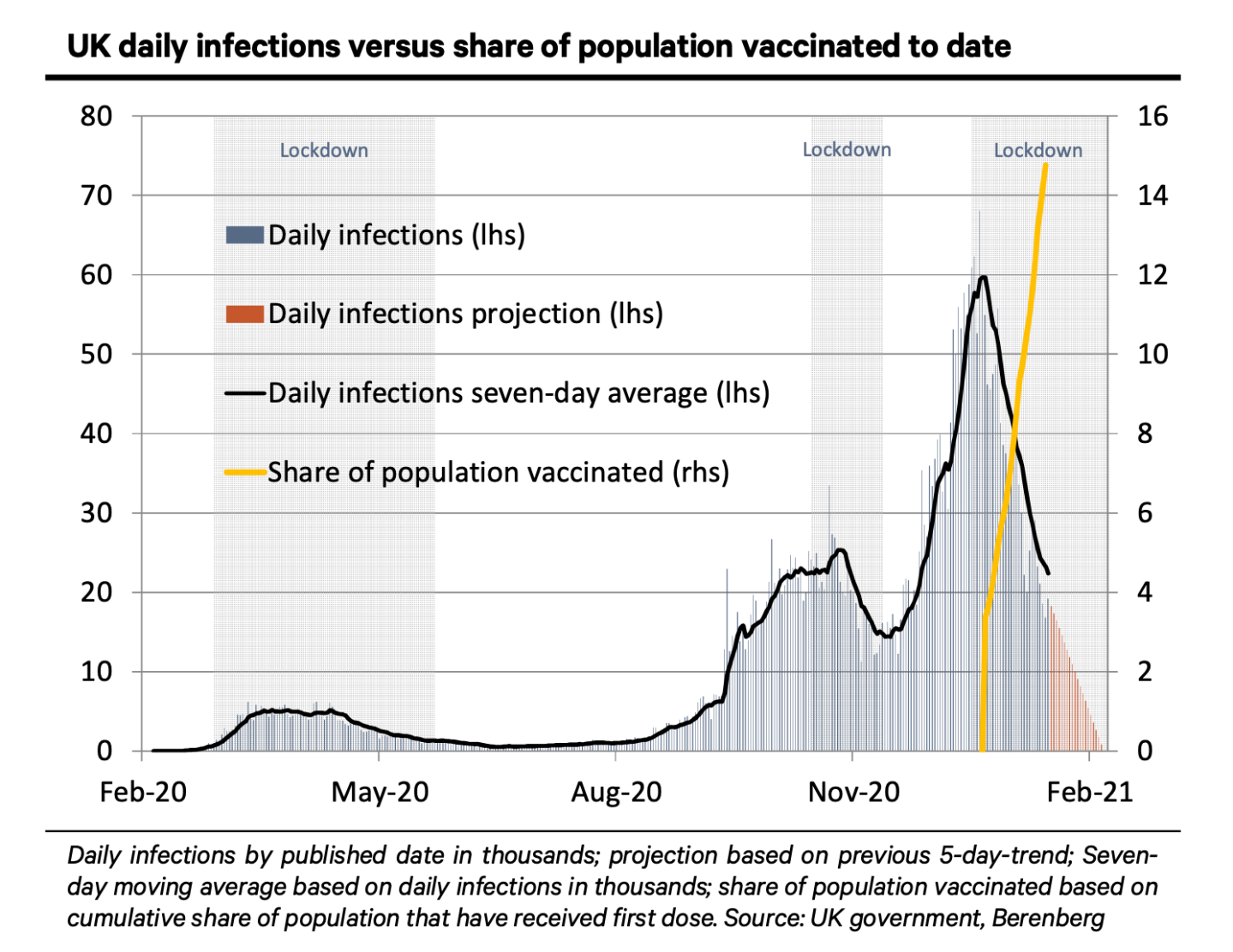

Let’s give credit to our friends in the United Kingdom. Britain has delivered at least one dose of the COVID-19 vaccine to 10 million residents, and that’s exciting investors. The pound sterling has soared and investors have poured into U.K. bonds as the country leads the way in the all-important vaccination leader board. The success gives rise to the question: should you be investing in countries that are doing a good job vaccinating the population, the ultimate recovery play? Here’s what a successful vaccination campaign looks like: infections go down as vaccinations go up. This chart is courtesy of Berenberg Bank:

***

Have a nice weekend, everyone… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Robinh-oops. It's been a rough week for the Silicon Valley darling. Following a customer revolt over trading bans, news now emerges that the popular investing app's CEO isn't licensed by Wall Street regulator FINRA.

J&J, on the way? Johnson & Johnson's single-dose COVID vaccine could get emergency approval as soon as this month, giving the U.S. a third vaccine to distribute to Americans. As you're aware, the supply crunch has been really frustrating. I don't know how many hours I've lost trying to book an appointment for my mother. (She got her first jab yesterday, I can happily report.)

23andMe, and Richard Branson, too. The consumer DNA-testing company will merge with VG Acquisition Corp., a SPAC founded by the billionaire. Such a move allows 23andMe to quickly go public without the kind of oversight that comes with a traditional IPO.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

-23%

2020 went down as the year of the SPAC attack. Lesser-scrutinized SPACs have become the favored vehicle to raise big money on the quick in a bull market, and that's unnerving a lot of Wall Street watchers. One such SPAC is the celebrity-backed Clover Health, which got hit by a blistering report yesterday outlining a list of alleged corporate misdeeds that they failed to disclose to investors. Its shares promptly bomb lower on the revelation. CLOV is now off 23% since the Jan. 8 close, the day it went public.