This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, and welcome back!

After a weak showing last week, U.S. futures and global stocks are moving higher this morning as we head into a busy stretch for corporate earnings. Below, I offer a primer on what to look for. Oh, and Postscript is back. Reader warning: it involves food.

But first, let’s see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading with Hong Kong’s Hang Seng up 2.7%.

- China’s economy grew 2.3% last year, helped by a strong Q4 surge. China is now on pace to overtake the United States as the world’s biggest economy by 2026, Fortune‘s Naomi Xu Elegant reports.

- The World Economic Forum is out with its annual risks report, and the 2021 version makes for tough reading. What could be on tap in the years to come? A bleak youth precariat and state collapse (along with the usual doom-and-gloom about the climate crisis).

Europe

- The European bourses were broadly higher in early trading with the Stoxx Europe 600 up 0.5% at the open.

- COVID-19 has left a €600 billion hole in the balance sheet of European companies, a prominent trade associate warns, an argument for Brussels to prepare yet another stimulus package.

- Shares in Stellantis, the newly merged Fiat-Peugeot alliance, officially started trading yesterday in Paris and Milan under the ticker, STLA. It closed nearly 8% higher on Monday. Auto stocks, meanwhile, were flat on Tuesday after data showed car sales fell last year by a record-breaking 24%.

U.S.

- U.S. futures have been edging up all morning, with all three exchanges poised to start the week in the green.

- A recap: The Dow, S&P and Nasdaq all finished lower last week, the worst showing since October.

- Janet Yellen will testify today before the Senate Finance Committee (the same group that will cast a decisive vote on her Treasury Secretary candidacy), and the big question will be: just how much debt can the U.S. afford to rack up to get out of this economic crisis?

- On the earnings calendar today we have: Bank of America, Halliburton and Netflix, to name a few.

Elsewhere

- Gold is up, trading around $1,840/ounce.

- The dollar is slightly lower.

- Crude is up a touch, with Brent trading around $55/barrel.

- Bitcoin is up 3.2% in the past 24 hours to $37,100, but trade has been choppy for the past 10 days.

***

Earnings season

This week and next make up the busiest stretch of earnings season. The last of the big banks report this week, and next week we get a wave of Big Tech results. In fact, firms representing more than half of the S&P 500 market cap will report between January 25 and February 5, Goldman Sachs calculates.

Throughout much of 2020, COVID-ravaged companies repeatedly threw in the towel and declined to give investors a full outlook. That won’t be tolerated this year.

Here’s what else you should be looking for.

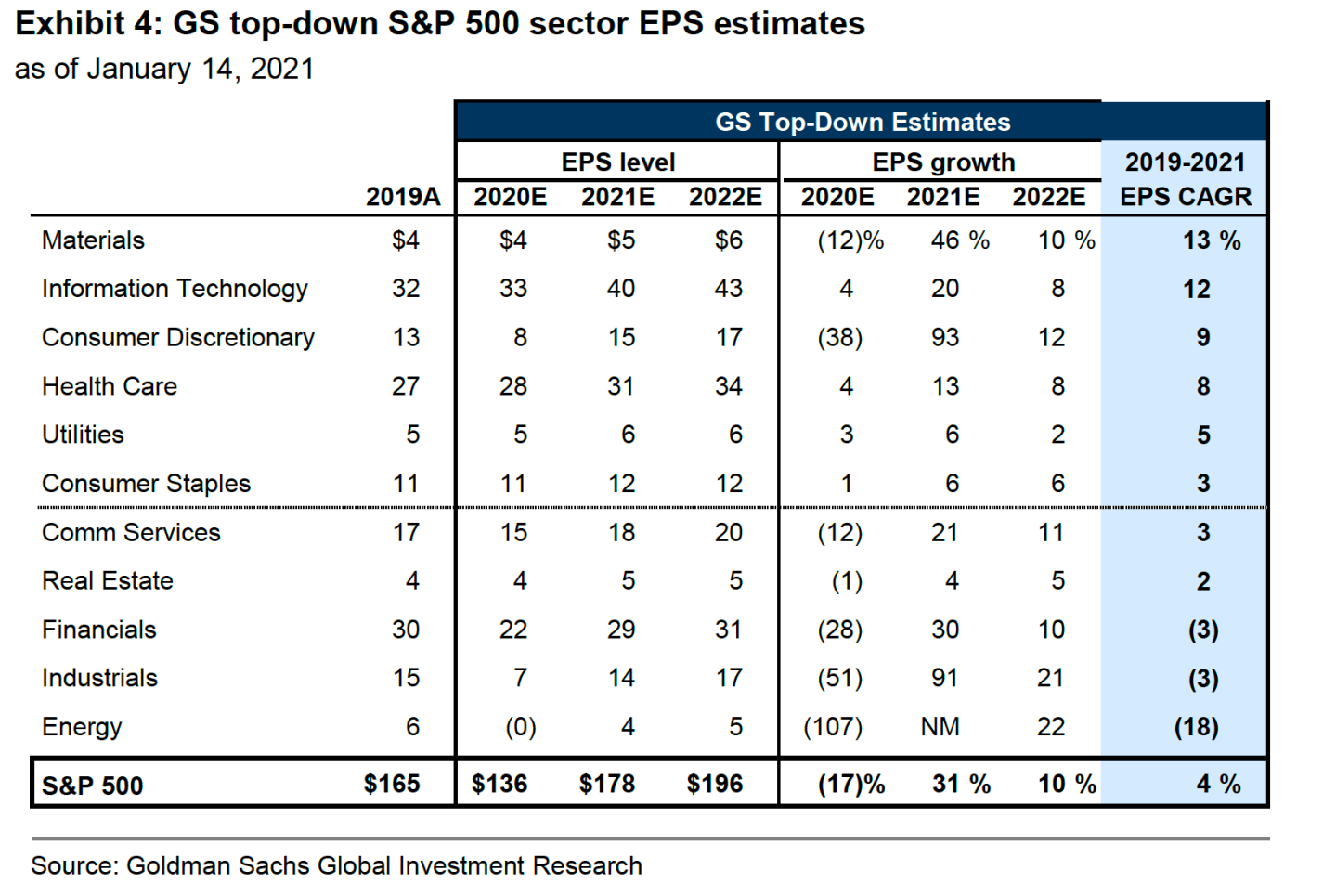

The Q4 2020-to-Q4-2019 comparison will be brutal. Across the S&P 500, Goldman predicts, EPS is expected to have fallen by 11% (take energy out of the equation, and it’s merely bad—an EPS decline of 8% year-on-year.) But there will be some bottom-line winners from the likes of health care, IT and materials.

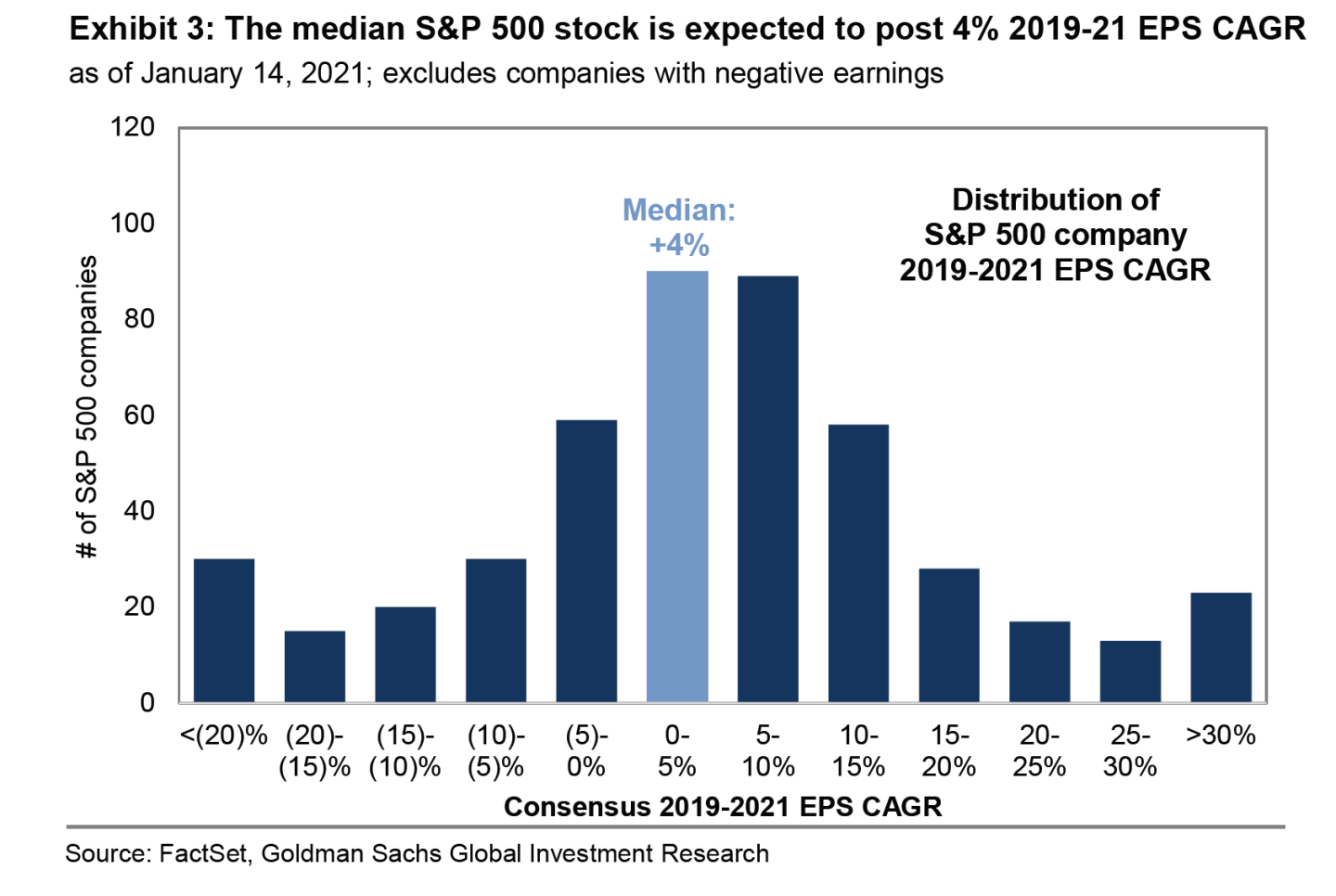

Looking forward, investors should focus on the full-year 2021 estimate, and compare that with the pre-pandemic full-year 2019 performance, Goldman advises. By that measure, the S&P looks a bit better going forward. The median company in the S&P is expected to post a 2019-21 EPS growth rate of +4%.

So, a return to growth is in the offing, which supports Goldman’s view that the benchmark S&P will climb to 4300 by year-end.

We’ll know soon enough if that’s plausible.

***

Postscript

A longtime Bull Sheet reader sent me a note over the weekend with a simple request. The email subject line read, “Minestrone Soup.”

One of the most memorable “authentic” minestrone soup meals he’d ever had, he explained, was at a Roman pensione years ago. “Any chance,” he asked, “you could publicise a good recipe for same in your column?”

Soup S.O.S.

This, I knew, would be a job for Postscript. “Certainly,” I responded.

I have to admit, I thought this would be a simple task. That was before I fell down a rabbit hole of minestrone recipes. You see, Italian families live off minestrone soup from September to May. Come meal time, it’s a go-to primo. (A reminder: no Italian meal is complete without the trinity: primo-secondo-vino.)

Sitting in the kitchen on Sunday afternoon, I consulted two experts sources on the matter: the Cucina Italiana cookbook and Xtina, my wife. The Italians have countless recipes for minestrone; there are more than two dozen in the very first cookbook I picked up. The ingredients depend on the time of year, what’s in the garden/at the local farmer’s market, and what goes best with the pasta of choice for the soup, the minestra.

As my wife explained, Italians have real reverence for the minestrone as a primo. Just as your financial manager would never advise you load up your portfolio with nothing but growth stocks, Italians would never think of serving pastasciutta (or, dry pasta) at every meal. Besides, you can find a decent dish of pastasciutta anywhere in Italy. A good minestrone is harder to come by.

Here’s how we do the minestrone at Casa Warner:

We start with three humble vegetables: the potato, zucchine and carrot. In the autumn, we might substitute in zucca, or sweet pumpkin. In the autumn, it could be bieta, or chard.

The key, my wife stresses, is to start with a nice, simple sofrito. Pour in a bit of olive oil and diced onions (some suggest a laurel leaf; we don’t), and let them cook into a nice sweet, aromatic base. Then drop your cubed veg into the pot, adding a bit of water or broth as you go. (We stick with good old Roman tap water.) Oh, and don’t forget the salt. When the vegetables have cooked for a good hour, take a little hand blender and, zap, transform your floating, boiling veg into a thick broth. To give it more heft, go with more potatoes at the start. (White beans work great too, but that requires a bit more preparation.)

The next step: chuck in your minestra pasta, and serve with a dollop of olive oil and a coating of Parmigiano Reggiano.

Years ago, on a trip to Tuscany one frigid February weekend, I discovered the local dish, the ribollita. We make it a couple times each winter. It’s one of my favorites. As the name suggests, it gets better every time you re-heat it and ladle it into your bowl.

The ribollita calls for a much more involved recipe as you have to source pig bones to make the broth, plus a couple different types of cabbage. If you’re interested in that recipe, let me know.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

At the corner of Main Street and Wall Street. On JPMorgan Chase's analyst call last Friday, a number of revealing details about the health of America's biggest bank and the wider U.S. economy came clear. For starters, there's a widening gulf between the consumer and corporate bosses. “Consumer confidence is still low, and CEO confidence is high,” says CFO Jennifer Piepszak. That's an ominous sign for the recovery.

Thieves in the night. At a tiny museum in the Dutch town of Leerdam you can usually find a small painting by the 17th-Century Master Frans Hals called, "Two Laughing Boys with a Mug of Beer.” The problem is thieves have again swiped the work, the third time it's gone missing over the years. The art world is puzzled why this particular painting is so highly sought by thieves. Perhaps it's the $10 million valuation.

Diamonds are forever. At these prices, they'd better be. At a recent auction, DeBeers had jacked up diamond prices by 5%, its biggest hike in years, for stones bigger than 1 carat. Bull Sheeters, no doubt, don't mess with anything under a few carats.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quiz Time

Which exchange and/or index is outperforming all others, the world over?

- A. Kospi (South Korea)

- B. IPSA (Chile)

- C. Russell 2000 (USA)

- D. Nikkei (Japan)

It's B, Chile's IPSA, up 9.4% so far YTD. Wild FX swings between the dollar and the Chilean peso are partly driving the gains.