This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. Stocks and futures are little changed on Thursday despite reports the incoming Biden administration is planning a fresh round of stimulus spending, this one carrying a $2 trillion price tag. Robinhood traders, you’re in luck. The proposal reportedly includes $2,000 stimulus checks, which would buy you a decent fractional share of Bitcoin.

The other big news out of Washington—Impeachment 2.0—did little to ruffle markets yesterday. Yes, the Dow fell in the last half-hour of trade, coinciding with the historic “insurrection” vote, but the real test comes in the Senate—whenever that may be.

Let’s see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading, with Japan’s Nikkei up 0.8%.

- China reported its first COVID death in nine months and its biggest cluster of new cases since last spring, revelations that are weighing on investors.

- The Trump administration slapped import bans on Chinese cotton and tomato shipments as global criticism mounts against Beijing for human-rights abuses in Xinjiang.

Europe

- The European bourses were mixed in early trading with the Stoxx Europe 600 up 0.2% at the open, before climbing.

- The euro is holding up as are Italian stocks and bonds even as PM Giuseppe Conte’s government in Rome teeters on the brink of collapse. Toppled governments are nothing new in Italy (though it’s a rare occurrence in the middle of a pandemic).

- The $20 billion mega transatlantic grocery merger between Canada’s Couche-Tard and French retail giant Carrefour has hit a huge snag. The French government is voicing its opposition to a foreign takeover of France’s favorite place to buy papier hygiénique during a pandemic.

U.S.

- The U.S. futures are again flat this morning, after meager gains on the S&P 500 and Nasdaq yesterday. Intel was the top performer yesterday after the beleaguered chipmaker announced a change in leadership.

- What happened to the stimulus trade? CNN is reporting President-elect Joe Biden will unveil a roughly $2 trillion COVID-19 relief package today, and yet the markets are thoroughly unimpressed.

- Shares in Johnson & Johnson were 1.2% higher in pre-market trading after the drugmaker announced its single-shot COVID-19 vaccine generated a promising long-lasting immune response in early stage testing.

Elsewhere

- Gold is down, back below $1,840/ounce.

- The dollar is flat.

- Crude is down, with Brent steady around $56/barrel.

- Bitcoin is up 10% in the past 24 hours. Maybe I should have taken my butcher’s advice to go all in at $35,000.

***

Buzzworthy

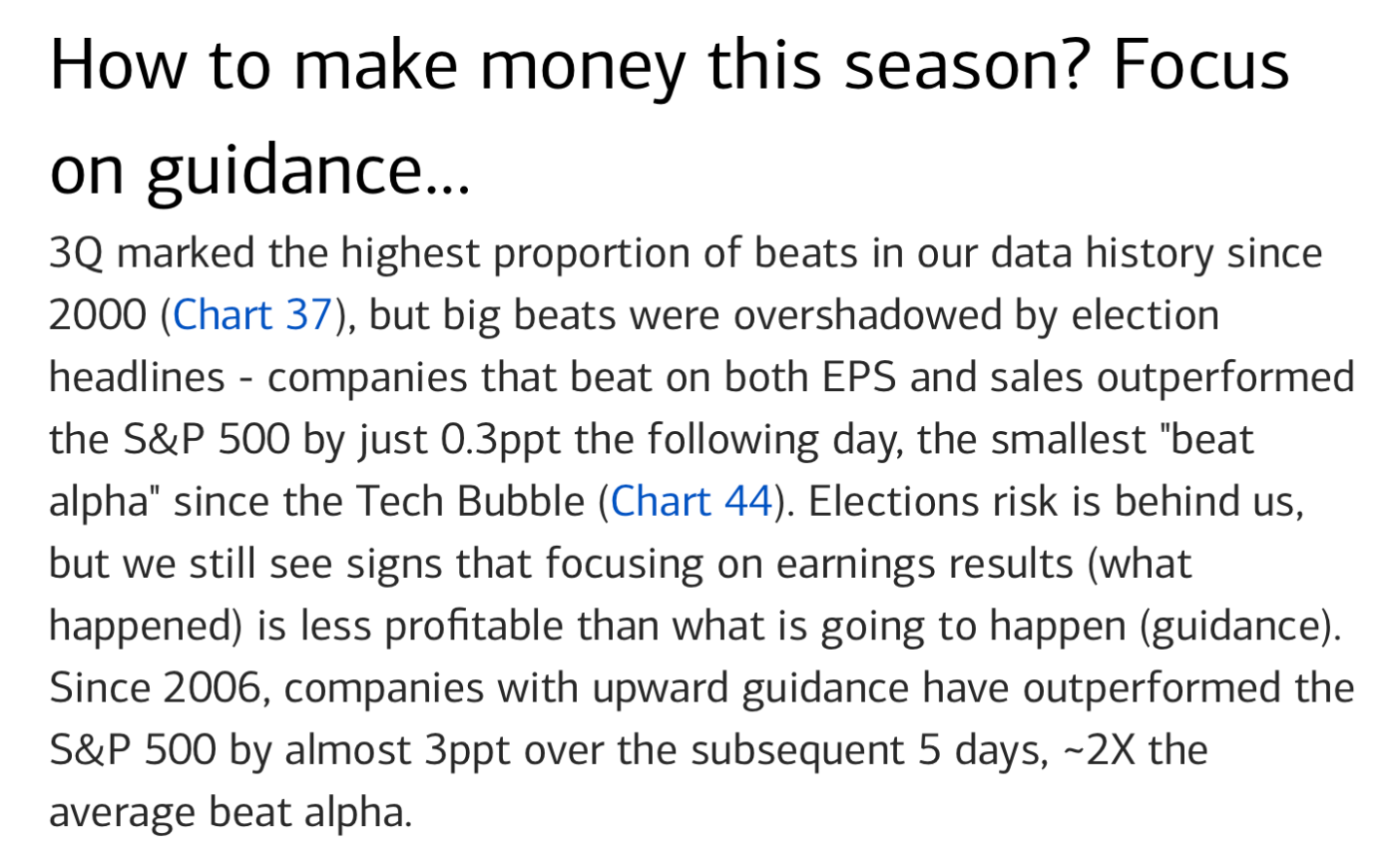

Earnings season advice, courtesy of BofA Securities

Stock-picking advice, courtesy of Meek Mill, famous rapper

And the vaccination leader is…

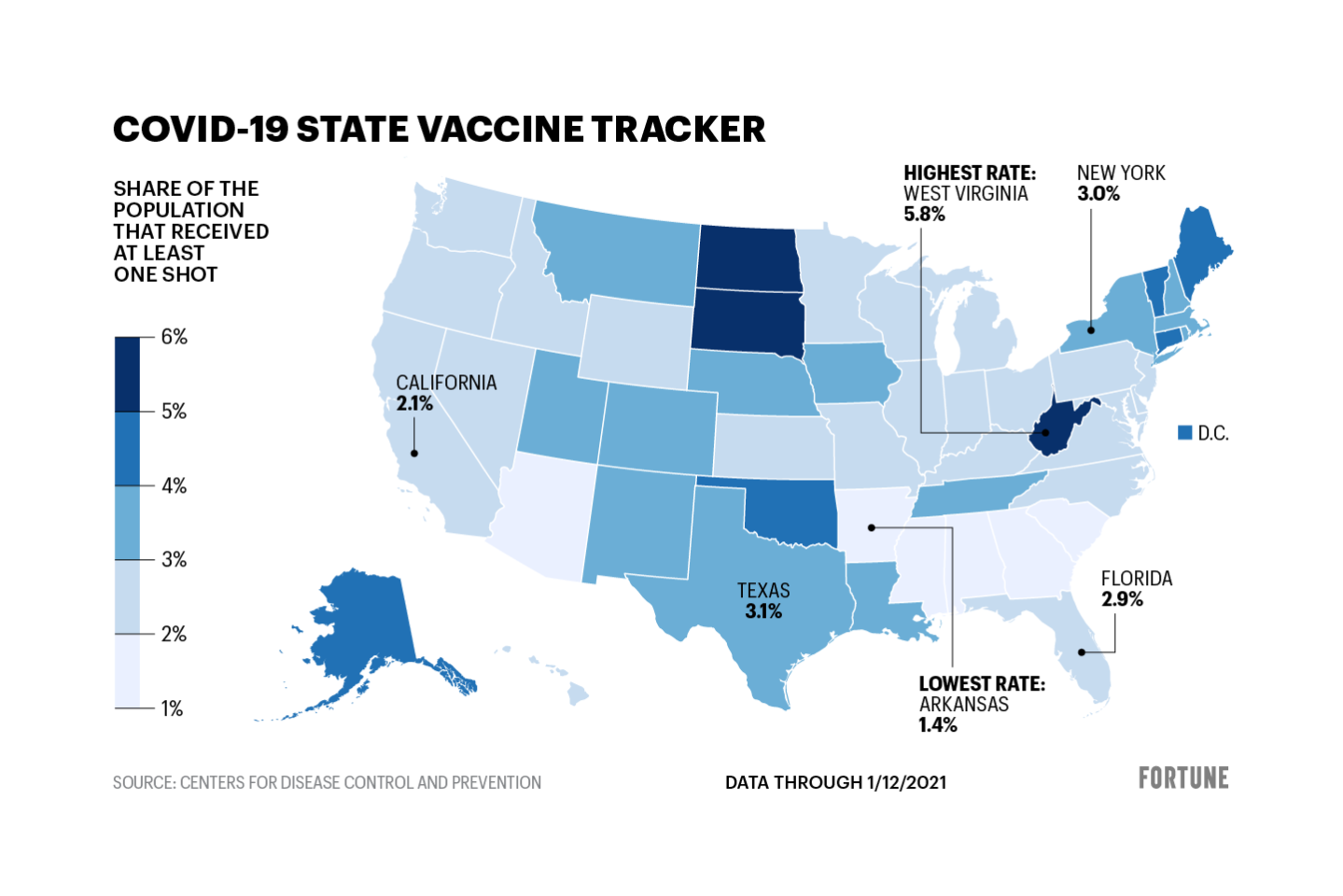

The recovery trade hinges on a successful vaccine rollout. Fortune is tracking the winners and losers.

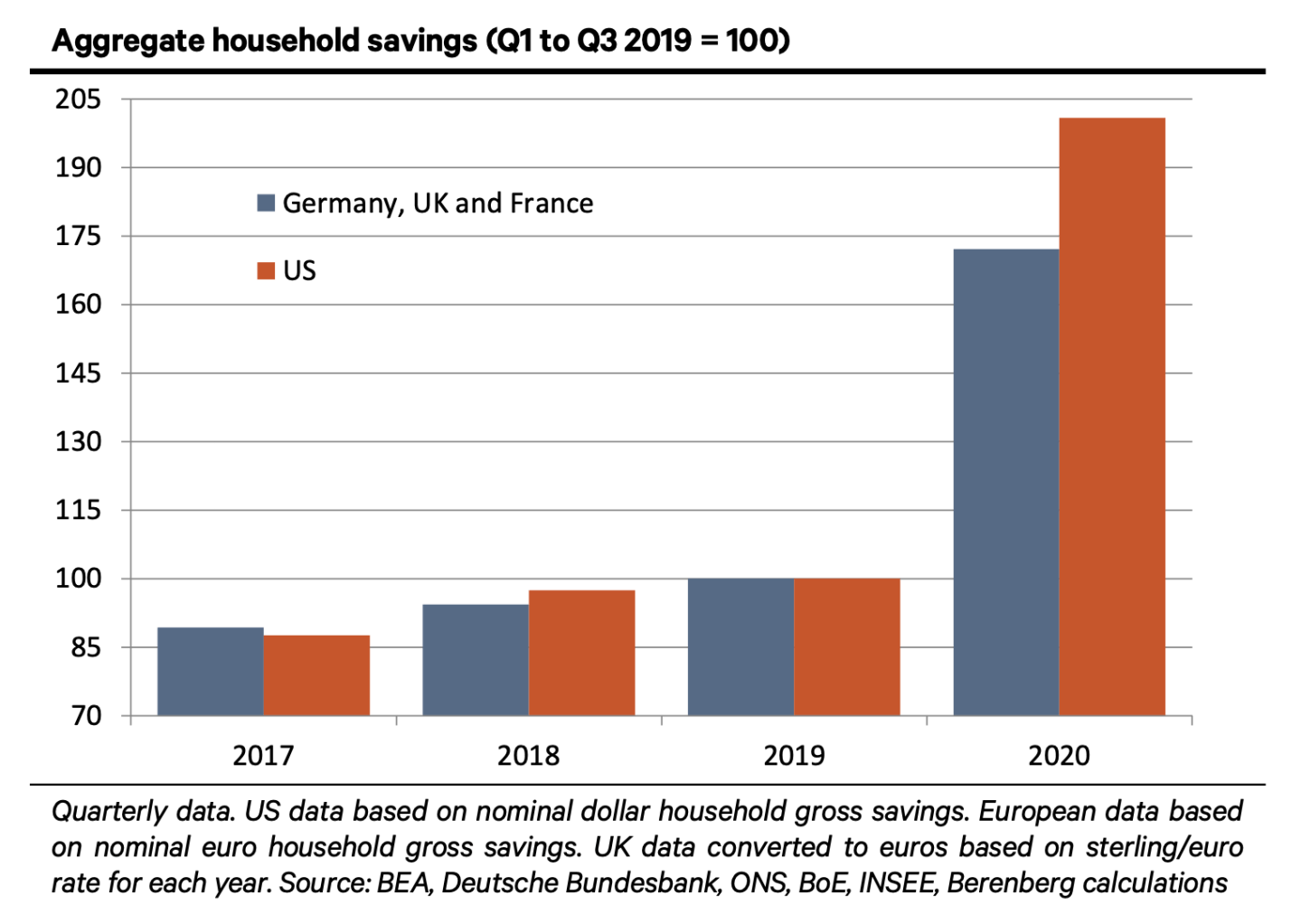

Who needs stimulus, anyhow?

As the incoming Biden Administration plans a third round of stimulus, let’s take a look at household savings rates. According to the German investment bank Berenberg, American households are pretty flush compared to the Germans, French and Brits.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Money on the table. Yesterday's blockbuster Affirm IPO revealed yet again that companies and their bankers are doing little more than guessing what investors will pay for new shares. Fortune's Shawn Tully ran the numbers on the 2020 IPO field, and found executives left a cool $1.23 billion (at least) on the table. Here's why that's such a big deal.

Intel insider. Who's the new guy set to run the show at Intel? Fortune's Aaron Pressman is the one to ask. He weaves in anecdotes and analysis to explain why the naming of Pat Gelsinger as the new CEO is such a big deal. Investors like the appointment. Intel was the best performing stock yesterday.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

SPAC-tacular returns

I've given a bit of flack to blank-check special-purpose acquisition companies, or SPACs, in the past year. But there's a reason why we've seen such a mania behind SPACs. They're super volatile, but they've delivered some strong returns. The Wall Street Journal goes through the Q4 performance of SPACs, and finds some solid numbers for early investors.