That kink in your neck? It might be from watching your portfolio this year whipsaw from precipitous lows to glorious highs in what seemed like a blink.

But who could complain? In December, investors drove up stocks to a series of fresh all-time highs on all three major U.S. exchanges. The Dow Jones Industrial Average and S&P 500 both finished 2020 in the record books. According to LPL Research, the S&P 500 has just notched its best November-December run ever, rallying 14.3% in the final two months. (That was as of noon ET on Dec. 30; the benchmark climbed a further 0.45% through the year-end close on New Year’s Eve).

The record run could be seen across the Atlantic, too, as Germany’s Dax closed in record territory just after Christmas. And, in this past month Japan’s Nikkei hit a high last seen in the Super Nintendo days of the early 1990s.

And yet all of that good news got overshadowed by Bitcoin, which has had the Santa Claus Rally to end all Santa Claus rallies.

Here’s a look at the best- and worst-performing asset classes for 2020, and what that that performance might bode for the year to come.

Stocks

It’s hard to forget those gut-churning days in Q1 when the S&P 500 plunged 32% from peak to nadir. But by August, much of that had been forgotten as the benchmark index rocketed back to record territory, helped by investor mania for tech stocks, plus trillions in fiscal stimulus measures and a let’s-buy-everything Federal Reserve whose central motto has become: “Lower for longer.”

That “Don’t fight the Fed” message, in turn, triggered an unprecedented buying spree in all things tech that pushed the Nasdaq into a bull run for the record books; it finished 2020 up 43.6%. It has also pushed tech-heavy indexes in Seoul, Tokyo and Frankfurt to new highs.

On the flip side, investors dumped their holdings in energy and finance, two sectors hit hard by the COVID-19 pandemic and the lockdowns that followed. The S&P 500 Energy sector was among the worst performers of 2020, down 37.3%. The S&P 500 Financial sector, meanwhile, closed off 4.1%. (Alas, bank stocks have rebounded since early November when we got our first batches of good news on the COVID vaccine front, a real shot in the arm for value stocks.)

As indexes go, London’s FTSE was one of the biggest duds of 2020, off 14.3%, underperforming nearly all major European bourses. Yes, Brexit uncertainty hit shares hard. But the heavy concentration of energy and finance stocks on the FTSE didn’t help either.

By any historical basis, tech stocks are expensive. But there are plenty of signs the big trends of digitization we saw in 2020—not just the boom in e-commerce, but also the rise in virtual meetings and a shift to working from home—are here to stay. Don’t be surprised though if much of those gains are already priced in.

As BofA Securities equity analysts wrote in a recent investor note, “our top two sectors are unapologetically cyclical and value-focused: financials and energy (which we double-upgrade from underweight).” They’re also long small-cap for 2021 and underweight staples, real estate and communications services.

EV stocks had a heck of a year, none better than Tesla. Bulls sent Tesla shares into the stratosphere, up more than eight-fold in 2020.

Commodities

COVID completely walloped the oil market, sending crude to historic lows. In April, the price of a barrel of oil even went negative for the first time ever in a fluky moment where a glut of futures contracts chased nonexistent bidders.

Panic selling aside, the collapse in commodity prices is understandable. When much of the global economy crashes into recession, commodity prices fall with it.

But as factories reopen, those prices bounce back. And we’ve seen that with some commodities, at least.

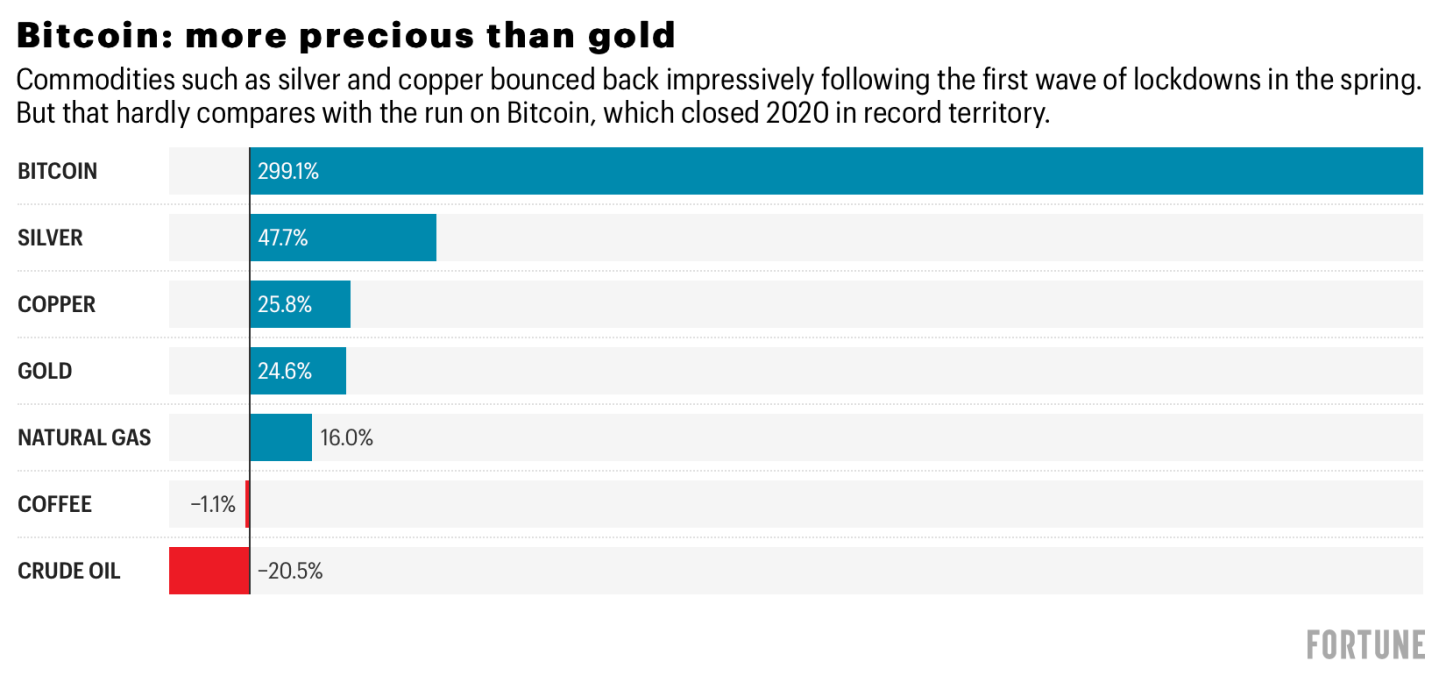

The big winners in commodities this year have been silver (up 47.7%) and copper (up 25.8%). Both are used extensively in industrial processes. They stand to gain further in 2021 as the global economy gets back on track.

Top of the chart is Bitcoin, which nearly quadrupled in value in 2020. No, Bitcoin is not a commodity in the traditional sense of being a physical object, but it’s worth comparing the digital currency’s bull run with that of gold. The shiny yellow stuff ended 2020 up 24.6%. But it’s been virtually flat since September, just as Bitcoin took off. And Bitcoin’s stellar December rally pushed the crypto currency to the brink of $30,000 by New Year’s Eve. So much for that seemingly overly bullish $20,000 Bitcoin call in November.

The FX trade

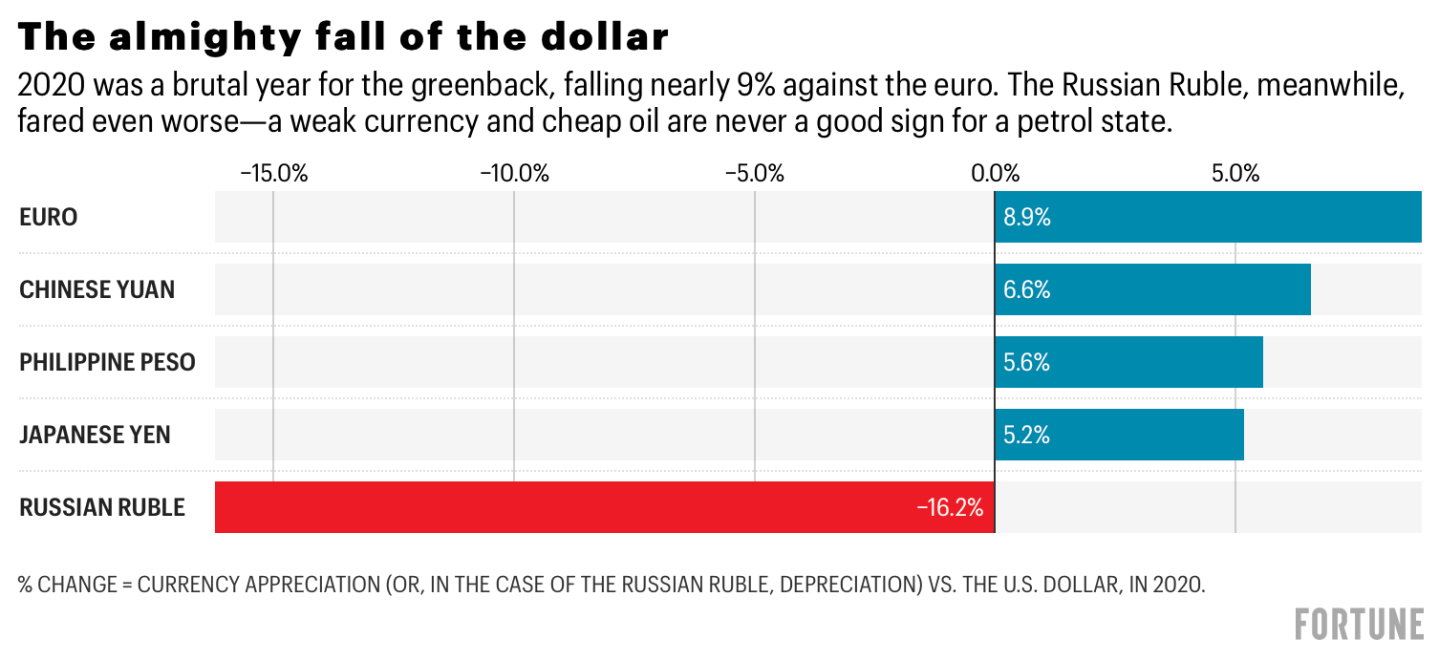

The dollar has had a rough year, posting its biggest annual loss since 2017. And, it’s likely to get worse in 2021.

Not long ago, back in March, the greenback soared as equities fell. That’s the typical pattern. A strong dollar goes hand in hand with risk-off investing sentiment.

As the global economy began to recover in Q2, however, and stocks began picking up, the dollar fell. And kept falling. None of this should have surprised investors.

As Goldman Sachs wrote in a Dec. 18 investor note: “We are revising down our forecasts for the US Dollar against several major crosses this week. The rationale for further depreciation remains the same: the Dollar is overvalued after a long stretch of US asset market outperformance, Fed rate cuts have eroded the currency’s carry advantage, the central bank’s new average inflation targeting framework should keep (real and nominal) interest rates low for a number of years, and a recovering global economy should weigh on the ‘safe haven’ Dollar through a variety of channels.”

A weak dollar creates all kinds of ripple effects around the world. It’s great news for U.S. multinationals, lifting profits. And, a sustained cheap dollar should lift exports.

A weak dollar is also a big boost for emerging markets. And, on cue, investors have been piling into emerging economies in recent months to take advantage of the relatively weak greenback FX gap.

On the flip side, it’s not great news for America’s biggest trading partners—namely, the Eurozone. As such, Goldman Sachs forecasts a year-end 2021 price of one euro equaling $1.28. That would represent a further 4% slide in the greenback from the Dec. 30 EUR/USD FX price, mainly as investors continue to bail on the safe-haven dollar amid unprecedented levels of stimulus pumped into the U.S. economy. In fact, the dollar’s standing as the world’s global reserve currency—a much watched measure—fell to a level last seen in early 1996.

A weak dollar also equates to low inflation, and that’s good news for the consumer. And that should bring another steady tail wind to stocks in 2021.

In other words, get ready for the whiplash.