This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters. There’s incremental—ish—progress on a new stimulus package in Washington, and on a post-Brexit trade deal. That’s providing abundant reason for the bulls to send global stocks and futures higher this morning.

Speaking of bulls… we got perhaps the most bullish call of the year yesterday on Bitcoin. How bullish? Would you believe, in the foreseeable future, a single Bitcoin could be worth several hundred thousand bucks— enough to buy you 1.17647059 Ferrari GTS convertible roadsters? If you want the Stradale Spider, you’ll need a second Bitcoin. (Whether a Ferrari dealer will take your Bitcoin, dear reader, is an entirely different thought experiment.)

Let’s see what’s moving markets (in hard currency terms).

Markets update

Asia

- The major Asia indexes are higher in afternoon trading with the Shanghai Composite up 1.1%.

- The woes of Luckin Coffee continue. The SEC yesterday slapped a $180 million penalty on Nasdaq-delisted Chinese coffee chain after discovering it went to elaborate means to deceive investors and regulators. Luckin’s malfeasance first came to light thanks to some dogged short activists… Serious question: how’s Luckin’s coffee? Any good? Anybody know?

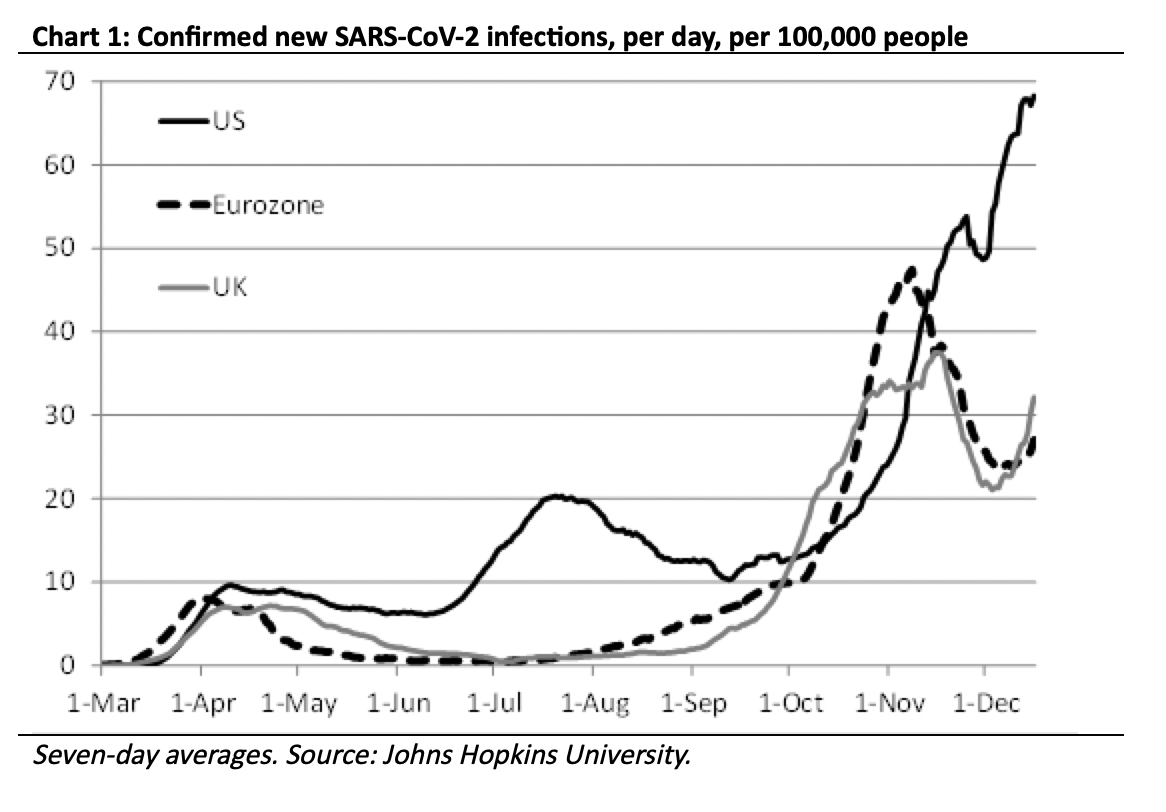

- New Zealand, under Prime Minister Jacinda Ardern, has become something of a global model for fighting COVID. The country’s economy has bounced back sharply from pandemic lows, achieving what appears to be a solid V-shaped recovery.

Europe

- The European bourses climbed out of the gates with the Stoxx Europe 600 up 0.5% at the open.

- The British pound continues to climb on hopes a post-Brexit trade deal. Fishing rights, which amounts to an infinitesimal sliver of trade between the neighbors, is the last big holdup.

- Alas, it’s not a fully rosy picture. Nissan is pulling out of a pact to make its new EV, the Ariya, in Britain. The reason: concerns of higher tariffs in a post-Brexit world.

U.S.

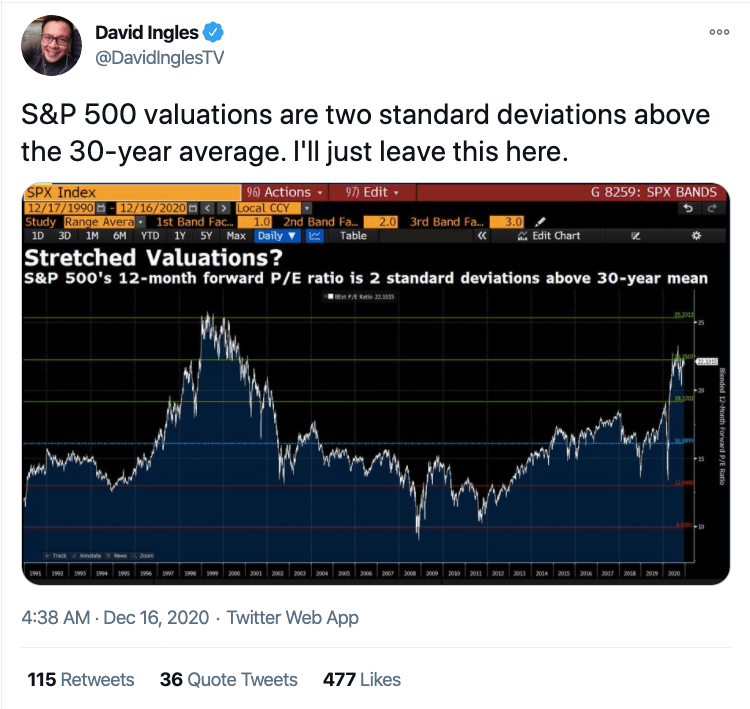

- U.S. futures point to a solid open this morning. That’s after the S&P 500 and Nasdaq closed higher on Wednesday on, get this, hopes of an imminent stimulus deal, making this perhaps the lengthiest buy-the-rumor trade in stock market history.

- Shares in Alphabet’s Google and Facebook closed essentially flat yesterday after Texas filed an antitrust lawsuit accusing the search giant of colluding with Facebook to put a chokehold on the online ad market.

- In this everything-goes-up market, here’s an unfathomable misfit of a headline: Online retailer Wish falls in 2020’s worst debut for big U.S. IPO.

Elsewhere

- Gold is up, trading around $1,880/ounce.

- The dollar is down.

- Crude is cruising, with Brent futures trading above $51.25/barrel.

- Bitcoin bulls are lighting fancy cigars with wads of worthless dollar bills this morning. The crypto currency is up an additional 16%, trading, at one point, above $23,000. Next stop? $400,000 (that’s not a typo), says Guggenheim Investment’s Scott Minerd.

***

Buzzworthy

Running the numbers, Part I

Running the numbers, Part II

Running the numbers, Part III

Herd on the Street

***

Postscript

A programming note: Fortune‘s newsletters will go on hiatus over the next two weeks in observance of the Christmas and New Year’s holidays. As such, tomorrow’s edition will be the final Bull Sheet newsletter for 2020.

***

Have a nice day, everyone. I’ll see you here tomorrow. But first…there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Crypto securities. Lost in the euphoric headlines over Bitcoin valuations yesterday was a fascinating piece of news out of Germany. The country is giving the green light to electronic-only securities, "a move that paves the way for 'crypto securities,'” writes Fortune's David Meyer.

Santa Claus rally? The S&P has been trading mostly sideways in December, but that doesn't mean 2020 has already seen its last all-time high. LPL's Ryan Detrick, one of the best markets historians out there, presents an interesting case for why investors shouldn't count out a late-December rally.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

As a broker-dealer, Robinhood has a duty to protect its customers and their money... Treating this like a game and luring young and inexperienced customers to make more and more trades is not only unethical, but also falls far short of the standards we require in Massachusetts.

That's William Galvin, Secretary of the Commonwealth of Massachusetts, who announced yesterday a lawsuit against Robinhood, accusing the popular investing app of aggressively marketing to novice investors, exposing them to "unnecessary trading risks."