This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning. It’s V Day in Britain: The first national rollout of a clinically tested COVID-19 vaccine is underway. The markets’ reaction? A big fat yawn.

Pfizer, one of the makers of the vaccine, is flat in pre-market trading. Elsewhere, the bourses in Europe and Asia are mostly lower, as are U.S. futures.

Let’s check in on what’s happening.

Markets update

Asia

- The major Asia indexes are a touch lower in afternoon trading with Japan’s Nikkei down 0.3%.

- Investors are bullish on Asian assets going into the final weeks of 2020. According to Bloomberg, the MSCI Asia Pacific Index hit record territory last week, and bonds are nearing multi-year highs as well.

- On Monday, the U.S. House of Representatives passed a bill that would give Hong Kong residents special refugee status to live and work in the United States as tensions between Beijing and Hong Kong becomes a larger geopolitical issue. Meanwhile, more U.S. sanctions loom for Chinese officials.

Europe

- Brexit jitters are weighing on the European bourses again this morning. The Stoxx Europe 600 is down 0.2% hours into the trading session.

- Earlier this morning, a 90-year-old woman in the English city of Coventry got the first Pfizer-BioNTech COVID vaccine shot in the U.K., a rollout that will be watched the world over. It’s hardly a shot in the arm for the markets. The pound sterling is down and the FTSE is flat.

- COVID, schm-OVID. 2020 has been a banner year for Europe’s tech startup scene with the total venture investment poised to reach $41 billion by year’s end.

U.S.

- U.S. futures are lower after the Dow and S&P 500 kicked off the week in the red; the Nasdaq nudged higher on Monday.

- Uber Technologies fell 1.9% yesterday after it announced it had sold its self-driving car unit to Aurora Innovation, effectively getting out of the business. It did, however, take an investment in the company, valuing Aurora at $10 billion.

- Water—specifically, California water— is the newest trade-able asset. The precious commodity made its Wall Street debut on Monday, allowing investors to bet on the ups and downs of this life-giving essence. Can clean air futures be that far behind?

Elsewhere

- Gold is up, trading near $1,870/ounce.

- The dollar is flat.

- Crude is down, with Brent futures trading around $48/barrel.

- Bitcoin is down, trading around $19,100.

***

The almighty consumer

Would you rather live in a country with high sovereign debt, but low household debt? Or, the other way around—a place of low national debt, but highly indebted households?

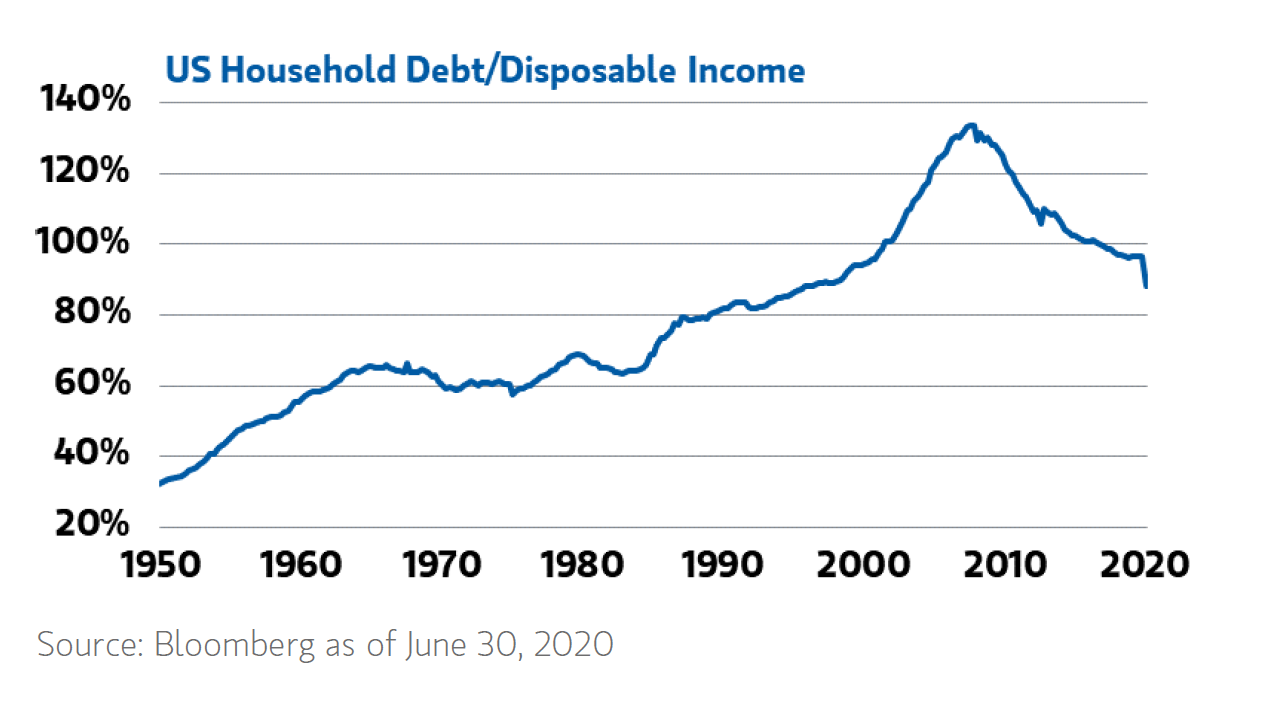

From the 1980s until about a decade ago, household debt in the U.S. hit a crazy extreme. Just as the housing bubble was reaching its peak, U.S. household debt was reaching 130% of disposable income. The bubble popped, and Americans grew more thrifty.

Something similar has happened in the aftermath of COVID: household debt has fallen precipitously as today’s chart, courtesy of Morgan Stanley, shows.

“One unique feature of the current recession,” writes Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, “is that rather than consumers tapping their credit cards, they have paid down debt, especially relative to disposable income and net worth. In fact, current readings are the lowest since the late 1980s and nearly 50 percentage points lower than during the worst points of the Global Financial Crisis.”

“This suggests that a vaccine rollout could easily unleash pent up demand for consumer services,” she continues.

That would bode well for some of the more beaten-down investment sectors in the year ahead. Those would include travel and leisure, plus energy and finance as people book travel, dine out and begin to move around again.

This explains much of the thinking around why value stocks (banks and energy, in particular) are booming in recent weeks.

To borrow a term from the worlds of VC and private equity, American households have plenty of dry powder as we head into 2021.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

The i-word. From gold bugs to crypto bulls, investors have been keenly watching for signs of inflation. While prices are no doubt likely to rise next year as the global economy reopens further, any inflation effect is likely to be short-lived. A mirage is how economists are describing it.

Business owners, beware. The Paycheck Protection Program expires in the coming weeks unless Congress acts to save it. There's another doozy in the details, Fortune's Geoff Colvin reports. "The IRS effectively canceled the tax break that made PPP loans so valuable to small businesses," Colvin writes, creating a potential tax headache in the year ahead.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

562%

Never heard of Adani Green Energy? Neither has the equities analyst community, apparently. The Indian energy high-flyer is up 565% year-to-date, landing it in the MSCI India Index. And yet, not one analyst has initiated coverage of Adani, Bloomberg reports.