This is the web version of The Ledger, Fortune’s weekly newsletter covering financial technology and cryptocurrency. Sign up here to get it free in your inbox.

It’s a well-worn business tactic: Pose as an innovative disruptor and sidestep the responsibilities that set back incumbents.

Often the playbook involves identifying as a technology company. For years, Mark Zuckerberg insisted Facebook was not a media company; therefore, it didn’t have to comply with that industry’s rules. Amazon built a competitive edge by rejecting state sales taxes, arguing that it was a place-less online store. Uber fought to treat its app workers as contractors, not full-time employees entitled to benefits—a battle it just won after the election day approval of ballot measure Proposition 22 in California.

Ant Group’s strategy was no different, but this week it had less luck than the U.S. tech disrupters. Jack Ma, the Alibaba billionaire and richest man in Asia, four years ago coined the term “techfin” to describe his fintech brainchild’s special status. In a barefaced rebrand earlier this year, Ant stripped the word “financial” from its name and replaced it with “technology group.”

It’s easy to understand why Ant would prefer to identify as a technology company rather than as a financial one. Look no further than stock multiples. Shares of Industrial and Commercial Bank of China, the biggest state-owned bank, which once boasted the biggest IPO of its day, trades at six times its price-to-earnings ratio. Ant, whose IPO was poised to be the new record-setter until regulators abruptly halted it on Tuesday, would have seen its shares open at a price 31-times the company’s net profit forecast for 2021, as Reuters observed.

Now regulators are dragging Ant closer to the “fin” side of the “fintech” equation. They imposed new capital requirements and restrictions on lending across the industry on Monday. Questions over compliance forced the Shanghai exchange to suspend Ant’s IPO, and Ant pulled the plug on the Hong Kong listing soon after. Ant, obviously surprised, apologized to investors and said it would “overcome the challenges,” including by an “embrace of regulation…and win-win cooperation.”

That conciliatory tone is a major reversal from the defiant one that Ma, Ant’s cofounder and biggest shareholder, struck during a Shanghai conference last week. During the event, Ma railed against incumbent banks’ tightfisted approach to consumer lending, saying they exhibited a “pawnshop mentality.” He took global financial regulators to task, criticizing them for stifling innovation. “The Basel Accords,” Ma said, referring to international risk rules for banks, “are like an old people’s club.”

Ant’s shock IPO suspension comes as a dressing down for Ma, and a wake-up call for any company in China that believes it can resist the crushing pressure of Beijing’s boot. No exceptions: Welcome to the club, Jack.

Robert Hackett

DECENTRALIZED NEWS

Credits

SEC raises caps for unregistered fundraising ... Wyoming approves banking charter for Kraken ... U.S. election juices demand for blockchain betting markets ... PayPal raises crypto-buying limit to $15k/week, and will expand crypto services ... Former Bakkt CEO Kelly Loeffler's Georgia Senate race goes to a runoff.

Debits

FinCEN proposes dramatically tighter AML/KYC thresholds ... Leaked documents reveal Binance efforts to evade U.S. regulators ... Beam Financial customers report long waits for withdrawals ... Tron blockchain freezes for hours ... JPMorgan's Marko Kalonovic accuses forecasters of political bias ... Puerto Rican activists confront would-be colonizer Brock Pierce ... Falling oil demand is undermining the ruble ... Softbank-backed supply chain financier Greensill Capital sells some planes to cut costs ... Chinese fintech Lufax drops 4.8% on IPO.

FOMO NO MO'

“This has happened before when companies appear to have become too big versus the state for the authorities’ liking.”

Sean Darby, strategist at Jefferies, speaking to Bloomberg about the Chinese government order halting Ant Group's IPO. Though the announcement halting the IPO cited "significant change" in the regulatory environment, there's considerable agreement that the Chinese Communist Party's deeper motive was squashing Ant's influence in the financial sector. At the same time, China hawks have frequently pointed to the close ties between the CCP, Alibaba, and Ant, hinting at a more complex internal power struggle.

BUBBLE-O-METER

$60 Billion

The amount suspending Ant Group's IPO knocked off the market cap of Alibaba.

THE LEDGER'S LATEST

PayPal will expand cryptocurrency options to Venmo and beyond - Jeff John Roberts

SoFi approved for national bank charter - Jeff John Roberts

Challenger bank Jiko raises $40 million - Robert Hackett

The stock market's final prediction: A Biden win - Jen Wieczner

Why Chinese regulators summoned Jack Ma ahead of Ant Group IPO - Naomi Xu Elegant

U.K. bettor puts 1 million pounds on Biden to win - Rey Mashakekhi

Hackers steal $2.3 million from Wisconsin GOP with fake invoices - Jeff John Roberts

MEMES AND MUMBLES

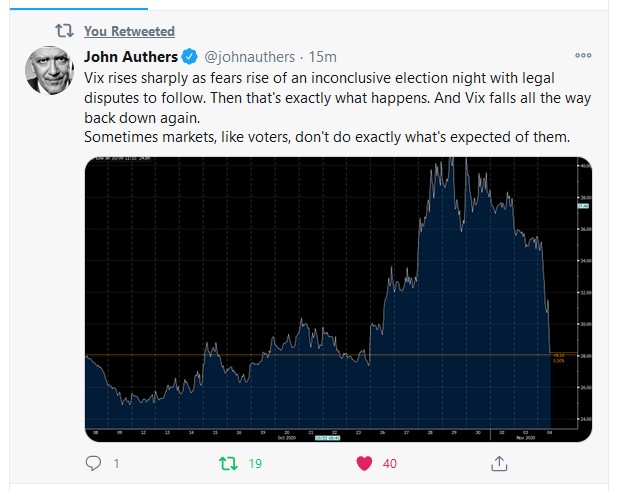

(The VIX is a 'volatility index,' sometimes referred to as the market's 'fear gauge.')

This edition of The Ledger was curated by David Z. Morris. Contact him at david.morris@fortune.com