Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, subscribe today.

Talk about backwards.

Companies crushing 3Q earnings largely haven’t been rewarded by investors, while those missing the mark have seen a stock pop, compared to the S&P 500.

“So far this quarter, companies that beat on both top and bottom line have underperformed the S&P 500 by 5bps the day after (worst in history), and misses outperformed by 60bps, highest in history,” strategists led by Savita Subramanian at Bank of America wrote in a note Monday.

That pattern, as odd as it may look, has happened before: Stocks reacted similarly during the Tech Bubble in 2000, “the only earnings season in history when surprises saw perverse rather than intuitive reactions—beats were not rewarded and misses were not penalized,” Subramanian notes.

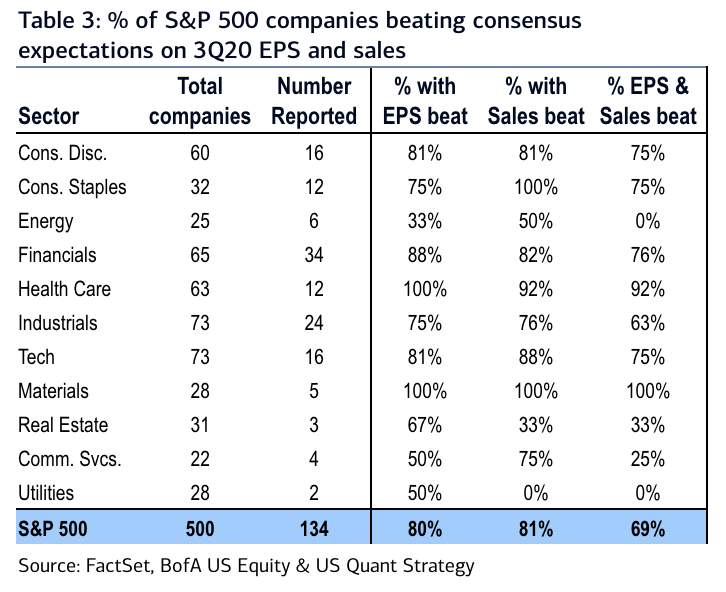

It’s certainly not the first time the current market has been compared to the Tech Bubble this year. But so far, the portion of companies beating earnings on the top and bottom for Q3 this year is the “strongest post-Week 2 proportion of beats in our data history” since 2011, Subramanian points out (see chart).

Third quarter EPS is “now pointing to $34.90 (-17% y/y), up 6% since the start of October,” according to BofA, and earnings expectations for the fourth quarter are “rising in virtually every sector, suggesting that the strong earnings momentum has legs,” UBS’s head of equities Americas David Lefkowitz and associate equity strategist Americas Matthew Tormey wrote in a note Friday.

So, why the unusual reaction? UBS’s Lefkowitz and Tormey argue the market is being dominated by bigger questions: “What’s going on? We think the market is concerned about the election, prospects for additional fiscal stimulus, and rising COVID-19 infections,” the strategists wrote.

BofA’s Subramanian is of the same mind, noting “the lack of alpha indicates a lot of good news (or bad news) is priced in already, and investors are more focused on the upcoming election and macro factors … than what happened in 3Q.”

Unease over the outcome of the election (and, perhaps more importantly, over the possibility of a contested election dragging on after Election Day) could continue making investors touchy, while a near standstill on Capitol Hill over a fresh round of stimulus has sent the markets lower.

For now, despite companies posting impressive earnings so far this quarter, UBS’s Lefkowitz and Tormey warn: “The triple whammy of election, stimulus and COVID-19 uncertainties may be keeping investors sitting on their hands.”

But better times may lie ahead: UBS estimates the S&P 500 will hit 3,700 in June next year—that would be more than 9% higher than Monday’s levels.