This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The Dow and S&P’s seven-day rally faltered in the final hour of trade on Tuesday on fears a fiscal stimulus deal won’t materialize any time soon. (That the college football season now looks like a goner didn’t help sentiment either.) Gold too suffered its worst drop in seven years, losses that spilled into the early portion of the trading session.

But European equities are trudging higher and U.S. futures are nudging up too—as is gold.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are off their lows with Japan’s Nikkei up 0.4% in afternoon trade.

- The White House’s top economic advisor Larry Kudlow says the Phase One trade deal is “fine” and that China is “substantially” increasing purchase of American goods. This comes a day after President Trump downplayed the importance of the trade pact, telling reporters it “means very little.”

- A brutal year has forced SoftBank to pivot from tech firm/startup-incubator into asset management. The company announced yesterday it’s created an asset management arm with $555 million in capital. It’s already invested in Apple, Facebook and Amazon.

Europe

- The European bourses were flat at the open, but gained momentum an hour into trading. London’s FTSE was up 0.4% even as U.K. GDP fell a staggering 20.4% in Q2, the worst performance of any G7 economy so far.

- Russia’s pronouncement it had developed and registered a COVID-19 vaccine—so safe and effective Vladimir Putin’s daughter got the jab—proved to be a short-lived jolt to the markets yesterday. Health experts are highly dubious of the fast-tracked vaccine, to put it mildly.

- Is Boeing‘s 737 Max headed for further delays? Regulators in Europe and Canada are holding up approval until engineers can sort out a series of technical issues on the grounded jet.

U.S.

- U.S. futures have taken off in the past hour, indicating a positive open. That’s despite real concern Washington will not get a deal done any time soon on a new fiscal stimulus coronavirus bailout. “If we don’t get a deal, I think markets will correct quite quickly,” Nicholas Brooks at Intermediate Capital Group told the Wall Street Journal.

- This should excite Robinhood investors: Tesla announced a five-for-one stock split. Shares are up 6% in pre-market trading.

- Bookings at Airbnb may still be below pre-pandemic levels, but that’s not dashing the company’s IPO aspirations. It plans to file this month, the Journal reports.

Elsewhere

- Gold had bombed early, down at one point below $1,900/ounce. It’s stormed back, however.

- The dollar is off its highs as equities and gold rebound.

- Crude is climbing again, with Brent up 0.8%.

***

The sky is falling, stocks climb

Stop me if you’ve heard this one: the economic data bombs to historic lows and stocks go up. We’re seeing this phenomenon again this morning in the U.K.

GDP there fell by more than 20% in Q2, the worst performance in the modern records-keeping era. And the FTSE and pound are, after a sluggish start, gaining impressively.

Why do stocks keep rallying in the face of bad news? Investment pros are getting this question a lot these days.

BofA offers this explanation. They point to three factors that shed some light on why this investor exuberance is not as irrational as you might think.

The four-month rally, it says, stands on three legs: fiscal stimulus measures, investors pouring into a small sliver of pandemic-proof sectors and—everybody now: central bank liquidity.

Let’s take them one by one:

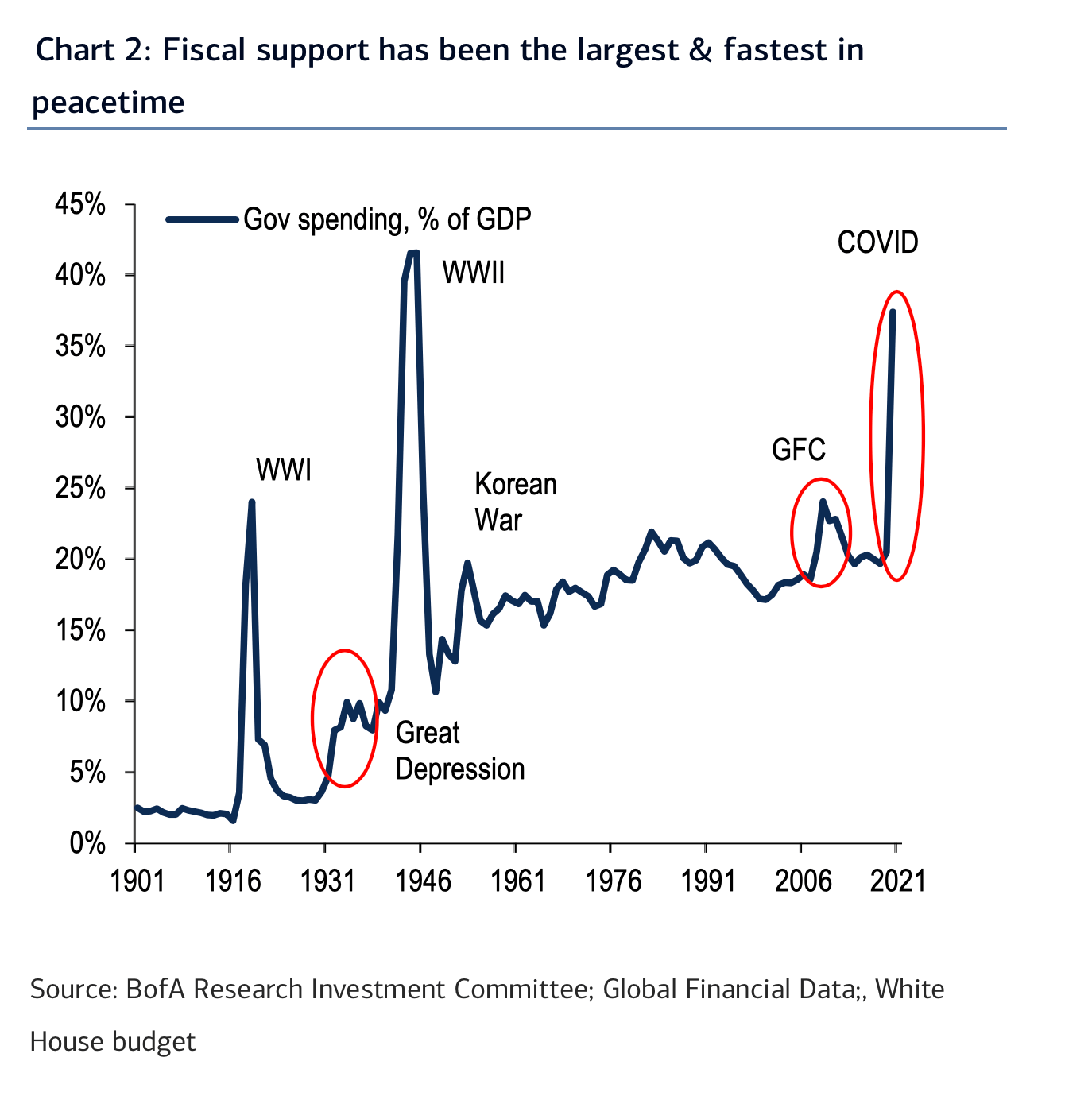

Fiscal stimulus: So far, U.S. lawmakers have earmarked $2.8 trillion. Those spending measures have been “a rousing success,” BofA says, in keeping American households solvent. It’s the biggest peacetime stimulus plan ever, as the chart here show:

But you know what? It’s probably not big enough, particularly as the coronavirus pandemic continues to rage on across much of the United States. As yesterday’s late-afternoon market tumble reminded us: failure to reach a deal on Round 2 would likely send the markets and the economy lower.

Moving on…

Health care and tech stocks: They’re soaring. And, no, they are not a proxy for the wider economy. These “defensive growth stocks,” as BofA calls them, “account for 18% of US jobs but now comprise 54% of the S&P 500 market cap.”

The biggest losers from the pandemic (e.g. retail, airlines, travel & leisure, oil & gas) accounted for 47% of job losses but only 10% of S&P 500 market cap.”

That paradox explains somewhat why the markets are flying even as so many Americans are out of work and suffering. In a word, BofA calls it a case of fiscal “inequality.”

Finally…

Central Bank largesse: So far in 2020, central banks around the world have issued 167 rate cuts and have pumped $8.4 trillion in monetary support into the global economy. Those measures have been great news for equities markets, but, BofA writes, “monetary policy can do little for the real economy.”

Without the central banks’ help, this rally would have never materialized, most market observers now agree. They’ve been a godsend for Wall Street. For the rest of America though—not so much. The American consumer—a not insignificant part of the U.S. economy— is much more reliant upon the first leg of the stool, the fiscal stimulus.

If there’s no CARES Act II, market observers now fear, both Wall Street and Main Street will feel it.

***

Have a nice day, everyone. I’ll see you here tomorrow… But first, more news below:

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

Where the jobs are—and aren't. On first glance, last Friday's non-farm payrolls report looked pretty good. The U.S. economy added a better-than-expected 1.48 million jobs. But Fortune's Shawn Tully digs into the numbers and finds some worrying data, sector-by-sector. "The pandemic crisis," he concludes, "is on track to permanently destroy many millions of positions, even more than were lost for good in the Great Recession."

King dollar gets crowned. It's amazing how far a bit of political solidarity can go in a devastating pandemic. The European Union struck a deal on €750 billion coronavirus stimulus package in mid-June and the euro has since taken off. It jumped 4.9% last month against the dollar, and now investors are dumping the greenback for the common currency.

MPW. As I mentioned yesterday... Fortune is collecting nominations for our annual Most Powerful Women lists, which publish in our November issue. We’re accepting submissions through this online form. The deadline for applications is Aug. 24

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Top Five

Fortune's Global 500 list went live this week, and I'll be breaking down the findings on Bull Sheet over the next few days. This caught my eye: five cities—Beijing, Tokyo, Paris, New York, and London—are home to one-third of the Fortune Global 500 companies. It should be interesting to check back in on that number a year hence to see what impact coronavirus has had on the world's major urban business centers. You can read the Global 500 list here.