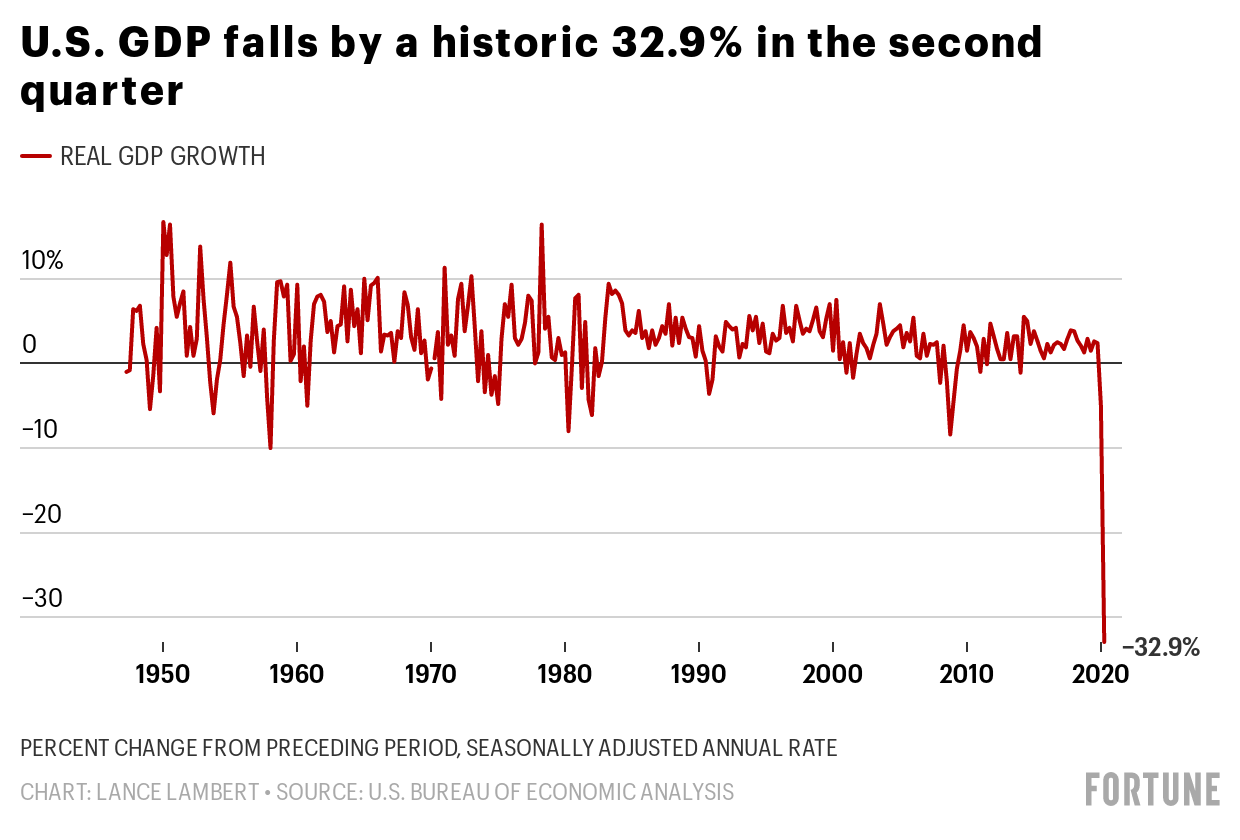

The coronavirus outbreak has hit the U.S. economy harder and faster than any event in the history of modern economic records.

That grim point was made official on Thursday when the U.S. Bureau of Economic Analysis announced that second quarter real GDP—from April to June—declined by 32.9% from the preceding period. It’s the largest single quarterly decline on record for data going back to 1947 and represents more than $1 trillion in economic output wiped out by the coronavirus pandemic. The figure comes in at three times worse than the previous record in 1958 when the economy saw a 10% quarterly drop.

No matter how you look at it, it’s a sum that’s likely to have huge implications in U.S. political circles with Election Day just over three months away.

That 32.9% decline follows a 5% decline in the first quarter, which only included the first few weeks of the pandemic.

The good news? Some economists believe the worst is over, and that the economy has already recovered some of the losses detailed in today’s report. Goldman Sachs projects third-quarter GDP will jump a record 25%, as the economy benefits from those states that were able to reopen.

Mark Zandi, Moody’s Analytics chief economist, believes the recession ended in May, and that we’ve since moved into recovery. Labor data backs that up. The jobless rate has fallen from its 14.7% peak in April to 11.1% in June. And state unemployment rolls are down from its record peak of 24.9 million in the week ending May 9 to 16.2 million as of July 11.

But third quarter GDP growth could be threatened by soaring COVID-19 cases in the South, West, and Midwest. Florida, a hot bed for the virus, led the nation in unemployment claims last week, another sign the virus could pull the economy backwards.

“The intensification of the virus is doing significant economic damage. Sales are reversing … business people are being more cautious,” Zandi said.

And Zandi believes that if Congress allows the extra $600 unemployment benefits to expire without an extension, it could hamper consumer spending and push the economy into a dreaded double-dip recession.