This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning.

“My concern is we might see spikes that turn into outbreaks.” Those words by the Trump Administration’s top disease expert, Anthony Fauci, in Senate testimony, took the air out of yesterday’s rally. Fauci’s sober assessment is hanging like a dark cloud over global markets today. It’s a risk-off morning.

Let’s see if we can peer through the gloom.

Markets update

Asia

- The major indices are mixed. Japan’s Nikkei is down while Shanghai and Hong Kong are clinging to gains.

- There’s a new coronavirus hotspot in China: the northeast Chinese city of Jilin where authorities now say the outbreak risk level is “high.”

- A bit of rare news now…China’s Dada Nexus plans to file an IPO in the U.S., looking to raise about $500 million.

Europe

- European bourses opened in the red this morning, with the benchmark Stoxx Europe 600 down 1% at the open.

- Shipping giant Maersk sees Q2 volumes falling as much as 25% as the economic fallout of the pandemic continues to decimate global trade.

- Eurozone business investment has collapsed in recent weeks, signaling a deeper contraction is in the cards.

U.S.

- The Dow, S&P 500 and Nasdaq futures are pointing to a flat open, doing little to recoup yesterday’s losses.

- The V-shaped recovery “is a fantasy,” says Wall Street titan Stanley Druckenmiller, adding he’s not buying this rally.

- After the Fed warned of widespread business failures yesterday, the central bank’s chair, Jerome Powell, is due to speak today. He may urge policymakers to load up the bazooka again with more stimulus spending. On cue: the U.S. House has a $3 trillion plan looking for votes.

Elsewhere

- Gold is down

- The dollar is flat.

- Crude too is sinking as recovery concerns persist. Brent sunk below $30/barrel, falling to a five-day low.

Inside the C-suite

In this space, we’ve been looking recently at investor and consumer sentiment. Today, let’s look at corporate sentiment.

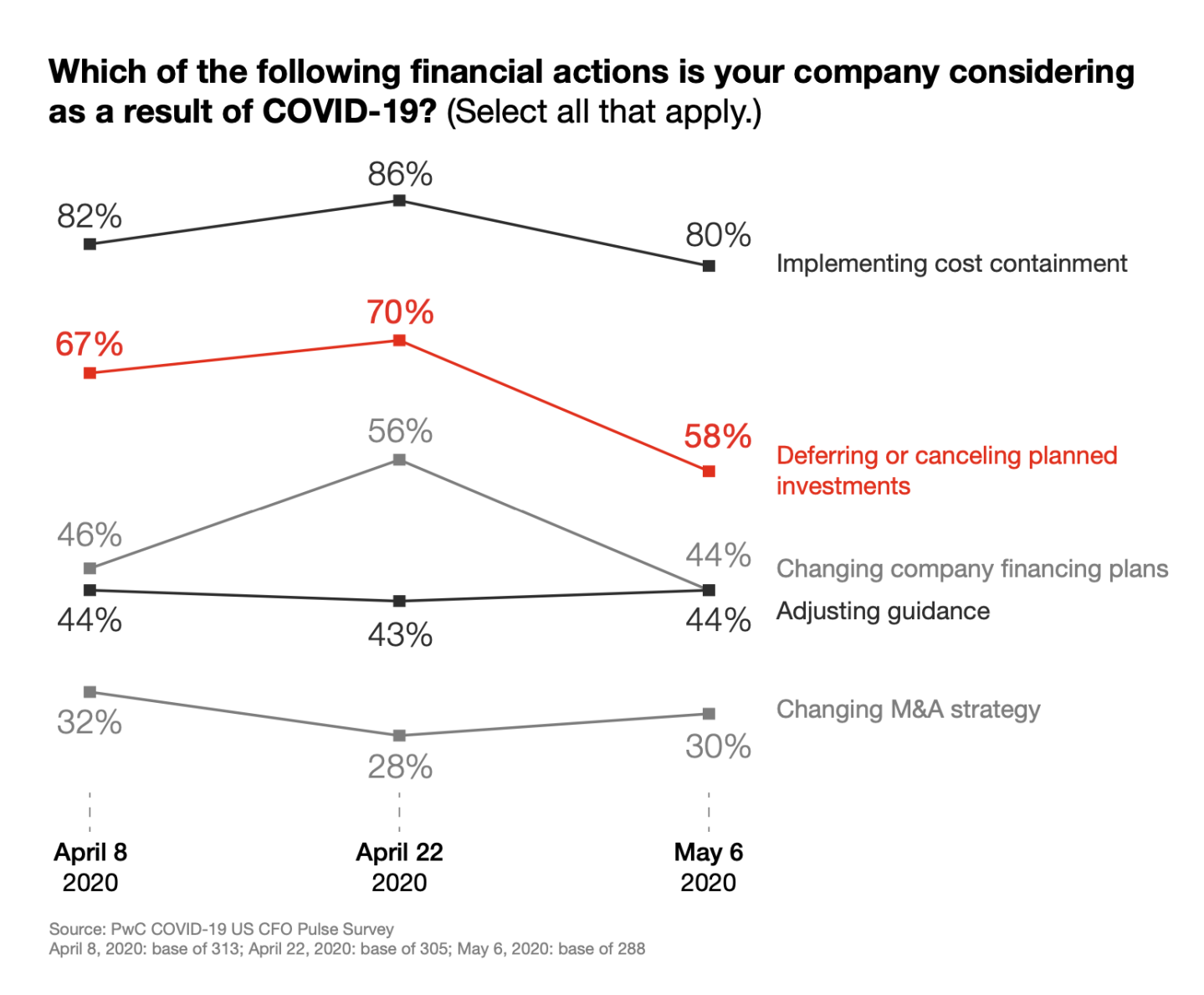

Earlier this week, PwC released its latest CFO COVID-19 survey, polling 288 finance chiefs at U.S. companies. The survey was conducted last week, which was a disjointed one. There was brutal economic data, capped off by last week’s jobs report, and yet the markets were rallying. Even still, there was a clear trend that Corporate America feels the worst is behind us, according to the PwC data.

As the PwC chart shows, sentiment over the past month has improved in regards to outlook and in business investment. (Not shown: there’s renewed confidence in productivity in this work-from-home era). The bad news: all this improved sentiment comes from a point of abject pessimism in the C-suite. There are still plenty of doubts about the overall business climate. The best indicator for that is CFOs haven’t budged on their view of whether they’ll need to adjust full-year guidance.

There’s a lot of chatter about what shape this recovery will take. And here the PwC survey offers some fresh insights. “Over half of CFOs expect it to take their company at least three months to recover once the virus recedes,” the survey authors note. This take-away seems to underscore what the likes of Stanley Druckenmiller (mentioned above) have been saying all along: the best-case-scenario V-shaped rebound is “a fantasy.”

***

Have a nice day everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune’s Outbreak newsletter will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Coming for your ETFs. Yesterday, the Fed began its historic move to buy U.S. corporate bond ETFs. Select iShares and SPDR ETFs make the grade. Here's what happens when Uncle Sam comes in with unlimited funds to buy the same assets held in Americans' portfolios.

Lockdown with the tax man. The mega-rich have a somewhat unique problem with this pandemic. A number of them are stranded in high-tax regimes, and as each day of the calendar flips they're closer to becoming accidental residents—meaning paying tax in the countries where they're locked down. Not everyone is sympathetic to their plight. As one tax lawyer told Bloomberg, “Taxes are only going to go one way—up... Someone has to pay for all of this.”

"I cried all day." Speaking of stranded...There are 90,000 cruise ship employees still stuck at sea, unable to come home to port. 90,000.

(Some of these stories require a subscription to access. To enjoy unlimited access, subscribe today. Thank you for supporting our journalism.)

Market candy

Quote of the day

Pension contributions are pretty far down the list of things they want to pay for.

That was Don Boyd, an expert in public pensions at the University at Albany’s Rockefeller College. He acknowledged what's on the minds of a lot of retirees and pension fund managers these days. Pension fund losses are mounting, losing a median 13.2% in Q1. With dwindling revenues, cities and states have bigger obligations. Pension contributions aren't high on the list, as the Wall Street Journal reports.