This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. It’s safe (for now) to look at the screen again. Equities may be trading lower, but at least oil markets are no longer in upside-down world. Still, the uncertainty is dragging just about everything down.

Let’s check on what’s moving markets.

Markets update

Asia

- The region’s major indices are all trading lower, led down by Hong Kong‘s Hang Seng.

- During Asian trade, the price of U.S. crude, WTI, climbed back above zero. The May futures contract is trading at a princely 14 cents per barrel, as I type. Counting the change in my pocket, I could afford three barrels, and probably haggle for a fourth.

- Much of the turmoil this morning can be seen in South Korea. Conflicting reports from north of the border, of Kim Jong Un‘s fragile health, is sending the won and KOSPI in a tailspin.

Europe

- Europe was the outlier yesterday with all major bourses ending in the green. They’re all down at the open today by more than 1%.

- Now some good news—the coronavirus outbreak continues to show progress across the continent, in Italy, Spain, Germany and Britain.

- With oil prices so volatile, BP, Total and Royal Dutch Shell were all down significantly in the first half-hour of trading.

U.S.

- The Dow, S&P 500 and Nasdaq look to open in negative territory today, though they’re all off session lows.

- With all the excitement in the oil markets you might have forgotten it’s earnings season. There were a number of disappointments yesterday from airlines to tech, including: Halliburton, DuPont, IBM and United Airlines.

- There was a bit of good news for the airlines sector, however. The Treasury Department agreed to a $2.9 billion payroll aid package with America’s struggling carriers.

Elsewhere

- Gold is up, slightly…as is the dollar.

- Crude is a good news/bad news story. WTI was up more than 100% in morning trade, but it was still hovering around zero. Brent crude, the global benchmark, is down more than 7%, but at least it’s trading in the twenties.

Crude joke

The May contract for WTI futures expires today, and that’s got to be good news for traders. Yesterday’s plunge was “like trying to explain something that is unprecedented and seemingly unreal,” Louise Dickson, an oil analyst at Oslo based Rystad Energy, told Fortune‘s Katherine Dunn last night.

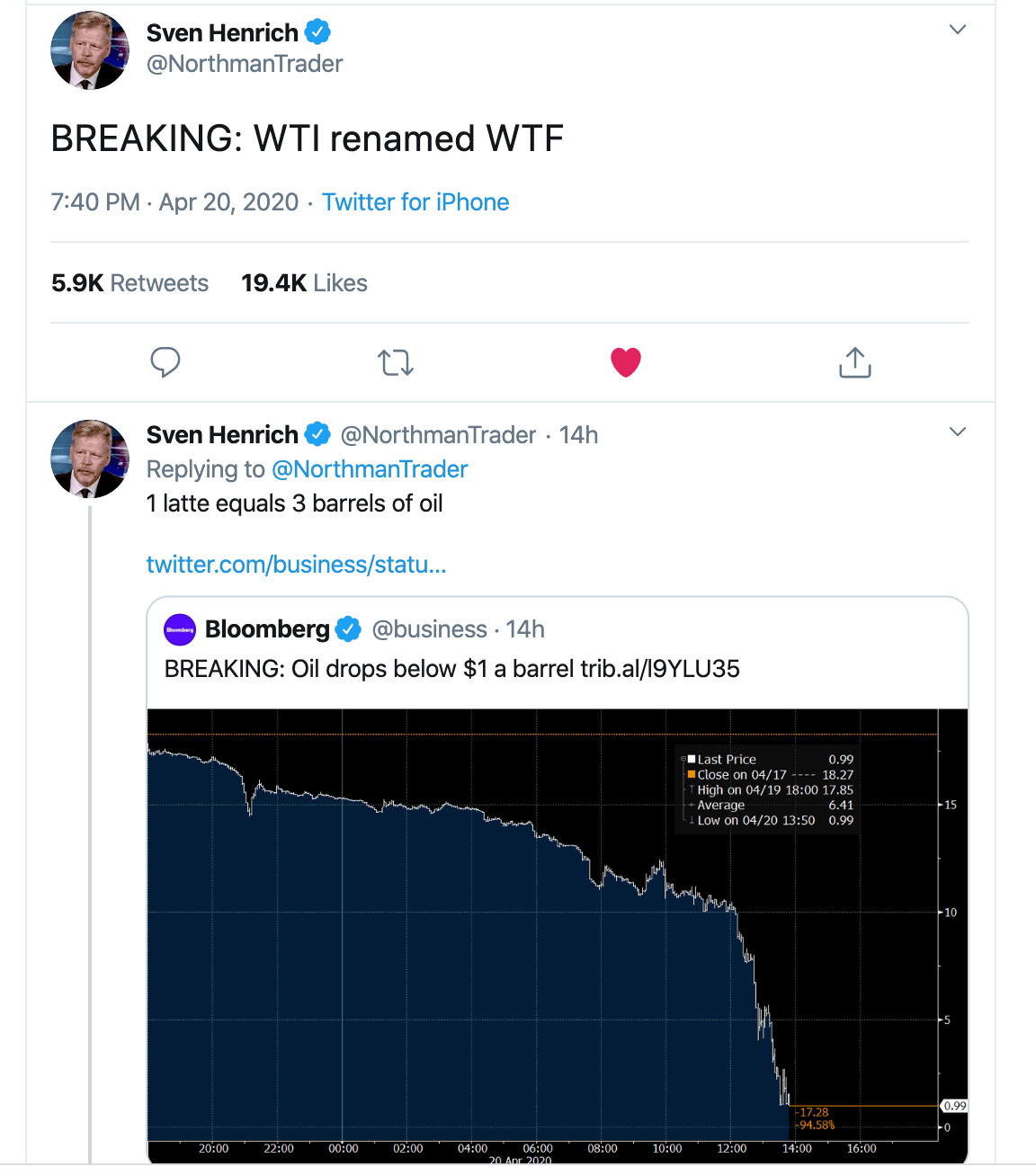

When WTI sunk below 10 bucks a barrel yesterday, alarm bells went off everywhere. And then the price just kept falling. At one point, it cost less than a six-pack of Budweiser. Minutes later, less than a gallon of milk. Then crude was worth less than the barrel holding it, giving rise to some classic comments from energy Twitter yesterday.

The barrel-half-full crowd would say these are just contracts, that it’s the fault of technicals, that it doesn’t reflect the true price of physical stocks. But even before those contracts hit negative $38.45/barrel yesterday, it became clear this was a toxic asset. The ramifications are being felt well beyond the May contracts. Prices on July and August futures are also under pressure this morning, trading at sub-$30. June, meanwhile, fell below $20/barrel. The problem is we’re running out of places to store the stuff. It’s a textbook market crash.

Nobody is suggesting negative oil is the new normal, but the ripple effects will be felt well beyond the oil patch. It took down the equities markets yesterday, and it’s doing the same today. It’s impacting emerging markets and virtually every commodity not named gold. The concern is it will cause a wave of layoffs and bankruptcies in oil country, and that will become a political issue, too.

One of the startling things about this recent two-week bull run in equities is that it occurred as energy prices were collapsing. Usually, they trend up and down in the same direction. That makes sense. When the economy is running on all cylinders, energy prices go up. That decoupling pattern finally broke yesterday. Once oil crashed below $10, the gravitational pull proved too much for the S&P 500, and the Dow, and even the Nasdaq. The sell-off began in full.

“What’s very apparent is someone lost their shirt,” Bjarne Schieldrop, chief commodities analyst at SEB in Oslo, told Fortune‘s Dunn.

He was speaking of oil traders. But the concern amid the barrel-half-empty crowd is that other investors could fast become shirtless, too.

Postscript

While oil prices were tanking yesterday, news broke here in Italy that the number of active coronavirus cases fell over the previous 24 hours. It’s the best news we’ve had in weeks. And now the government is getting serious about officially easing lockdown measures in two weeks time. May 4 will be a manic Monday around here.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Future shock. The traumatic experience of the coronavirus crisis will have a lasting impact on our behavior, changing the ways we spend and invest, potentially for decades. Students graduating during a recession could suffer a decade of lower earnings and, if the 1918 flu pandemic is anything to go by, the crisis could even reduce the educational prospects of babies who haven’t been born yet, writes Fortune’s Geoff Colvin.

Work abroad. While U.S. companies laid off 22 million people in the last month, Europe has taken a different path, Adrian Croft explains in Fortune. European governments are spending billions on subsidies to allow private companies to keep paying their workers even when they have no work to do during the coronavirus lockdown.

Banking on trades. The wild swings in the stock market in the past few weeks as investors frantically moved their money around has been a boon for Wall Street trading desks. Trading revenues at the “big five” U.S. banks—Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, and Morgan Stanley—swelled 30% in the first quarter.

Market candy

Today’s quiz

Which stay-at-home stock is now worth more than ExxonMobil?

- Netflix

- Zoom

- Domino’s Pizza

Answer: A. Netflix shares have surged to record highs as locked-down viewers stream more TV. Netflix’s market value has surged to $192 billion, while the energy market crisis has sent the value of the biggest U.S. oil producer plunging to $174 billion.