This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. If yesterday was an “up” day then…yep, the rally is off. We’re solidly in the red today as the sugar rush of stimulus talk fades into global recession fears. The U.S. futures even triggered the limit down cool-off this morning. Again.

Let’s take a spin around the world to check in on global markets.

Markets update

We begin in Asia where all major indices are faltering. Sri Lanka and the Philippines have taken the unusual step of closing their markets as the ultimate circuit breaker measure. But there is a sliver hope: FedEx is seeing signs of a comeback in China.

Further west, Europe and the U.S. futures are following the Asia lead into negative territory. The Euro Stoxx benchmark opened down 1.58% today with most sectors in the red. News that the European Union is partially shutting its borders to combat the COVID-19 spread is spooking the markets.

Across the Atlantic, the Dow looks set to open about 820 points lower, as I type, wiping out a good chunk of yesterday’s gains. Clearly, Joe Biden’s primary sweep overnight is barely on investors’ minds.

On Tuesday, we had a big rally in the U.S. as details of a series of stimulus packages came in from both sides of the Atlantic. The markets cheered the various goodies proposed by the Trump Administration. The whatever-it-takes measure includes a tax holiday, checks in the mail, and small-business loans. Add it all up and the price tag for the U.S. measures could top $1.2 trillion. TARP seems downright wimpy in comparison.

The Fed was busy too, giving banks more firepower to lend to distressed companies and, in a recession-era move, intervening directly in the commercial paper market to prevent the kind of paralyzing credit crunch we saw at the height of the 2008-2009 financial crisis.

Today, the focus is on the economic impact of this devastating pandemic. Goldman Sachs and Morgan Stanley agree: we’re already in a global recession. (They’re hardly the only ones making such a call.) Closing bars, restaurants, office buildings and effectively slamming the brakes on global travel will put millions out of work.

In fact, Treasury Secretary Steven Mnuchin briefed GOP senators that unless they go big on stimulus the unemployment rate could soar to 20%. Twenty.

Elsewhere, the dollar is crushing global currencies again and crude continues to fall. And gold is down.

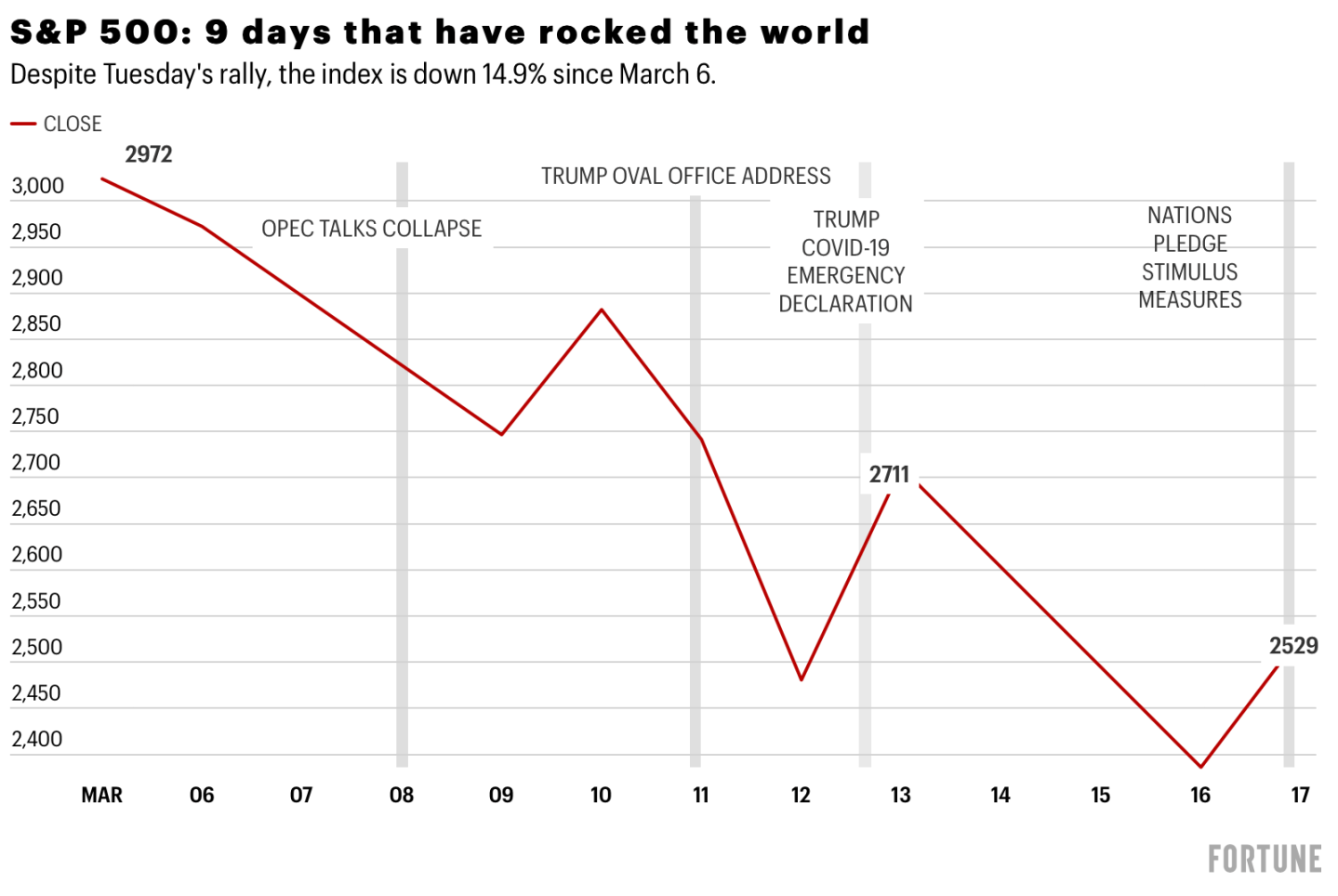

Let’s recap. It’s been a tumultuous week-and-a-half stretch. Just look at today’s chart.

***

Volatile times

Even after yesterday’s 6% rally, the S&P 500 is down nearly 15% since March 6. A lot’s happened in that time. We had the OPEC talks collapse, tanking crude. We had the Trump Administration finally acknowledging coronavirus poses a real threat to the economy. And then, yesterday, a series of stimulus plans, pledges of trillions of taxpayer’s money to get us through this historic contagion.

Taken all together and you can see why the markets have been so volatile. This health crisis is still raging in Europe. The scenes from the north of Italy are devastating. Nobody on the frontlines here dares even predict when we may see the peak. And so volatility will be with us for a while.

Postscript

I volunteered to go to the supermarket yesterday evening for some supplies. I was happy to get out of the apartment. It’s a chore that seems more alien by the day. Romans are not known to be the most courteous lot, but they’re doing their level best to respect the social distancing rules (it’s one meter here) and they’ve all but eliminated the national pastime of queue jumping.

Outside, there is almost no automobile traffic in my ordinarily bustling neighborhood of Rome. But that’s not to say the place is church-like. When I stepped out of the supermarket yesterday evening it was as if I’d been transported to a karaoke festival. It was a few minutes after 6 p.m., the flashmob hour in which Italians get on their balconies, blast music, play instruments and sing.

My neighborhood is a bit lame, to be honest. There are no stirring renditions of Figaro. But what they lack in talent, they more than make up for in enthusiasm. And volume. Yesterday evening, clusters of Romans were singing along to Volare. “Oh, oh. Cantare. Oh, oh.”

Okay, basta.

The songs are corny, even groan-worthy. The best kind.

I stood on the street, bulging shopping bags in hand, totally caught up in the emotion of neighbors serenading each other from distant balconies. The mini performance finished with the Italian national anthem. I can’t believe I know most of the words. I sang along too.

Over and out. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

A familiar pick. Europe’s biggest bank, HSBC, has confirmed interim CEO Noel Quinn will get the job to run the bank permanently after a seven-month search that included approaches to several high-profile outsiders. With markets melting down and the global economy headed toward recession, the bank opted for a known quantity to lead it through the mayhem, Bloomberg reports.

Zooming wealth. One billionaire has dodged the market meltdown as social distancing becomes the norm. Eric Yuan, founder of Zoom Video Communications Inc., has added $2 billion to his net worth this year, building his fortune to $5.6 billion. Demand for Zoom’s virtual conferencing software is exploding as the coronavirus pandemic prompts office closures and meeting cancellations.

PayPal warning. Dormant PayPal Credit accounts are coming back to haunt users—and hurt their credit scores. Before July 2018, neither PayPal nor its credit issuer reported to any credit bureaus. But when Synchrony, PayPal’s new partner, took over, it began reporting late payments and account closures to credit bureaus, leaving some customers shocked by an unexpected hit to their credit score, Fortune’s McKenna Moore reports.

Market candy

Goodies. Governments are taking extraordinary steps to help people through the coronavirus outbreak. Among the most unusual, the Trump administration wants to send Americans checks, possibly for $1,000, following Hong Kong’s example. France is suspending rent and utility bills for small companies. Italy will pay for babysitters and Britain is offering cash grants to retailers and pubs.