FORTUNE Analytics brings readers business insights from proprietary data and exclusive surveys. It will launch as a premium newsletter in the coming weeks. Sign up for the debut below:

It’s hard to lose money when the S&P 500 jumps 28.9%, like it did in 2019. But coming off that big year, how will investors tackle 2020? Will fears of a recession convince investors to cash in their winnings, or will they chase the bull and keep piling money into stocks?

To better understand investors’ plans for 2020 and what’s keeping them up at night, Fortune and Civis Analytics teamed up to survey more than 1,300 investors between December 19-20.

The big numbers you should know:

51%

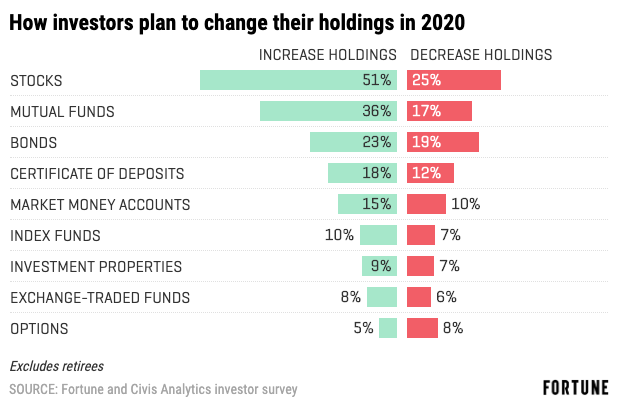

- … of non-retired investors plan to increase their stock holdings in 2020, while 25% plan to decrease their stock holdings.

76%

- … of investors think the stock market will rise in 2020, including 19% who think it will rise more than 10%. Only 5% expect a decline in the stock market.

58%

- … of investors say a recession is likely in 2020, compared to 42% who say it’s unlikely.

40%

- … of investors foresee the presidential election increasing volatility in financial markets in 2020.

7%

- … of investors say they own cryptocurrencies.

Big picture takeaway:

Investors are sending a contradictory message. They’re optimistic about financial markets in 2020, but think the economy is likely to enter a recession. Among investors, 58% say a recession is likely in 2020, while only 5% expect a decline in the stock market. But history tell us it’s unlikely stocks would move upward if the economy contracts.

And investors plan to act on that optimism. The majority of investors are planning to buy more stocks and boost their retirement savings in 2020. In fact, those planning to increase their stock holdings outnumber those who plan to shrink them by 2-to-1.

Three deeper takeaways:

1. Investors aren’t shying away from stocks

In August, when the yield curve inverted—an event that often is a forewarning of a recession—the fear on Wall Street was that investors would start to turn away from riskier assets and towards conservative holdings. The experts appear to have been wrong. More than half of investors plan to increase their net stock holdings in 2020.

Not only are investors continuing to turn to stocks, but they’re confident in their short-term returns. Among investors, 49% see stocks growing by more than 5% in 2020. Only 2.3% see stocks declining by more than 5%.

And American investors expect the biggest stock gains to come from home: 78% think the U.S. stock market will outperform international stocks in 2020.

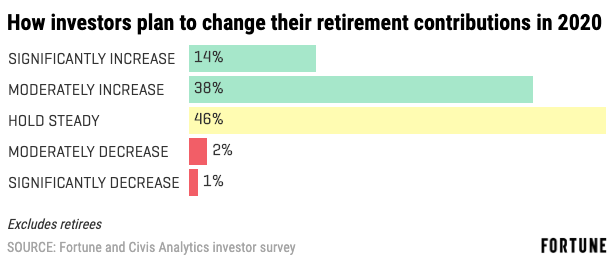

2. Investors plan to jack up retirement savings

Investors are planning to take advantage of the economic good times and increase their nest eggs this year. A total of 52% of non-retired investors plan to up their contributions to their retirement savings in 2020, compared to only 3% who plan to decrease them. That’s great news for firms like Fidelity and Vanguard, which administer millions of retirement accounts.

And 72% of investors are confident they’ll have a comfortable life in retirement, while 10% are unconfident.

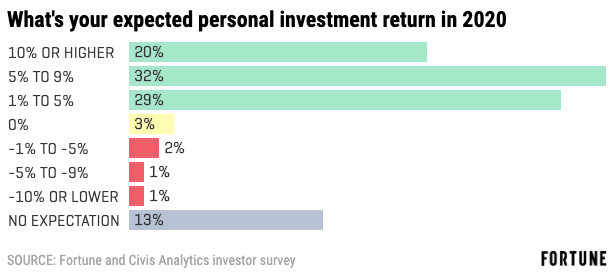

3. Investors are bullish on 2020 returns

Only 4% of investors expect their personal investment returns to decline in 2020. That is an incredibly low number give that more than half of investors say a 2020 recession is likely. Remember, during the last two U.S. recessions the S&P 500 dropped 13% (in 2001) and 38.5% in (2008). A lot of investors might be headed for a rude awakening if they’re right about a downturn.

One more interesting number:

57%

- … of investors say they plan to leave an inheritance for their family or friends.

*Methodology: The Fortune-Civis Analytics survey was conducted among a national sample of 1,315 investors in the U.S. between December 19-20. The findings have been weighted for age, race, sex, education, and geography.