U.S. stocks opened lower, Treasuries tried to push higher and the dollar dropped after weaker-than-expected jobs data bolstered speculation the Federal Reserve may have room to slow tightening next year. Oil jumped after OPEC ministers agreed on output cuts.

The S&P 500 vacillated before declining as the data failed to address concern whether the economic growth may be slowing. The 10-year Treasury yield slipped as low as 2.86 percent and the dollar slid against major peers as investors assessed whether the report will bolster central-bank doves.

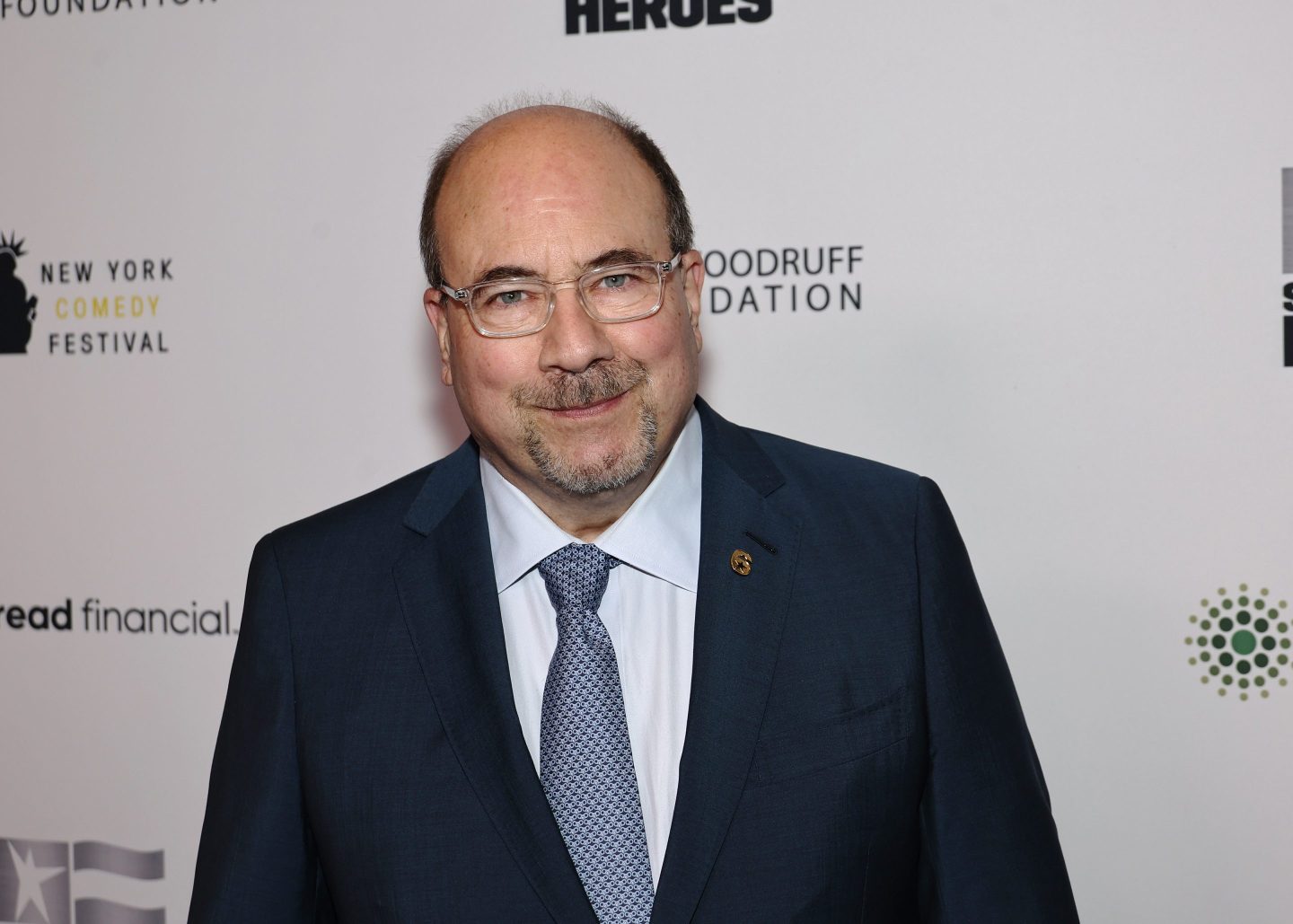

“It was a Goldilocks report,” said Alec Young, managing director of global markets research at FTSE Russell. “Weak enough to convince investors the Fed can slow their tightening, but strong enough not to get people more worried about a recession.”

U.S. payrolls and wages rose by less than forecast in November while the unemployment rate held at the lowest in almost five decades. The report comes with financial markets on edge over whether Fed Chair Jerome Powell is closer to pausing. Market-implied U.S. rate expectations have been sinking amid the tumult in equities, but hawkish views still exist among Fed officials, including Powell. He delivered a bullish assessment of the U.S. economy and the job market Thursday night.

Away from jobs and rates, markets have are closely watching developments in the U.S. trade war with China. The arrest of the chief financial officer of Huawei is seen as exacerbating tensions as the two sides are supposed to be working to reach a deal. Trump tweeted Friday that talks are “going very well,” though he supplied no details.

In Europe, stocks rebounded from the worst day in more than two years, while Asian shares posted modest gains as investors sought to end a bruising week on a more upbeat note. Italian debt climbed as European bonds largely drifted. The pound was steady as U.K. Prime Minister Theresa May was said to be weighing a plan to postpone the vote on her Brexit deal.

Elsewhere, oil rallied after OPEC broke an impasse over production curbs, agreeing on a larger-than-expected cut with allies after two days of fractious negotiations in Vienna. The cartel and its partners agreed to remove 1.2 million barrels a day from the market, with OPEC itself shouldering 800,000 barrels of the burden. Cryptocurrencies continued their slide with a fresh bout of losses after U.S. regulators dashed hopes that a Bitcoin exchange-traded fund would appear before the end of this year.