As an avid cryptocurrency nerd and someone who is fascinated by the huge appreciation and volatility we are seeing in this massive new market, I am constantly being asked, “Is Bitcoin going to $100,000 per coin?”

I make no attempts at predicting short-term pricing (under 10 years). It would be akin to answering the question, “When will the stock market crash again?”

That said, I do have some predictions on the development cycles of cryptocurrencies that could prove useful when considering a potential investment strategy.

As the CEO of a tech company, and as someone who has rebuilt, from the ground up, the technology on which my company is based four times, I do not envy the founders of blockchain startups. When you build new technology, it is nearly impossible to get things “right” on the first go. You make the button too big or too blue. You forget about some super-important factor. Or you realize, with time, that no one cares about your main product—it is that little side project that is selling like crazy.

As a traditional tech company, you have the luxury of being able to pivot. We can build a product and continuously iterate until we get close-ish to being mostly right. This lets us allocate resources in a flexible way. We can build a minimal new feature and only develop it further if there’s a proven demand. This helps us stay ahead of the competition and build a great product that improves over time.

When you launch a cryptocurrency, your main problem is that it’s incredibly hard to iterate. Blockchain tech is built on decentralization and democracy, both of which happen to be diametrically opposed to fast iteration.

Here’s how the process for improving many cryptocurrencies works. First off, anyone can do it. Because the protocols are open source, you can sit down, look at the Bitcoin protocol, and come up with a more awesome way to do things. Anyone can develop new code that meets whatever need the old protocol missed.

Now, in a traditional startup, once you are done with an improvement, you push the code to production, frantically run around fixing the unintended consequences, and, voila, that’s it. You have improved your technology.

In a blockchain startup, not so much. Because the blockchain decentralizes the administration of the protocol (its greatest strength), you have to convince the majority of users (either miners or owners depending on the blockchain) to adopt your new protocol. You can’t just push something to production and force everyone to switch. You have to engage in a democratic process in which unless you get 100% buy-in (which is roughly as hard as winning a political race with 100% of the votes), you create a fork in your currency—which tends to be bad news, although forks have been in vogue recently. At that point, you just have to hope that the other fork dies quickly, and that you have fixed the problem fully so you don’t have to start over again.

This is a massive weakness of blockchain companies in general. When you launch your tech, chances are you are going to be stuck with it for a while, and changing it will be a massive undertaking. This is too bad, because odds are you got many, many things wrong in your initial design.

Just imagine if Amazon’s 2001 website would have stayed static for the last 16 years because it couldn’t deploy code. It would be a nightmare, and Amazon most certainly wouldn’t be around anymore, let alone the massive success it is today.

This train of thought should be considered if you are evaluating whether or not you should invest in a cryptocurrency over long periods of time (think more than 10 years). Because it is so hard to iterate in a blockchain startup, my prediction is that a fast follower strategy will be immensely successful.

In traditional business, you wait until someone has a great idea, copy it, and then build a better version. This will occur in blockchain as well. An entrepreneur who has an idea for a better, faster, more secure blockchain will simply copy all the best parts of an existing currency, add their own spin, and start a new company. The currency that got copied won’t be able to defend itself by copying that new and improved feature, because there is no easy way to change anything.

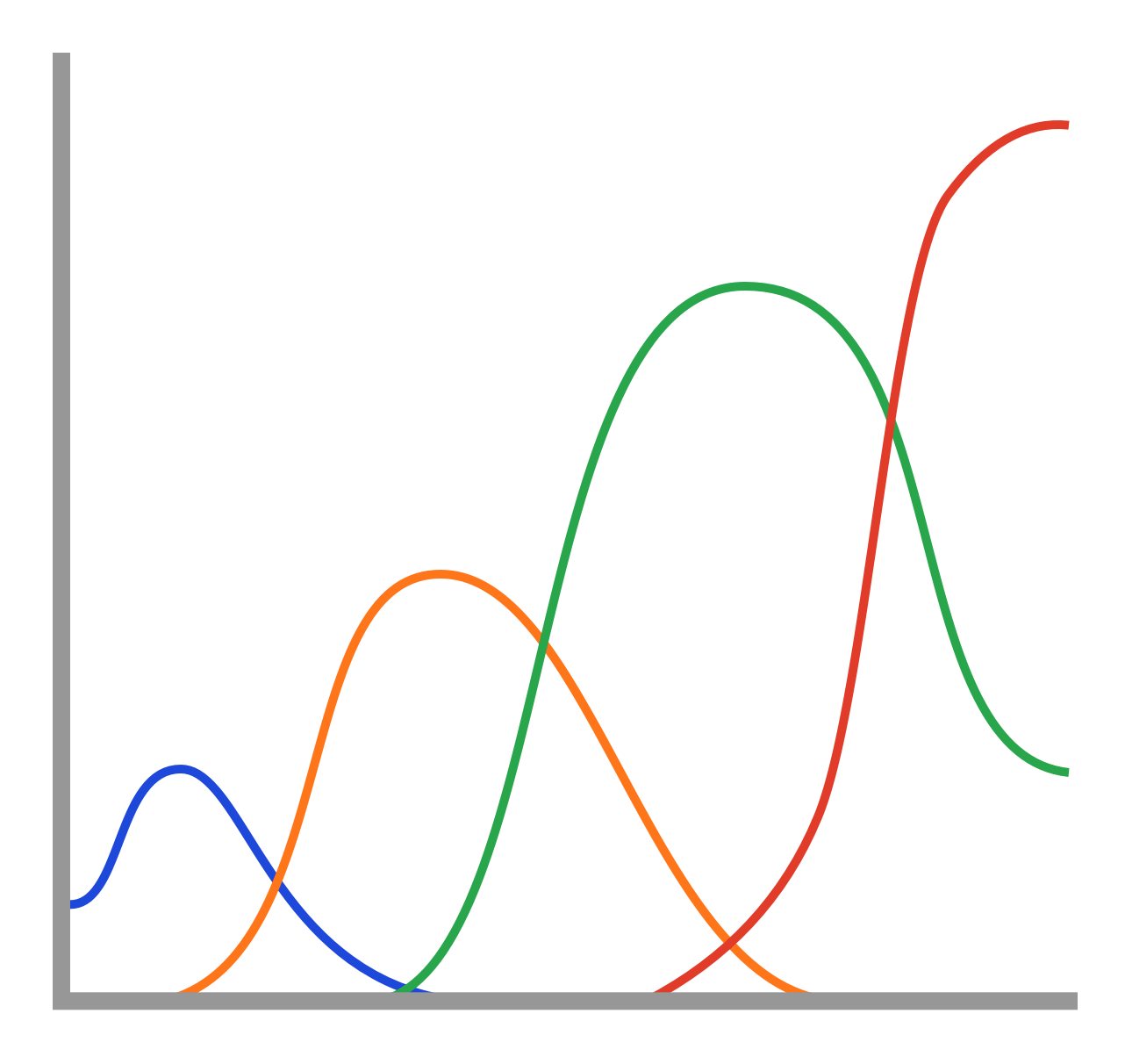

If the new idea is any good and provides more value, users will switch from the old currency to the new one. Then someone else will come up with an idea for improving that new currency, and the cycle will repeat itself, either until people run out of new good ideas, or until we arrive at a state of “good enough,” in which the marginal improvements aren’t substantial enough to warrant users switching.

So the question is, when a fast follower builds a better version of your favorite blockchain, what happens to the original one? Just like in traditional business, I think that successful fast followers will kill their predecessors.

It will look somewhat like this:

So with this in mind, I would be very hesitant to buy into Bitcoin, or any of the current currencies, if you are intending on a long-term hold. This is by no means to say that I don’t believe in blockchain technology. It is actually quite the opposite. I believe that 50 years from today, we will only be using cryptocurrencies, and government-run currencies will have gone by the wayside.

I just don’t believe that the current crop is the best it can possibly be. I think new, better, and faster tech will come along, which will be bad news for the existing currencies because they won’t be able to adapt. On a positive note, this means that there is massive opportunity in trying to find the next “hot” currency, as you can ride this cycle over and over again—buying low and selling high.

Stephan Goss is president and CEO of Zeeto.