Brexit? What Brexit?

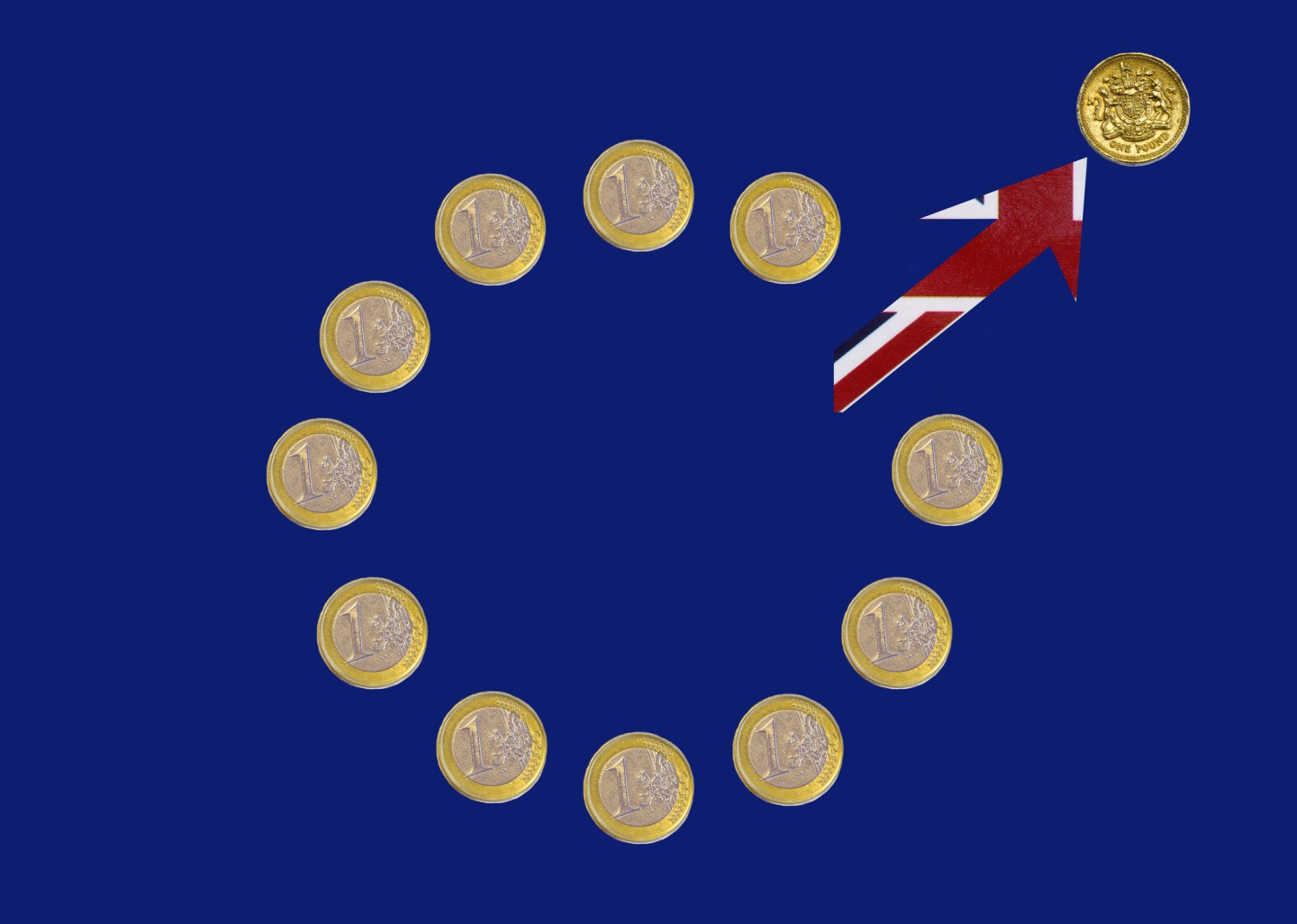

British manufacturing grew at its fastest pace in two-and-a-half years high in December, a new survey showed Tuesday, adding to signs that the economy ended 2016 strongly. That’s despite the ongoing political melodrama of leaving the European Union, which took a new twist Tuesday as the U.K.’s top diplomat in Brussels resigned only weeks before formal separation talks are due to start.

The Markit/CIPS UK Manufacturing Purchasing Managers Index (PMI) rose to 56.1, the strongest reading since June 2014, from 53.6 in November, helped by orders from home and abroad.

That exceeded all forecasts in a Reuters poll of economists, which had pointed to a slowdown to 53.1. The PMI numbers also boosted sterling to a two-week high against the euro.

Britain’s economy has fared much better than many economists predicted since the vote to leave the EU, with consumer spending strong and companies performing well. The latest data showed employment in the manufacturing sector rose for a fifth straight month, and grew at the fastest pace in over a year. Rob Dobson, senior economist at survey compiler IHS Markit, noted that “the expansion was led by the investment and intermediate goods sectors, suggesting capital spending and corporate demand took the reins from the consumer in driving industrial growth.”

(For more, read “These 5 Trends Will Shape the Global Economy in 2016.”)

So, does the crowd of largely London-based economists who generally fall into the “Remain” camp of U.K. opinion feel a little bit awkward about their forecasts of doom and gloom? Not yet, it would seem. Most remain wary about the outlook for 2017, arguing that official data for British manufacturing have been weaker than the PMI surveys have suggested.

“UK manufacturing is benefiting from both continued brisk growth in domestic demand as well as improving global demand, but this momentum likely will peter out in 2017,” said Samuel Tombs, economist at Pantheon Macroeconomics.

IHS Markit said manufacturing output appeared to be rising at a strong pace of around 1.5% for the last quarter of 2016, with orders boosted by sterling’s 10% plunge against a basket of currencies after the Brexit vote. But Tuesday’s survey also showed rising cost pressures on factories, something that is likely to feed increasingly into consumer prices.

“Of the companies citing a cause of higher costs, 75 percent linked the increase to the exchange rate,” Dobson said.

Britain’s economy looks on track to expand by more than 2% in 2016 – faster than almost all other big advanced economies except perhaps the U.S. Economists polled by Reuters expect Britain’s growth rate to more than halve in 2017 to 1.1%.

Elsewhere Tuesday, the political drama over how to go through with the Brexit process continued as Sir Ivan Rogers, the U.K.’s envoy to the EU, resigned 10 months early, a move that appeared to take the government by surprise.

Lord Peter Mandelson, a former Labour Party minister-turned-EU-commissioner, led a chorus of protests that Rogers had been hounded out of his position by a hostile and cavalier government with no respect for experts and expertise.

“Everyone knows that civil servants are being increasingly inhibited in offering objective opinion and advice to ministers,” Mandelson said. “Our negotiation as a whole will go nowhere if ministers are going to delude themselves about the immense difficulty and challenges Britain faces in implementing the referendum decision.”

More skeptical heads pointed out that Rogers had been due to leave in November anyway, and that it would be less disruptive for him to go now, before the actual separation negotiations start, than halfway through what is expected to be a two-year process.

“It’s not such a bad idea for him to go now,” said Pieter Cleppe of the Open Europe think tank in Brussels.